Index & Index Options Performance around MAG7 Earnings

Updated for Q3 2025 earnings season

Q2 2025 earnings:

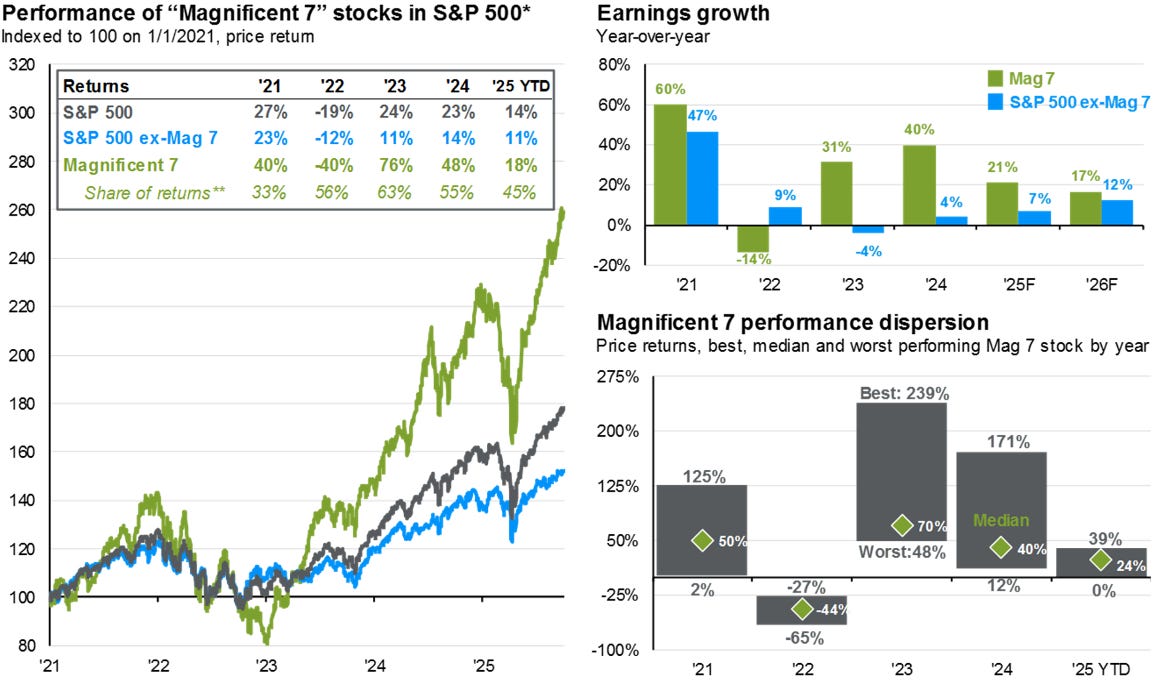

Mag7 up another 10% from previous earnings season, having spent the last month consolidating near highs. As a basket, Mag7 currently down ~1.8% from ATH, with a couple of sub 5% pullbacks in Aug and early Oct.

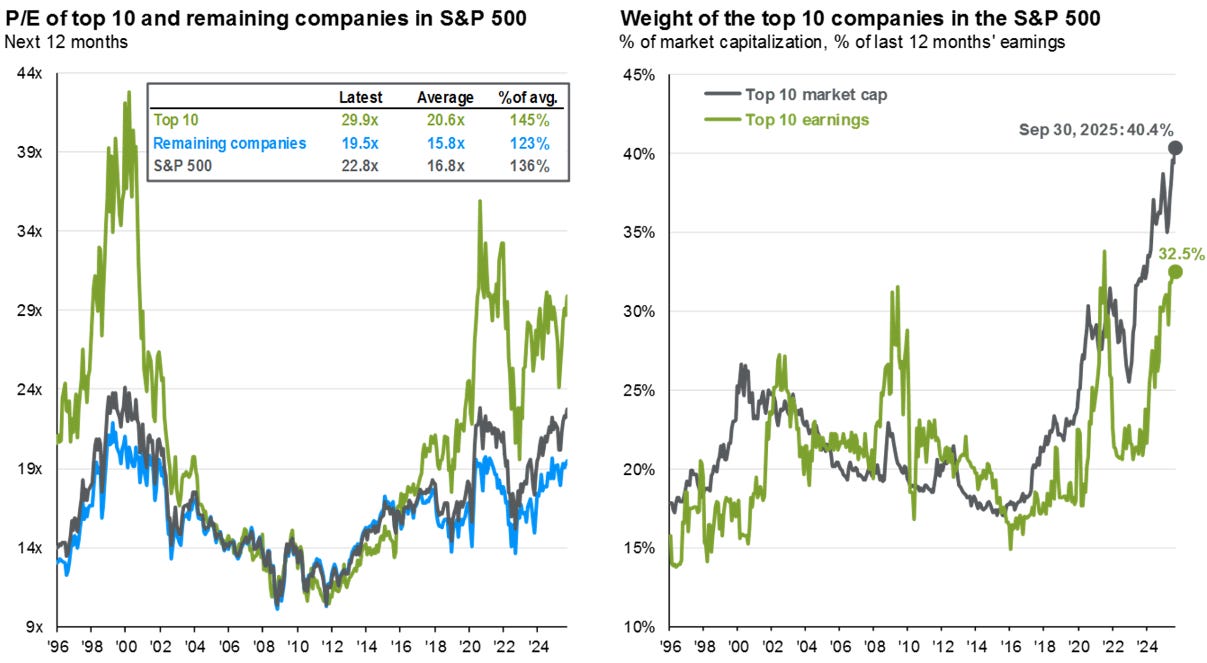

As a share of total market cap, Mag7 hitting another high in Oct, now ~35% of S&P 500 market cap. Higher concentration than 2000 despite valuation wise not being as extreme.

Source: J.P. Morgan: Guide to the Markets: https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/

As a share of YTD returns, Mag7 is back to outperforming rest of market after relative weakness early in the year.

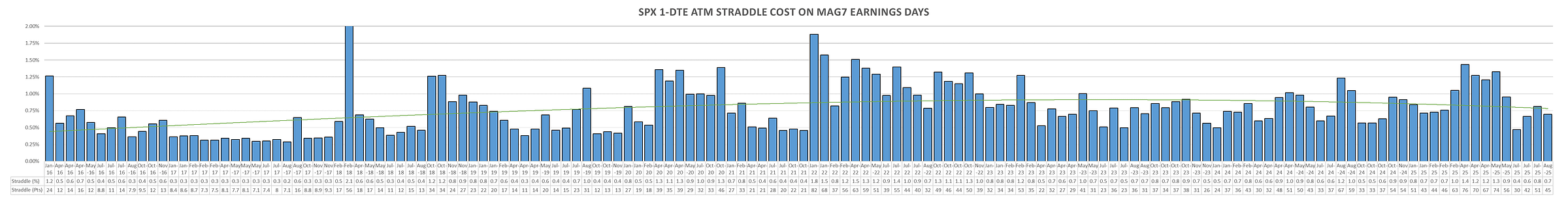

TSLA the first to report Q3 earnings tonight after market close with the lowest % index weight out of the group. The bulk of earnings coming out next week on the 29th/30th (along with FOMC.) NVDA reporting later in Nov & AVGO in Dec. Outside AAPL & MSFT, trading at 1m ~28-30 implied volatility, rest of Mag7 trading at mid 40’s, with TSLA highest at near 60.

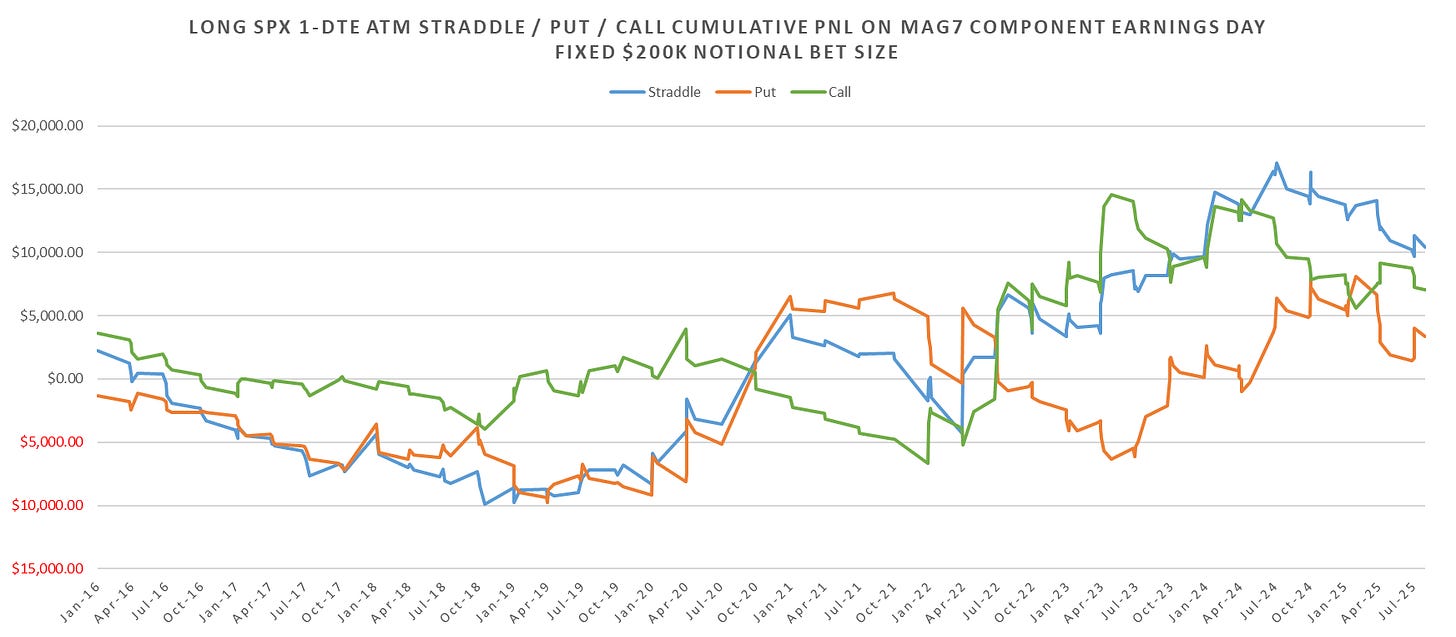

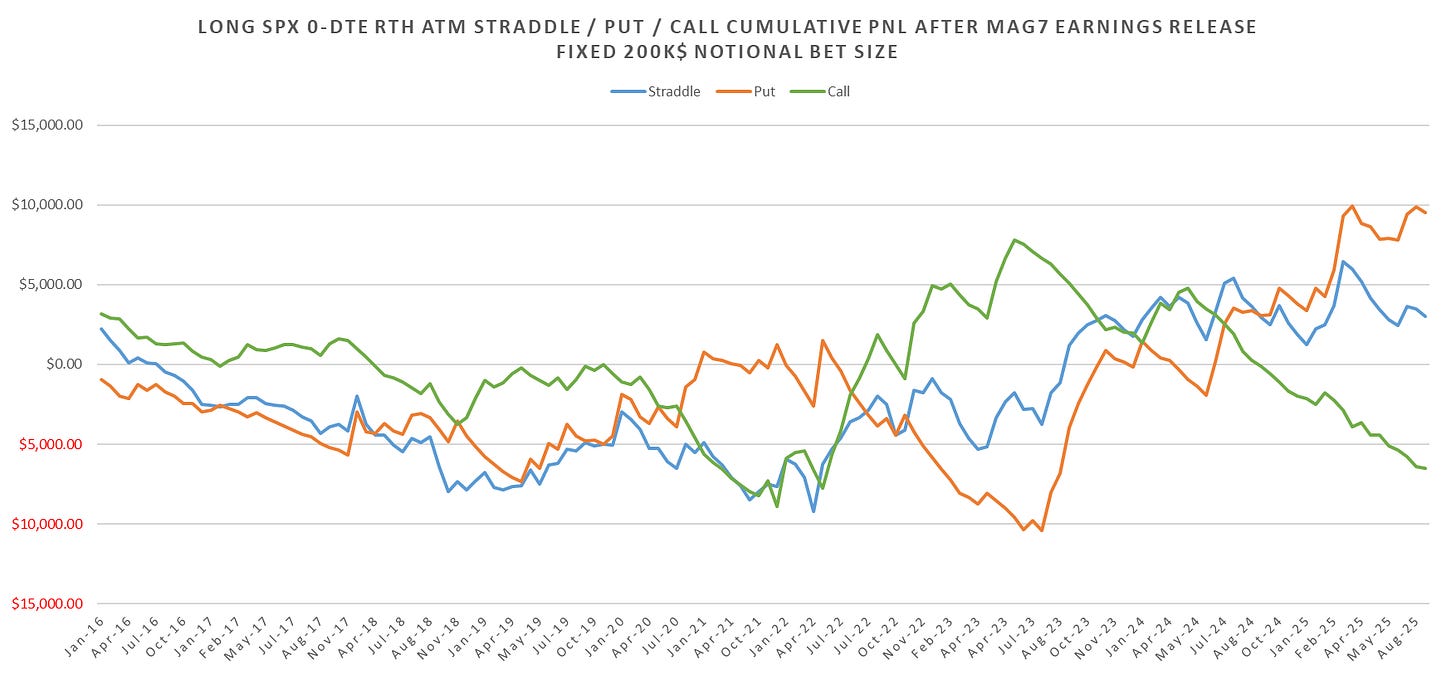

Net, index straddles ~flat over the previous earnings period.

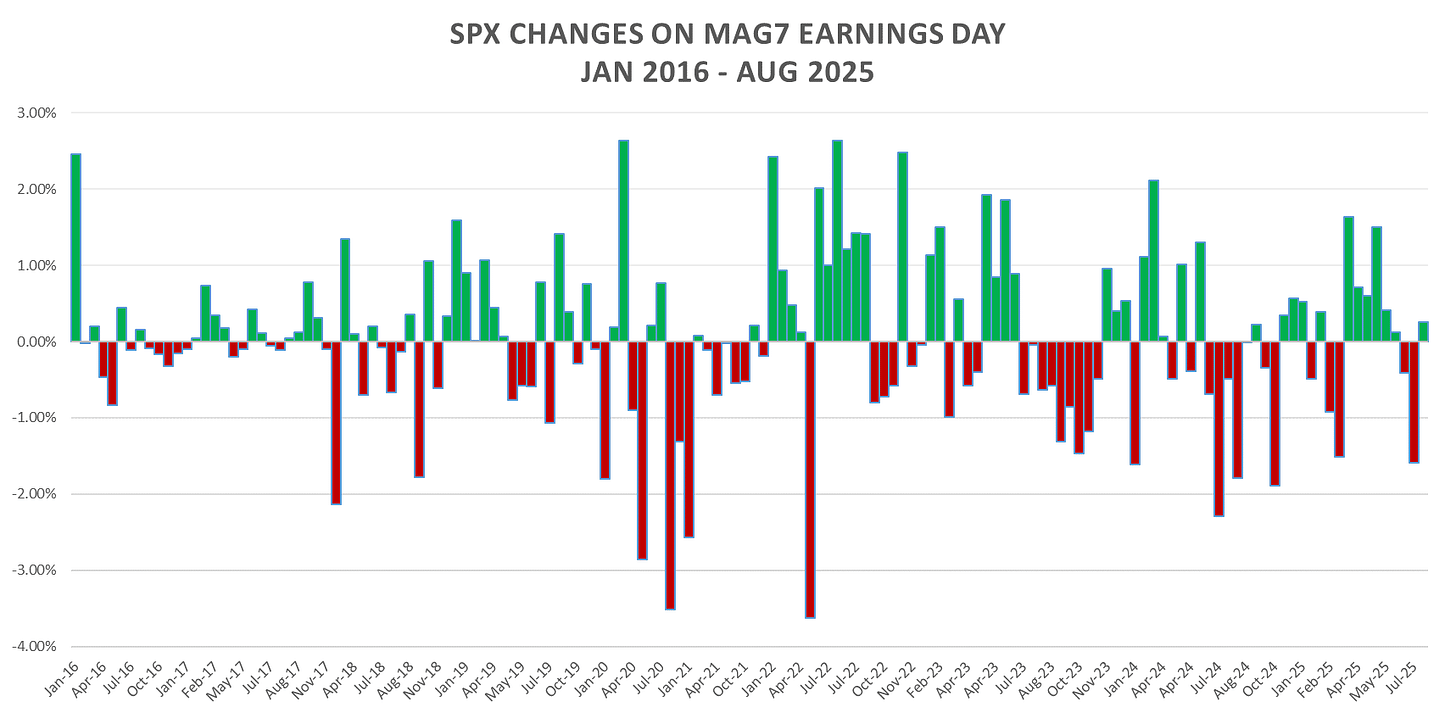

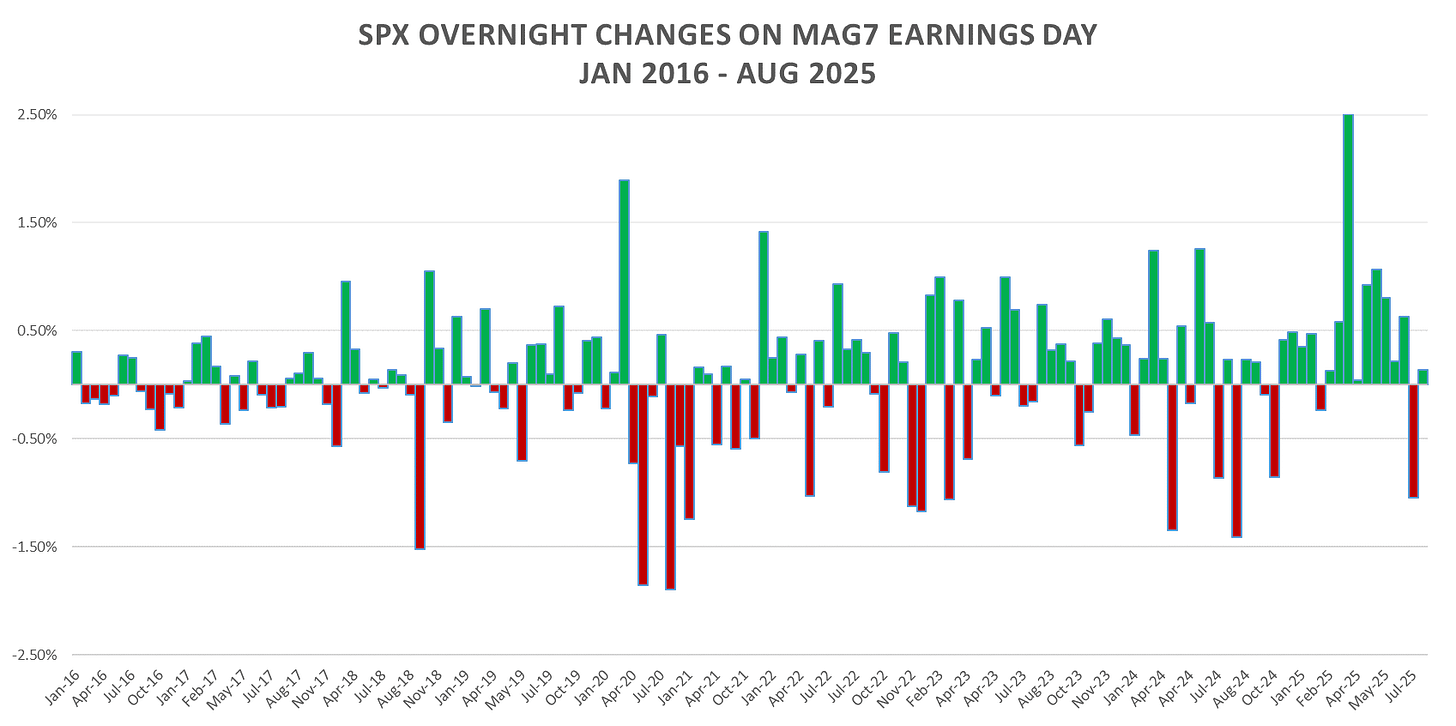

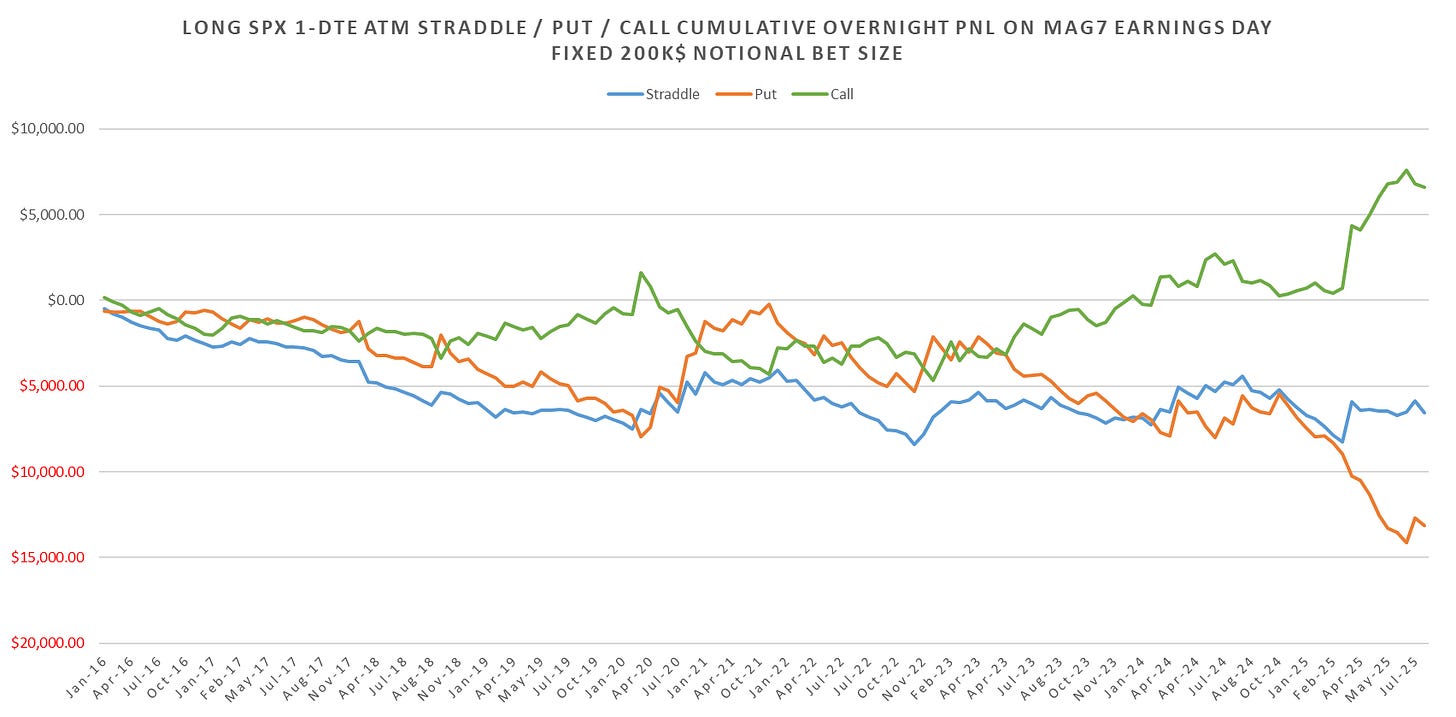

Mixed initial reaction to earnings, net flat overnight as well.

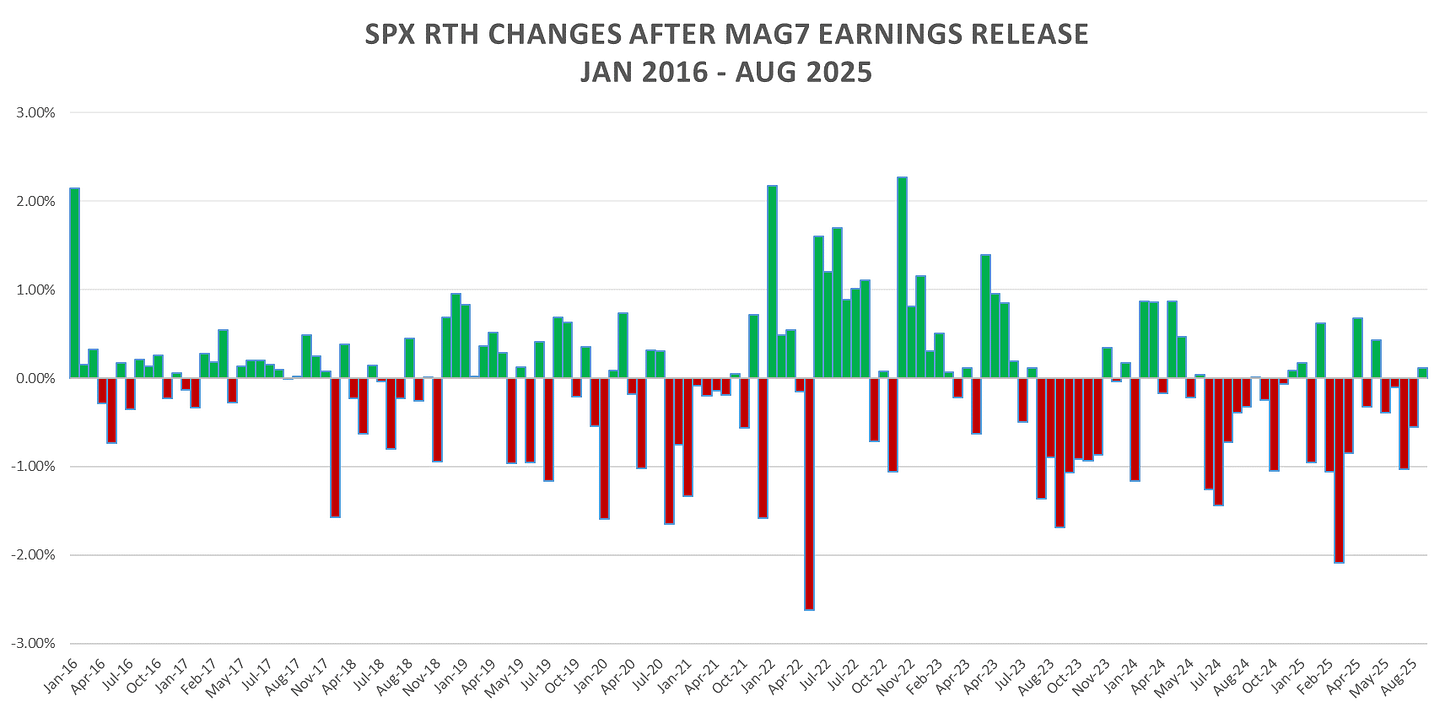

US RTH session continues to fade the gaps higher since 2023.