Following up on last weeks overview:

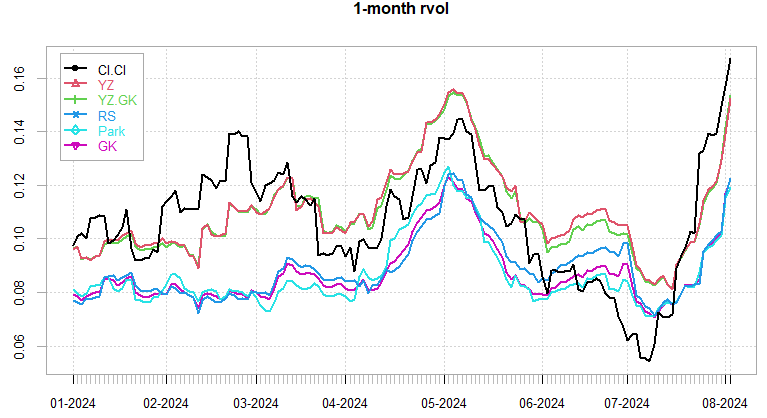

Last week was the most volatile week since March 2023 (SVB collapse) for the markets. We’ve had one of the largest positive days in the last couple of years on Wednesday, only to be followed by some of the largest down days. This is within expectations for elevated vol regimes. The lack of a clear single catalyst adds fuel to the fire, as general nervousness can keep volatility elevated for longer than single event spikes. Broadly, recession fears are back, however, few data points and the much discussed Sahm rule this week probably not the only thing to panic over. Middle East tensions, elections and other geopol headline risk all lead to deleveraging.

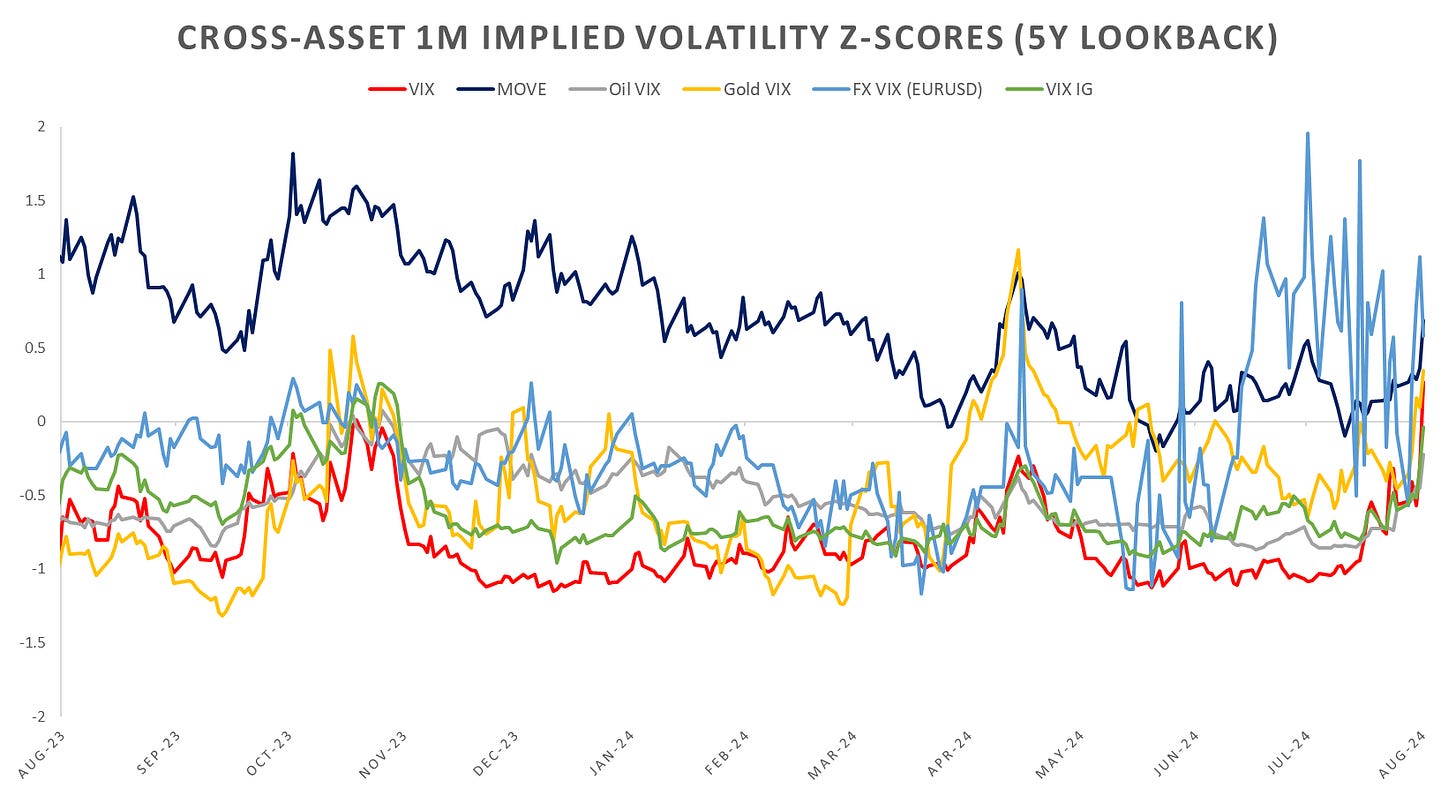

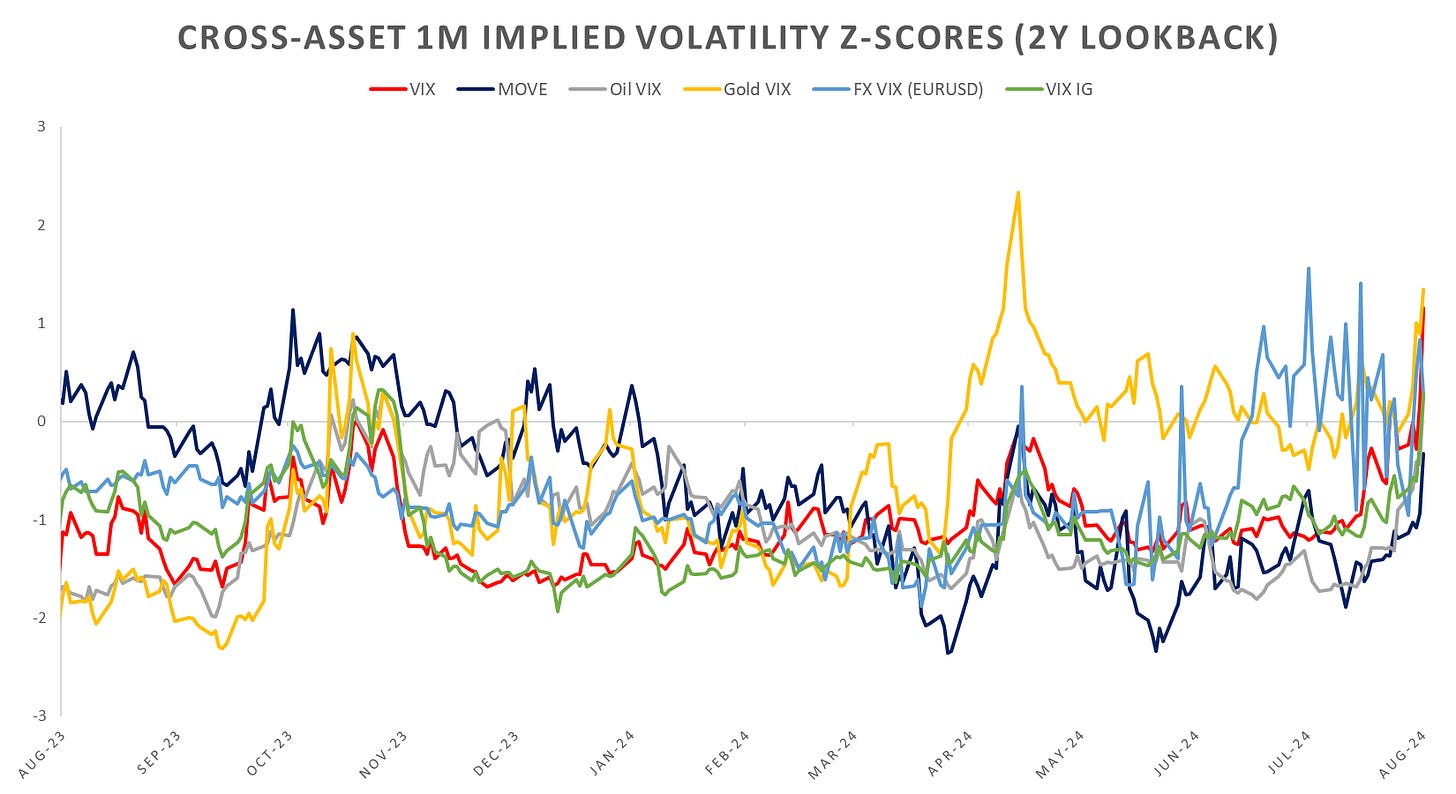

Last week I pointed out cross asset vols still remained well below their 5Y and 2Y averages. Well, no longer the case. Cross asset implied vols finally moved above their 2Y & 5Y averages with early morning panic grab for index protection in the equity space on Friday morning resulting in one of the top 5 fastest vol spikes in history (what a change in just 3 weeks…) 30-day implied vols did relax into the close as indices failed to follow through, but, overall, equities simply sat at VWAP all day, without any keen buyers.

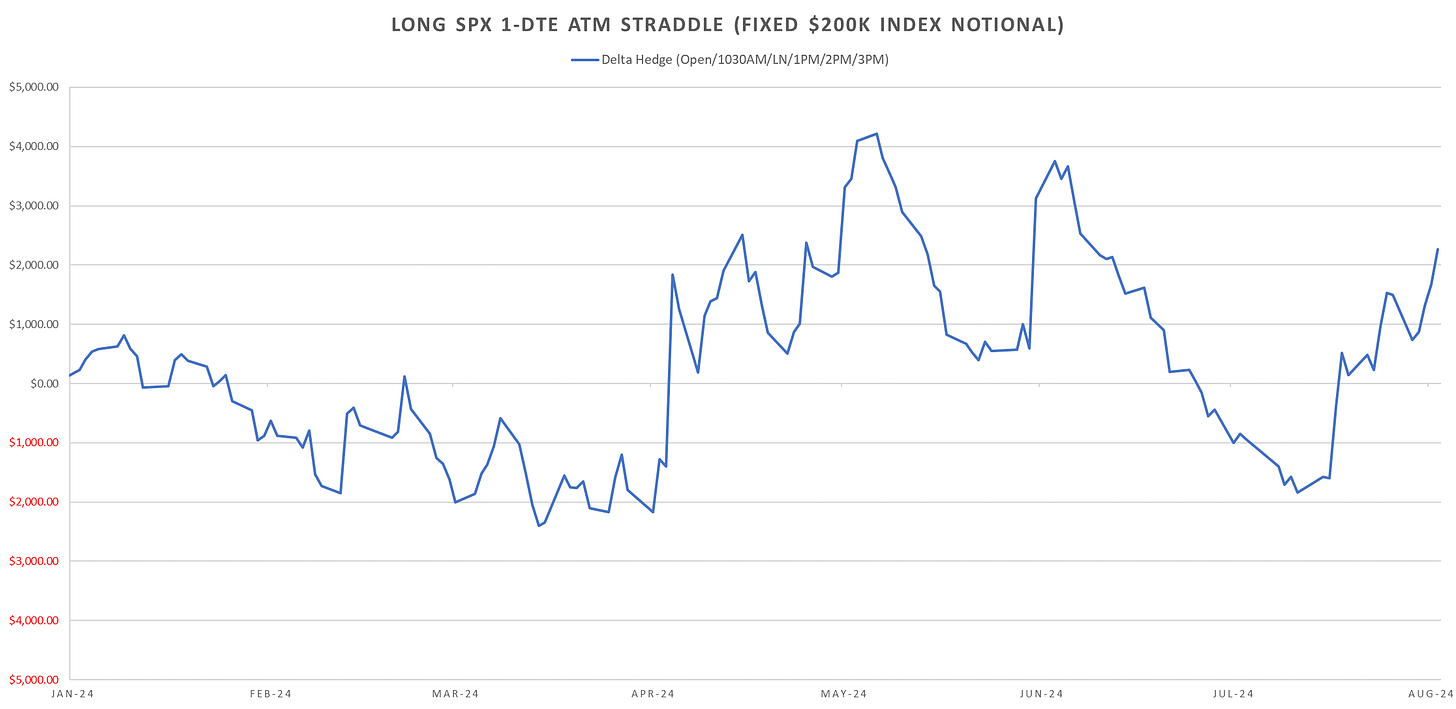

1-DTE SPX straddles reached their highest cost since March 2023. It is important to note, even 2017 had a more expensive 1-DTE Straddle (April 21 to April 24th on the weekend French election risk, for those that traded back then, you remember that was still a big deal after the Brexit vote in June 2016…)

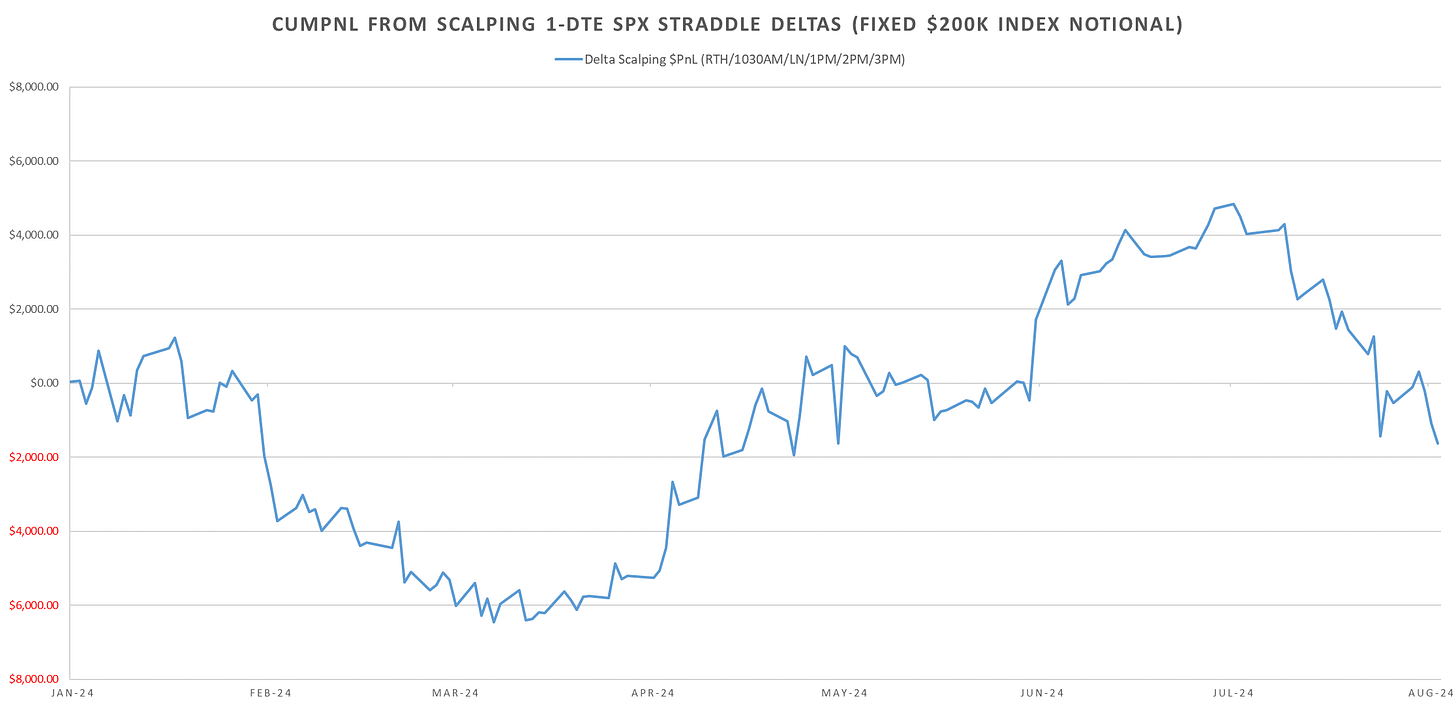

Even though 1-DTE Straddle costs almost tripled in the last 3 weeks, as pointed out last week, intraday gamma still pays… in the last post I pointed out that I expect vol to persist but with significant mean reversion intraday. That was true for a couple of days with intraday scalps paying more than the net straddle losses but proved to be wrong by the end of the week with Wed/Thu/Fri purely driven by the long straddle pnl with small losses on intraday mean reversion…

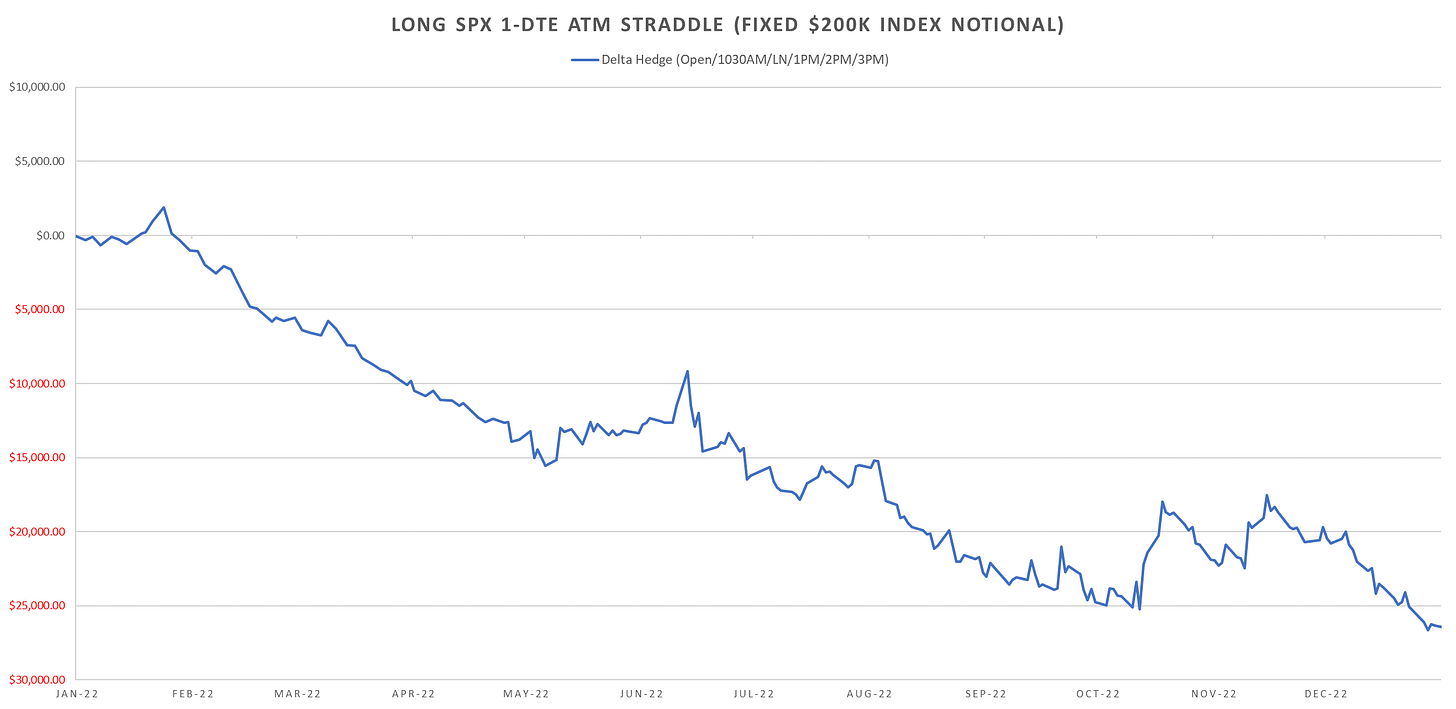

A relatively strong year for intraday vols, since April we’ve had outsized upside vol, now downside… For comparison, 2022 & 2017 pnl for intraday gamma below:

1-DTE straddles are STILL not that expensive… I expect vol to be sticky, 1-dte straddles closing relatively flat/down but with intraday mean reversion finally picking up…

Breaking down the cumulative points gain for for 1-DTE ATM straddles intraday, YTD we get the following picture:

Note: Cumulative sum of pts for an SPX ATM Straddle opened t-1, gains(losses) between entry-RTH open, RTH-1030AM etc. summed Jan 1st 2024 to Aug 2nd 2024. Gains(losses) are for the same strike straddle, not a new straddle opened at respective time period.

We see majority of the ‘risk’ shifted to midday, from ~1030AM to 2PM. For full historical studies see:

Lastly, regarding the VIX / VX moves, catching knives and dip buying inverse vol ETP’s. I saw alot of posts on Twitter regarding the Friday almost 4 point 30-minute ramp in VIX to about 25-26 and later to nearly 30.

I get the urge to dip buy, unfortunately, majority of the returns simply are not there when ts is inverted…

Looking for an extra 10-15% but jumping in front of the train is not worth it in the long run.. (and there’s no ‘weighting’ method that will make it better…)

One of the first ‘events’ that I remember that made me rethink jumping in front of the train was June 2016 Brexit vote. There were many vol spikes before that I avoided / made some money (2015) / got killed in, but the 2016 Brexit spike was the first time I was urgently rereading the XIV prospectus in the middle of the night looking at the acceleration event levels for the day…

Its a less cited event, but at the time, VX1 (which was recently rolled into and still was upwards of 80% in the weightings for the ETPs), was up nearly ~70% in the middle of the night (with VX2 not fair behind at ~40%.) I jumped in short around 21-22 and promptly got carted out at 25-26 (with some adds along the way…)

Point is, you just don’t know where the spike ends, its got very little to do with how ‘sensible’ it is or how expensive 30 day vol is at that point… Worst part being by the time you’d wanna be short VX, you’re eating a 30% dd…

Realized Volatility Overview

Intraday SPX barely up on the year now, with overnight performance ~1% off highs…

Not even a hint of stopping for 1m & 10d rvols, have to go back to 2022 to see rvol up for ~15 days straight.

VarRatio’s stead at lows… historically, still expecting mean reversion to pick up, couple of days earlier last week when markets looked like they put in a short-term low but alas..

Complete blowout in the overnight/intraday VX performance…

Short VX30 indices intraday now down ~40% on the year, with overnight performance still 50%+…

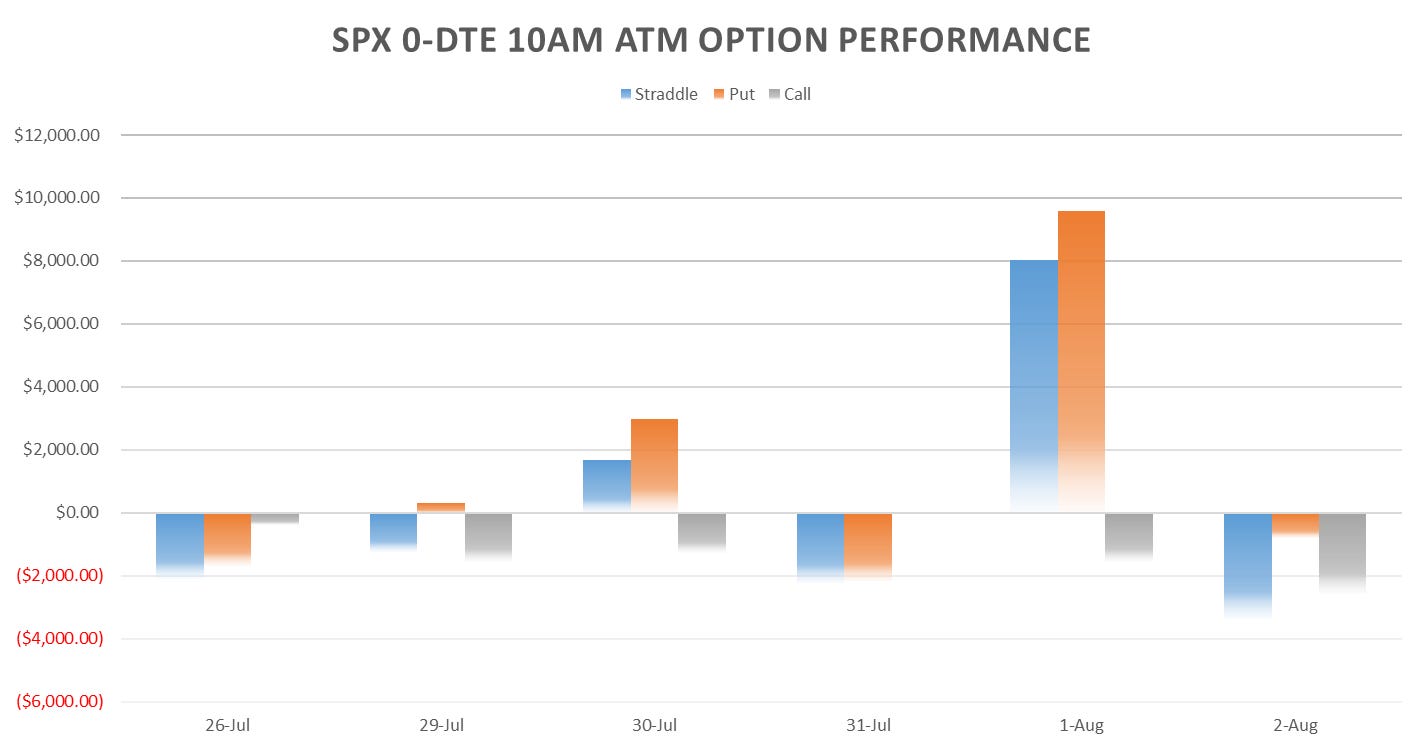

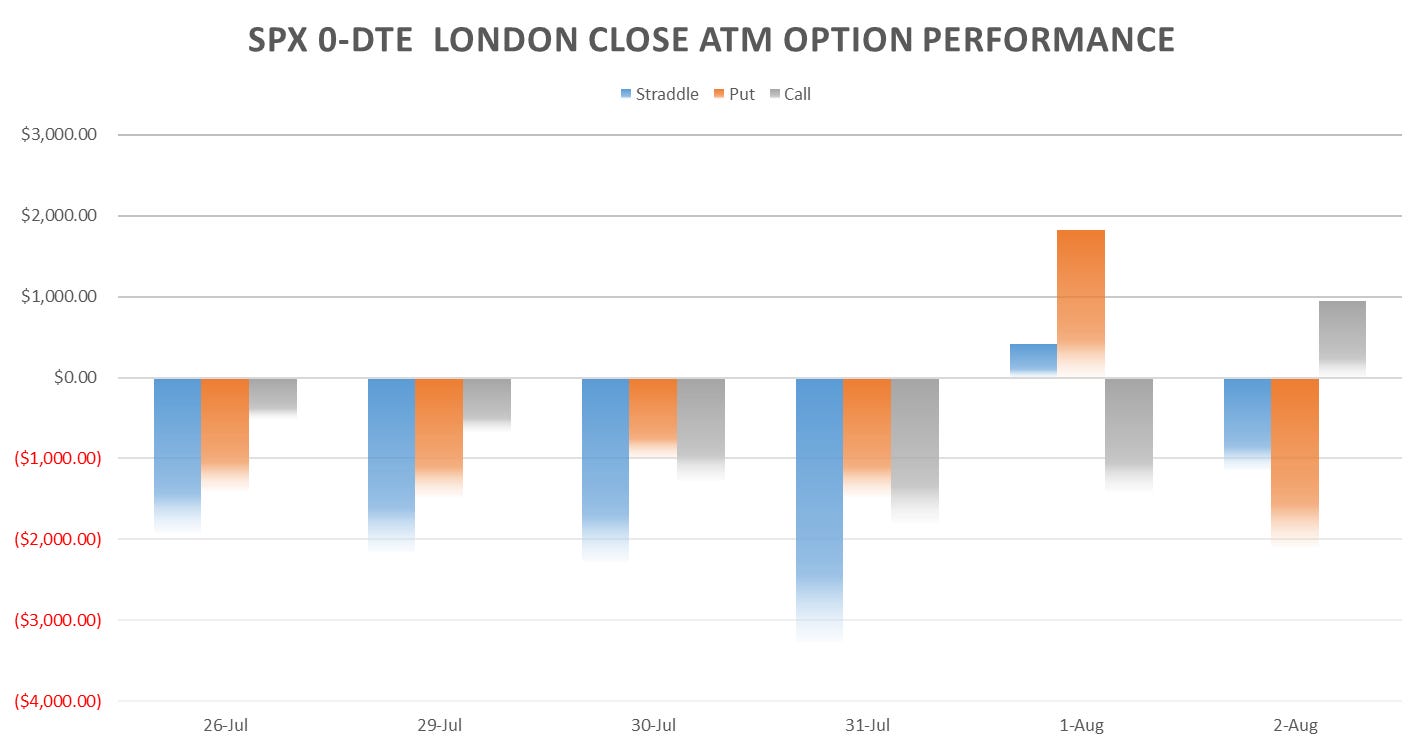

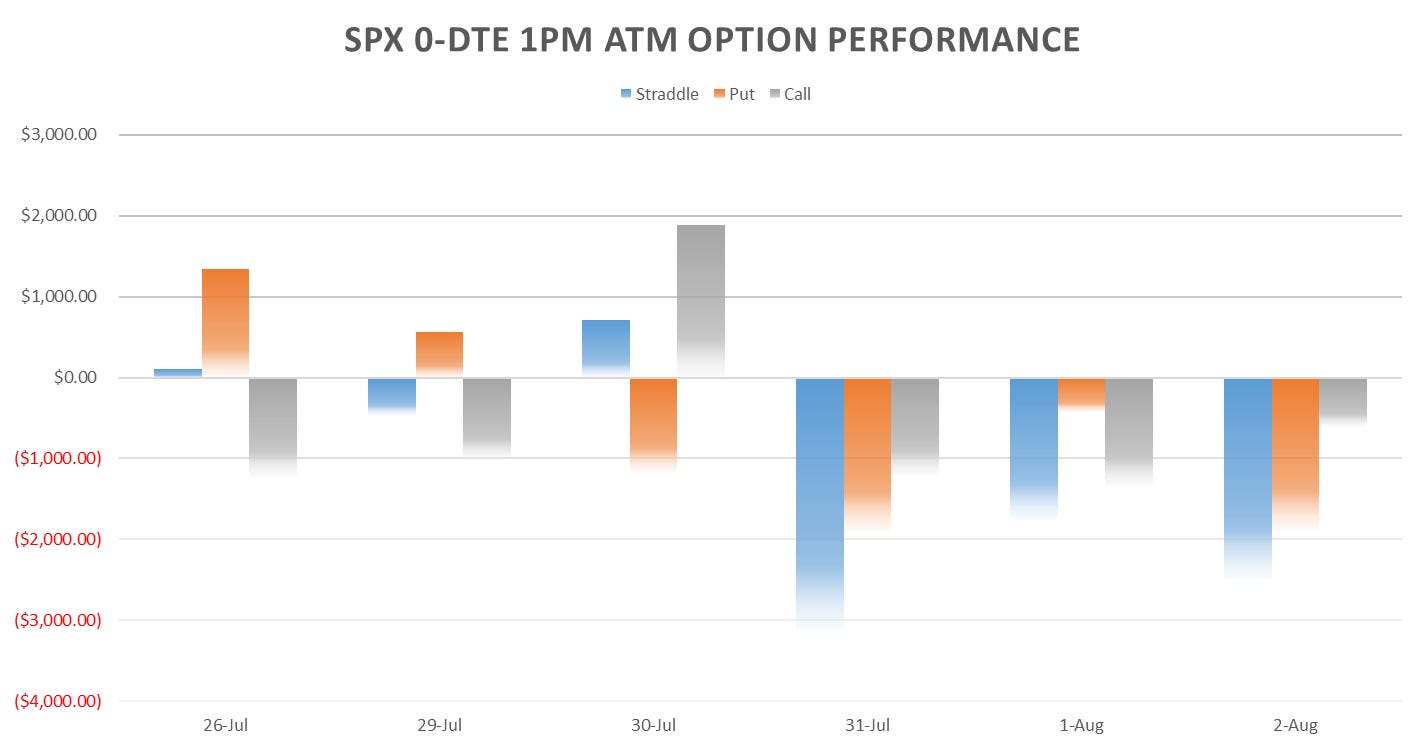

SPX ATM Straddle Performance

1-DTE straddles up ~50pts on the week, puts/calls both got chance to pay this week.

Even the massive Thursday win couldn’t save straddles opened at RTH that had a net 17pt loss for the week (no follow through at close on any of the big down/up days)

As mentioned, overnight straddles up a measly 5pts, really not alot of movement overnight even with the intraday chaos going on…

Straddles opened midday lost money almost every single day last week and a half.

As mentioned previously, all the vol mostly shifted to pre 1030AM-LN close.

Last 10 minute calls lost money 13! days in a row… Overall, last 10 mins aren’t that bullish but this is 2nd largest streak since 2016. The EOM trade largely flat this month after a couple of very strong months in April and May.

Variance Ratio Conditional Performance

From the following post:

After what looked like a bounce early in the week, back down to lows on short 1-DTE straddle trades (the short RTH leg was a small winner.) Looking at the performance over the years, even though its still net a winner (no losing years since 2016) it still gets caught in prolonged downtrends (2020) without mean reversion kicking in. Filtering by simple VIX TS (contango/backwardation) does improve sharpe but takes away some of the juicy returns (eventually we will mean revert downside…)

VX Carry & SPX Overlay

From the following post:

Just like that in a couple of weeks back to outperforming… Mentioned about a month ago that will be tough to outperform pure short inverse ETP’s if we keep buying every single dip immediately, well looks like its finally paying off… Caught a long trade Friday morning when the basis (VX1-VIX) widened significantly but closed the day in cash. With VIX being sensitive now, would not discount other trips to 30+ this week, which would make VX30 (~22) a decent trade as election premium will also keep those Sep/Oct contracts sticky.

Have a good week!

🧐🫡