Following up on last weeks overview:

Last week started off with a bang, ended on a whimper. No follow through on SPX to the downside, implied vols almost had a record breaking drop on Tuesday (VIX 30%+ drop intraday.) SPX managed to close the week completely unchanged from prior Friday close. SPX never quite made it to its 200dma, instead trading the range between 200 & 100 MA. As mentioned in previous posts, all the excitement was reserved for vol markets, with underlying indices not really showing the same panic as implied vols with SPX closing the week just 5% off ATH…

Looking at cross-asset vols, FX had the largest implied moves when ranked by Z-scores, closely followed by equities (VIX.)

Despite the jump on Monday, almost all vols closed the week at their ‘average’ 2Y levels, with only FX implieds sticking around on a 5Y lookback.

SPX 1-DTE Straddles traded the entire week above the 1% cost threshold, dropping below 1% for Monday. Not out of the woods yet (especially given we have been realizing wide ranges the entire week) but definitely walking away from panic levels.

This Friday is the monthly OpEx, as before, the week going into OpEx not all that bullish.

Given the damage to risk models is still fresh, having some downside follow through this week would fit the historic moves we’ve seen, with markets bottoming ~ opex (just as the shorter vol lookback windows drop the Monday ‘event’).

I’ve been posting intraday gamma performance last couple of weeks, it continued to pay this week, scalping deltas against the 1-DTE straddles up 3/5 days this week (vs 2/5 wins for long straddle.)

Pnl from scalping deltas picked up early in the week, Thursday/Friday not that great as we’ve largely pinned the last half of the day… Vol dropped alot into Friday close, ranges / intraday narrowed by less. I reckon there’s some more meat here, especially for this week that’s loaded with some crucial data points (CPI Wed morning.)

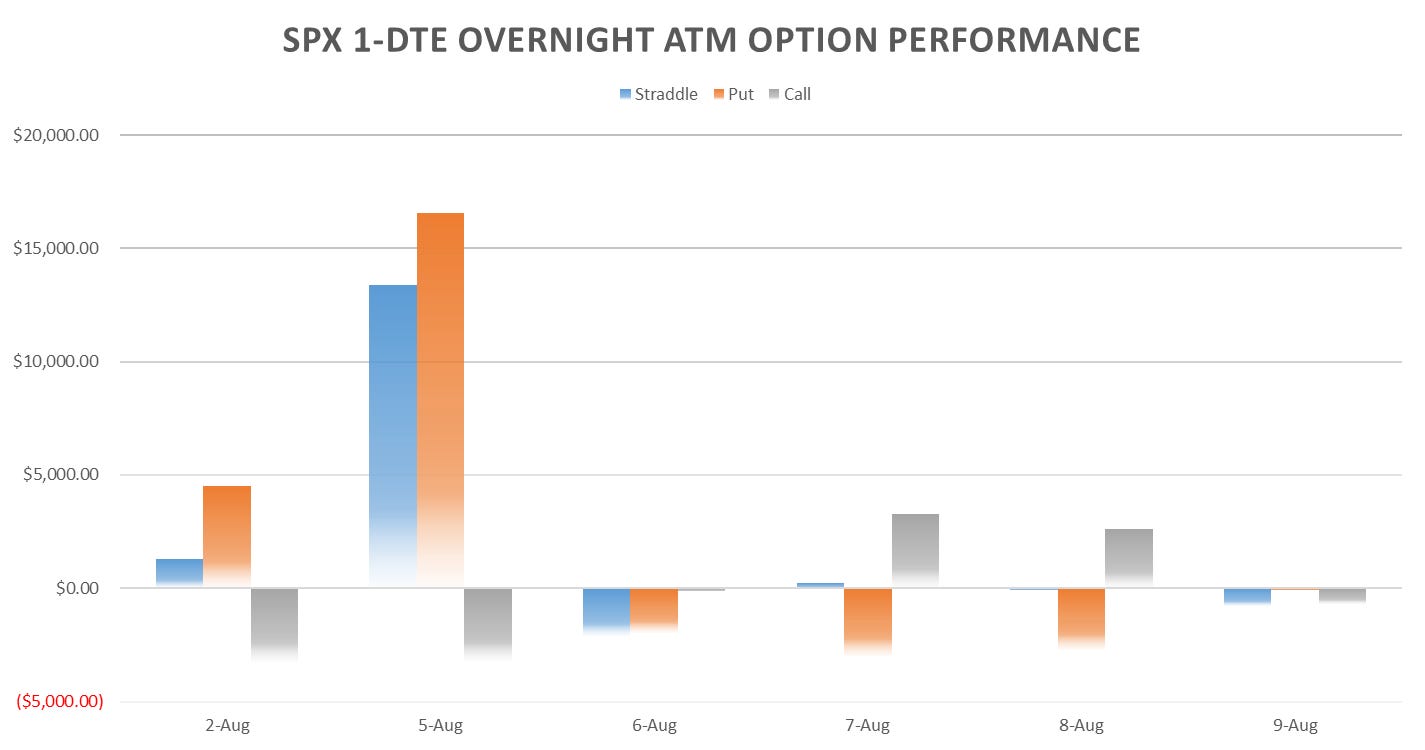

Monday almost entirely shifted the performance when looking at the 1-dte straddle cross-section. All the cumulative gains were largely following London close into 2pm. We’ve seen quite a reversal with eod vol falling off a cliff and the early day vol picking up… Makes some sense given risk mainly coming from overseas… but whats important is historically, these shifts tend to last for months, so will be looking to see if this is an ‘event’ or we are going to shift the intraday vol towards early morning from the afternoon session.

Skew flattened a bit into eow, but puts still bid and coming off alot less than calls. Heard alot of mentions of call overwriting this week, and looking at 25 delta call vols drop 8pts from Monday peak, possibly seeing people take advantage of slightly rich upside vols.

Was reading

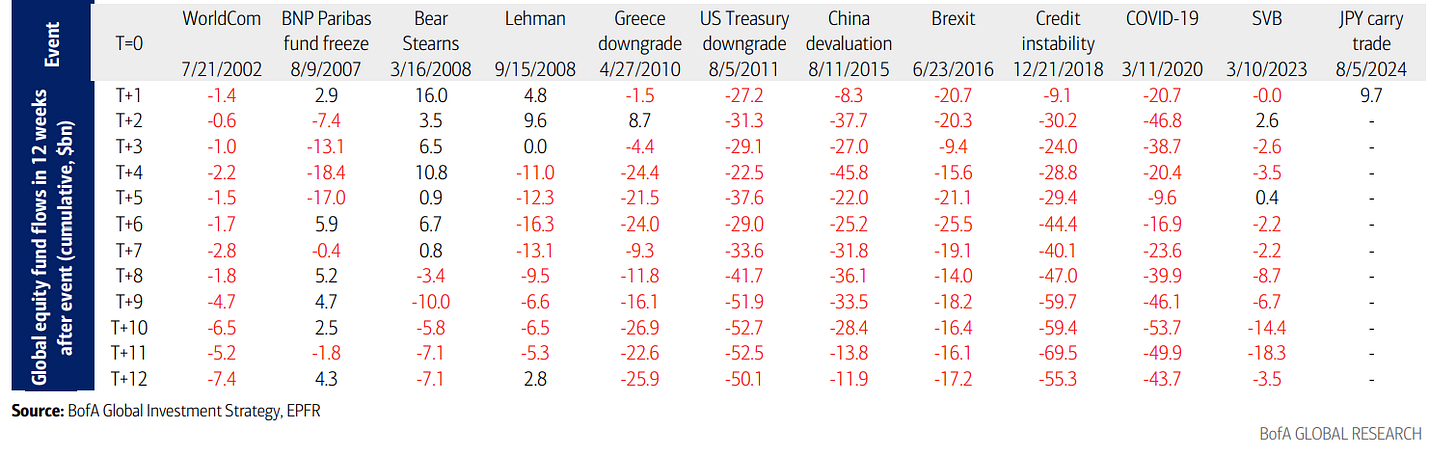

‘s latest post, BofA confirming what I wrote about earlier this week regarding deleveraging and volatility triggers. Majority of events last 20 years saw, on average, 12 weeks of outflows from equity funds… we are currently just a week in on Monday, which should add further caution in terms of position sizing and upside expectations.Realized Volatility Overview

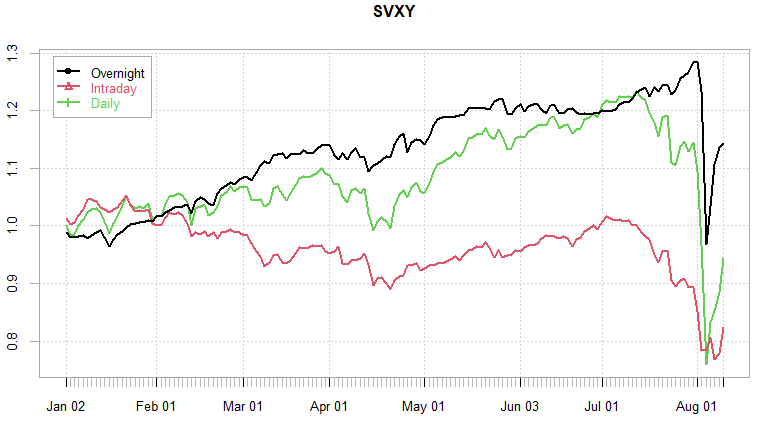

SPY still 13%+ on the year. Overnight performance had a hiccup with BoJ on Sunday, however, recovered rest of week… Intraday performance at just a measly few % ytd…

10-day rvols showing some easing into Thursday/Friday. Wider ranges tend to stick around longer than cl-cl changes (at least historically.) Implieds already started to fade rvols, now trading at a -ve 10-day VRP. Implied vol beta should remain responsive to underlying moves, which is why historically, not the best environment to short ivol here…

VarRatio’s showing *some* signs of mean reversion, although intraday ranges not exactly that much bigger than most cl-cl moves we’ve seen…

Short Vol ETP’s briefly went negative YTD even for overnight performance after the BoJ hike.

wrote an interesting note on VIX & SPX Options, specifically outlining the boost VIX gets from wider SPX quotes overnight… Maybe the overnight VX performance is indeed another example of the famous ‘peso problem'. Its hard to hedge the overnight trade as well when it goes wrong, as we’ve seen options markets freeze on a relatively ‘small’ SPX drop on Monday morning and the front month VX jumping ~1pt per 30 seconds.SPX ATM Straddle Performance

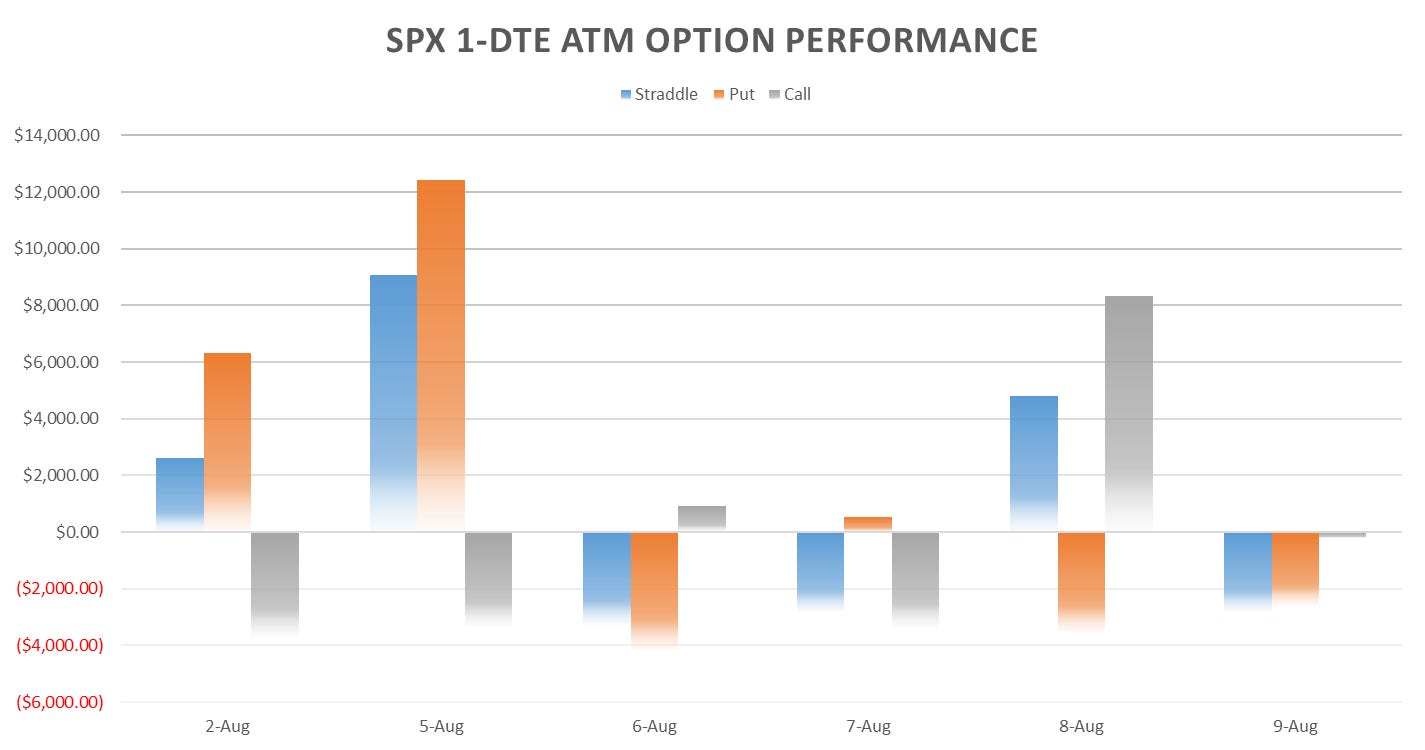

1-DTE straddles up ~50pts on the week, Monday and Thursday decent winners.

Outside of the Tuesday reversal from the gap up, RTH vol died off… almost 75pts loss from 2nd of Aug for RTH straddles.

Hard to get a clean quote on the overnight performance for Monday, spreads we’re extremely wide but given how deep ITM the puts we’re, roughly a 130-140pt win.

Once again, outside of Tuesdays big reversal from the open, intraday straddles did not do well… losing ~20pts each day.

Mixed performance for midday straddles, around net flat for 1pm and 2pm straddles…

Last 10 minute straddles did quite well, net up ~15pts on the week, large selling going on Mon/Tue/Wed towards the close.

Variance Ratio Conditional Performance

From the following post:

The VarRatio system trying to recoup some losses. Looking at the signals, quite a difference in pnls between RTH & 1-Day positions this week. 1-DTE leg traded long straddles all week, RTH leg was short RTH open straddles all week… Bias is towards intraday mean reversion, but the overnight moves not large enough to cover the 1-DTE premiums. Ideally what was expected was a large move into open, with some continuation that gets retraced towards eod.

One of the larger drawdowns, but started to recover last week…

VX Carry & SPX Overlay

From the following post:

VX30 system out of short trades for a while now (managed to capture some initial long VX momentum 2 weeks ago), unfortunately, Friday close before the Monday event closed without a long vol trigger… Overlay had 2 long straddle trades last week, gave back ~1-1.5%. Currently out of VX positions but long Monday 1-DTE straddle.

Have a good week!