Q3 earnings:

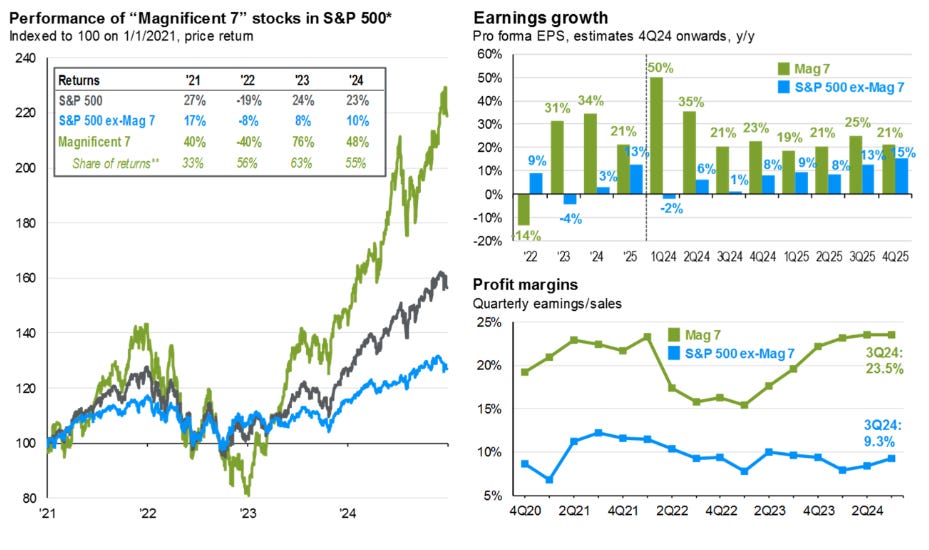

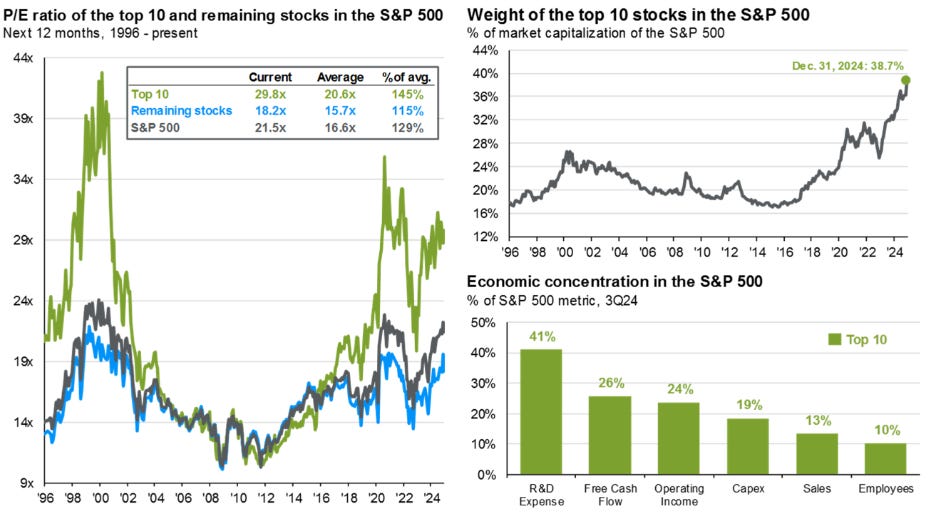

Another earnings season is underway with the main driver (similar to the few previous years) being the MAG7. ~37% of S&P 500 market cap is now concentrated in the top 10 stocks (up slightly from Q3 but down from the 40%+ July peak.)

MAG7 accounted for over 50% of the gains in the index in the past 3 years. Boosting overall SPX earnings growth to double digits & sporting almost triple the profit margins of the rest of the index.

Source: J.P. Morgan: Guide to the Markets: https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/

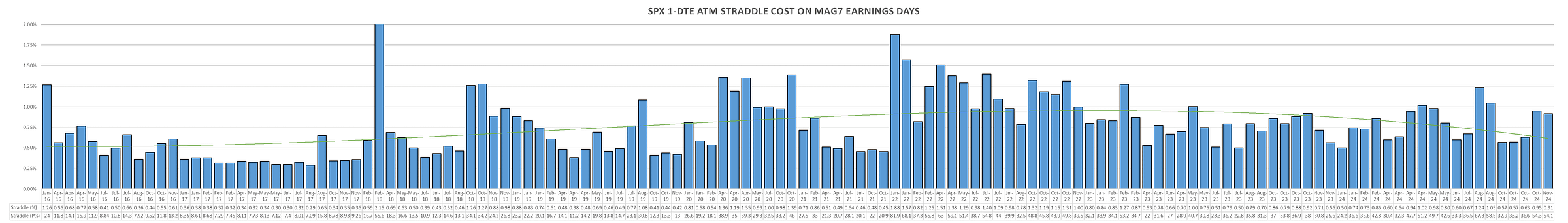

It is no surprise that MAG7 earnings now carry higher event ‘premiums’ than almost any other data release or even FOMC:

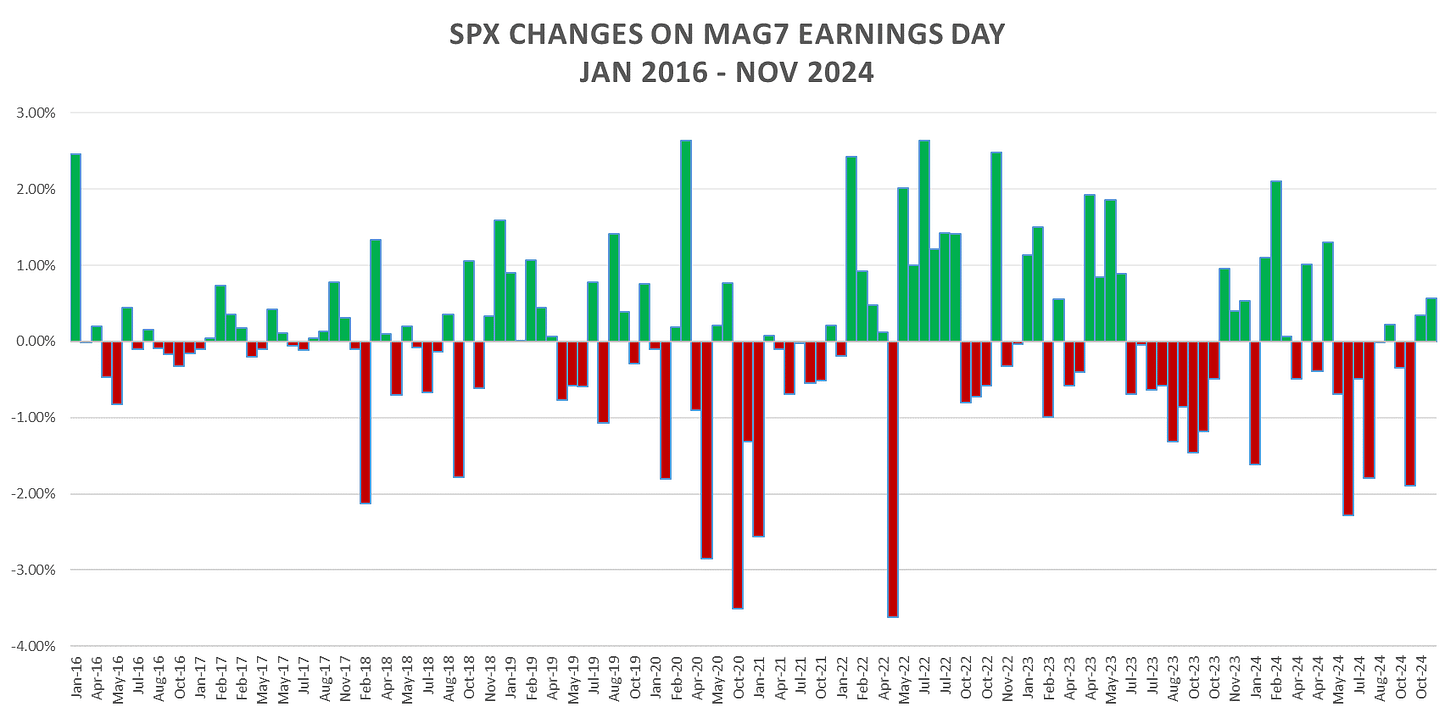

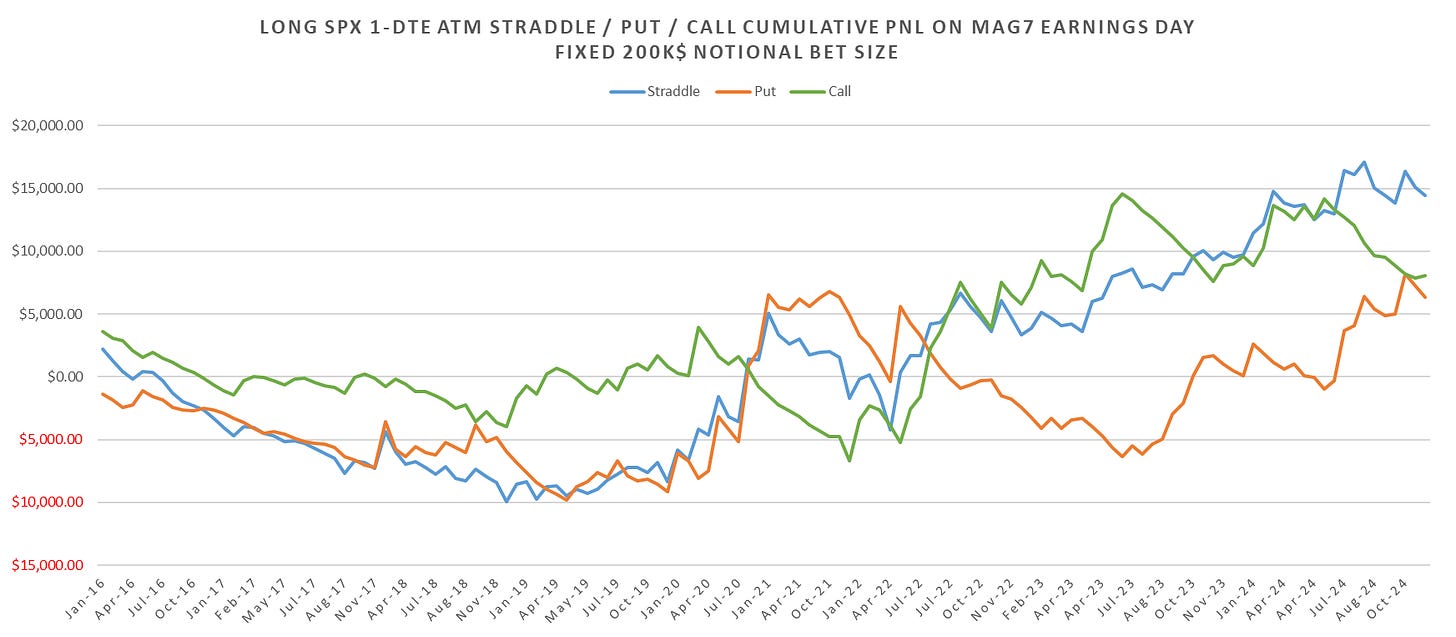

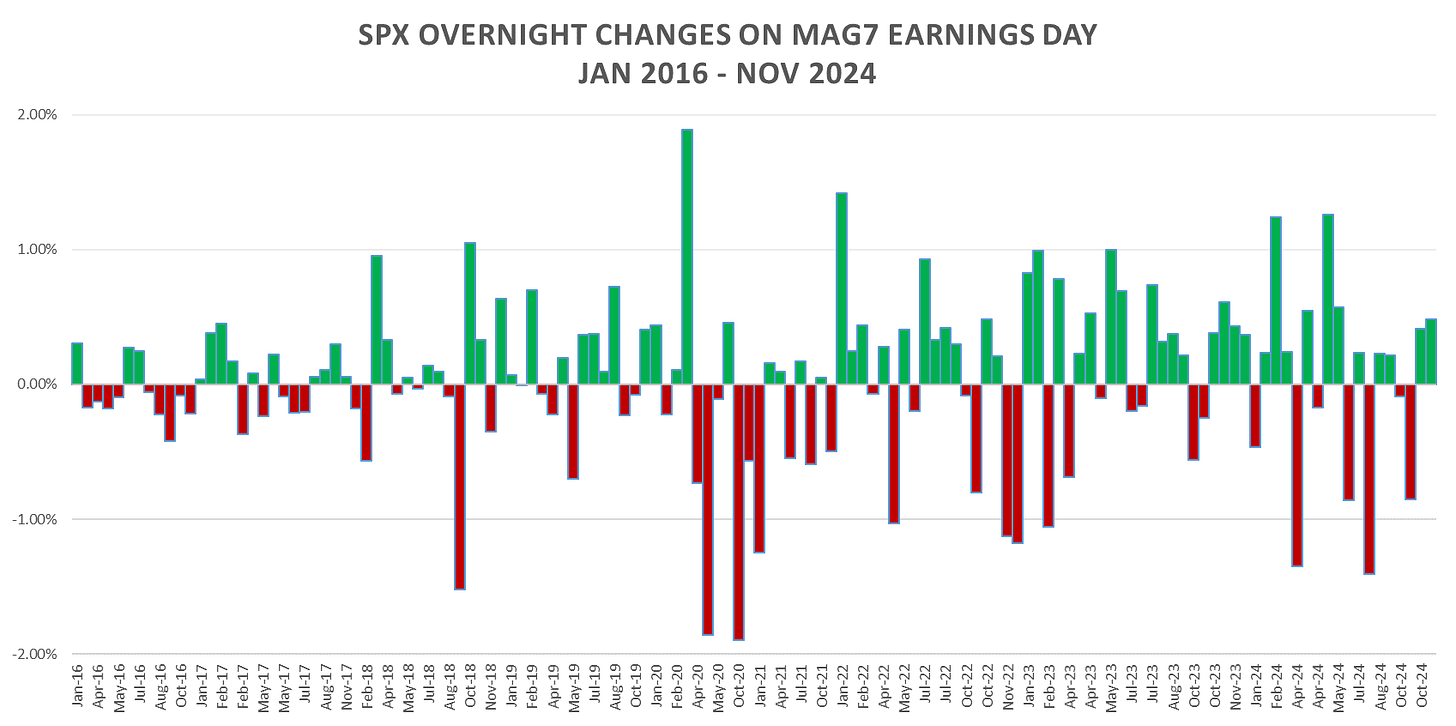

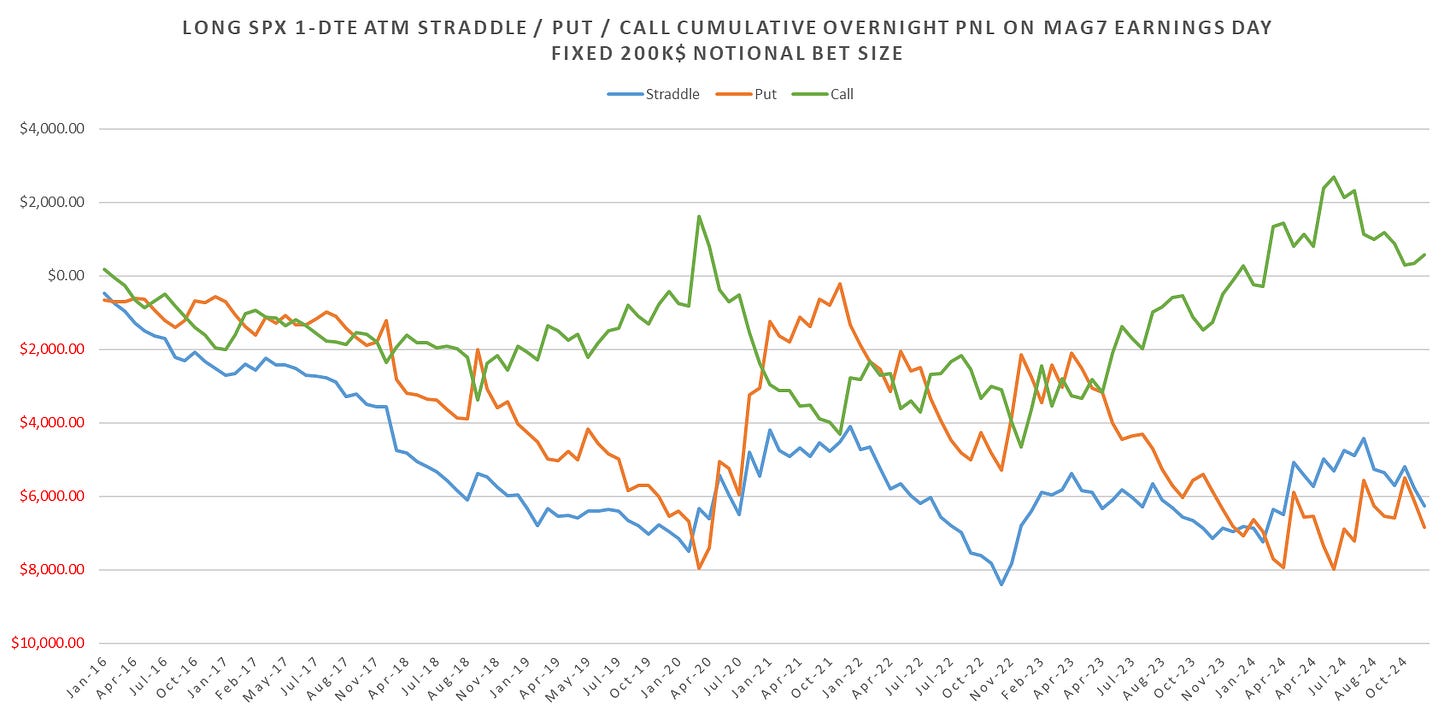

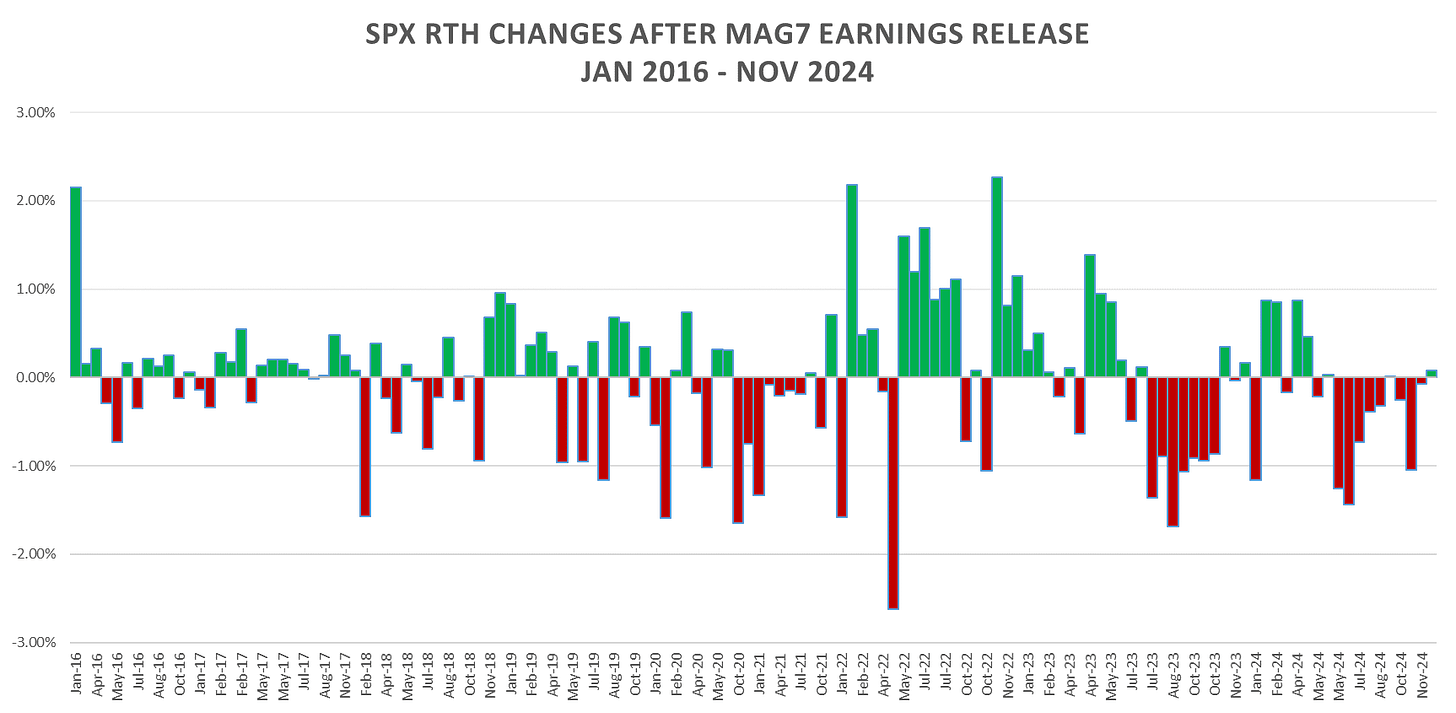

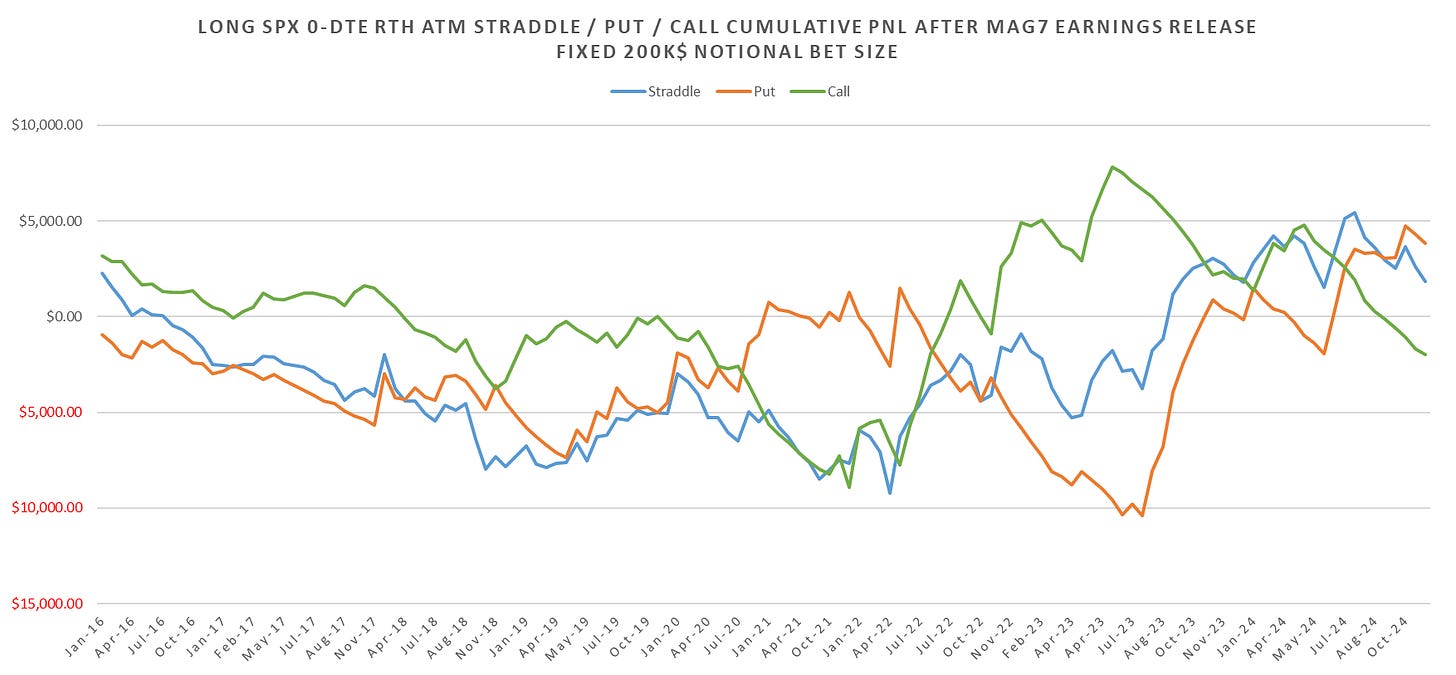

SPX 1-DTE & intraday straddles are selected based on earnings releases from Apple, Amazon, Meta, Google, Tesla, Microsoft & Nvidia. All of these companies report after market close which lets us see the immediate overnight reaction & follow through the next day. Lets take a look at the patterns we’ve seen on the days of MAG7 earnings releases & the performance throughout the day:

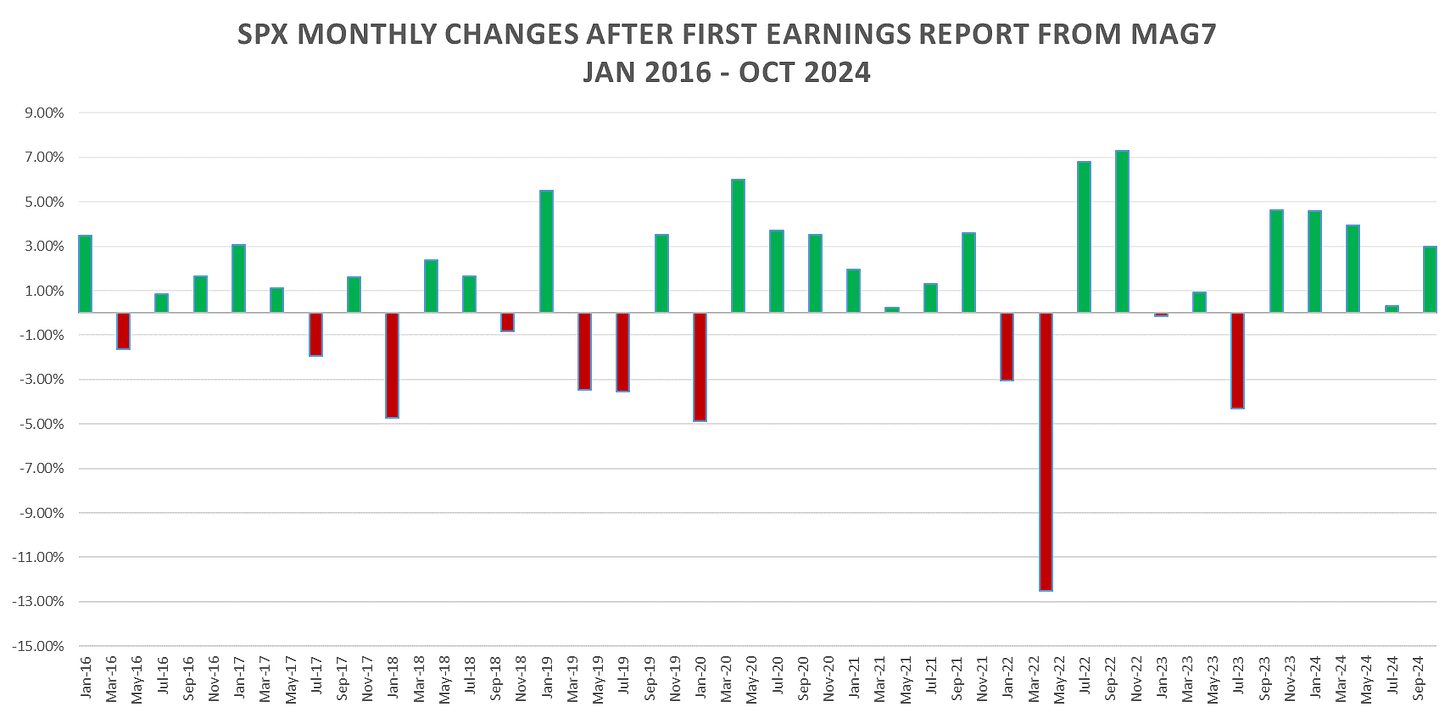

The Oct/Nov earnings season was relatively mild, with only MSFT/META dropping the index ~2% the following day, rest traded well within the straddle breakevens (~100bps.)

Immediate overnight reaction was still overall bullish, MSFT/META had a decent sized drop right after earnings were announced but rest traded higher into the next day open.

RTH performance has been horrible after summer 2023 for the index, all overnight gains given up by close.

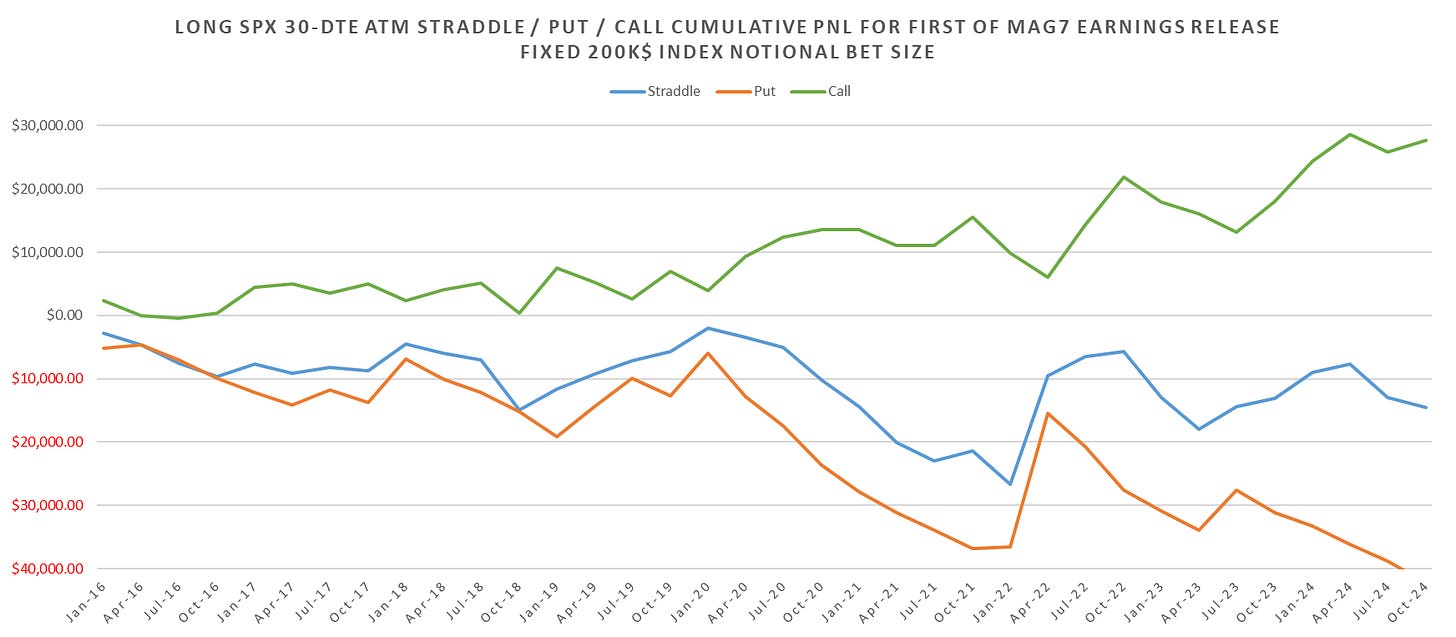

Also looking at the 30-DTE SPX straddle opened on the close before the first component of MAG7 report & held till expiration (covers NVDA earnings too as its last to report usually.) Will update this post with the post earnings announcement drift (PEAD) study for each of the components in the next few days!

I can't seem to reproduce earnings day 1 dte straddle RTH. What times are you using? 9:30am to 4pm est? Thank you.