Index & Index Options Performance around MAG7 Earnings

Updated for February/March earnings season

Previous earnings season post:

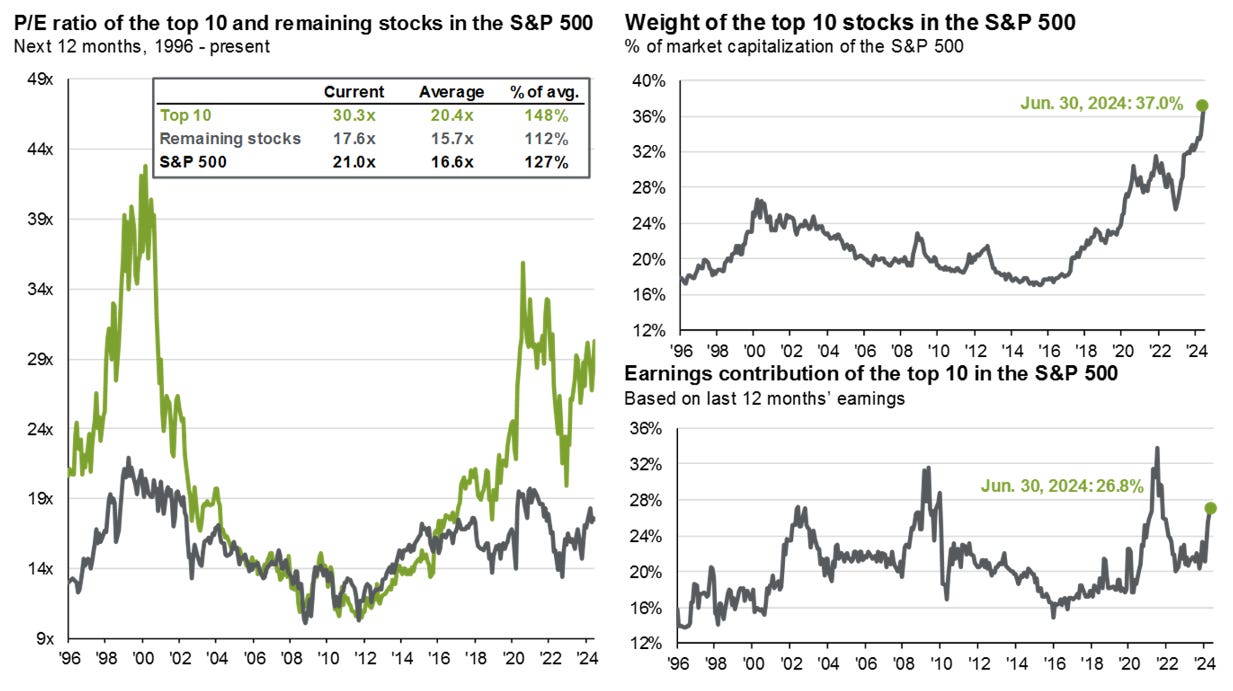

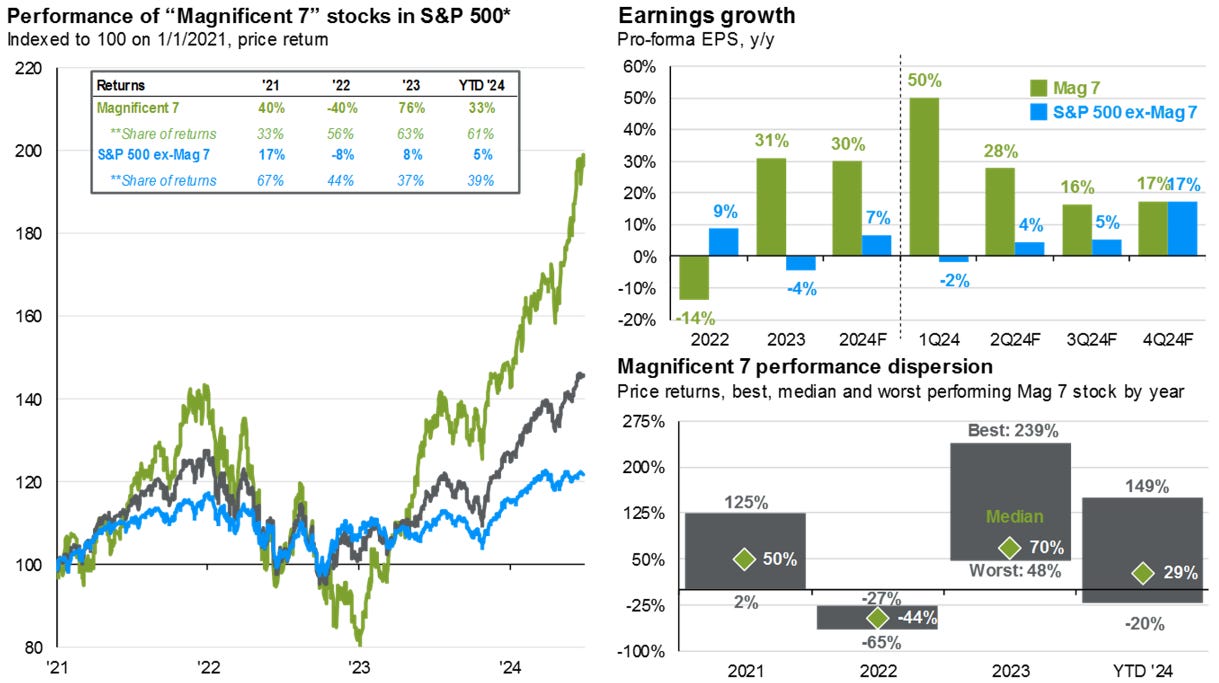

Another earnings season is starting and all eyes are once again on the MAG7 components that have become vital to equity indices. Since the last post, index concentration has increased further (although a bit off from a week ago after the rotation into RTY & YM.)

Earnings have slowed last couple of quarters, but double digit growth is still there…

Source: J.P. Morgan: Guide to the Markets

(https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/)

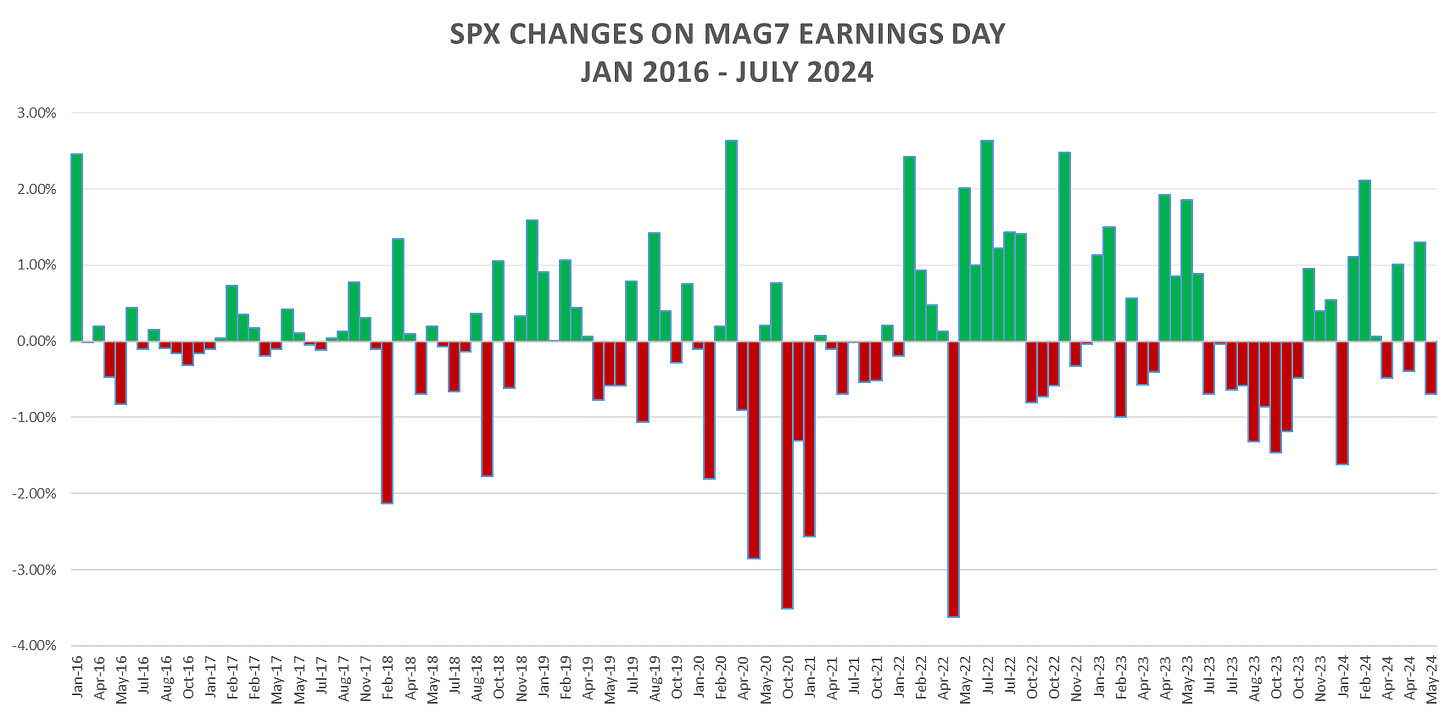

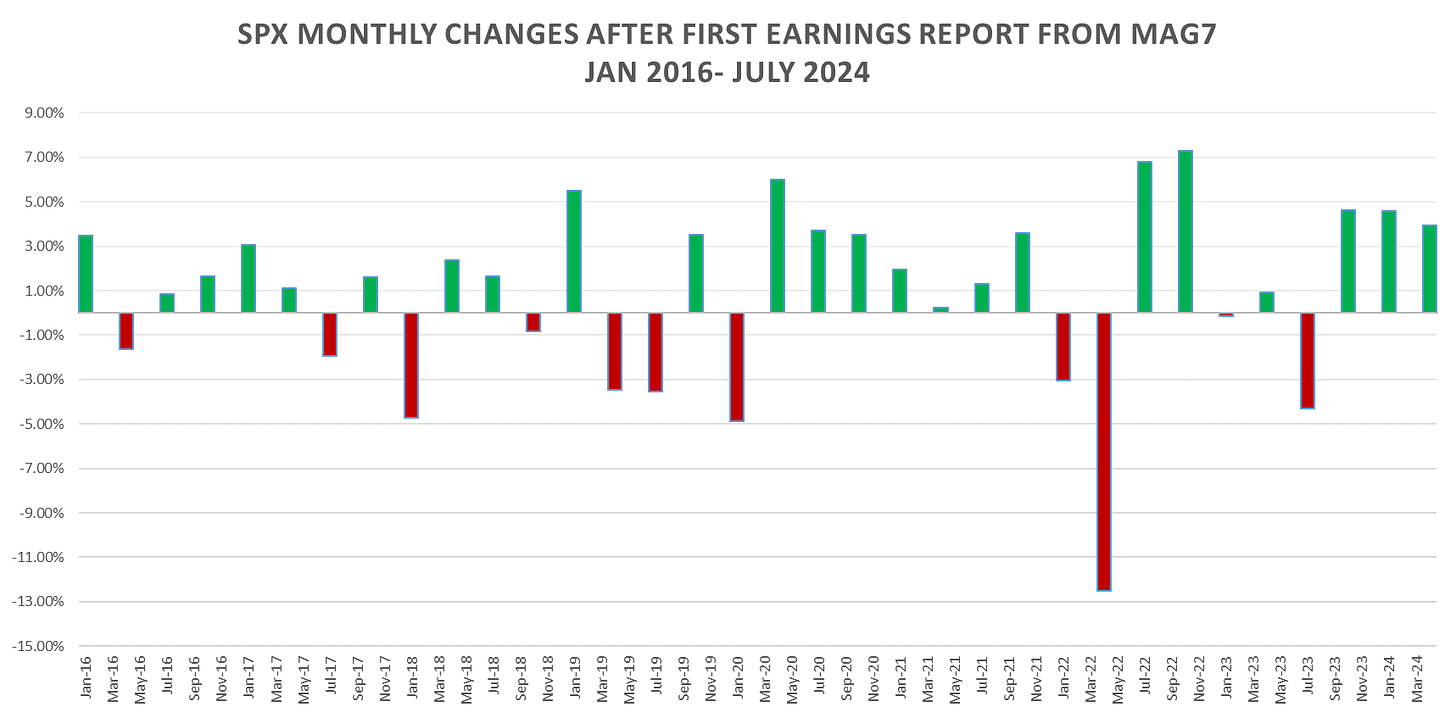

As with the previous post, we will look at last earnings season SPX performance for days when Apple, Amazon, Alphabet, Microsoft, Meta, Nvidia and Tesla report AH.

Relatively flat performance in February/March.

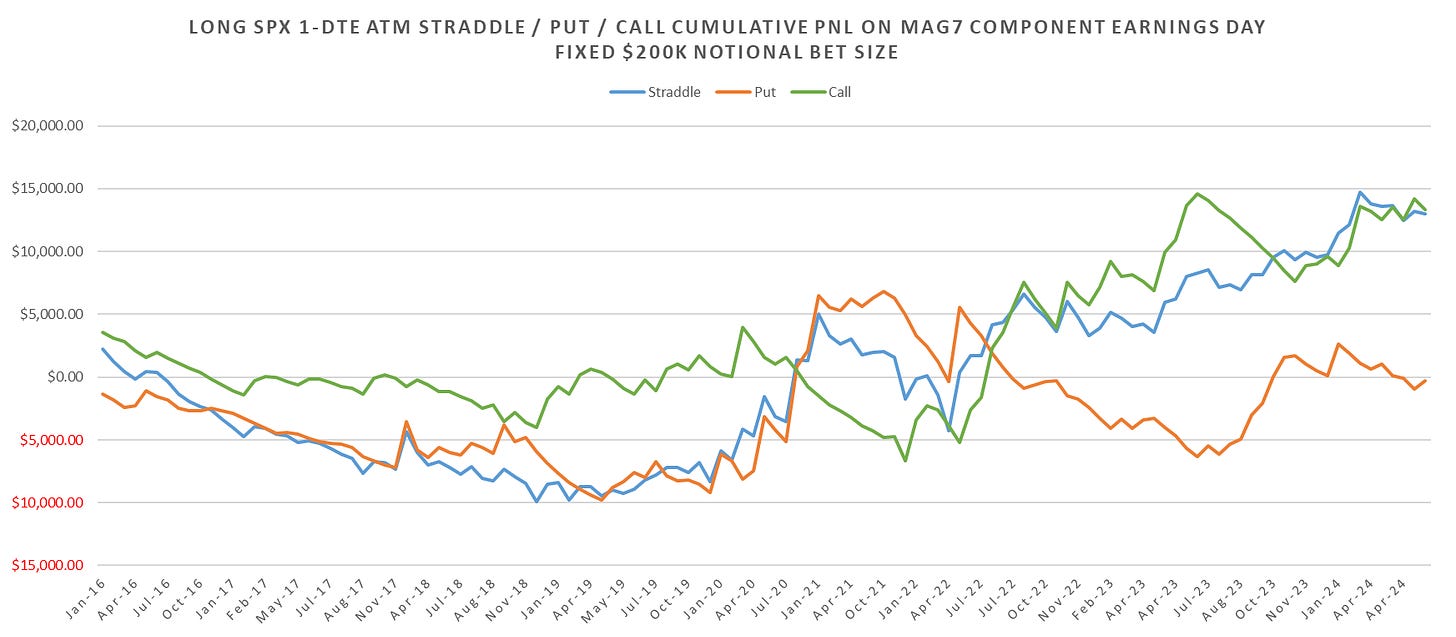

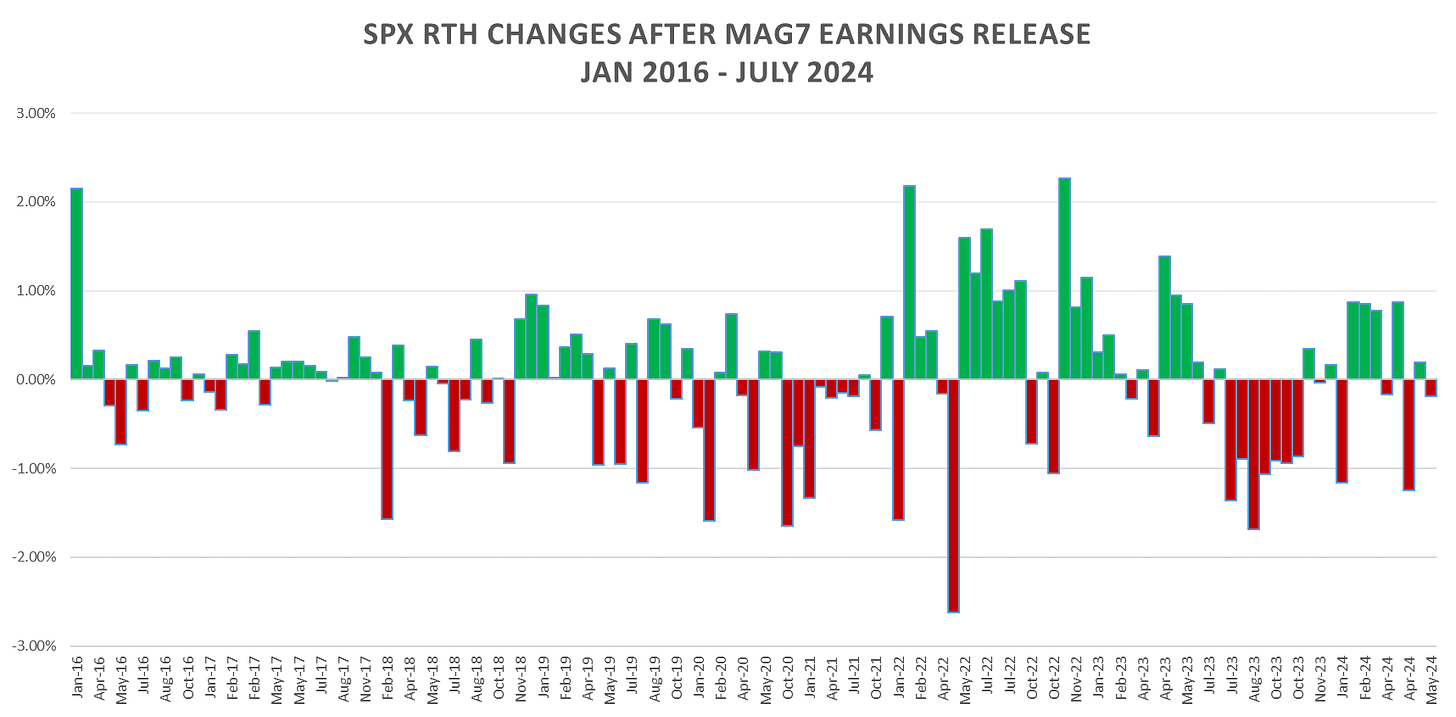

Looking at RTH changes after earnings, they continue to be weak.

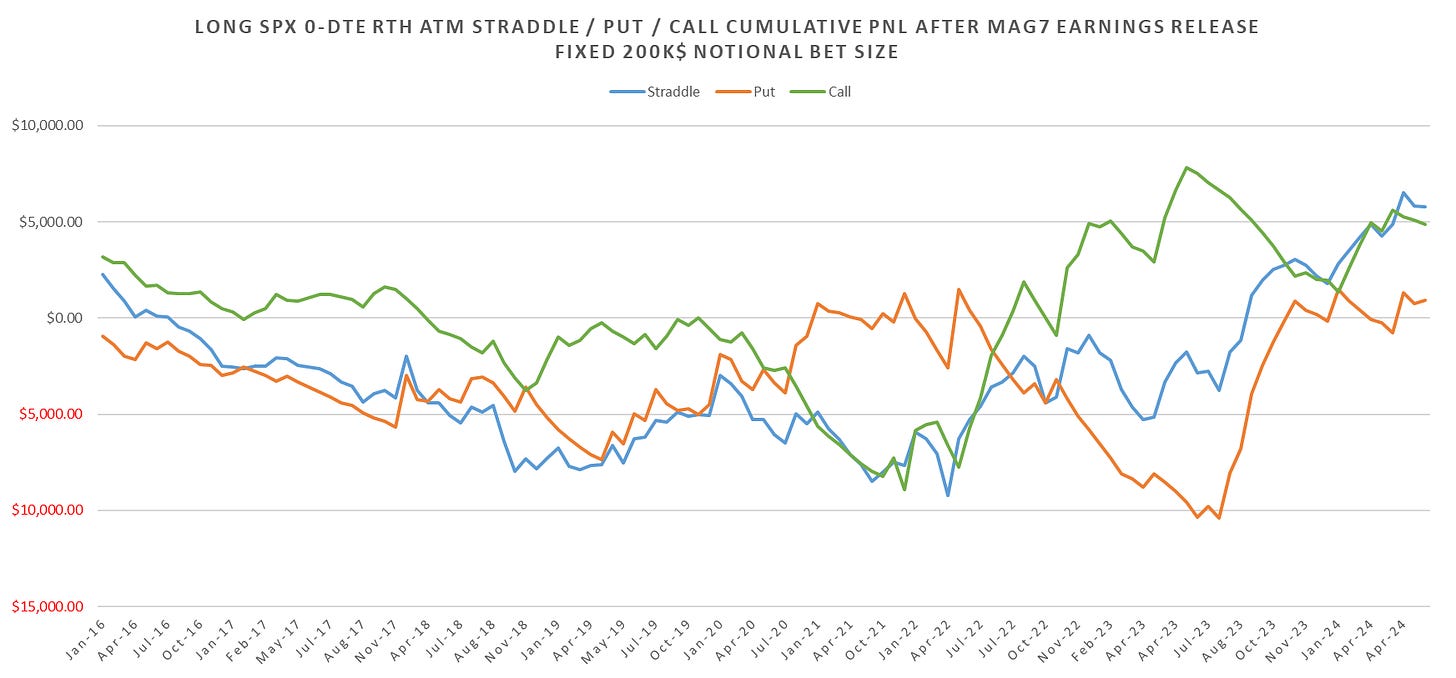

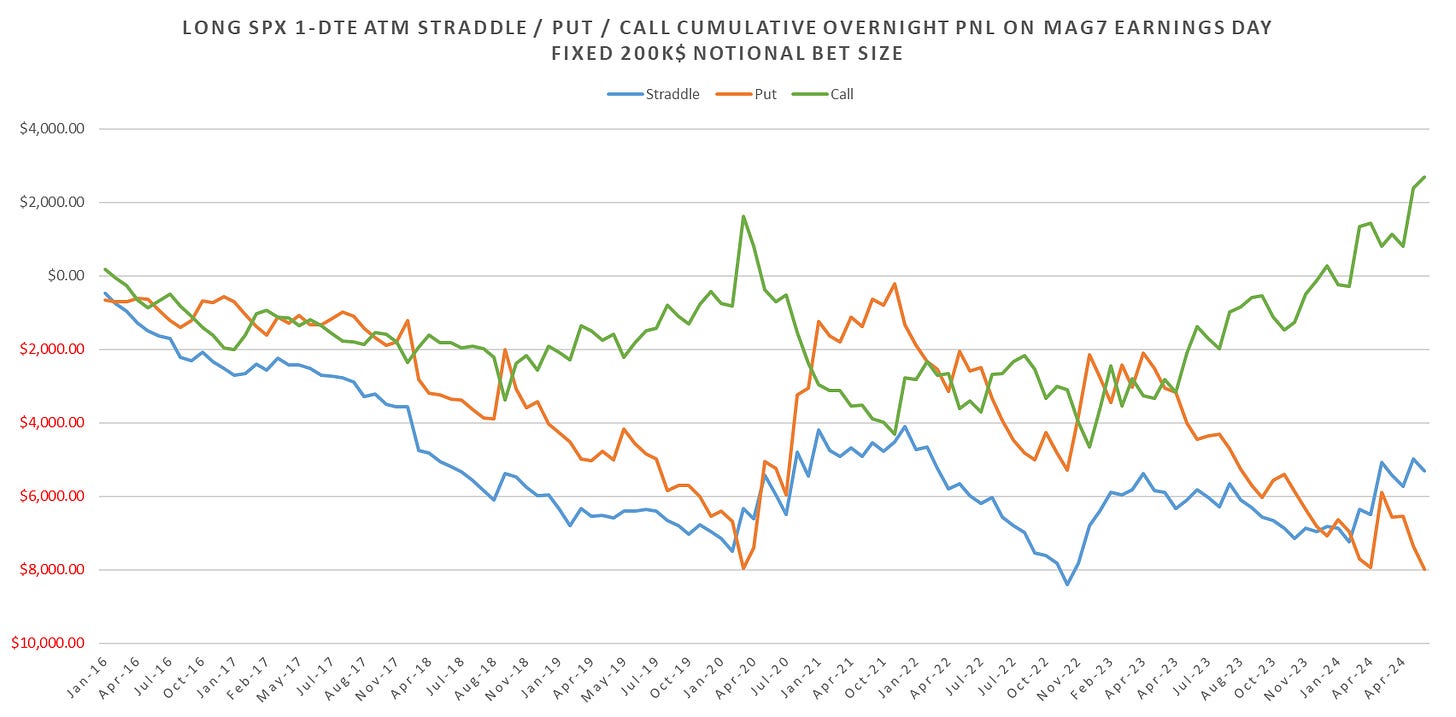

Puts holding up well when bought at RTH open after the overnight earnings move.

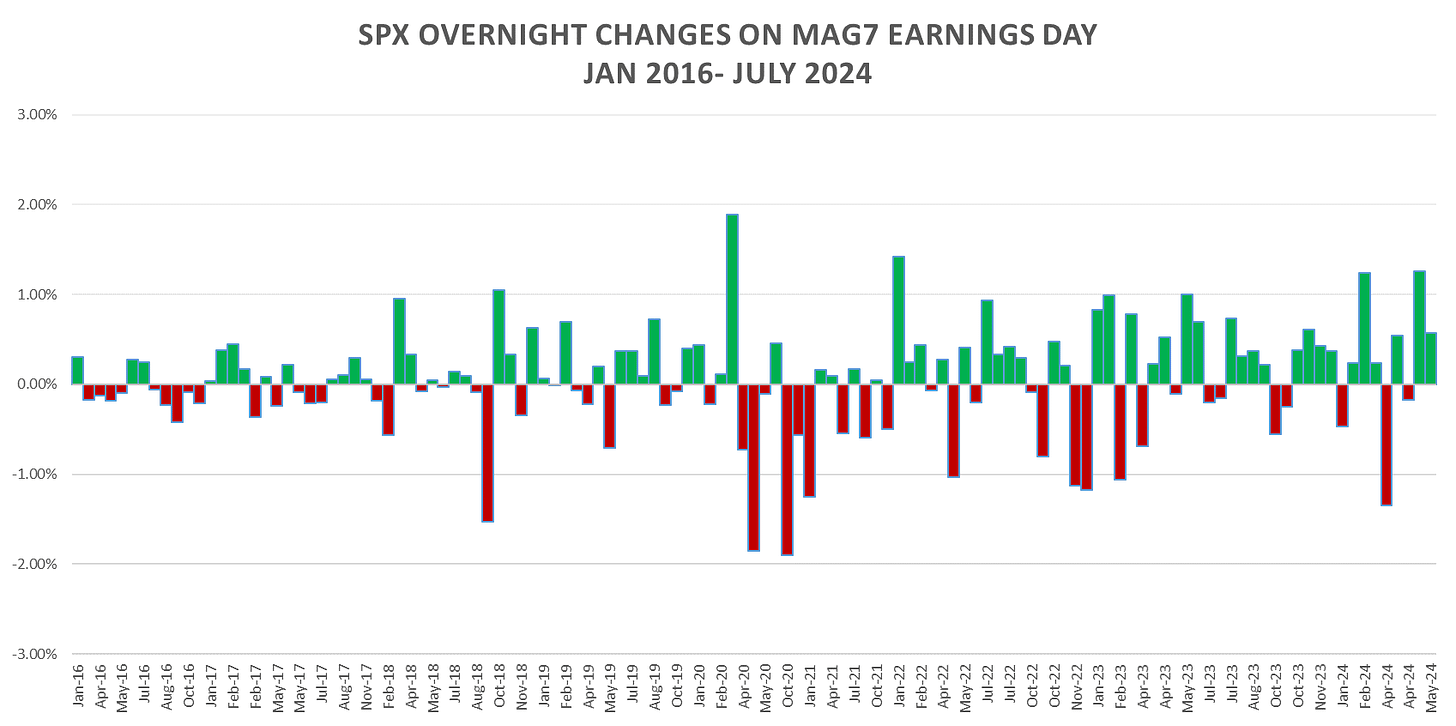

Overnight moves, however, still positive (outside of Apr 24th.)

MAG7 components traded off their July highs into the earnings season… lets see if we can see them at least test the highs by August.

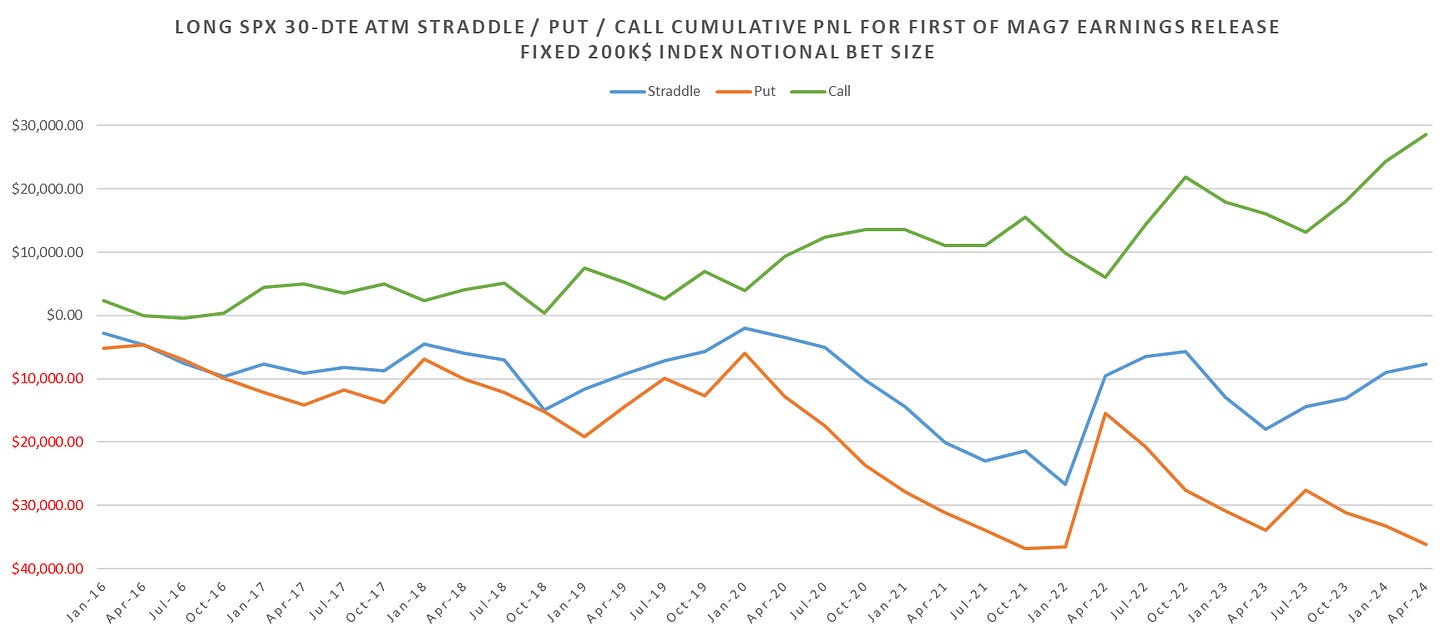

Current earnings season for MAG7 between todays Google / Tesla reports and Nvidia in August is exactly 30 calendar days, can be captured by a 30-DTE straddle.

Overall, looking at the 30-DTE trade on the night of the first MAG7 earnings component release, unsurprisingly positive…

Keep reading with a 7-day free trial

Subscribe to Vol Vibes to keep reading this post and get 7 days of free access to the full post archives.