Q4 2024 earnings:

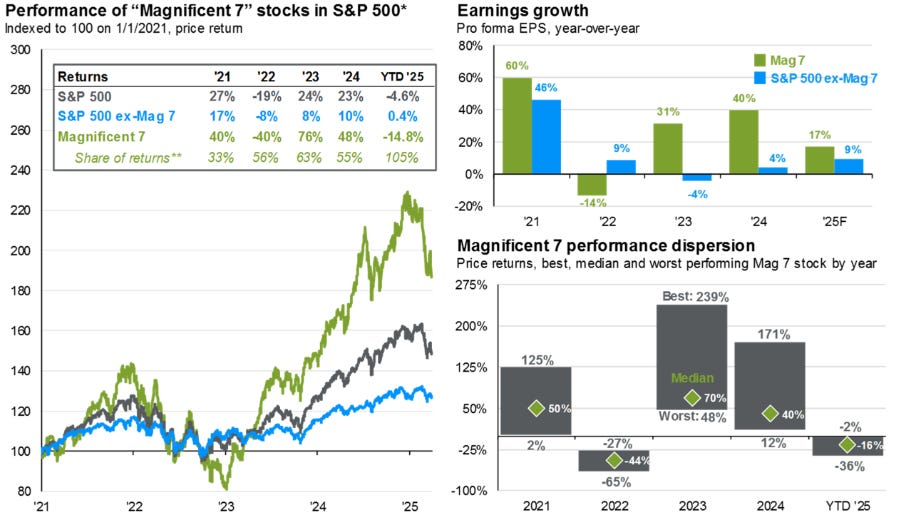

Earnings season has started with TSLA reporting earlier in the week. Despite the horrible numbers, TSLA gapped higher and is now churning for 2nd day in a row. MAG7 accounted for ~55% of returns for 2024, with broader market ex-mag7 up a healthy 10%.

As before majority of earnings growth is concentrated in the mag7 names for SPX. So far this year growth concerns forcing de risking in the tech stocks, fears of potential tariff retaliations that would target the tech sector dominate the narrative. Tech names were the most sold into the tariff panic over the last month.

Source: J.P. Morgan: Guide to the Markets: https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/

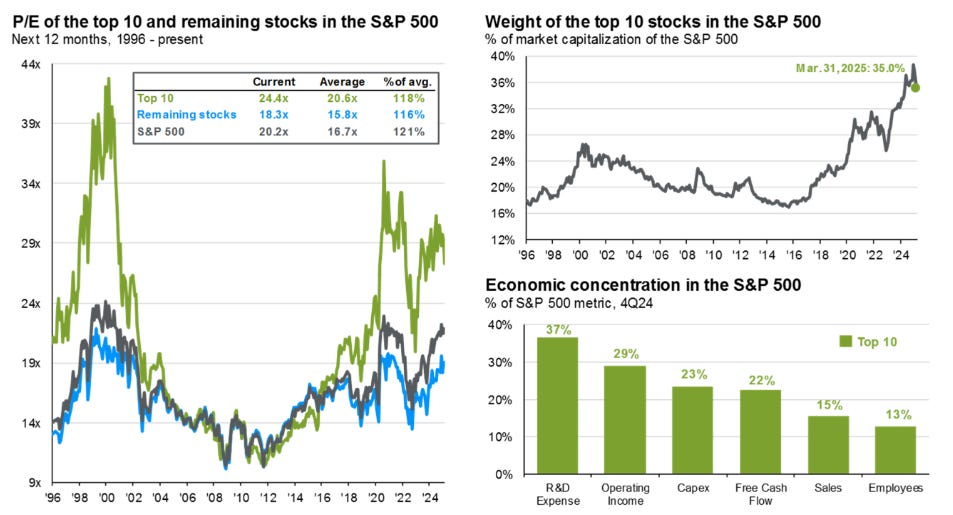

Even with the relative deeper correction in tech, mag7 still accounts for 35%+ of the index, which as mentioned in previous posts leads to outsized impact on overall index during earnings days.

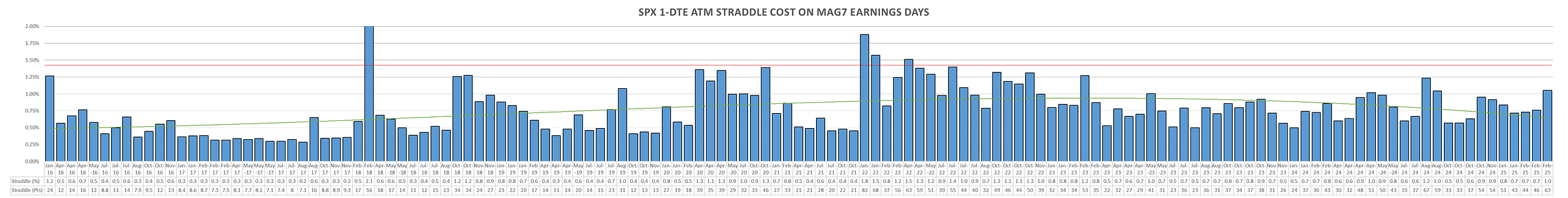

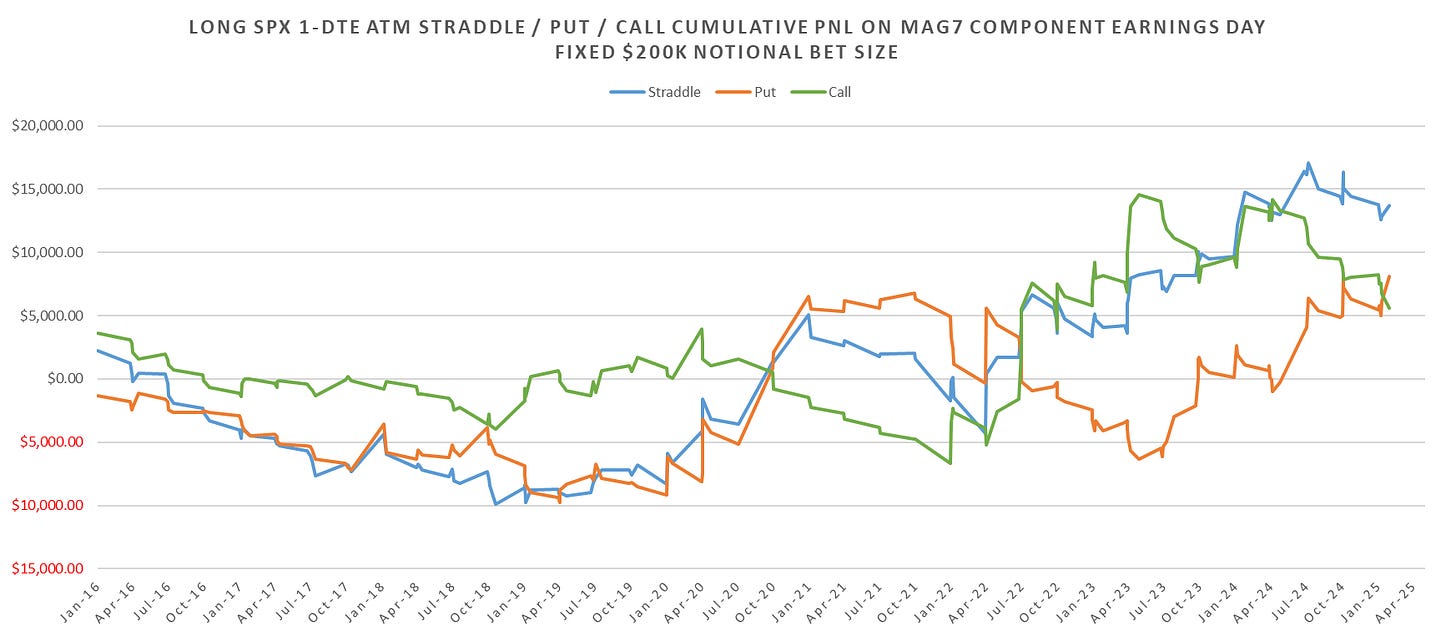

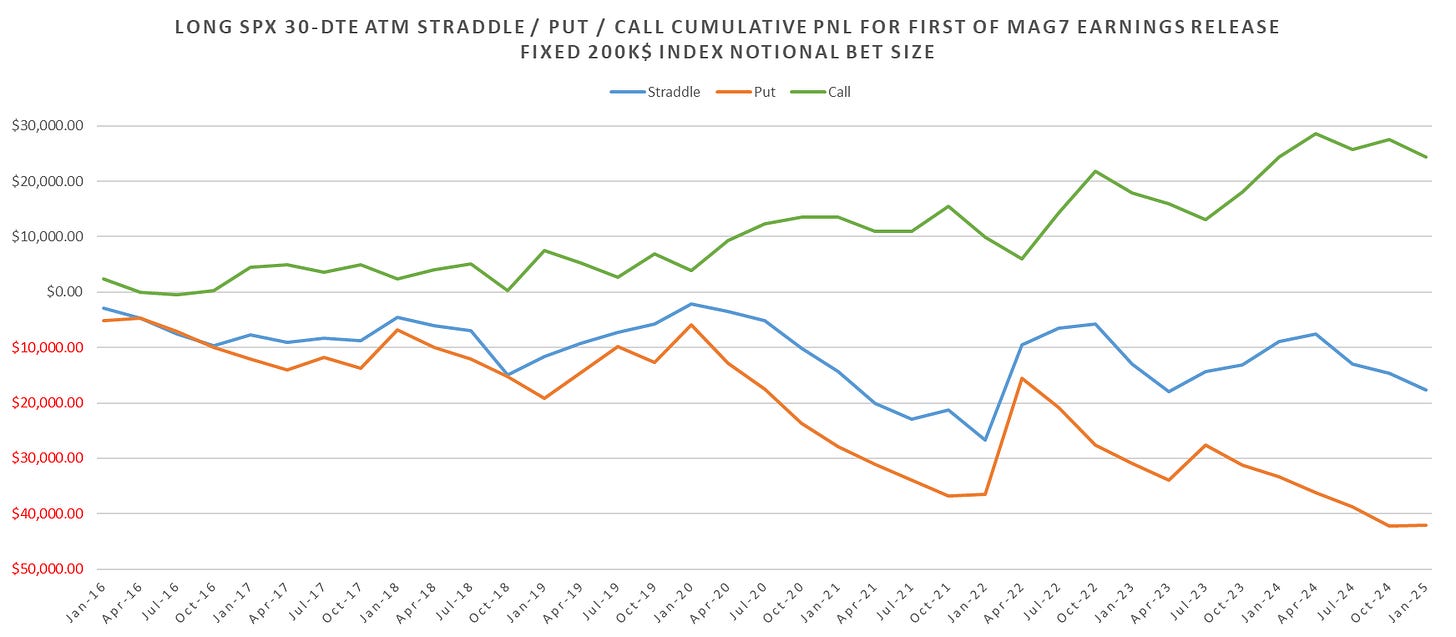

1-DTE SPX Straddles going into earnings trading at near 10-year highs. This is ofc in line with overall higher latent vol, when compared with last weeks straddles, tmrws Google earnings SPX straddles carrying small premium ~10-20bps relative to the calmer days we’ve seen over last 7 days.

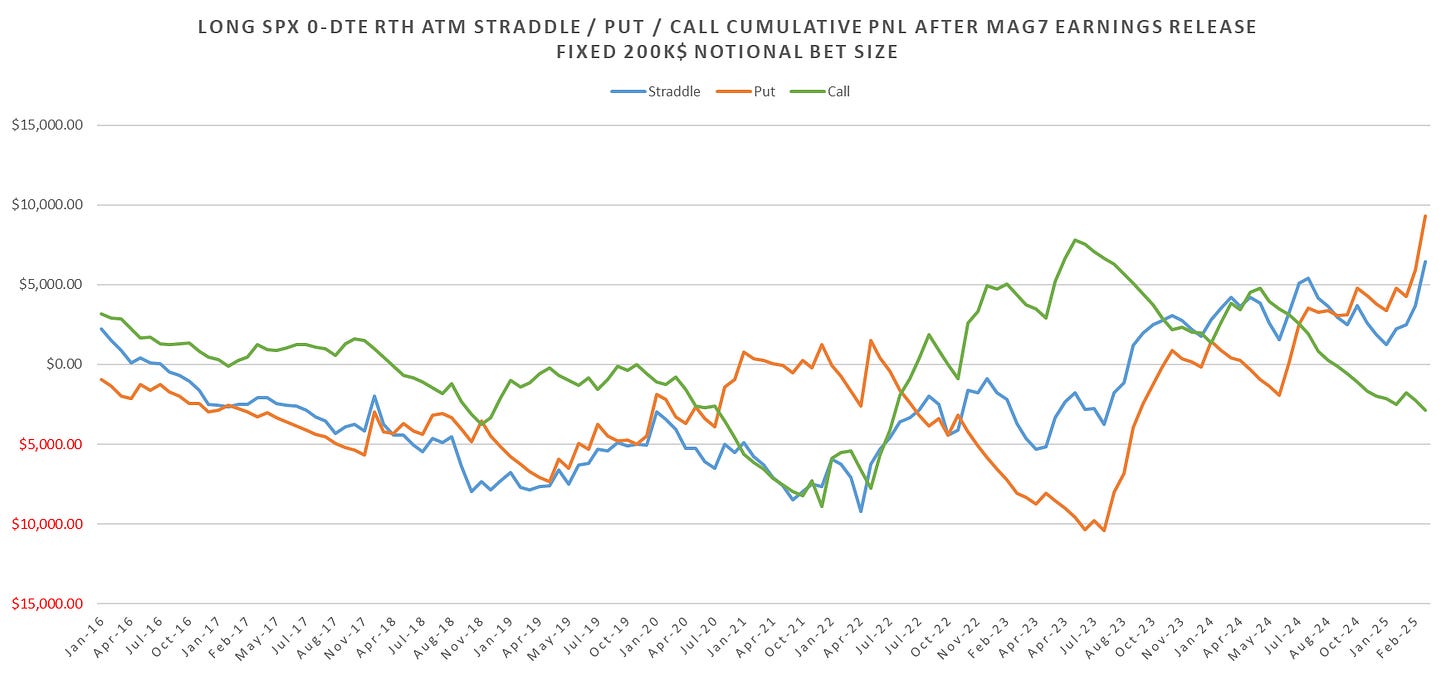

Q1 SPX straddles rather uneventful, net ~flat pnl across mag7 earnings days.

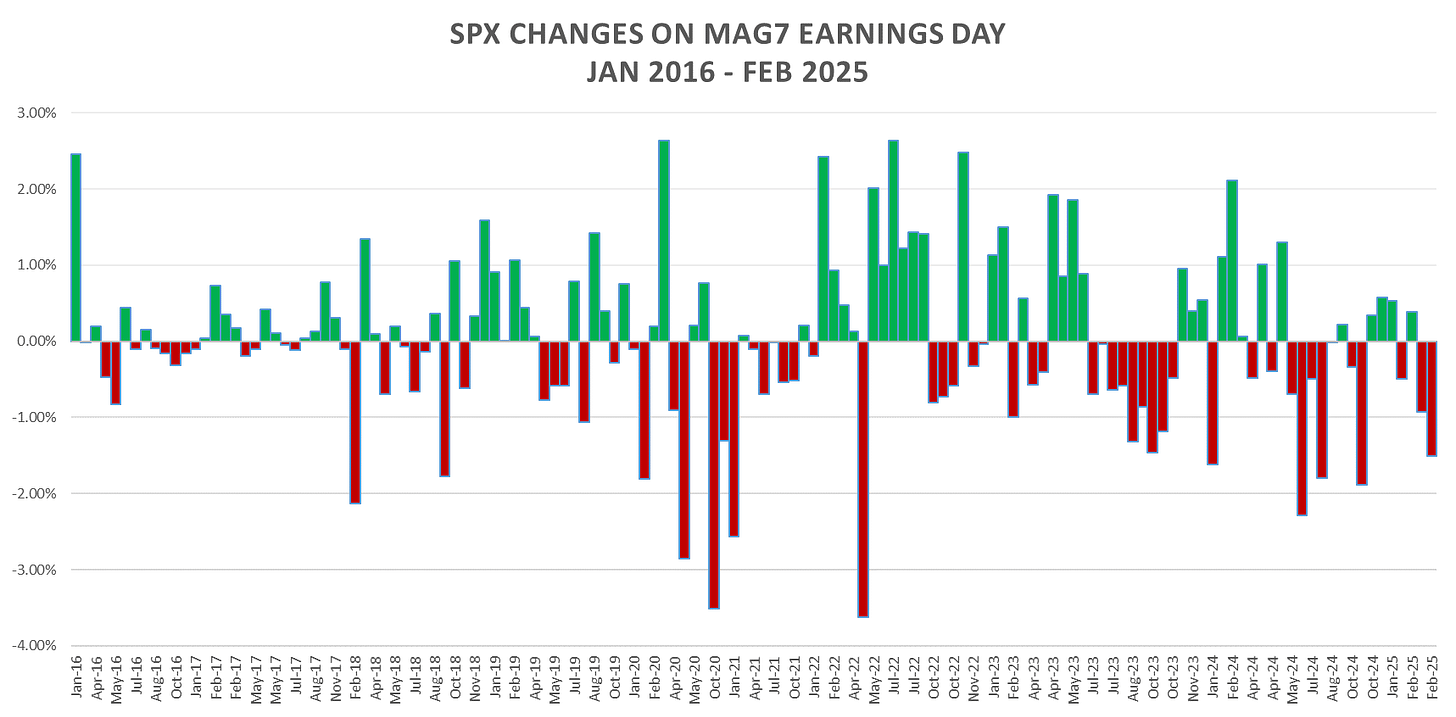

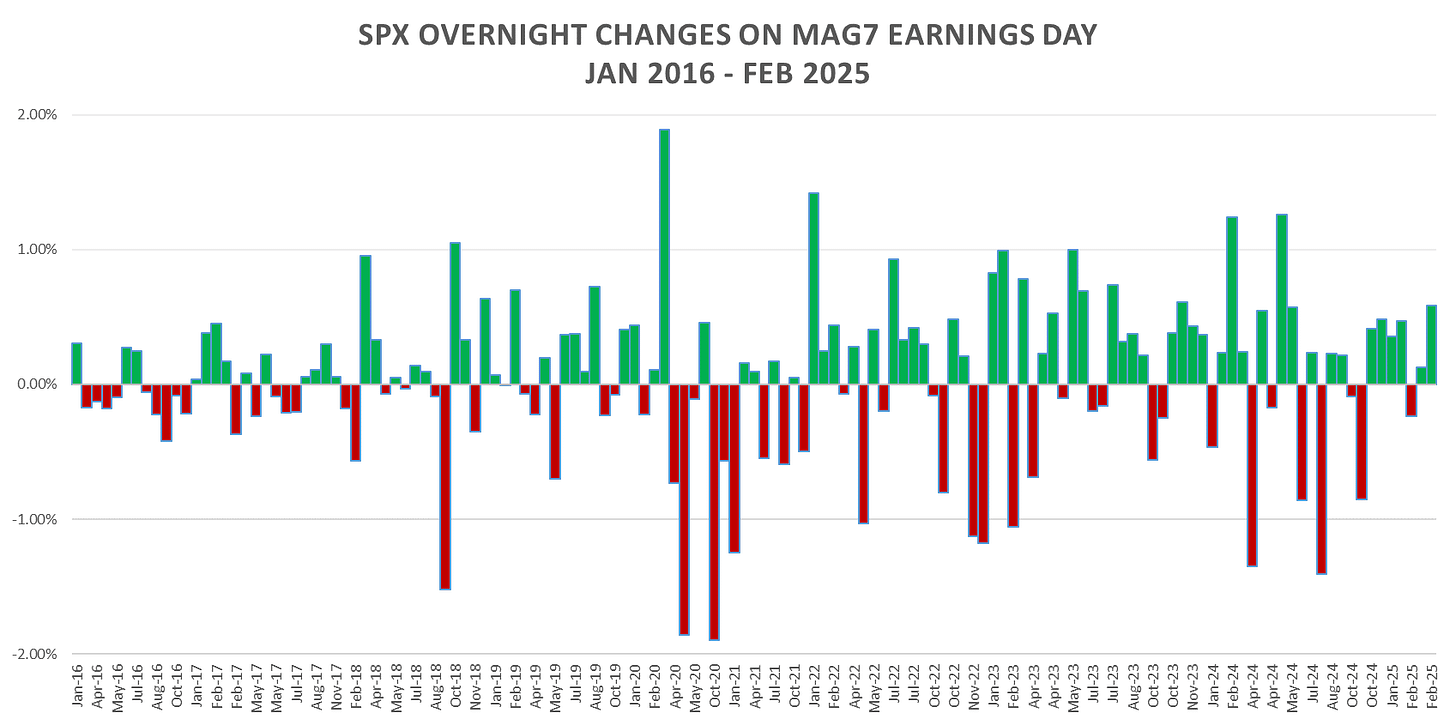

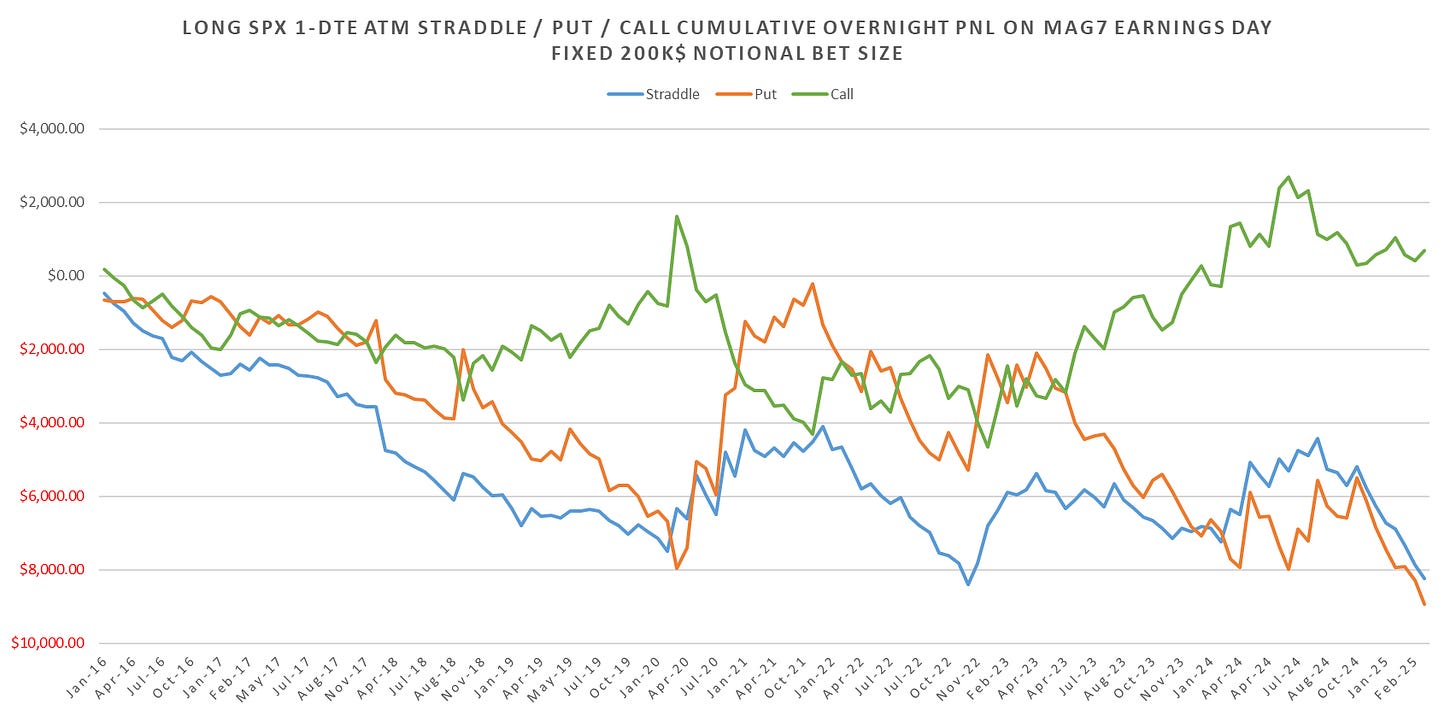

Breaking down the overnight reaction, largely positive outside Google, which took SPX slightly lower overnight.

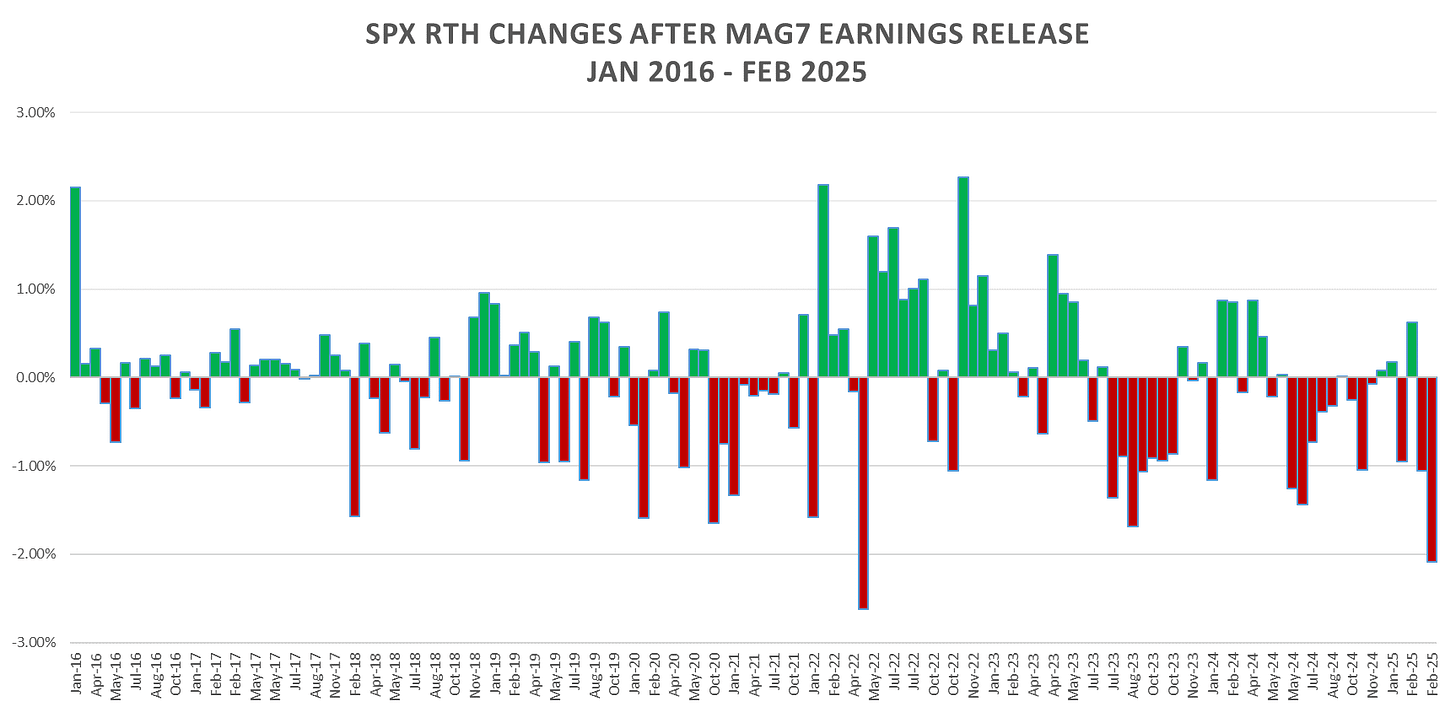

The post earnings RTH session hammering continued for the Q4 earnings release. Overwhelmingly bearish price action during the day after earnings released for the last 2 years.

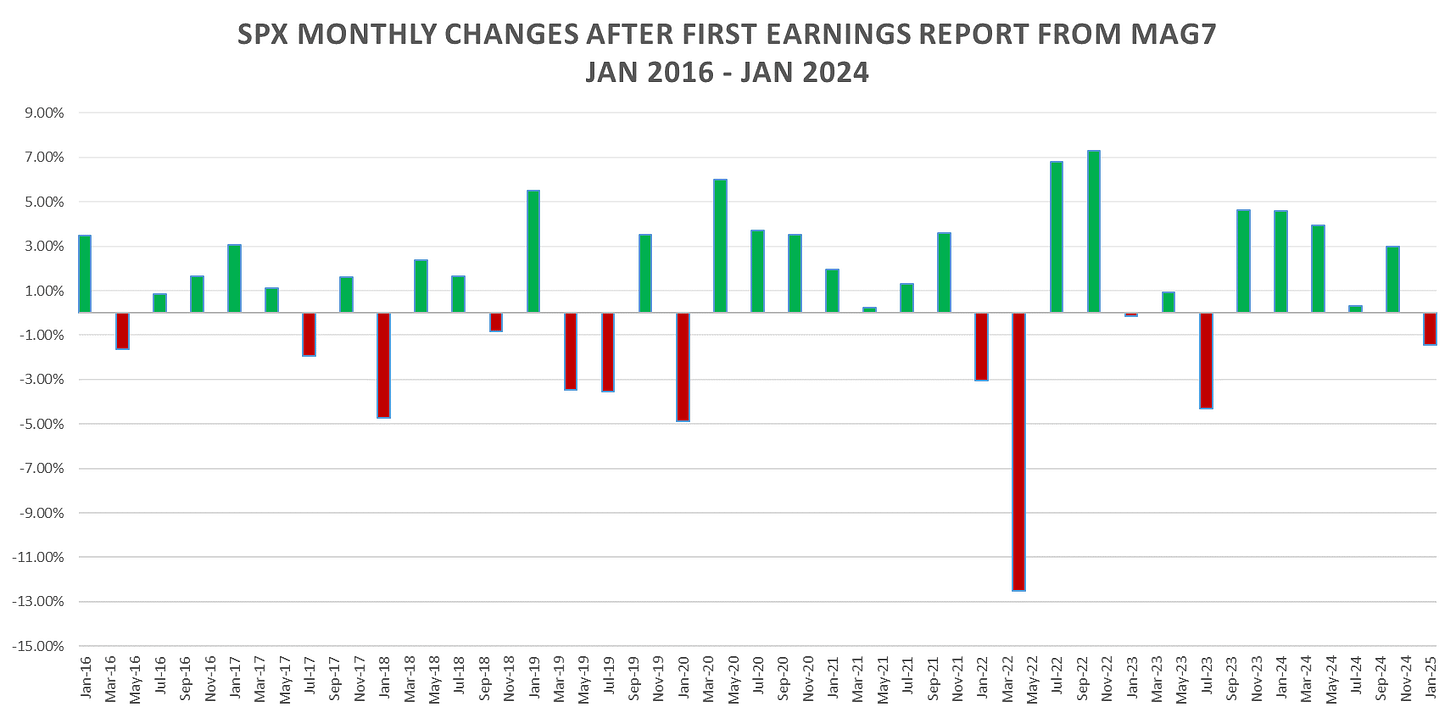

Looking at the SPX straddles covering the mag7 earnings releases, first time SPX lower over the next month since July 2022. All previous times we’ve had negative 1-month returns after mag7 earnings coincide with growth concerns, similar to what we see now. Likely see same price action with any upside used to sell into until we get clarity regarding trade & fed policy.