Q1 2025 earnings:

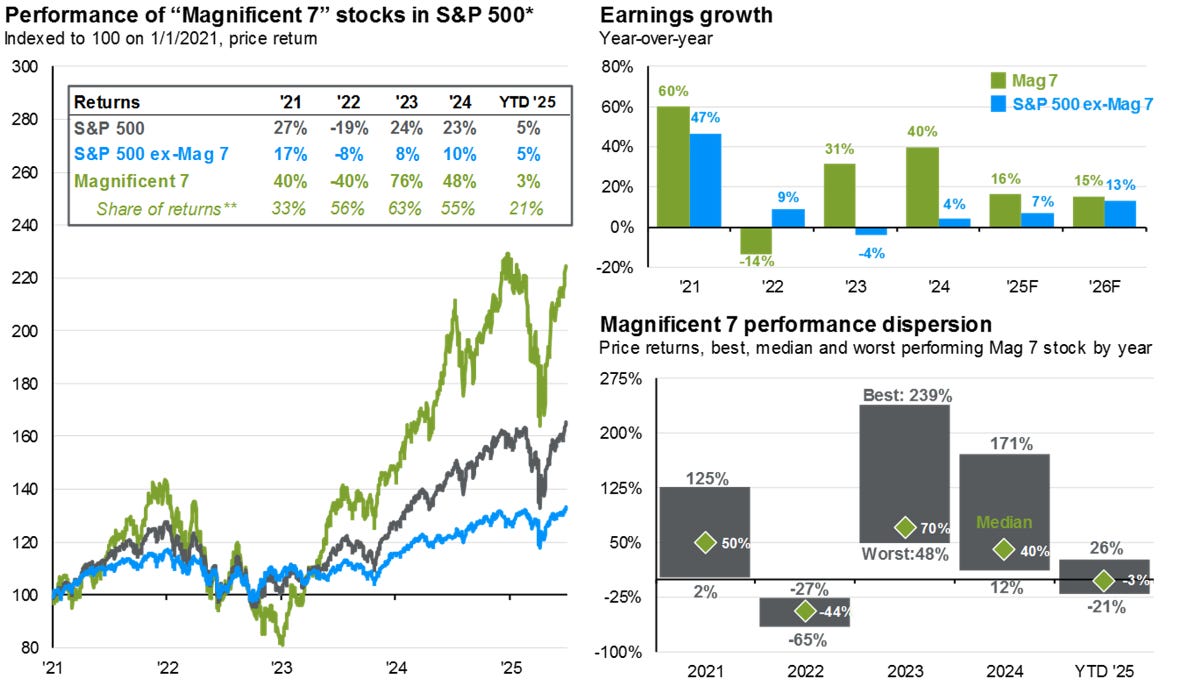

Google & Tesla set to report today after market close. Since last quarters earnings google up 20%, Tesla up ~38%. Markets have rallied ~15% from the start of previous earnings season, lead by the ‘AI’ basket once again. NVDA/MSFT/META all made new highs into July.

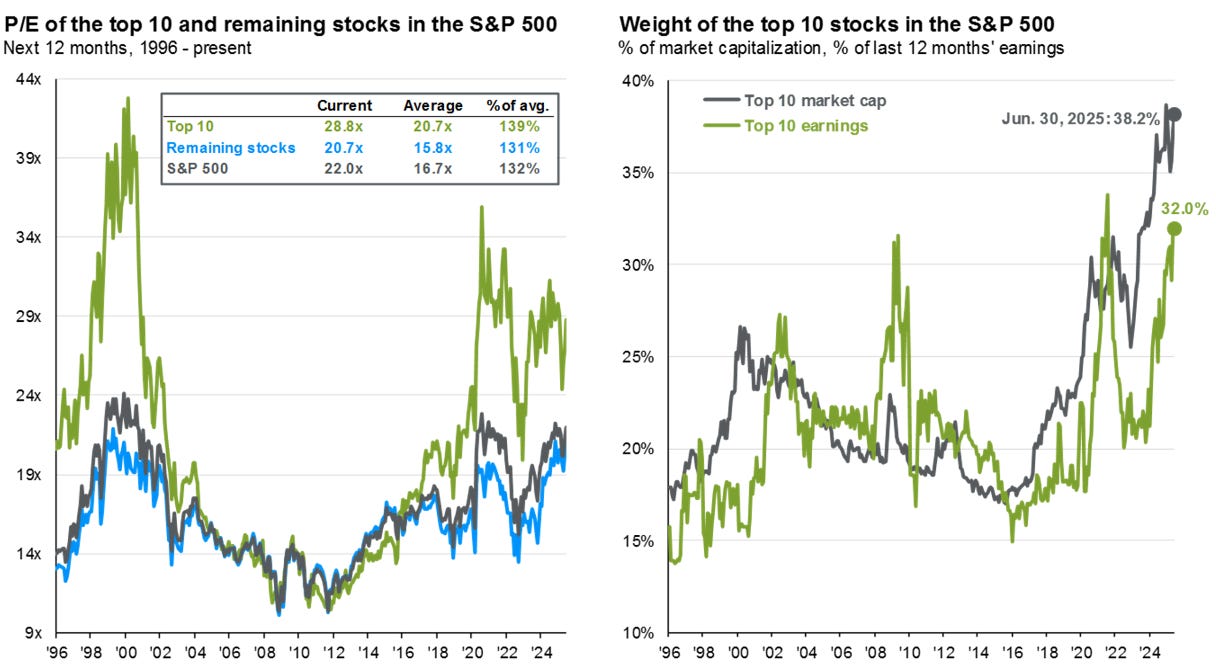

We’ve seen major multiple expansion since April/May in broader market but more so for large cap stocks. YTD, however, much more balanced earnings growth between MAG7 and rest of market.

Source: J.P. Morgan: Guide to the Markets: https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/

Weight of top 10 stocks back to 40% of S&P 500, highest ever. Outsized MAG7 impact on index vol is evident through sharp vol spikes last few years as correlations spike and index vol moves closer towards average single stock vol (which is substantially higher right now than at any point in last 20 years.)

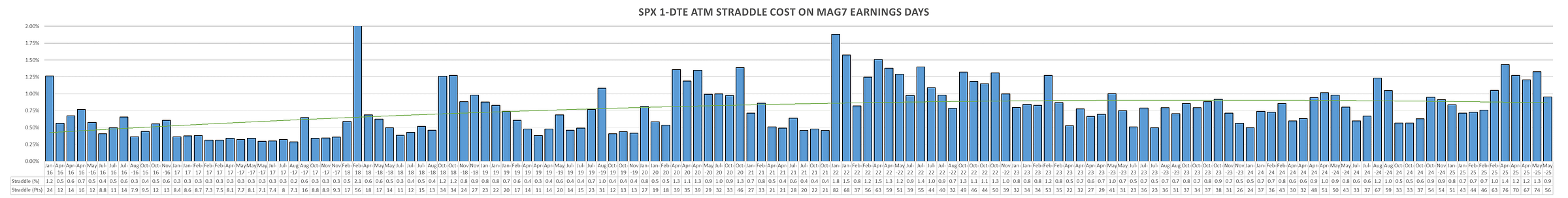

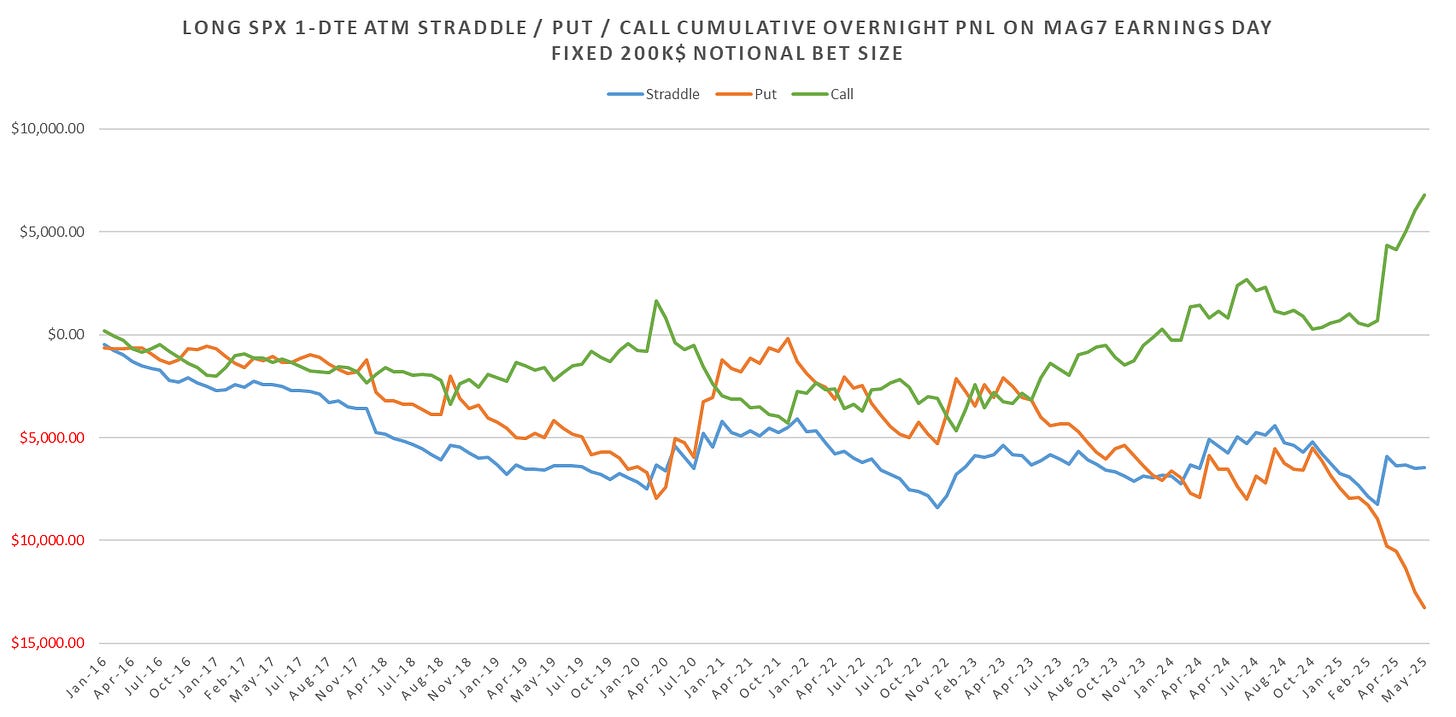

1-DTE SPX straddles currently only trading ~50bps for tomorrow despite Google & Tesla earnings (lows of the 3 year range.) This is the result of implied correlations dropping to near last years lows (1m icorrs down from ~15% to 10% in last few days.)

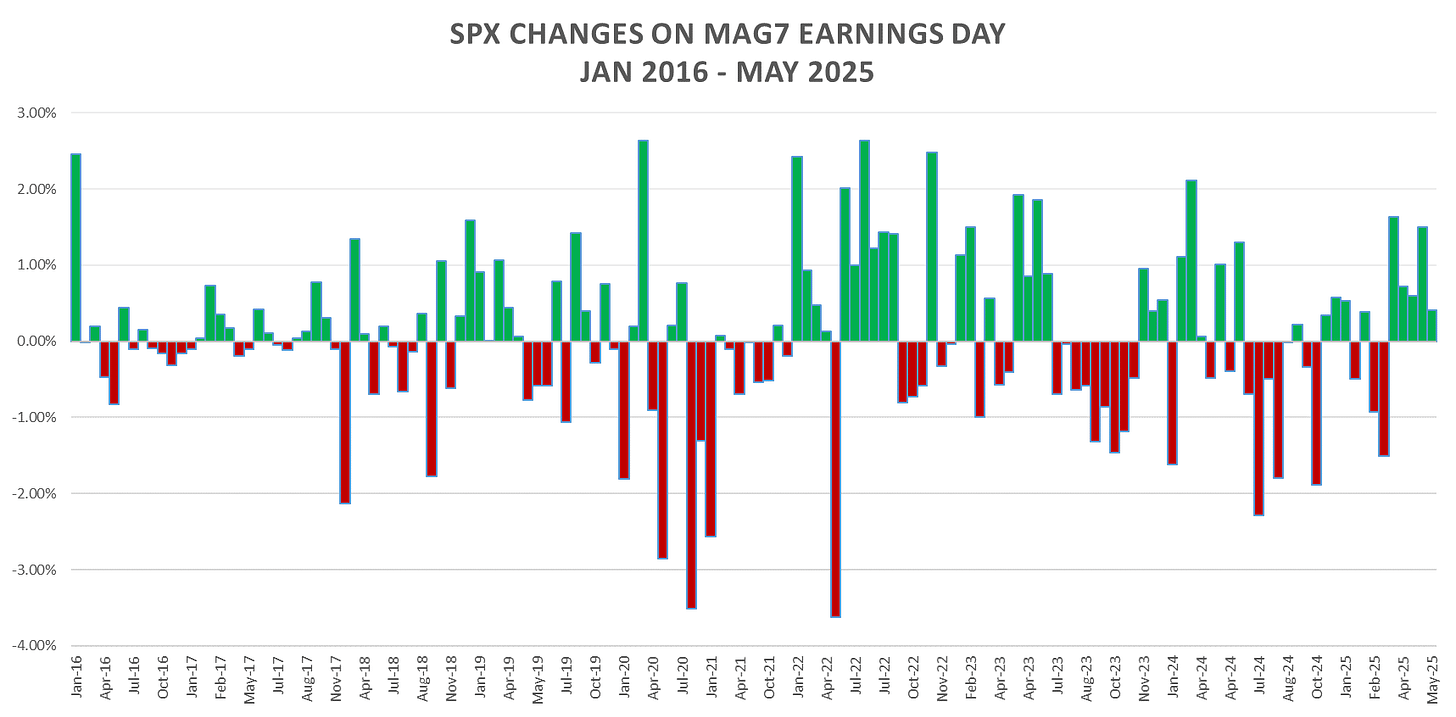

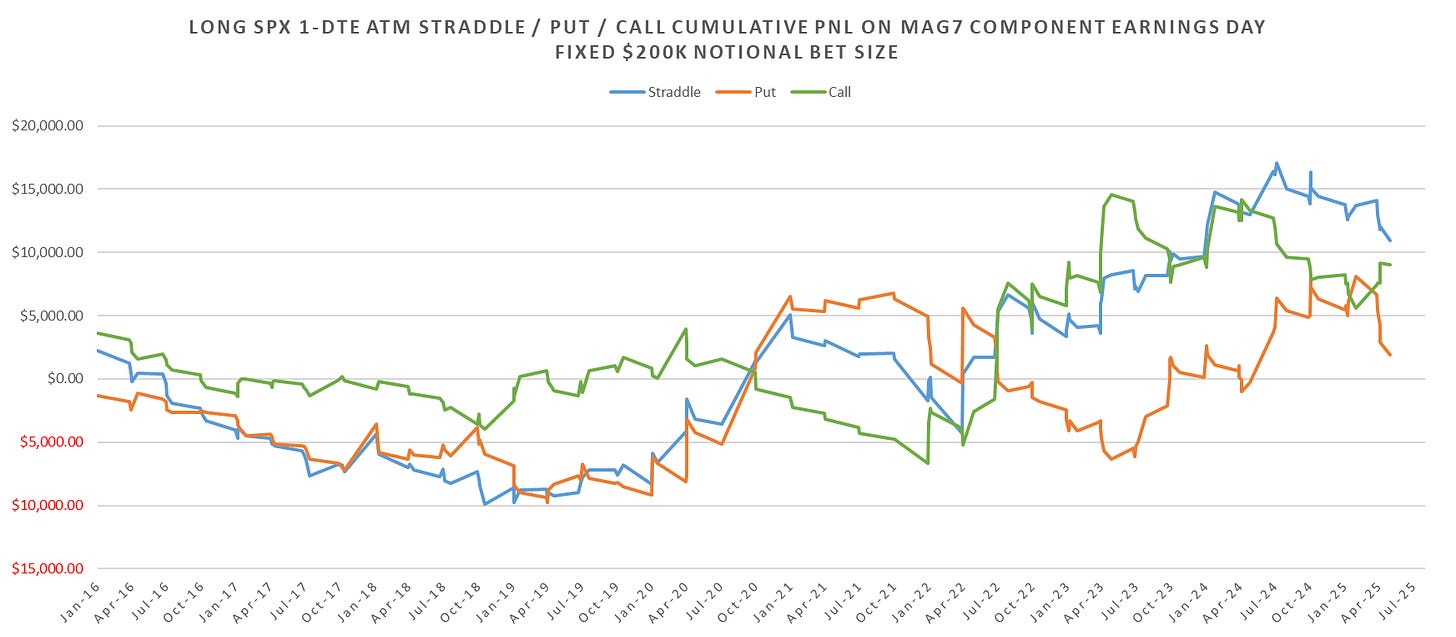

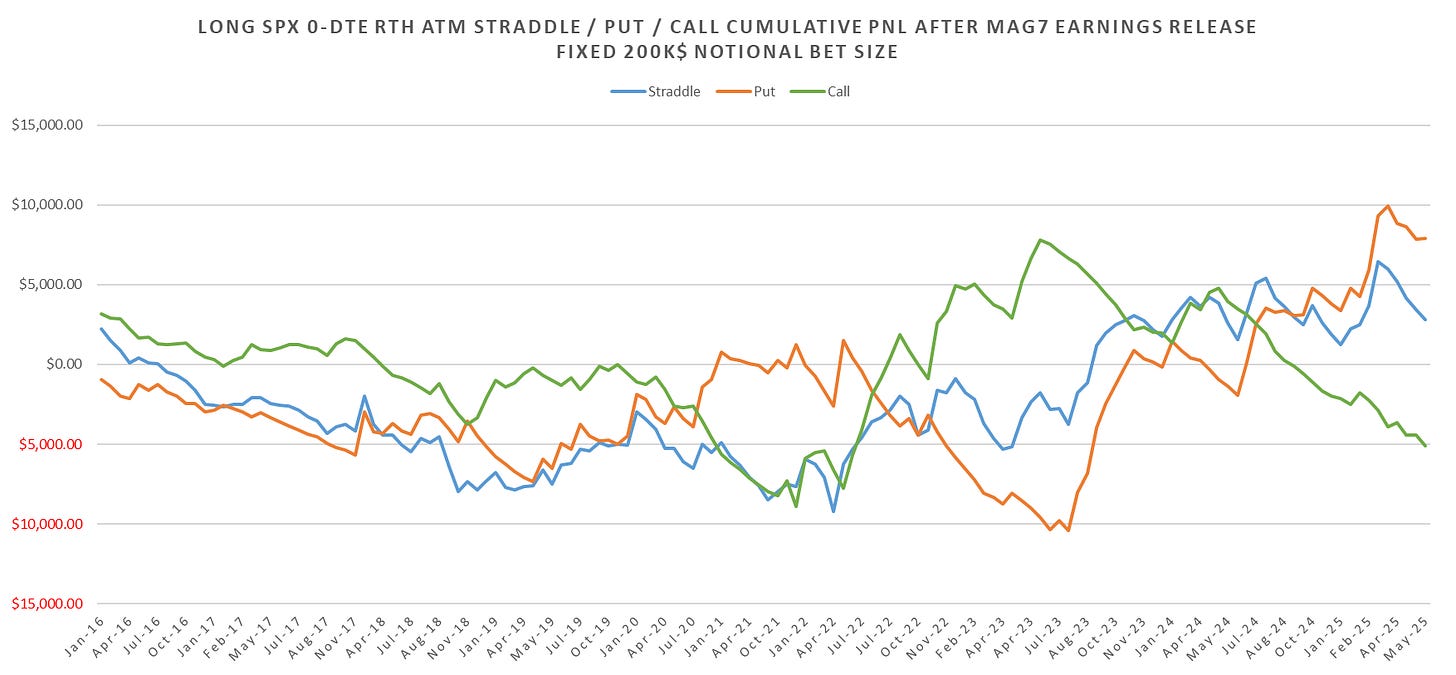

Last quarters index straddles net down as reactions have been very positive overall.

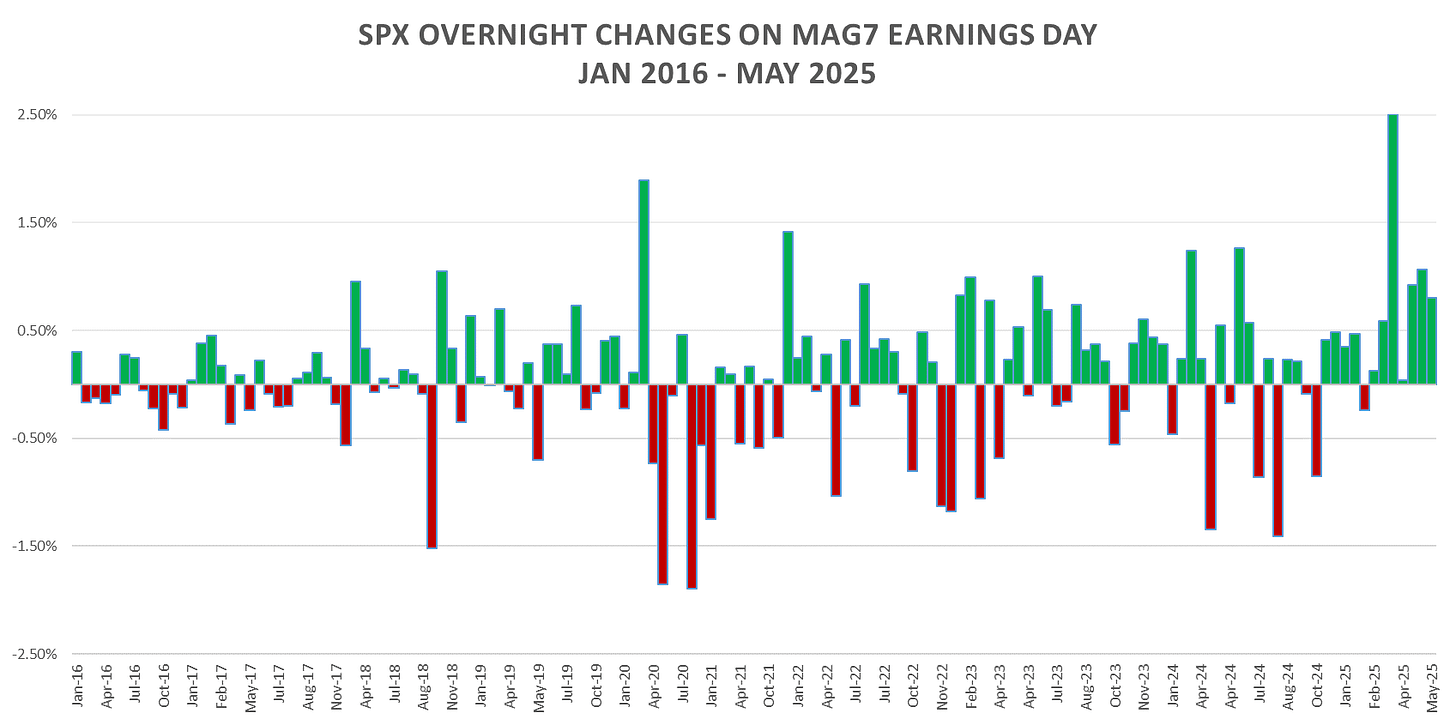

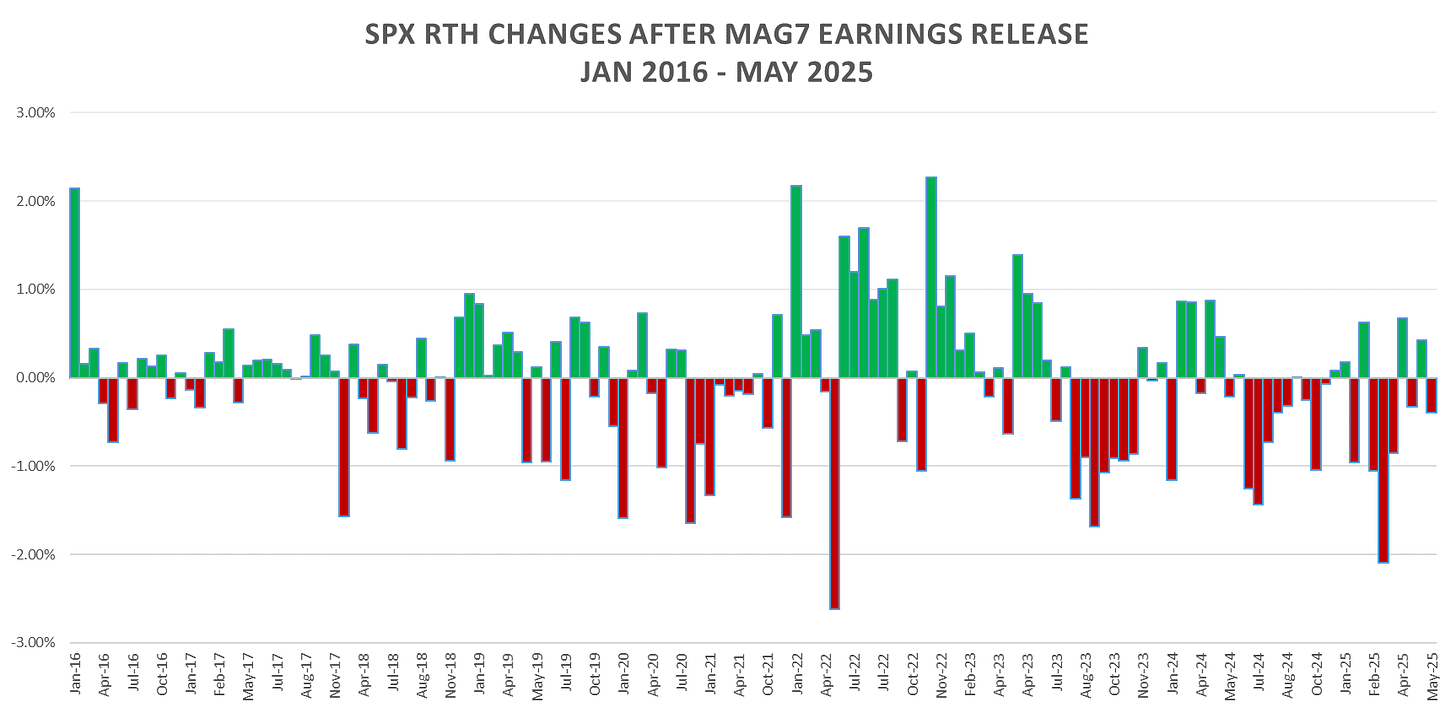

Between overnight & intraday dynamics, initial earnings reactions overwhelmingly positive, albeit that was during a major correction we’ve had early April.

Generally see profit taking after market open with selling into overnight strength. Given how much the leaders are up, likely to see more profit taking, especially given how frothy valuations are.