Index & Index Options Performance around MAG7 Earnings

Updated for June/July 2024 earnings season

Previous overview:

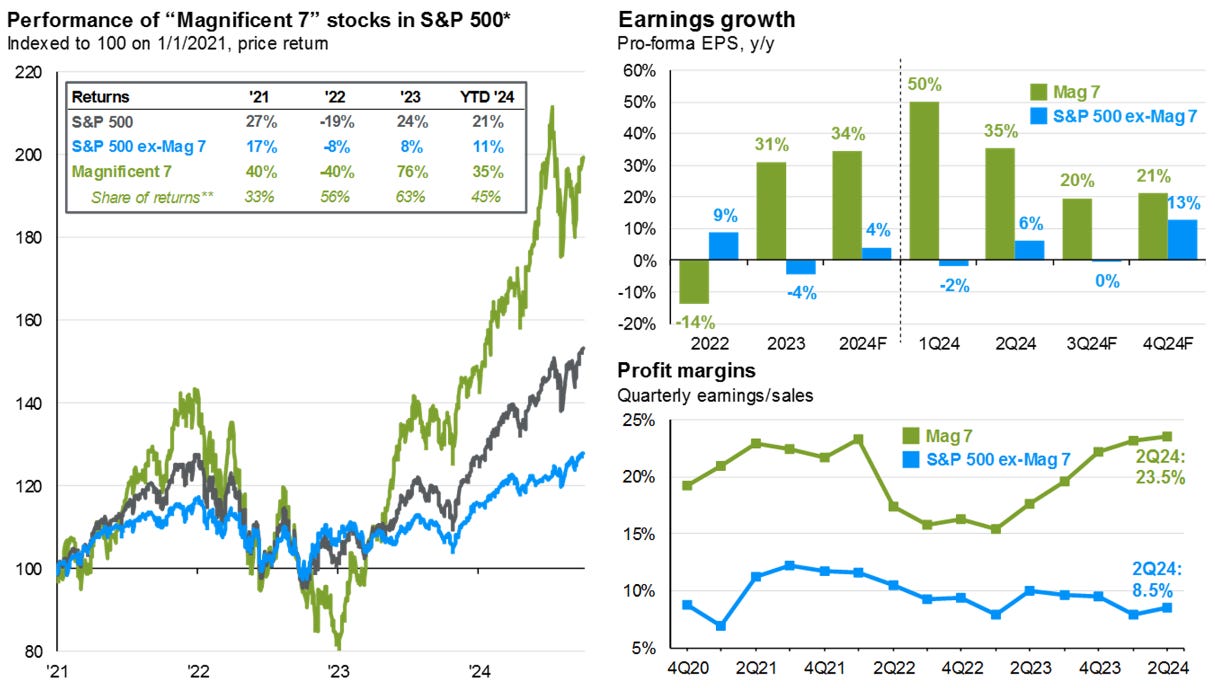

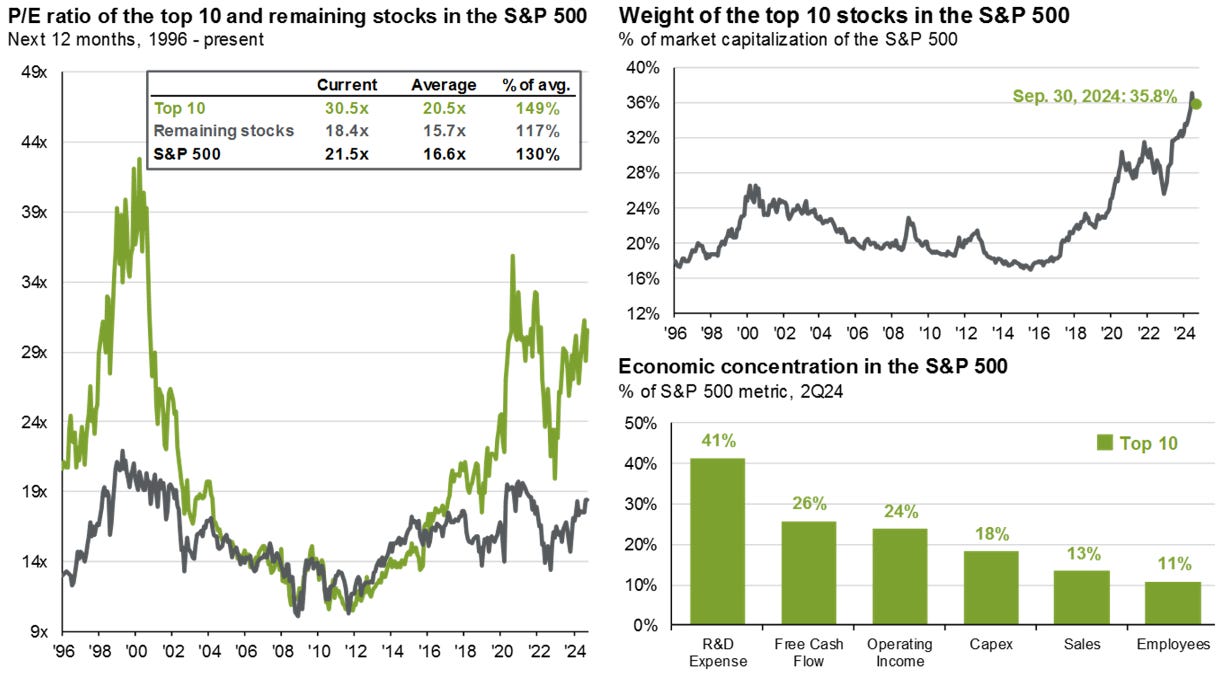

MAG7 contribution is pretty much the only growth SPX gets over the last few years. Upcoming earnings season (TSLA reported this week) should once again re-affirm the expectations of earnings growth for ~36% of SPX market cap.

Index concentration dropped a bit following the near 40% peak ~ July, however, still well above historic highs seen in 2000.

Source: J.P. Morgan: Guide to the Markets: https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/

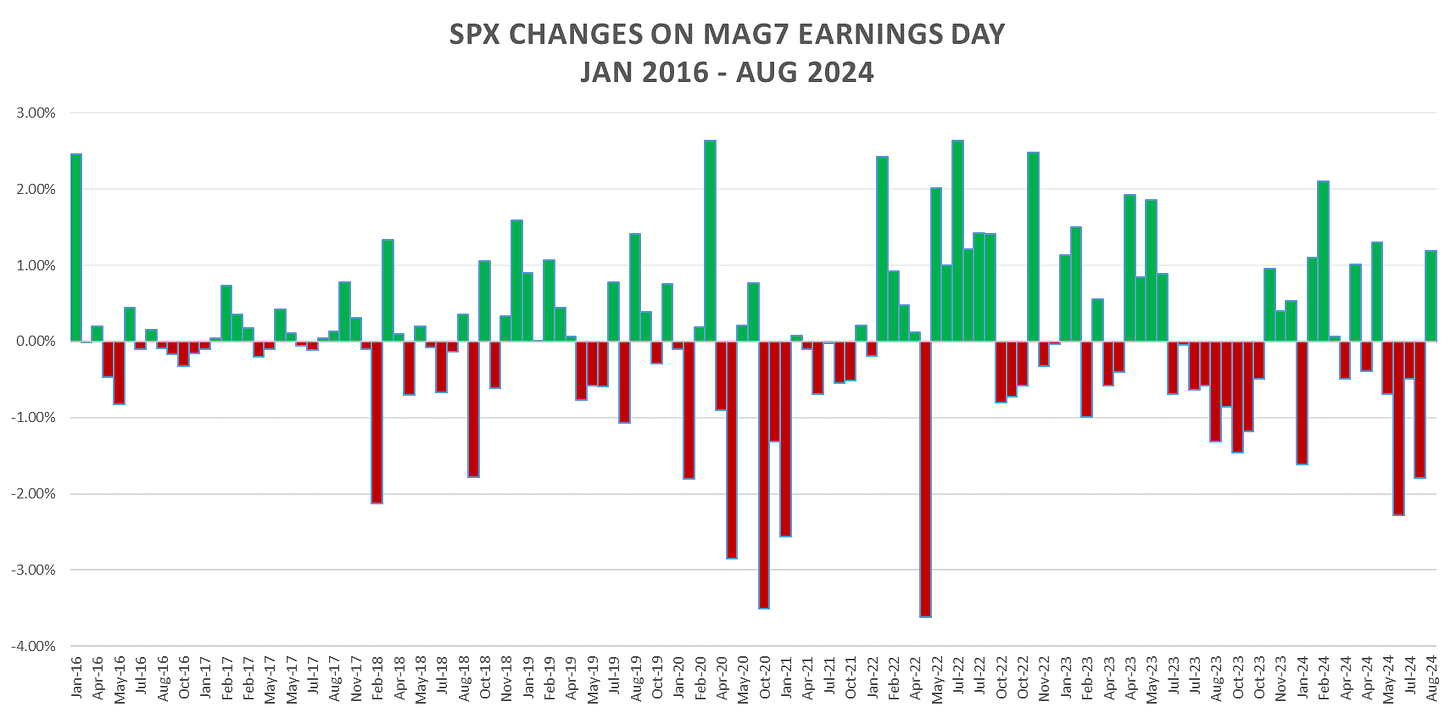

Lets take a look at how the summer earnings season has shaken out:

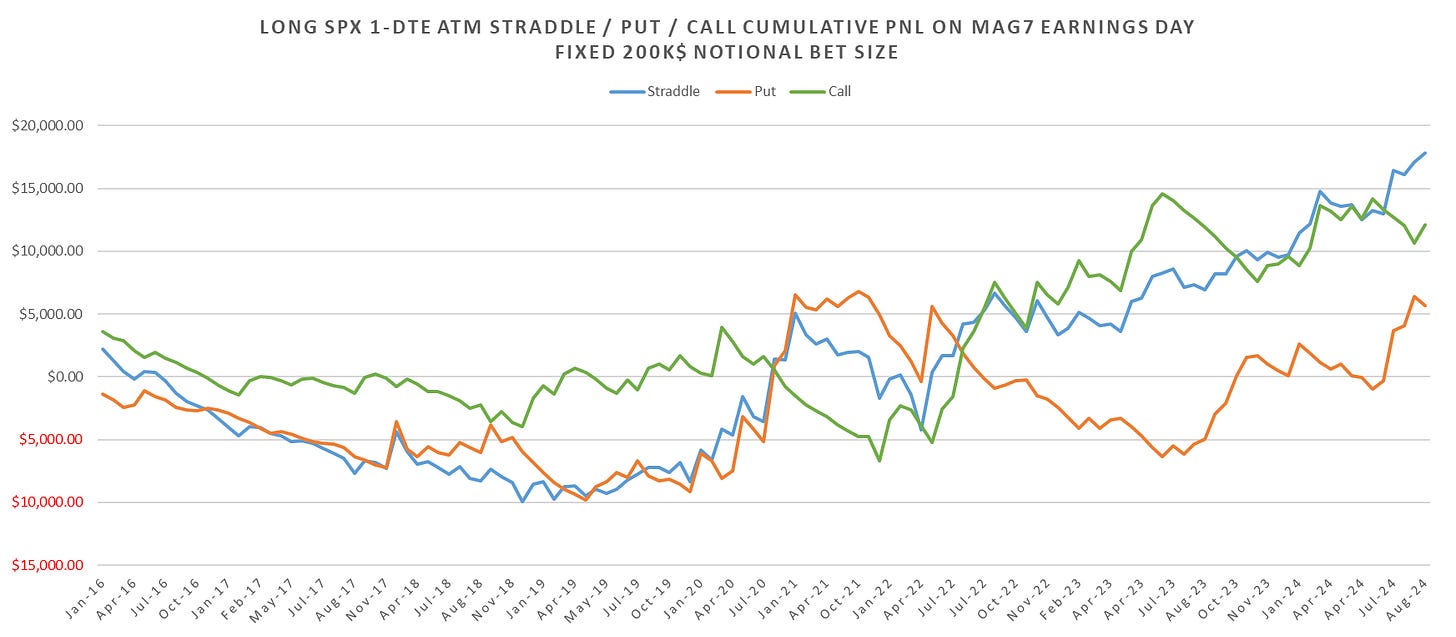

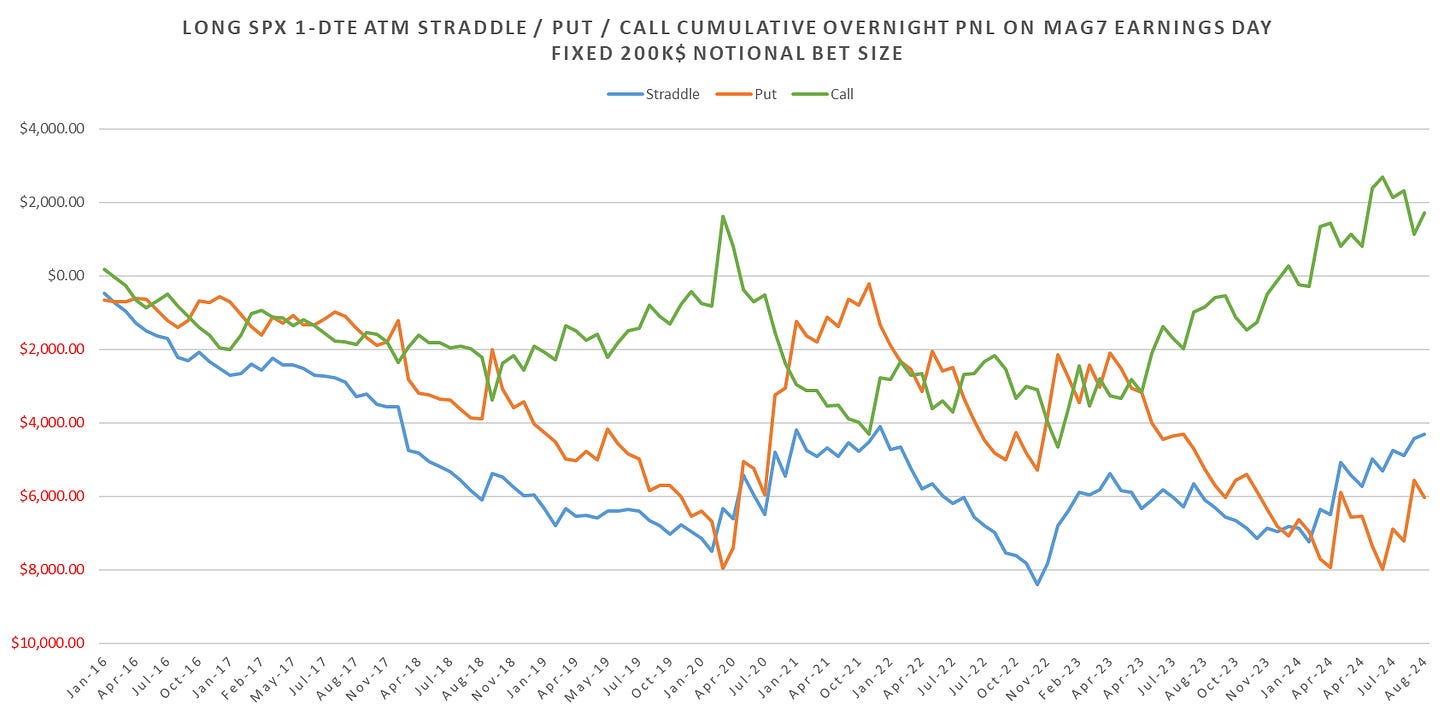

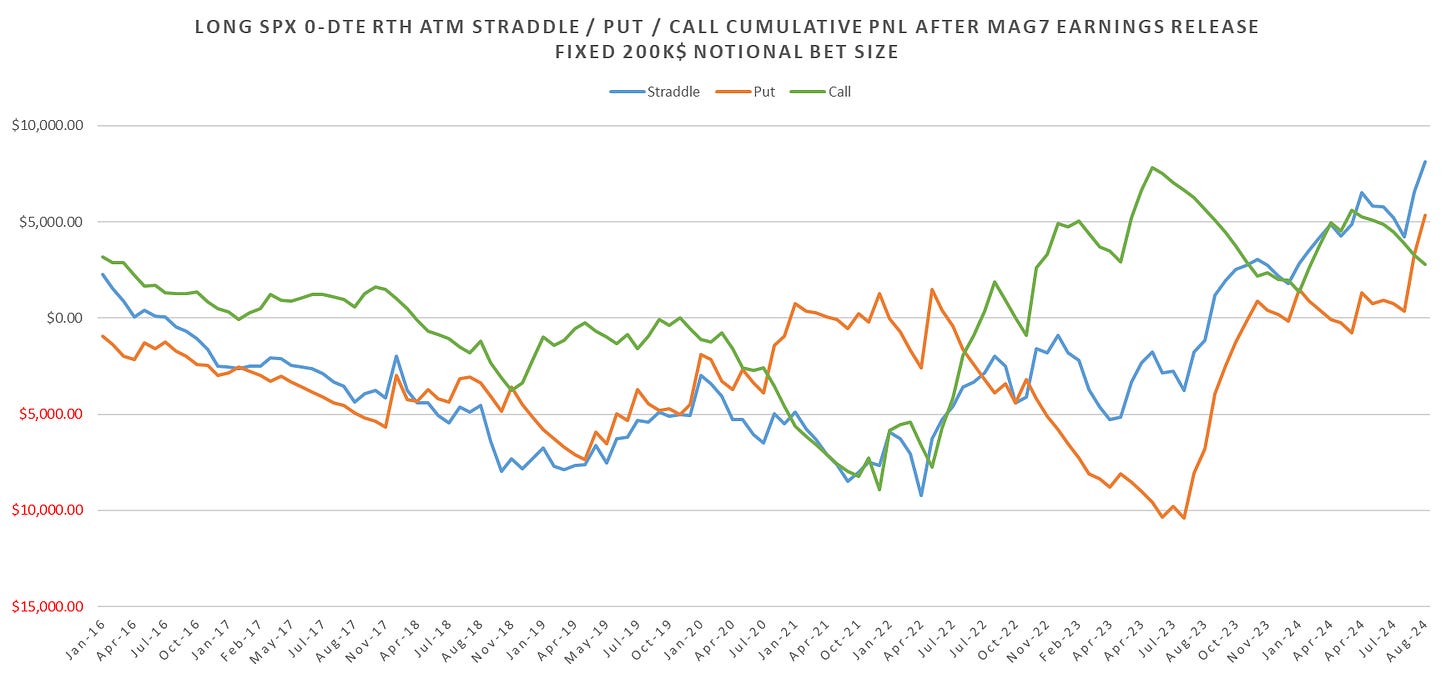

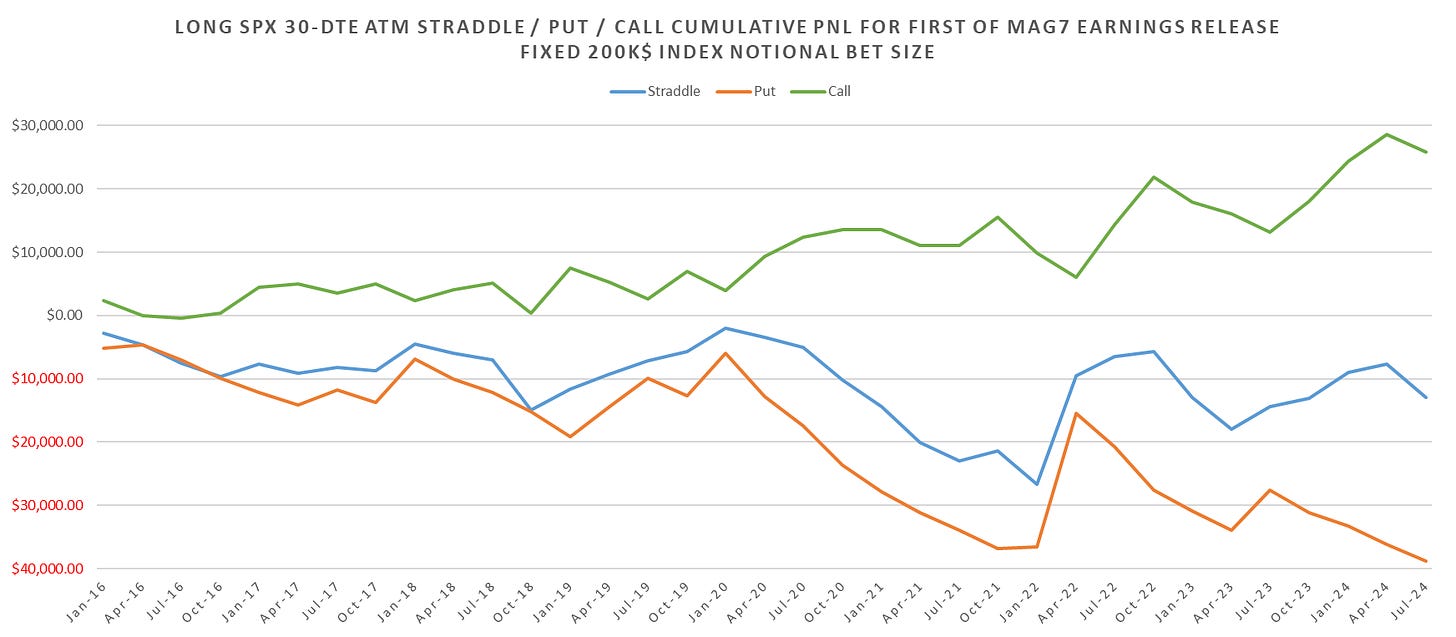

Once again, the broad impact on indices from MAG7 earnings was underpriced. Buying straddles during the summer earnings season for a MAG7 earnings day returned ~132pts (not bad for just 4 trading days that cover the earnings.)

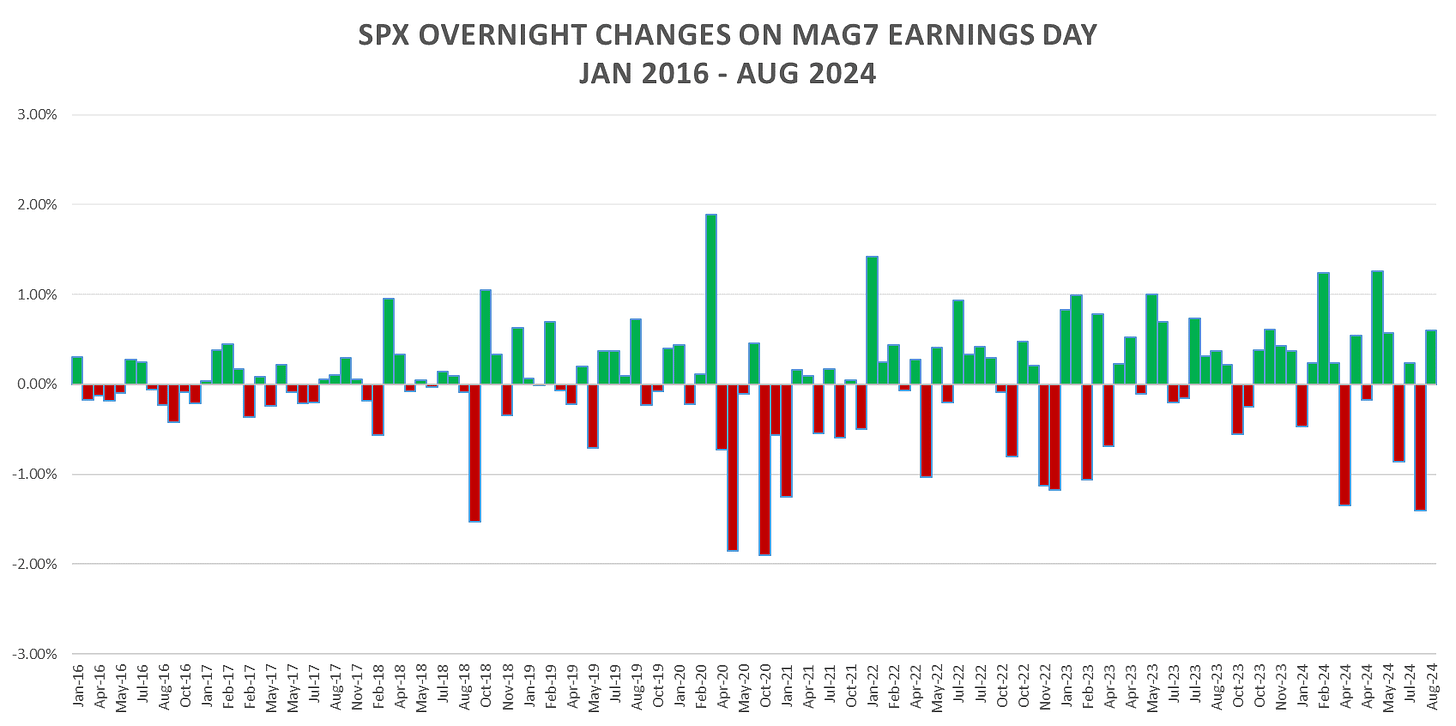

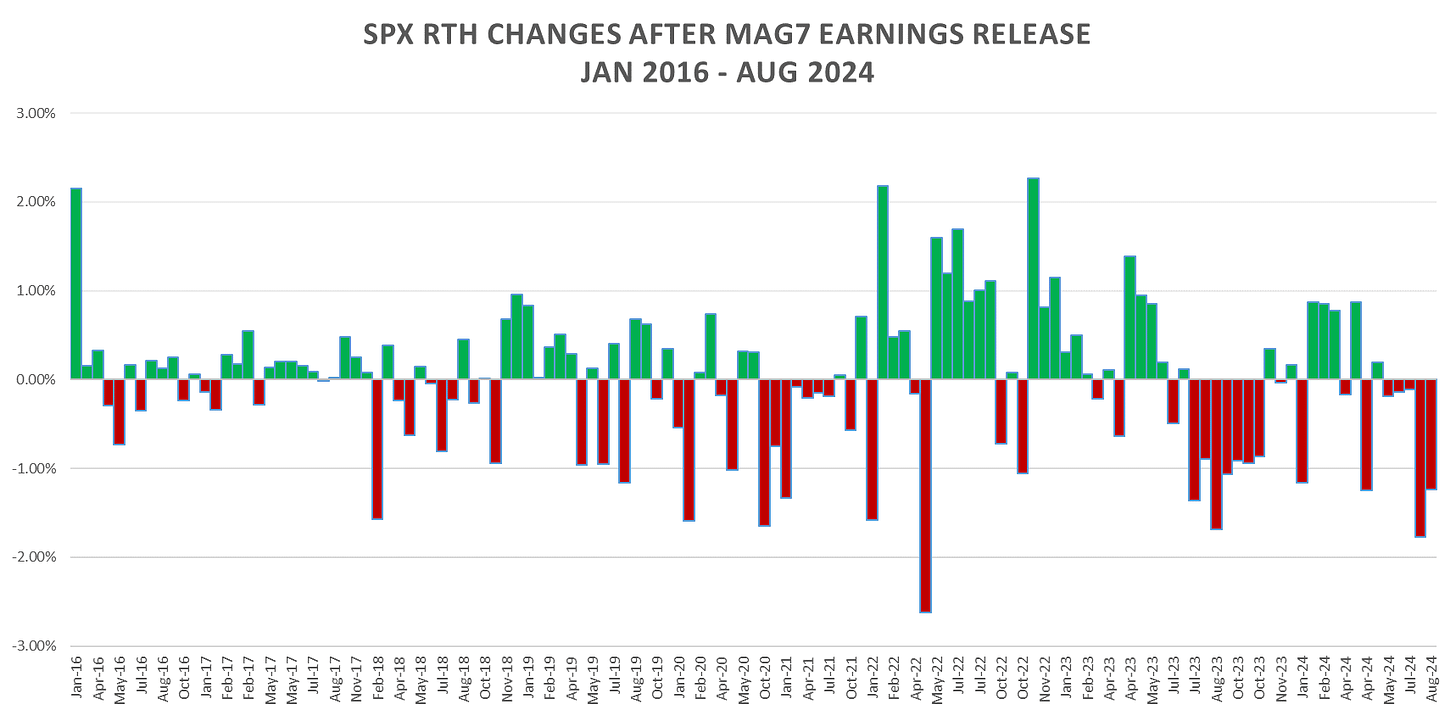

Breaking down by RTH changes & Overnight changes:

July earnings largely came during a nasty dispersion trade unwind so we saw some negative reactions in tech names. Mood was also marred by the uncertainty surrounding AI monetization timeline.

US RTH session is where majority of the downside action came in, with RTH puts up ~123pts for the summer earnings season.

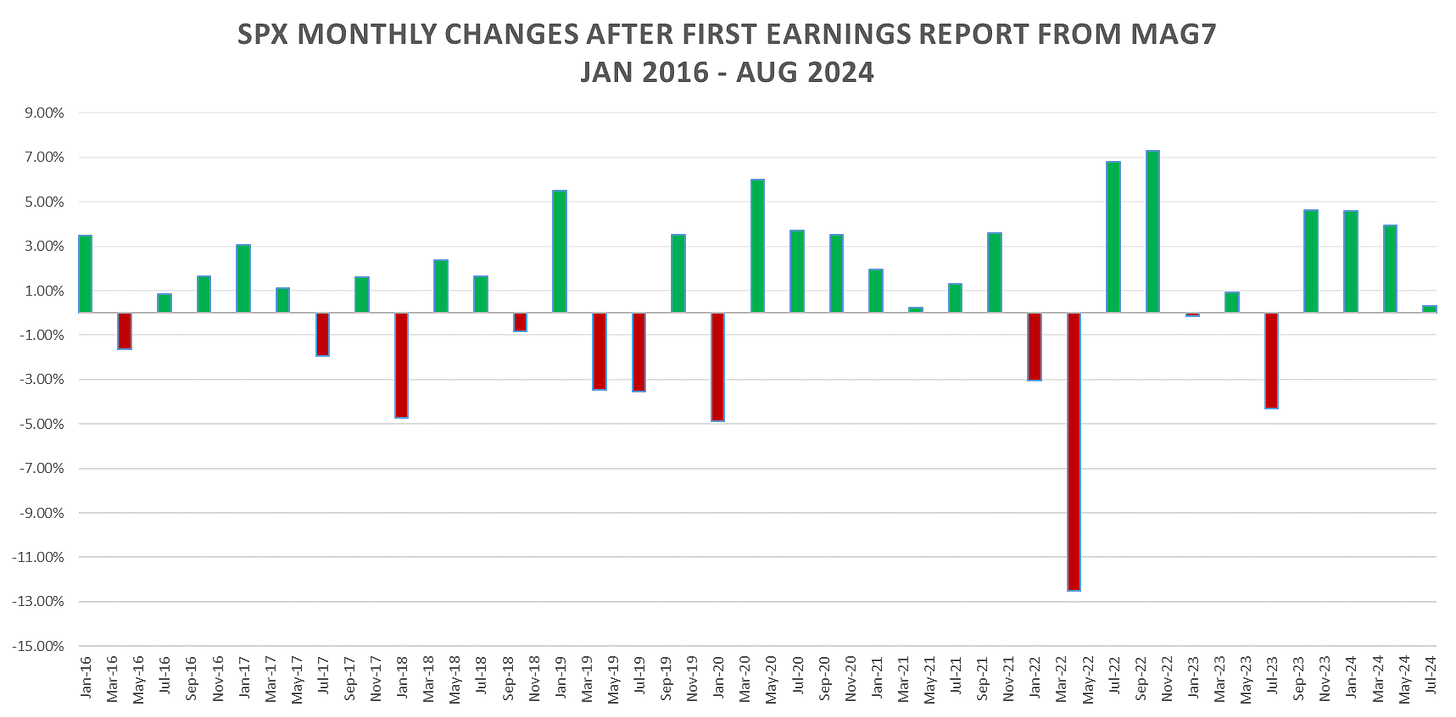

Looking at monthly performance:

SPX had a wild range in between the MAG7 earnings, however even with the BoJ induced drop in between it managed to close practically unchanged (30pts diff) between the first earnings on 23rd of July (GOOGL & TSLA) & NVDA earnings on 22nd of August.

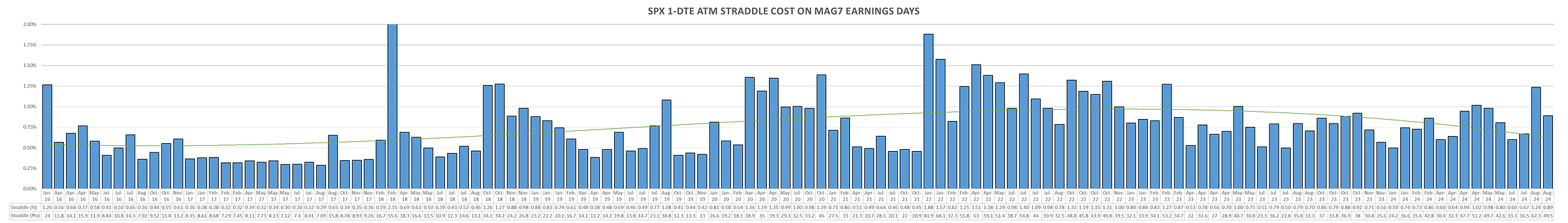

Despite (on avg) increase in SPX straddle cost for MAG7 earnings, still lags the realized move post earnings.