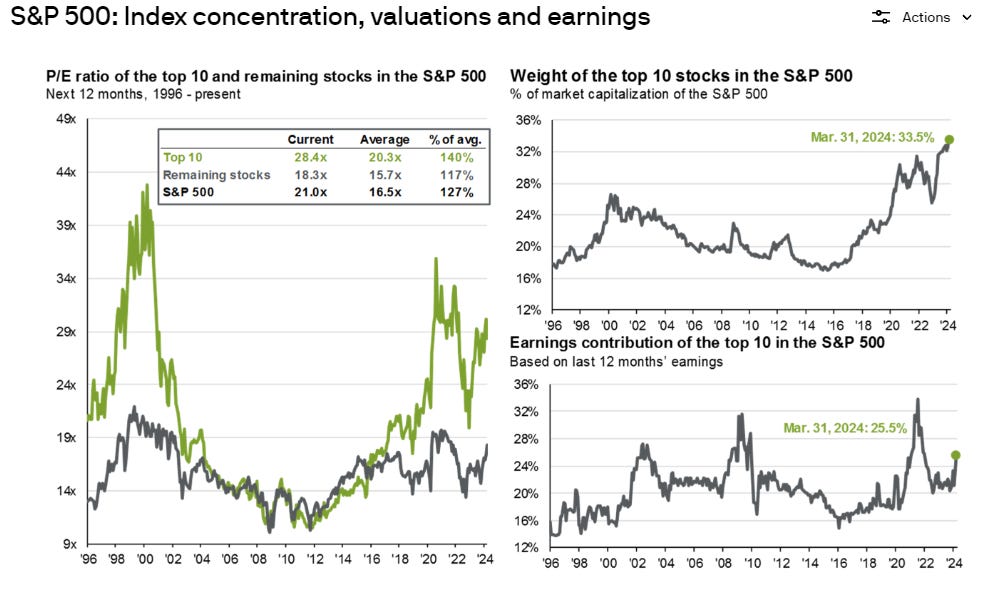

With large cap tech earnings coming up, % weight of these companies in SPX has never been higher. Lets take a look at how the index & index options perform on days when MAG7 earnings get released.

Source: J.P. Morgan: Guide to the Markets

(https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/)

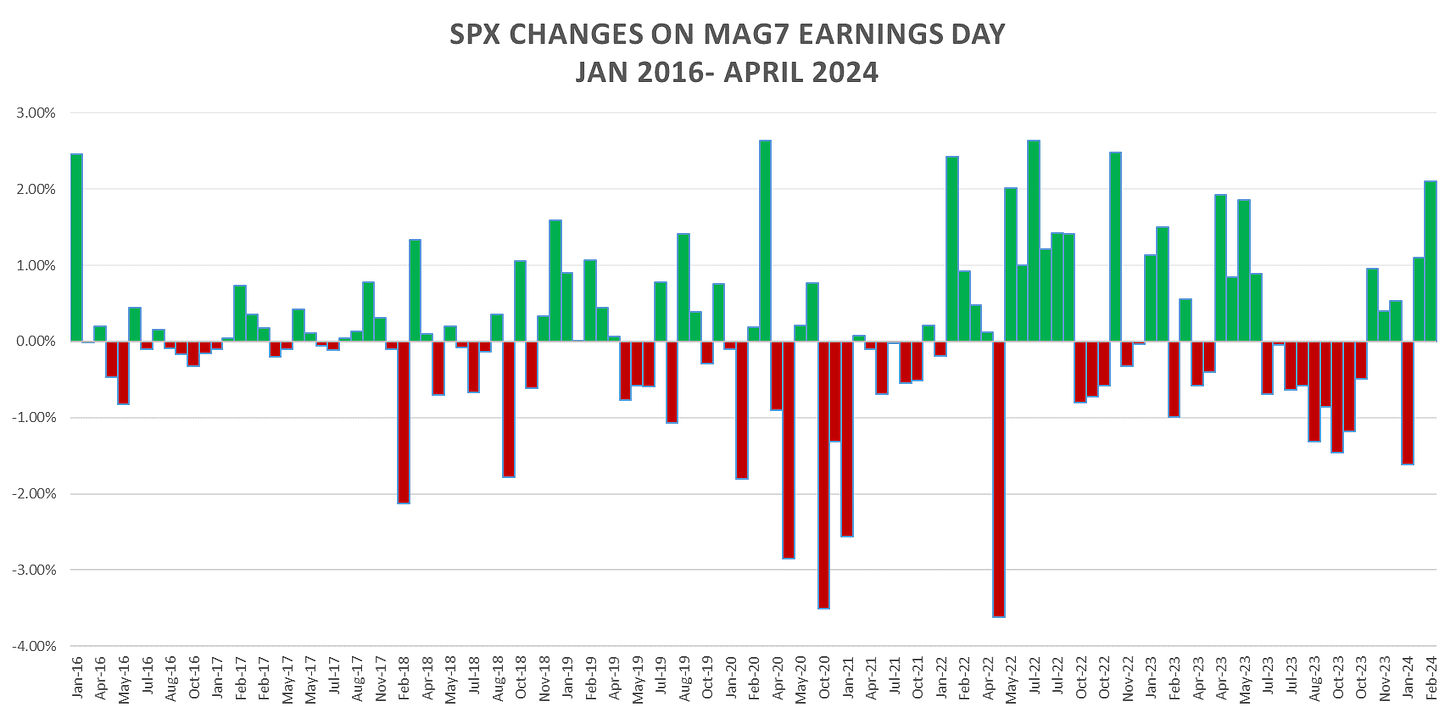

We will begin by looking at dates for earnings releases by Apple, Amazon, Alphabet, Microsoft, Meta, Nvidia and Tesla (fallen out of the top 10 but after todays positive reaction to earnings probably claws its way back in…)

Will look at data starting in 2016 (as that looks to be when the top 10 % weight in the index started its advance higher.)

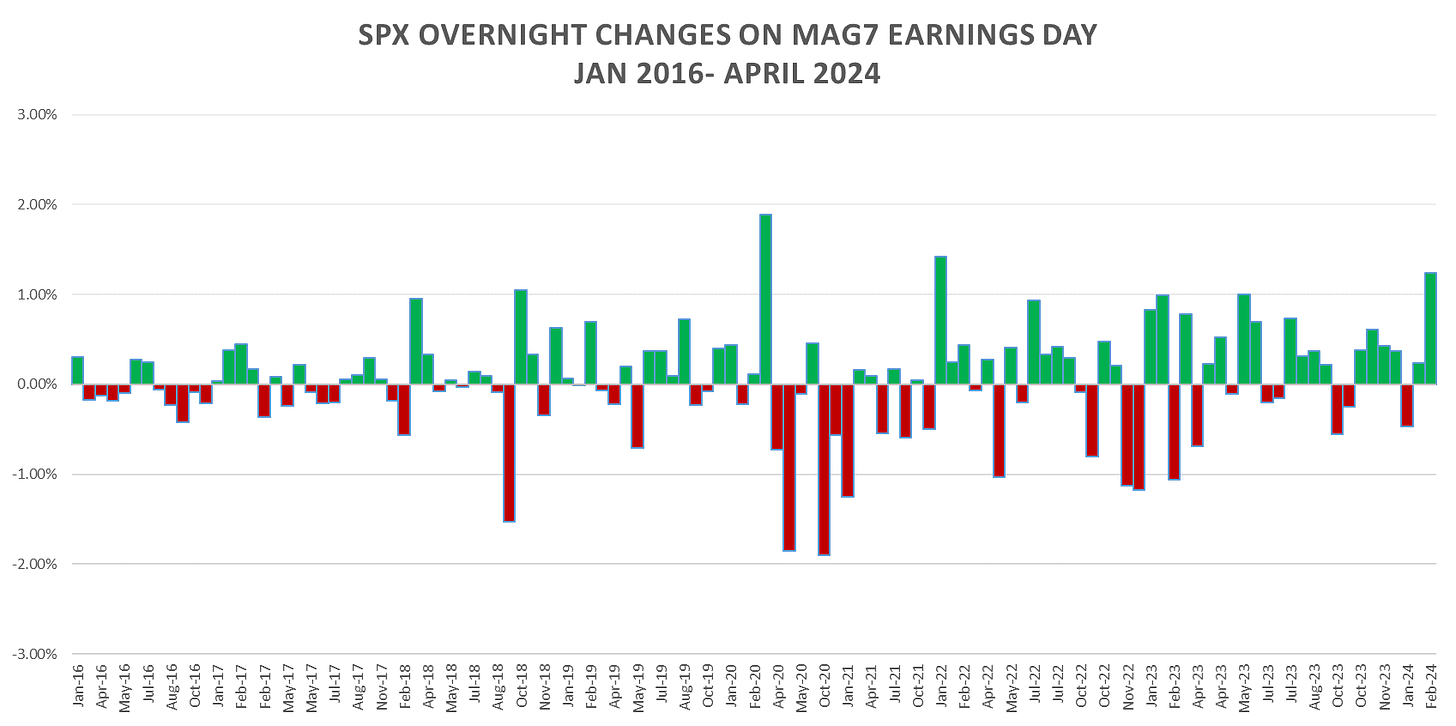

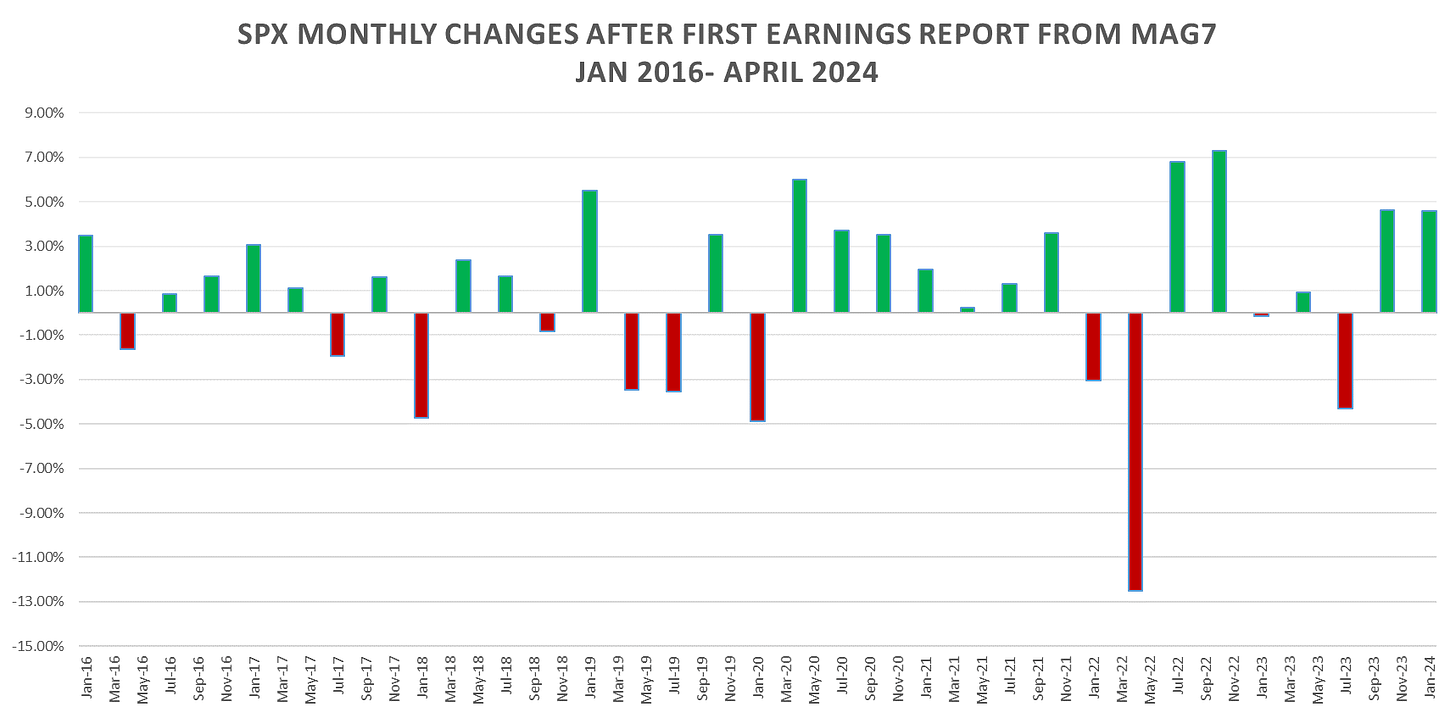

Can see moves pick up after 2018 once % index weight crossed 20%.

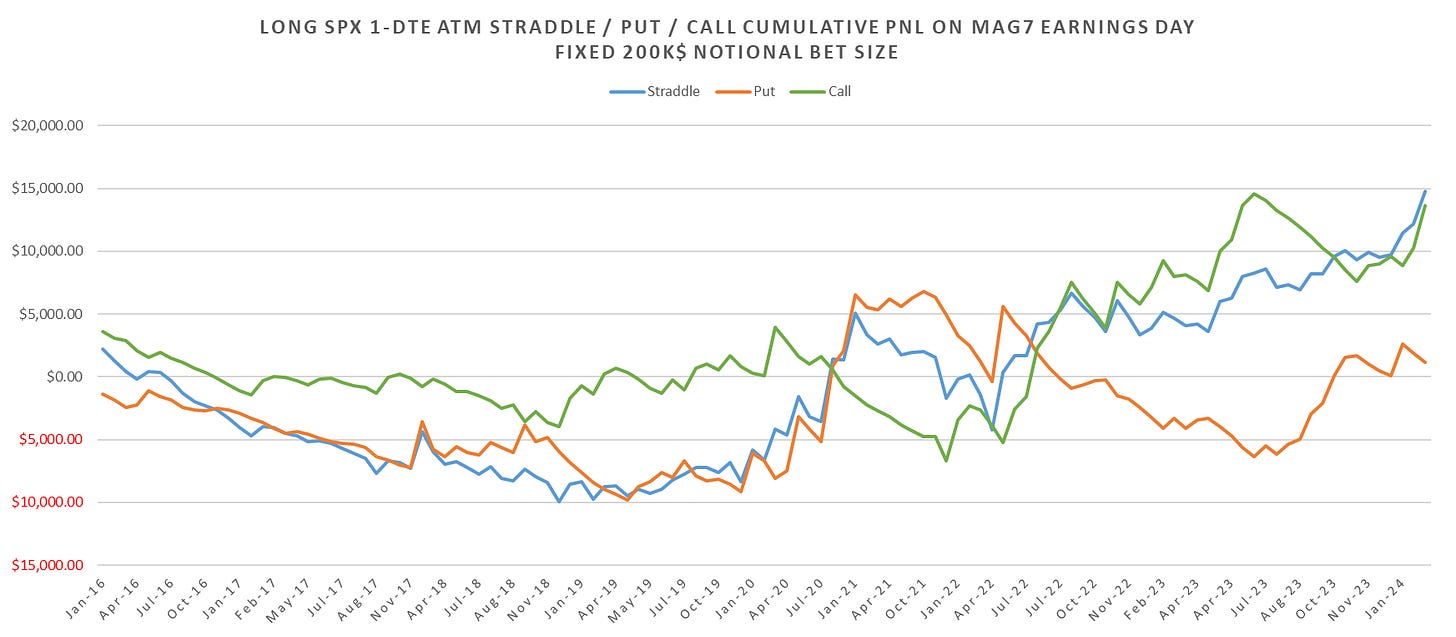

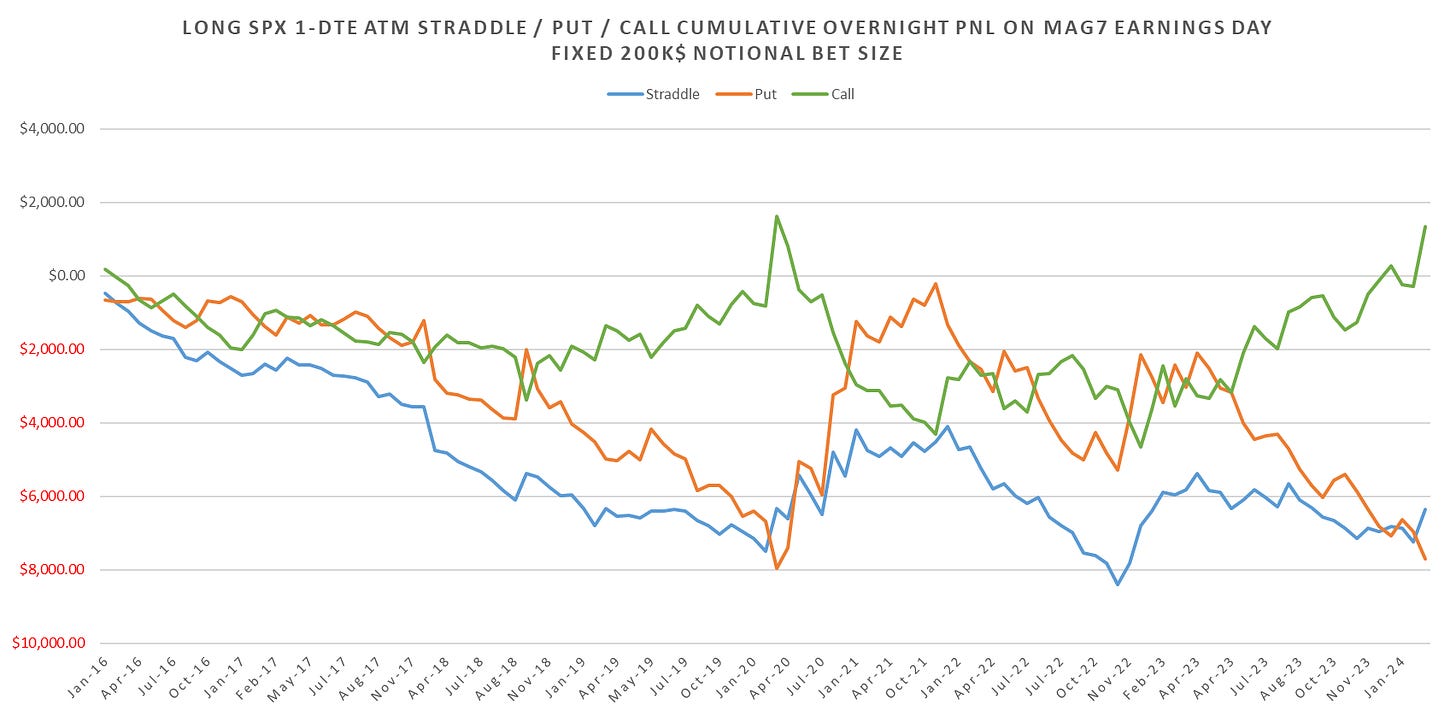

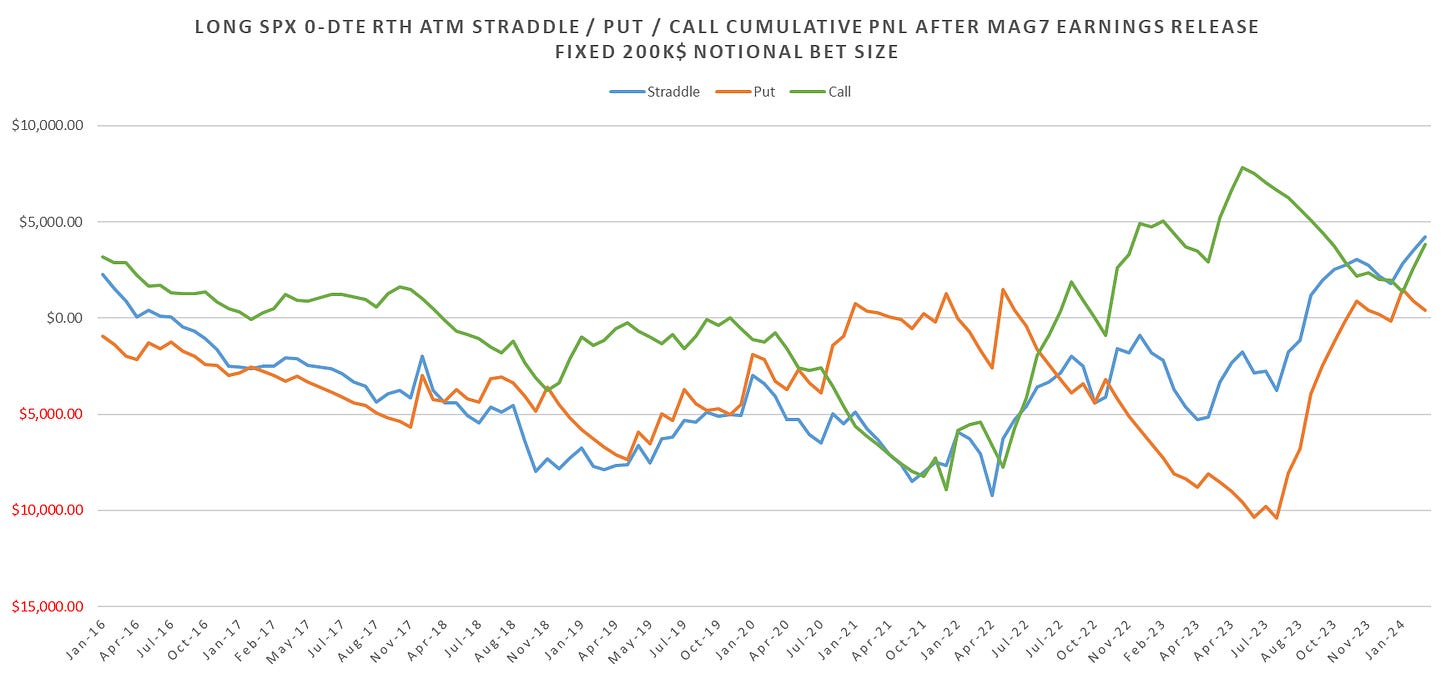

1-DTE SPX ATM straddles just slowly bleeding up until 2018-2019, after which straddles start to pick up (mid 2020 to end of 2021 period has straddles bleeding, however, index vol was fairly expensive in that time period.)

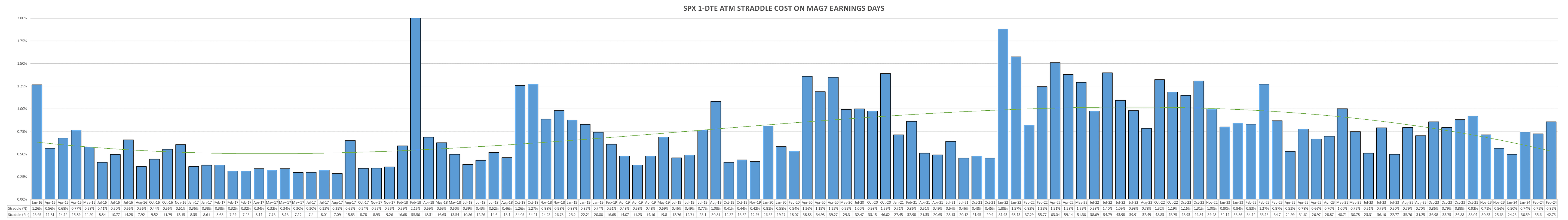

Daily straddles continue to pay even as the avg cost in bps up ~50% since 2017.

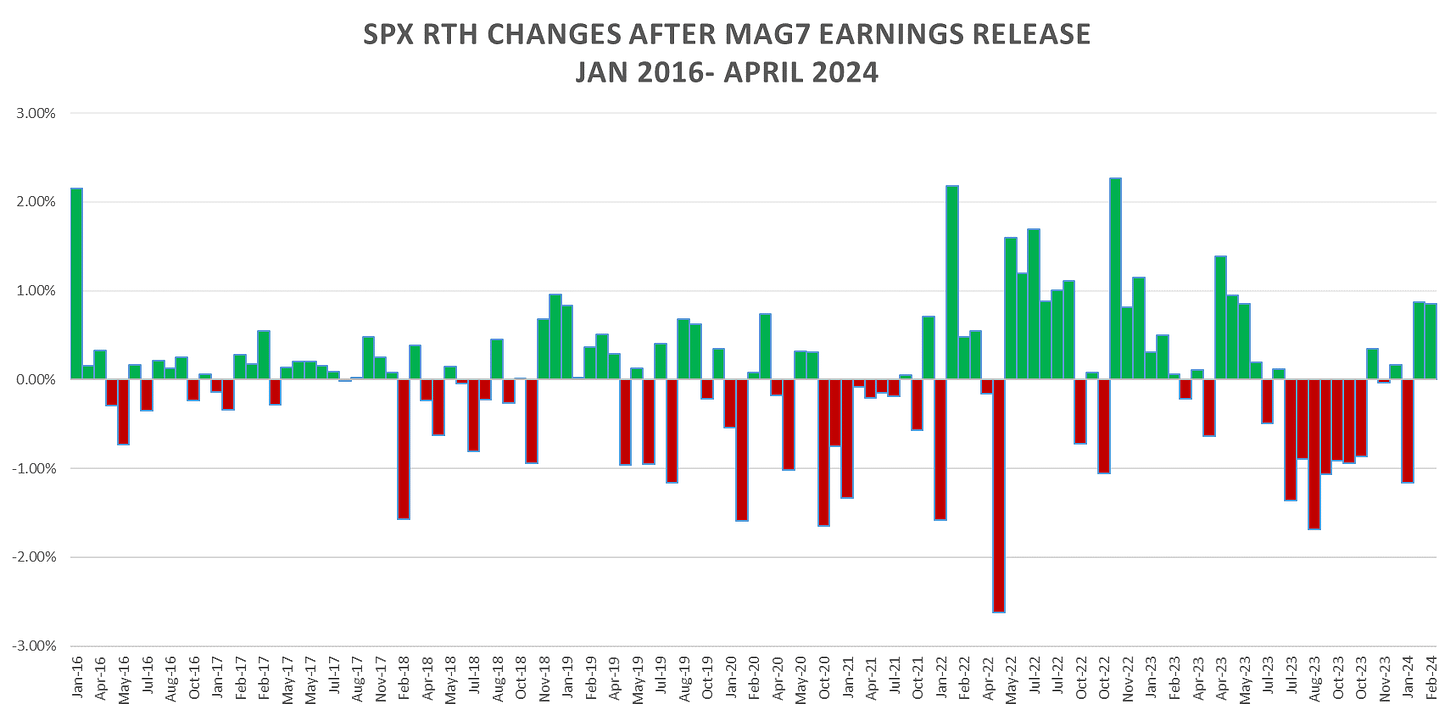

Lets take a look at the overnight moves (that capture the initial earnings reaction AH) relative to RTH moves and the relevant option prices.

Mostly positive spikes overnight post earnings release outside of Covid and 2022.

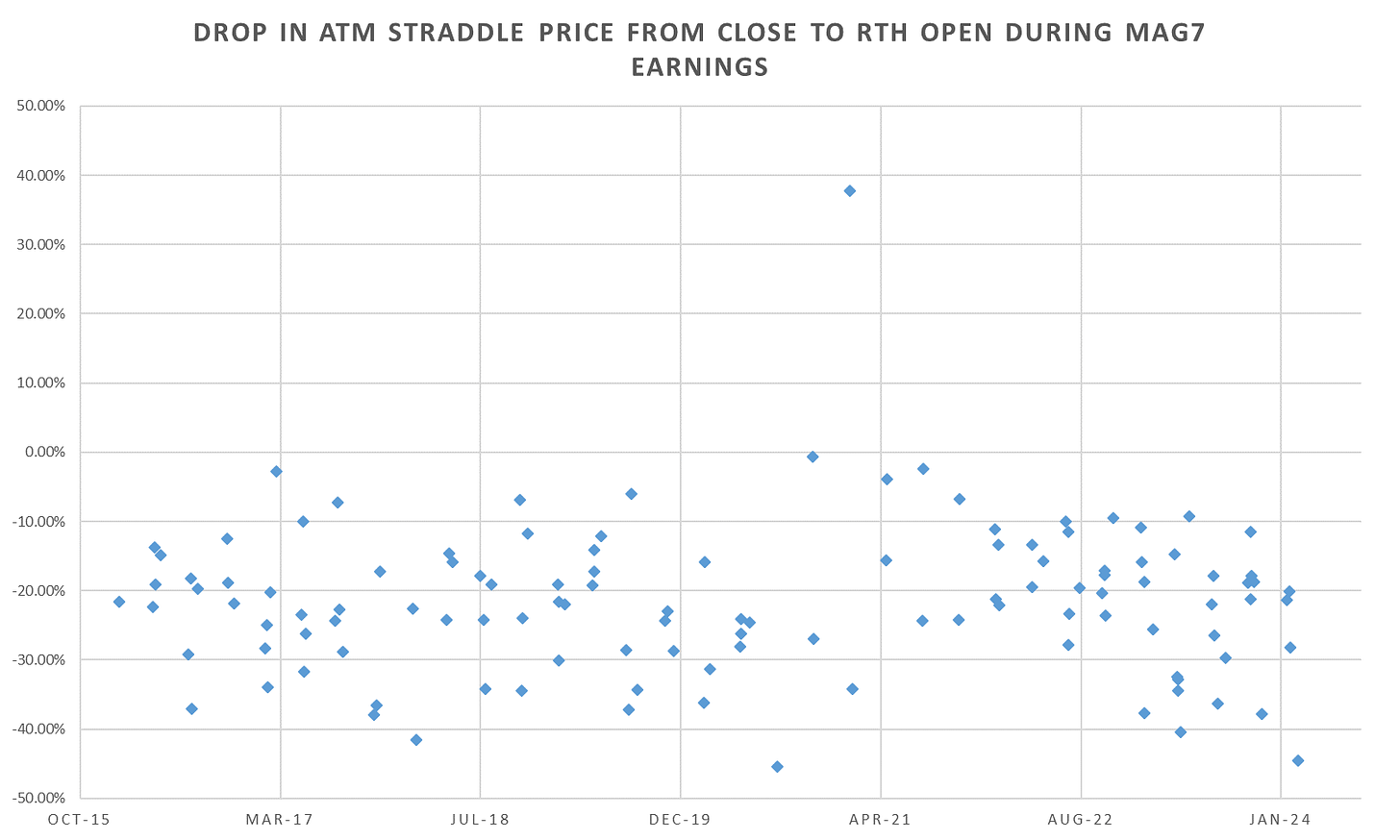

Holding straddles overnight purely for the initial earnings reaction not great… ATM straddles drop ~25% by open from the prior close.

RTH earnings gap ups got faded hard for 2 quarters straight last year, with Meta & Nvidia saving the day in February 2024.

RTH straddles actually performed alright, mainly due to downside moves last year and a half.

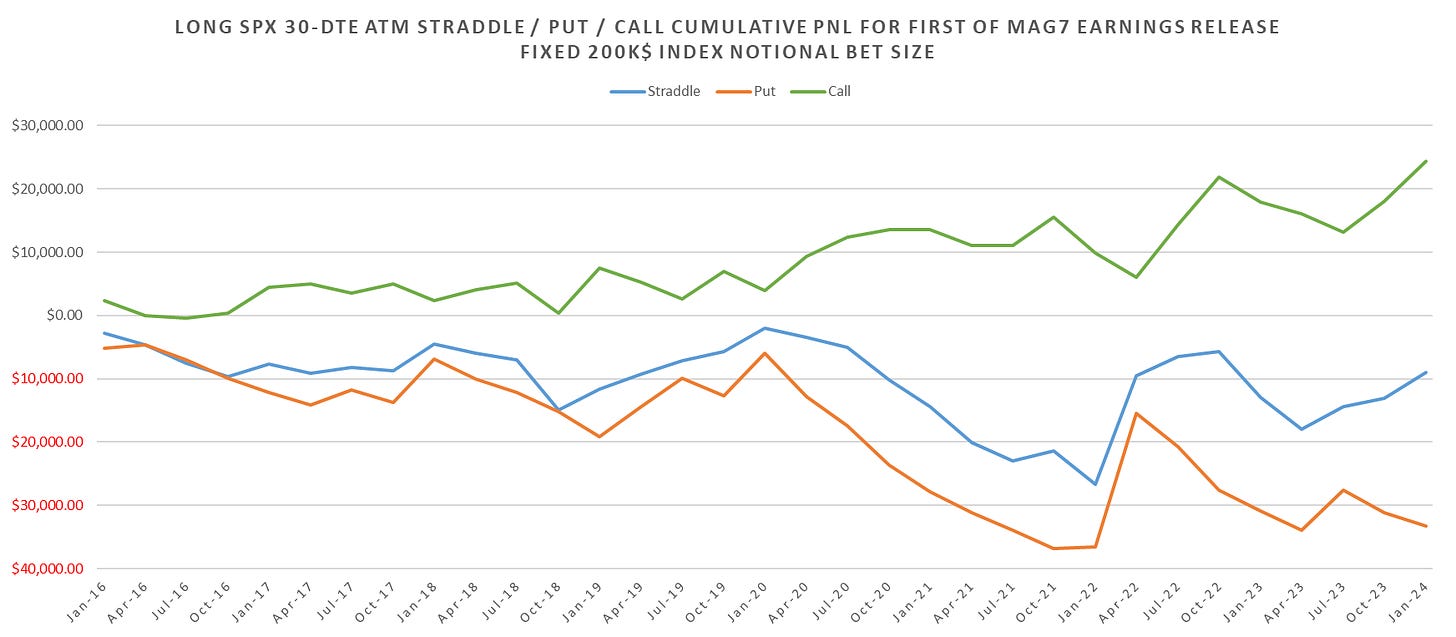

Finally lets look at monthly straddle performance following the initial report from a MAG7 component. Alphabet, Microsoft, Amazon, Apple and Meta have earnings releases within a week of each other with Nvidia and Tesla split farther apart.

On average MAG7 reports over a 24 calendar day period (min 8 in 2018, max 35 in 2022 and 2023). We can fit a 30-DTE Straddle opened on the night before the first component of MAG7 reports to capture the overall earnings period.

30-DTE SPX options performance: