VIX Futures Monthly Expiration

SPX Index & Index Options Performance

Markets chewing through CPI day gains so far today, not much movement in vols at the moment as this mainly looks like rotation out the AI basket into defensives. 1m implied correlations still 10-12%, this will keep a lid on vol if we bleed lower slowly.

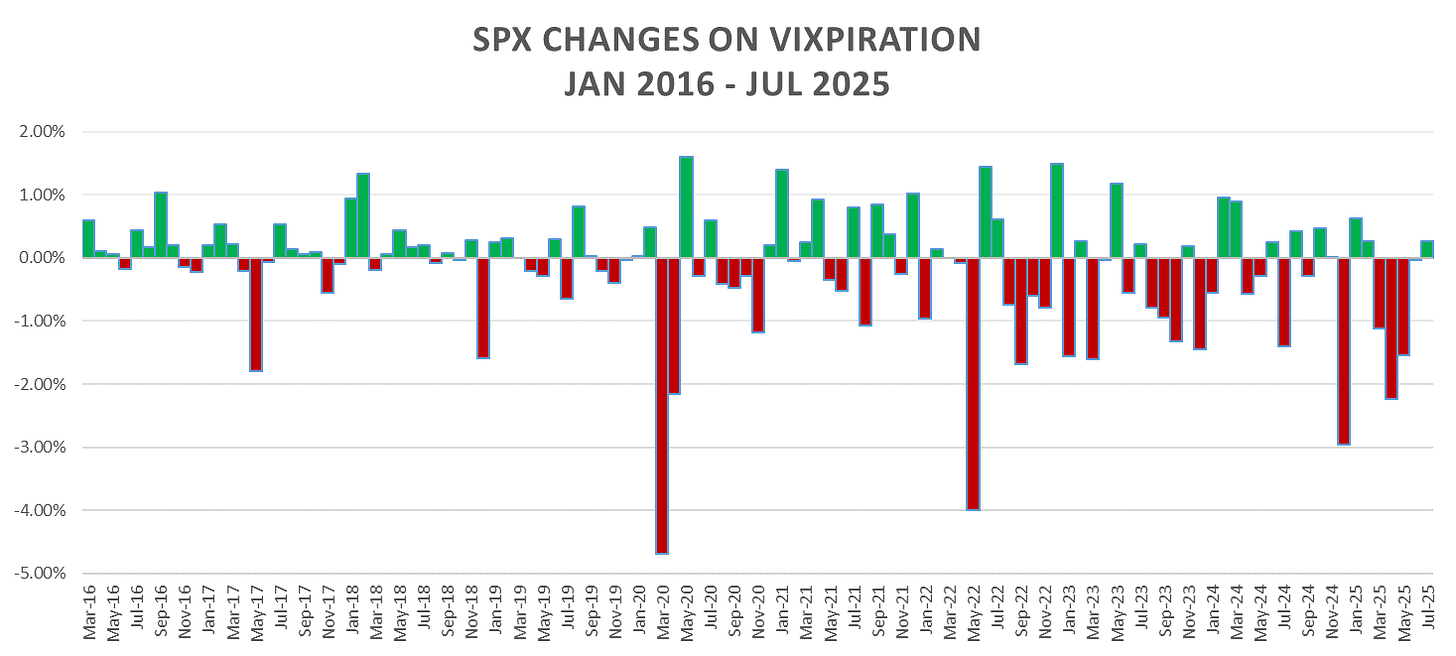

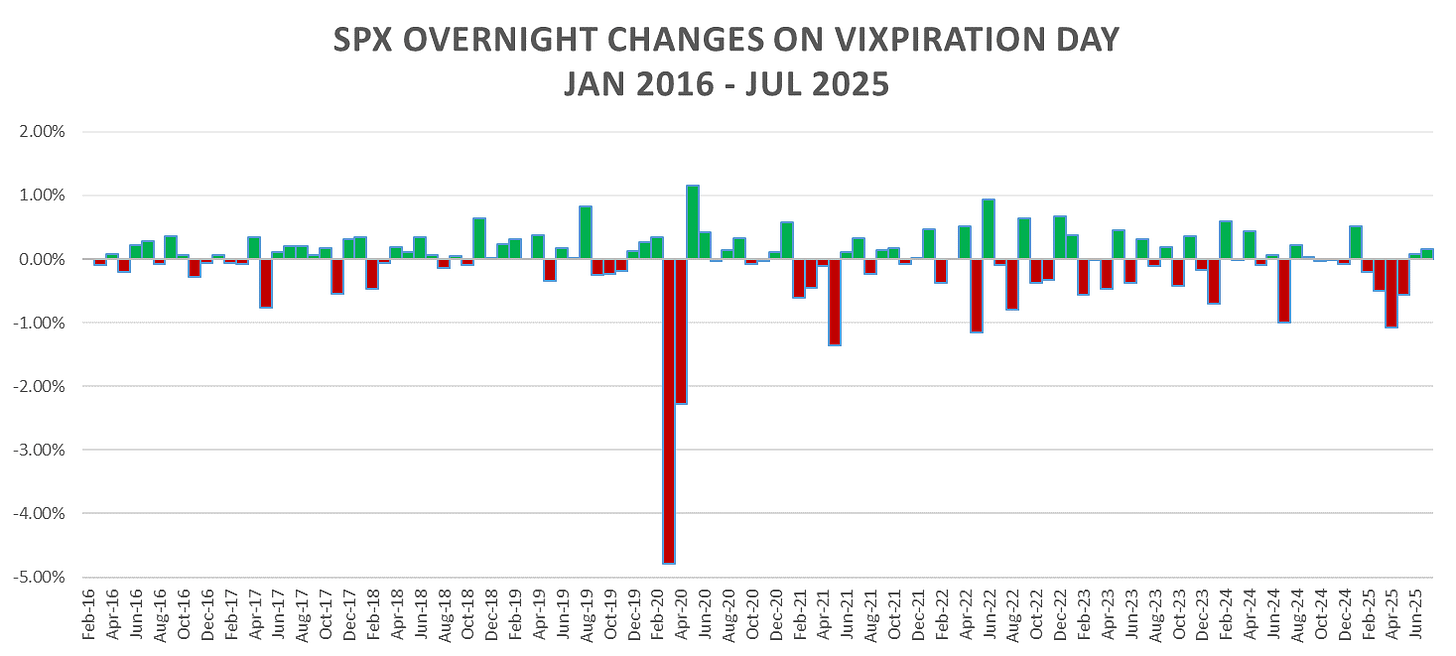

With VIX futures expiring tomorrow morning, as in the last post we have been seeing significant weakness following monthly VIX futures expirations:

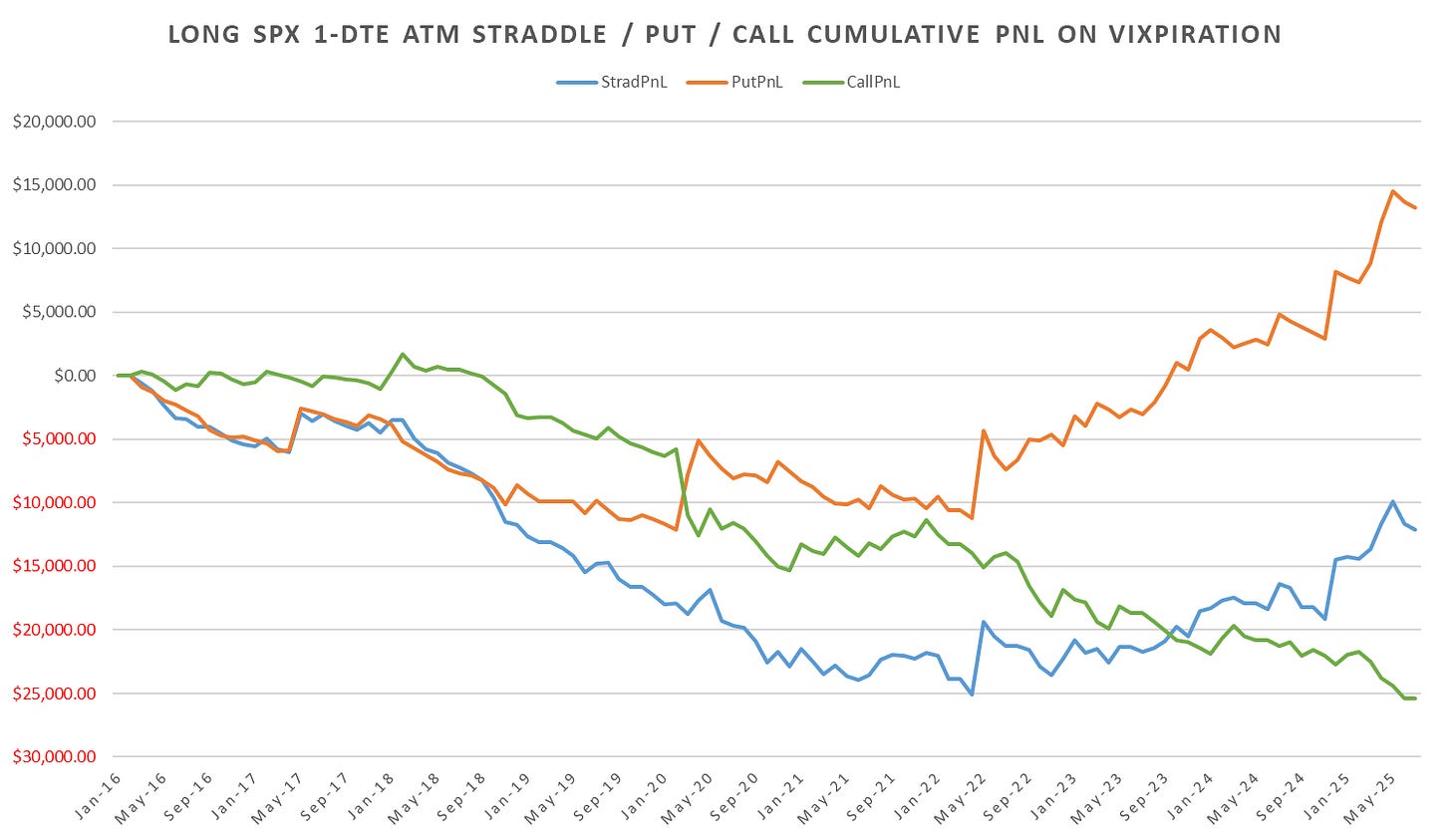

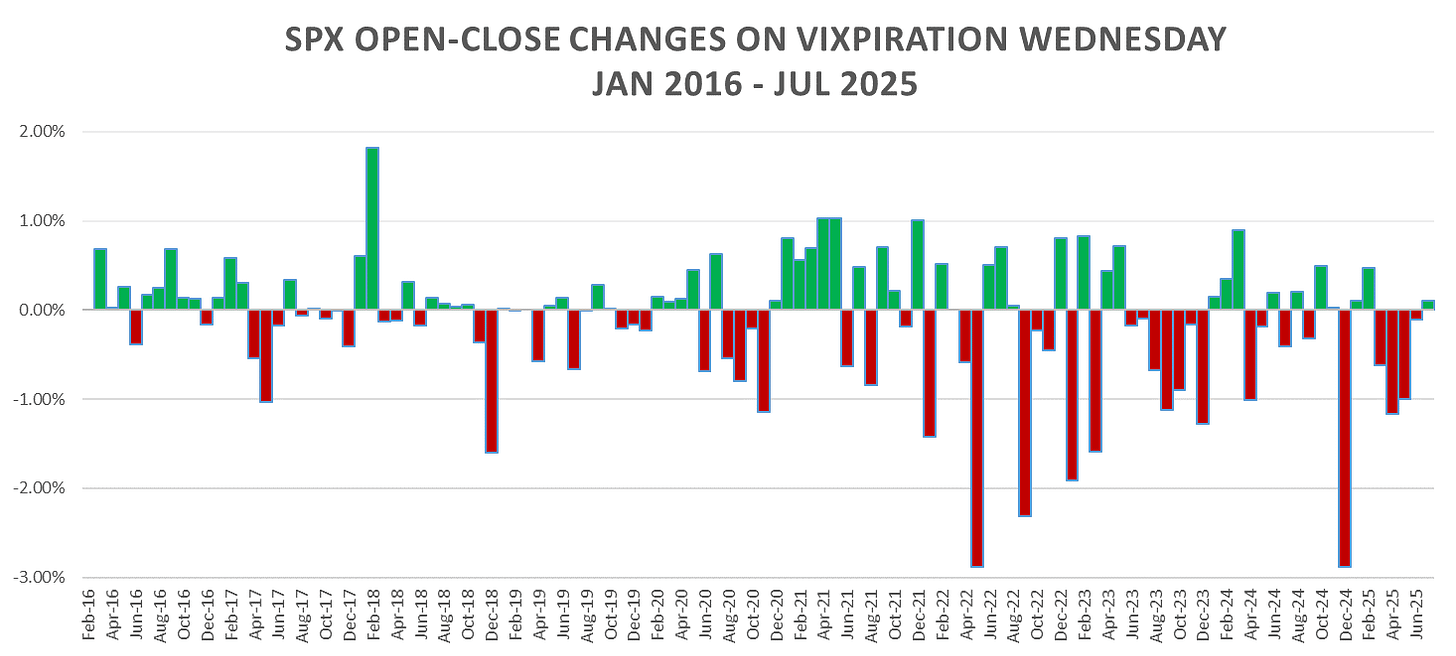

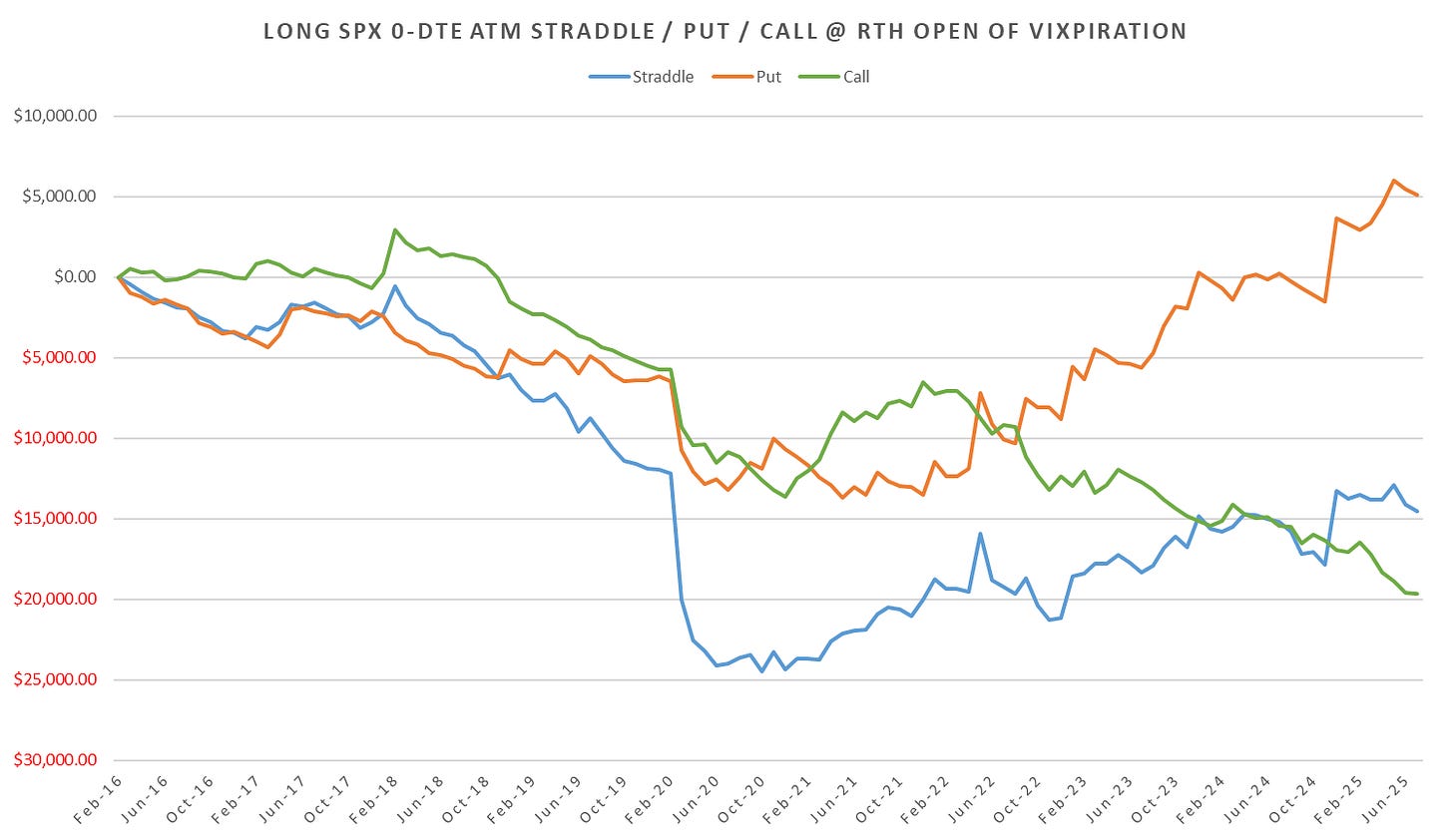

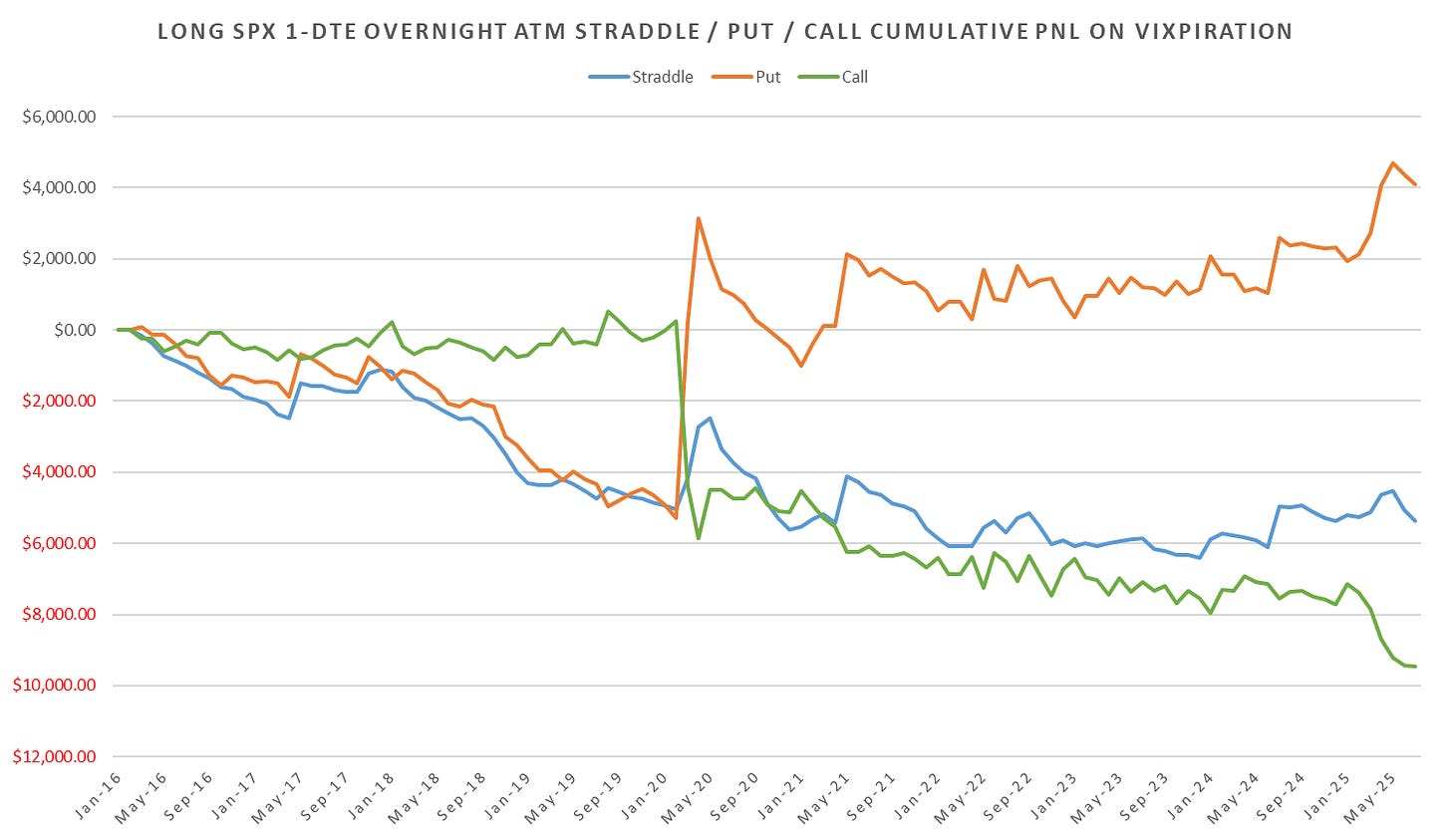

Updated historical performance for SPX Index & Options around Vixpiration posted below.

1-DTE SPX Performance:

Note: All $charts represent $200k notional bet size (ex. ~3 XSP at 6000 SPX)

US RTH Session:

Overnight performance into morning settlement: