Previous NFP overview:

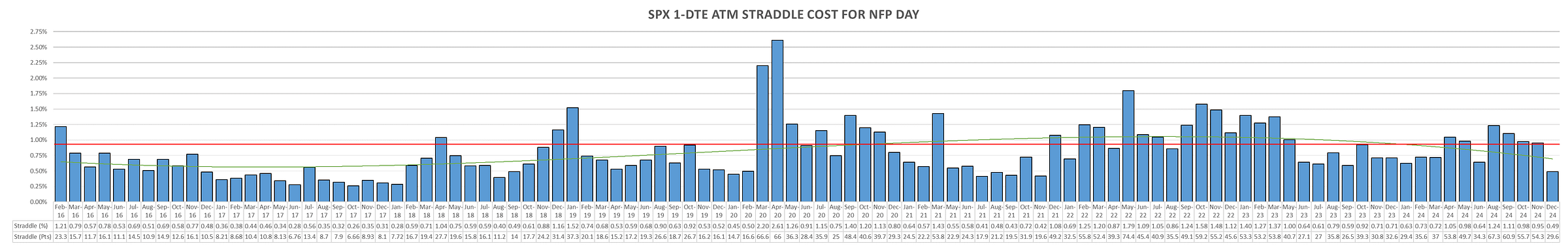

Another ‘biggest NFP of our lifetimes’ is on deck this Friday. SPX straddle going into NFP at ~90bps, back to Aug-Nov levels after going into the Dec print at 3 year lows.

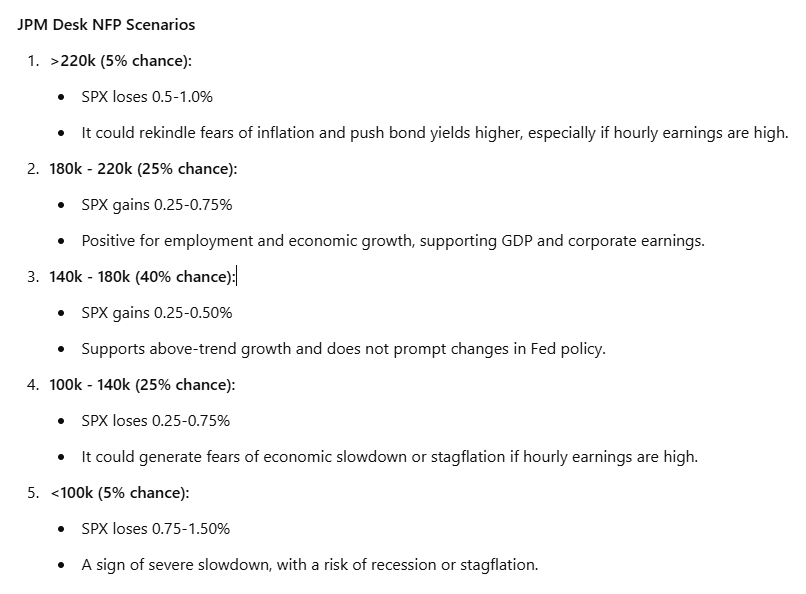

JPM scenarios for tomorrow:

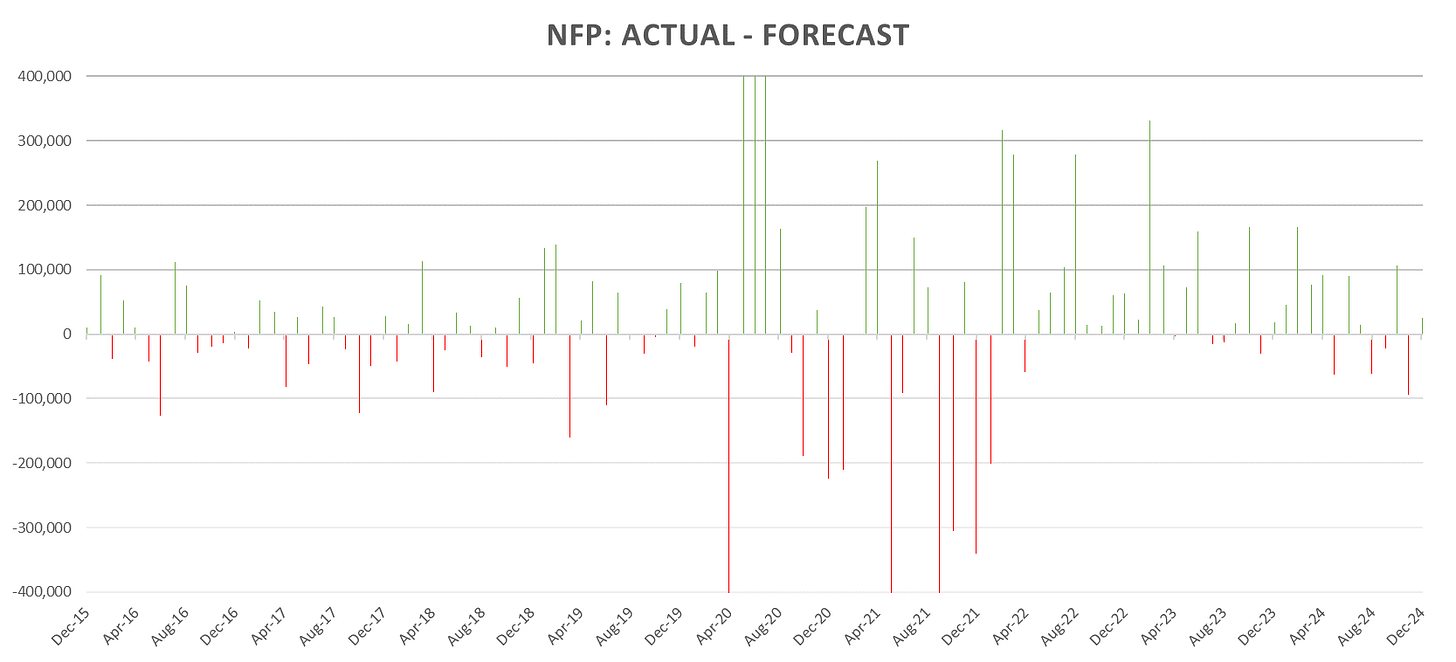

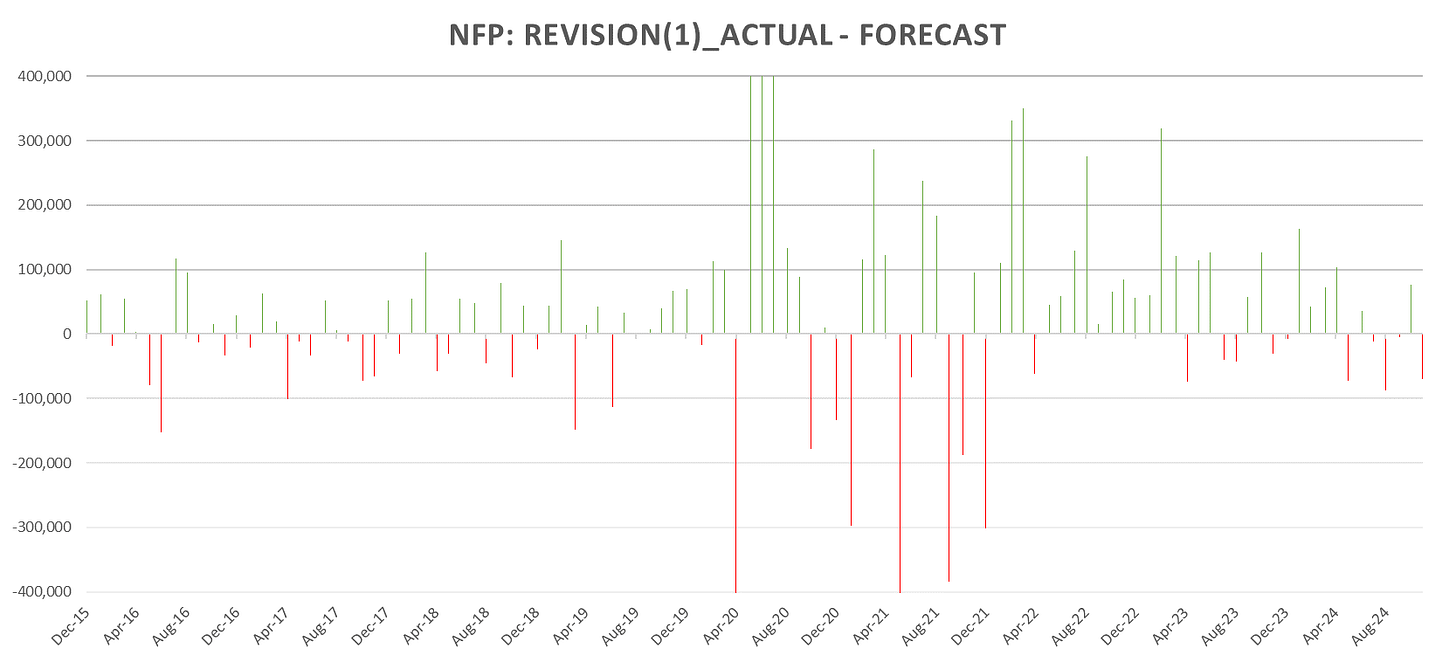

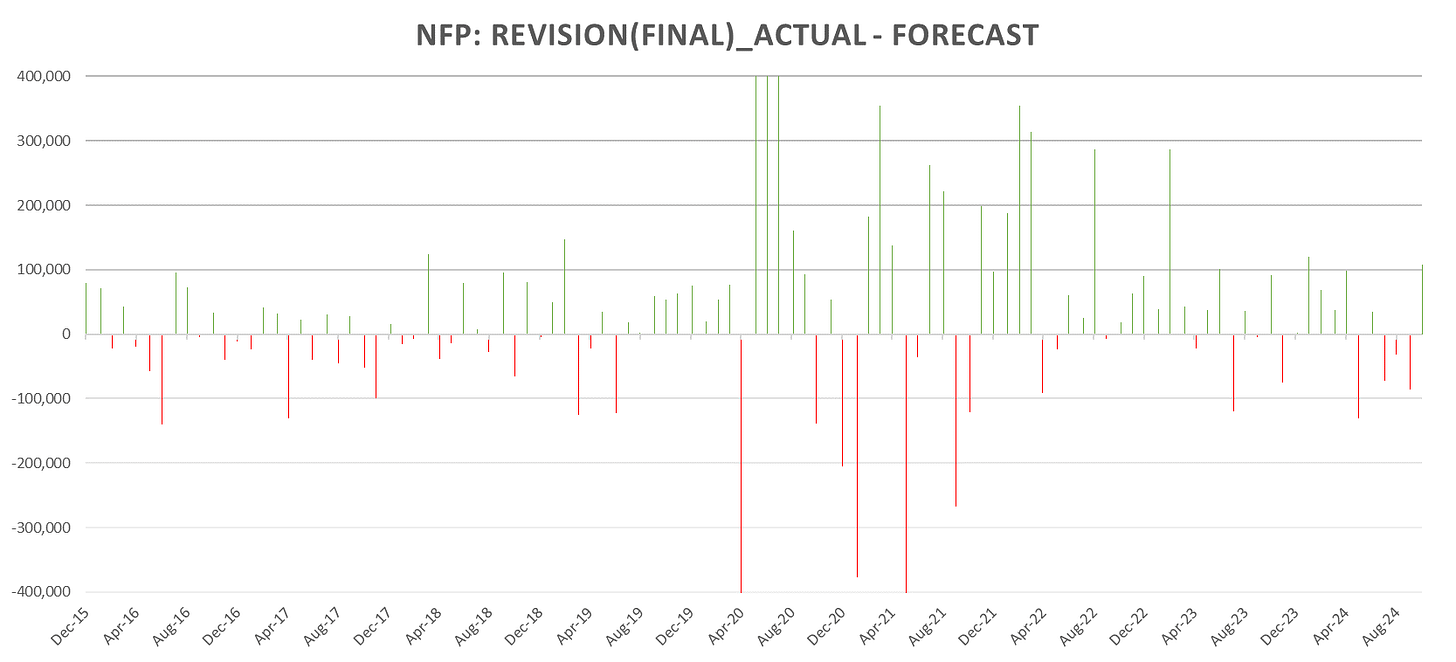

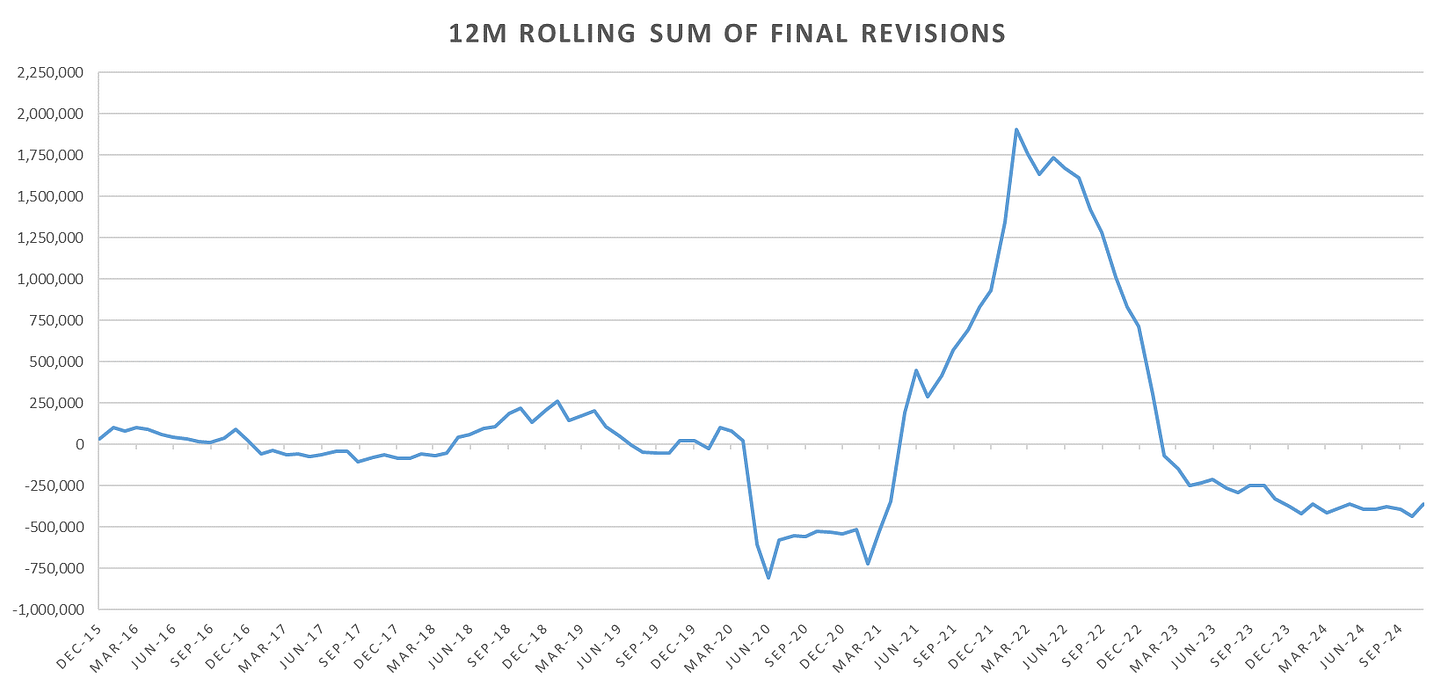

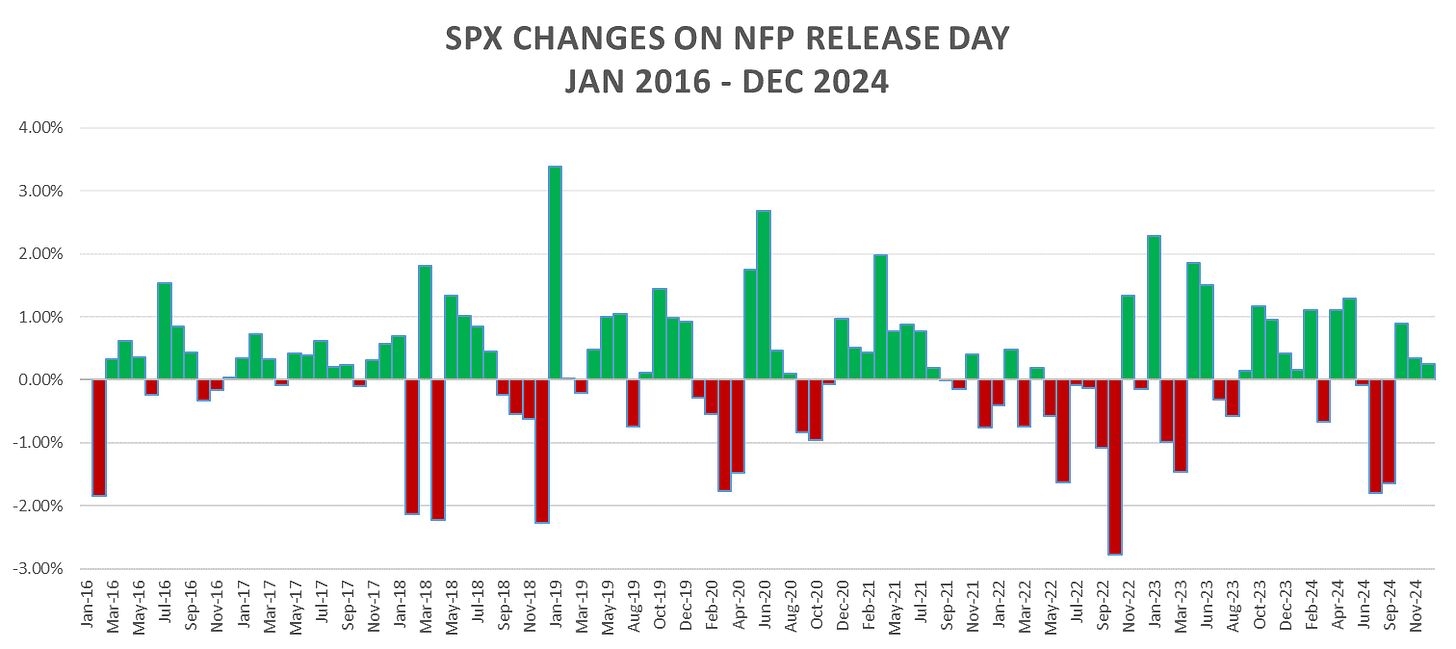

Historic NFP data (built from https://www.bls.gov/web/empsit/cesnaicsrev.htm):

Final revisions sum:

Historic SPX Straddle pricing (red line current):

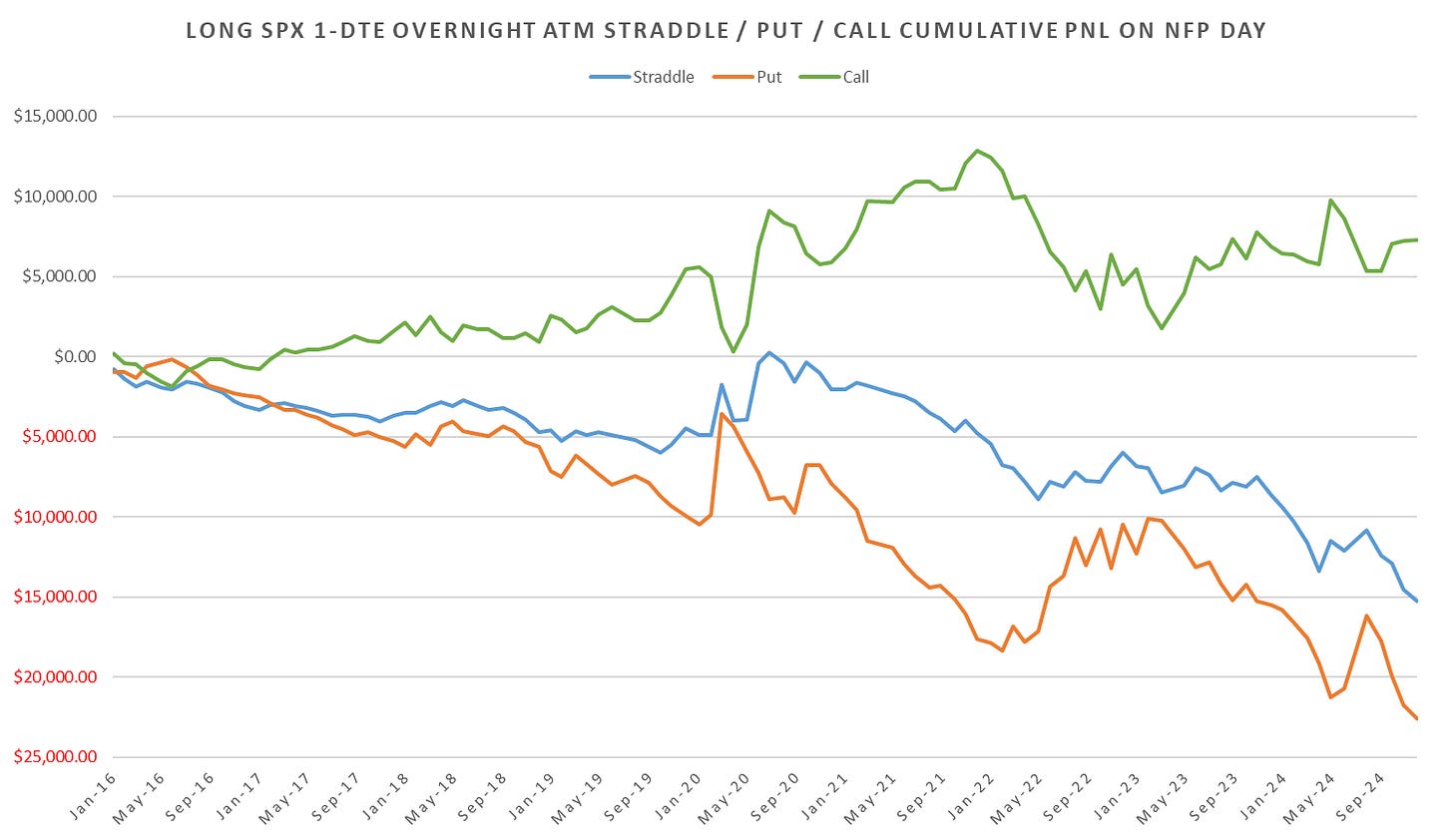

Overnight SPX Straddle performance (1x notional):

NFP straddles one of the last data release straddles to have any decent premium left, moves continue to be underwhelming…

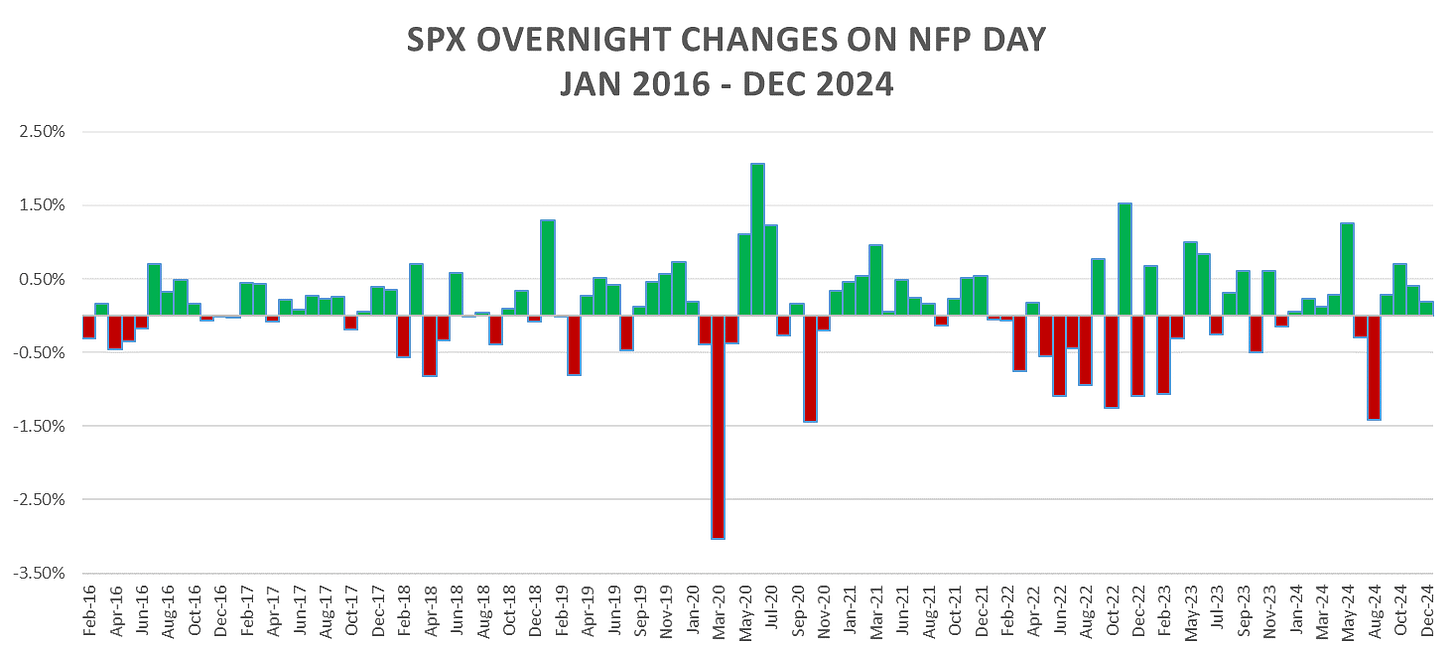

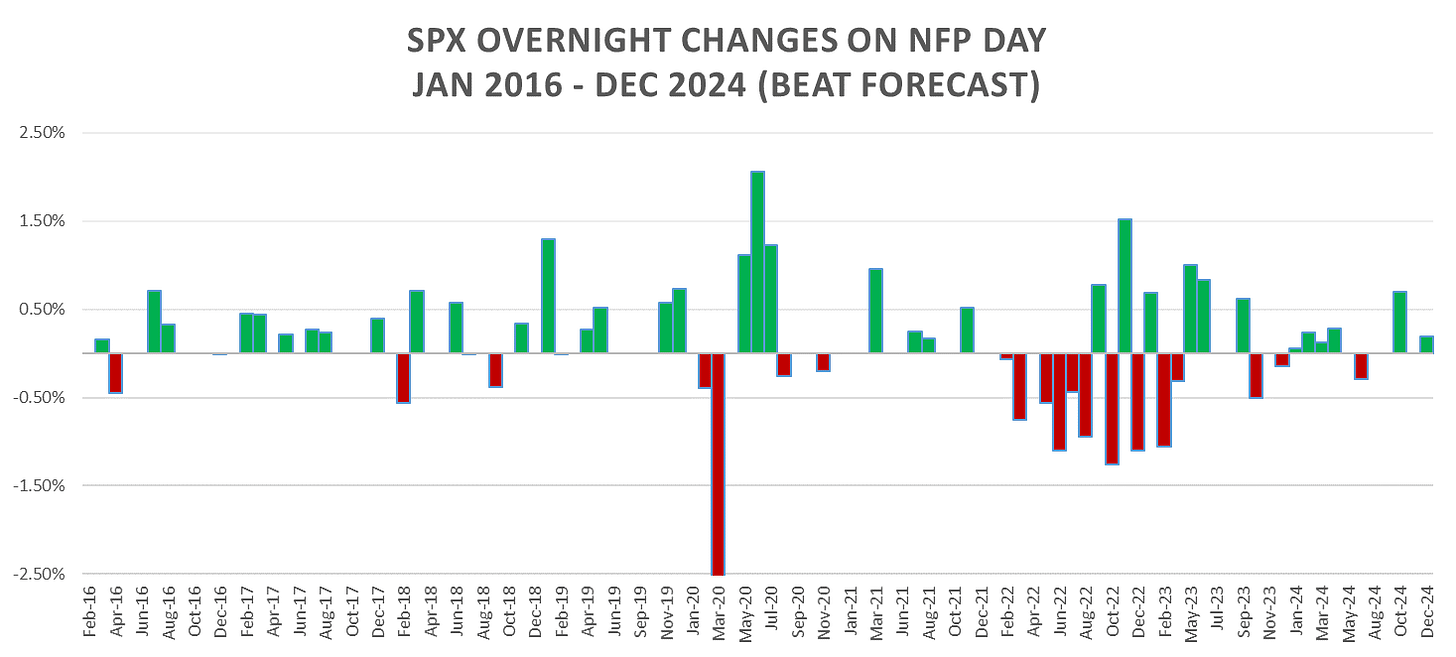

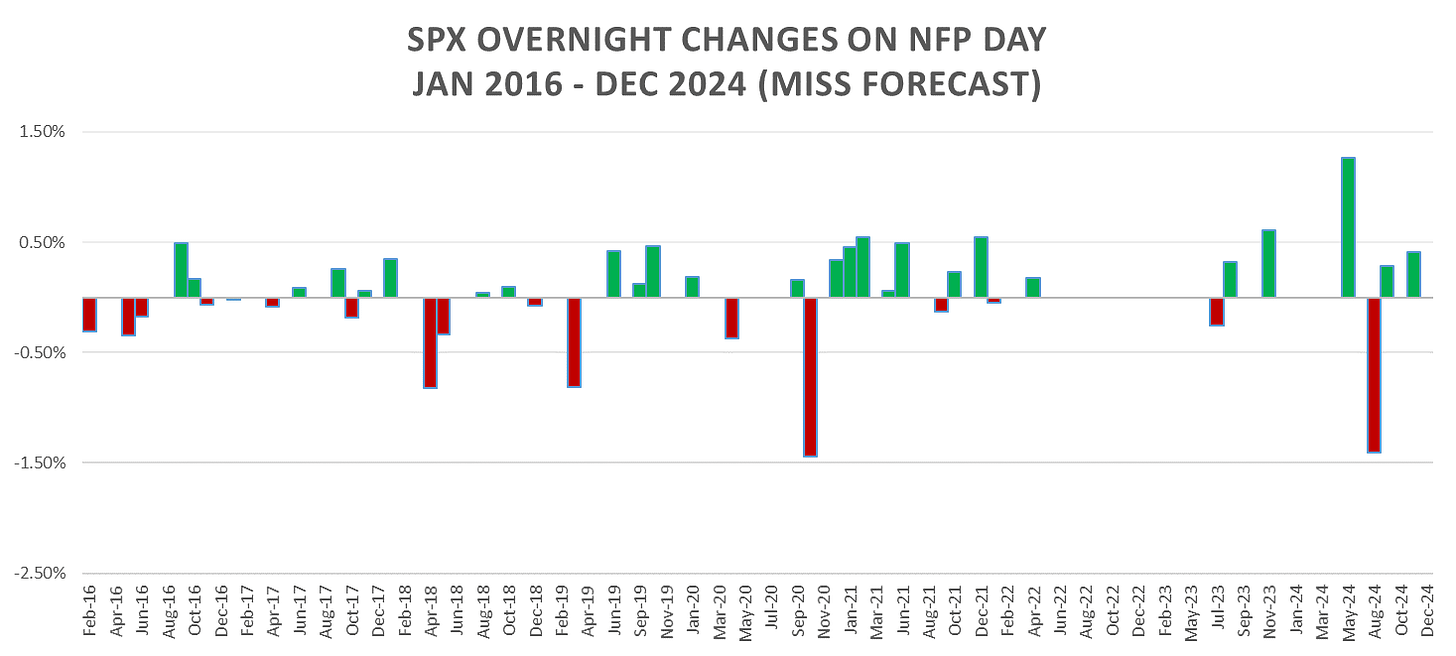

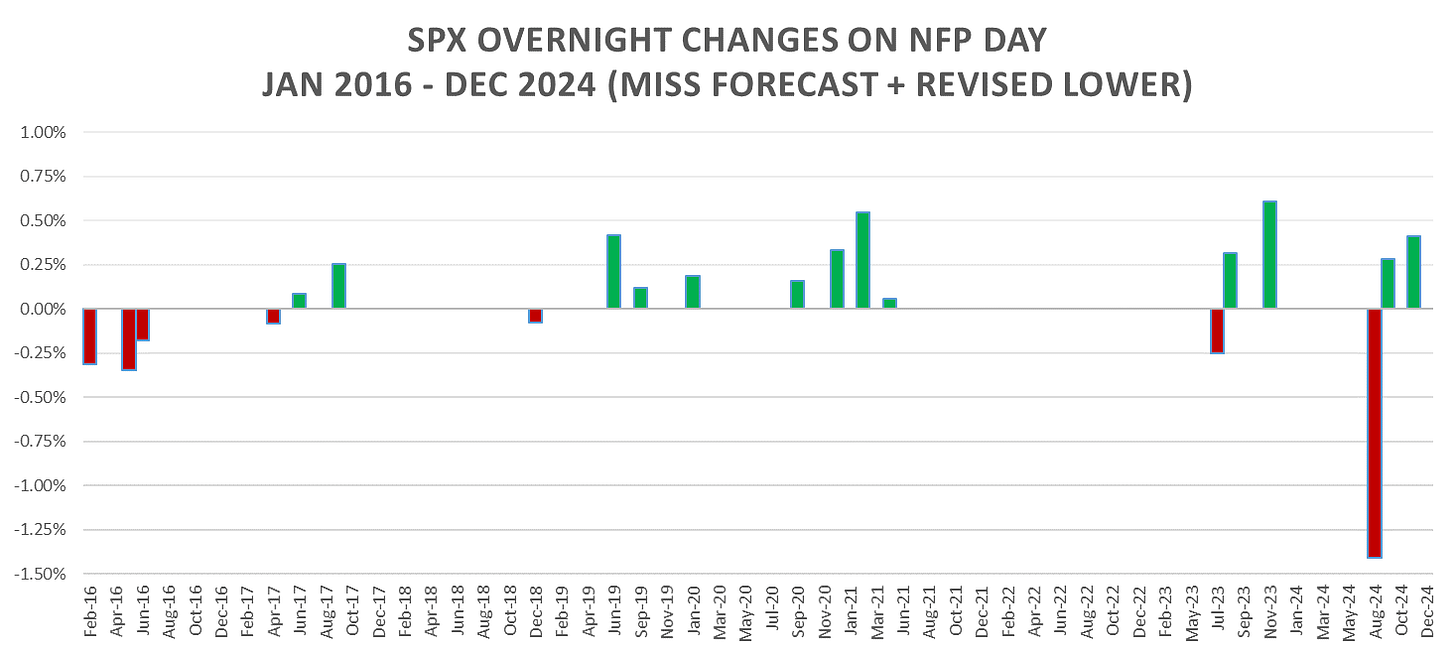

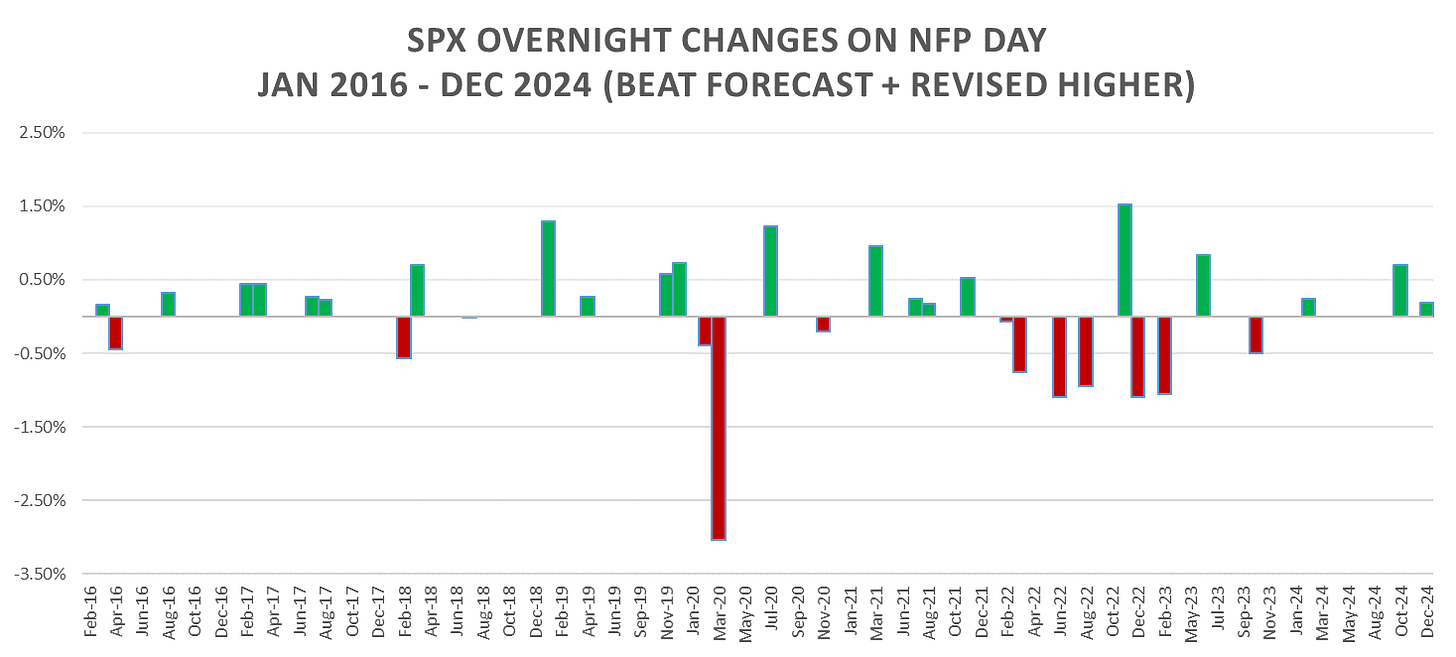

Sorting by beat/miss:

Additionally sorting by Beat/Miss + Up/Down Revision:

Managed to rally last 3 numbers on misses AND on beats…

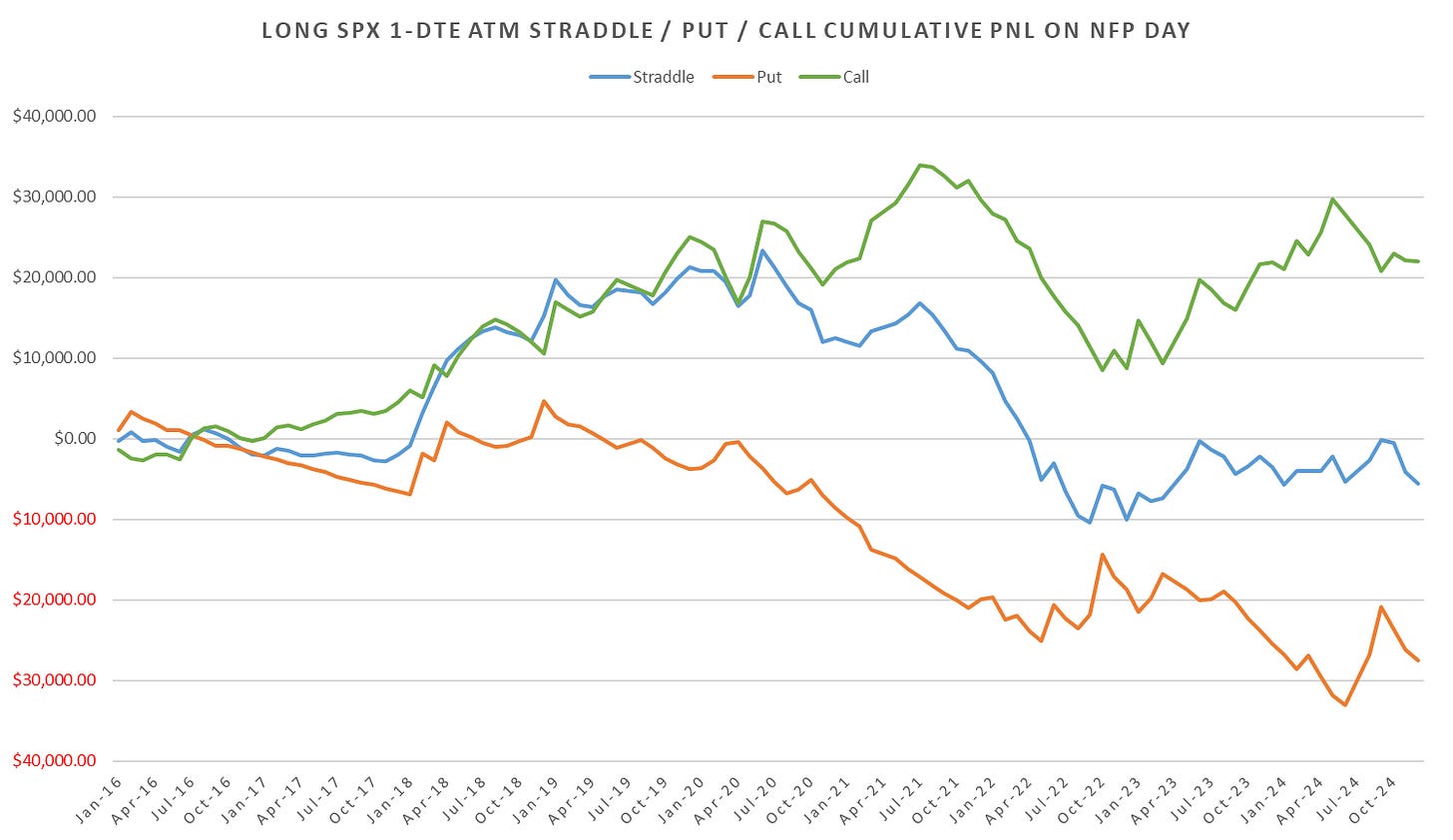

1-DTE full day performance for SPX:

(Chart: Position sizing 1x notional [+1 put + 1 call] on SPX)

Overall ~ flat if held till eod on the 1-dte straddles since 2022.

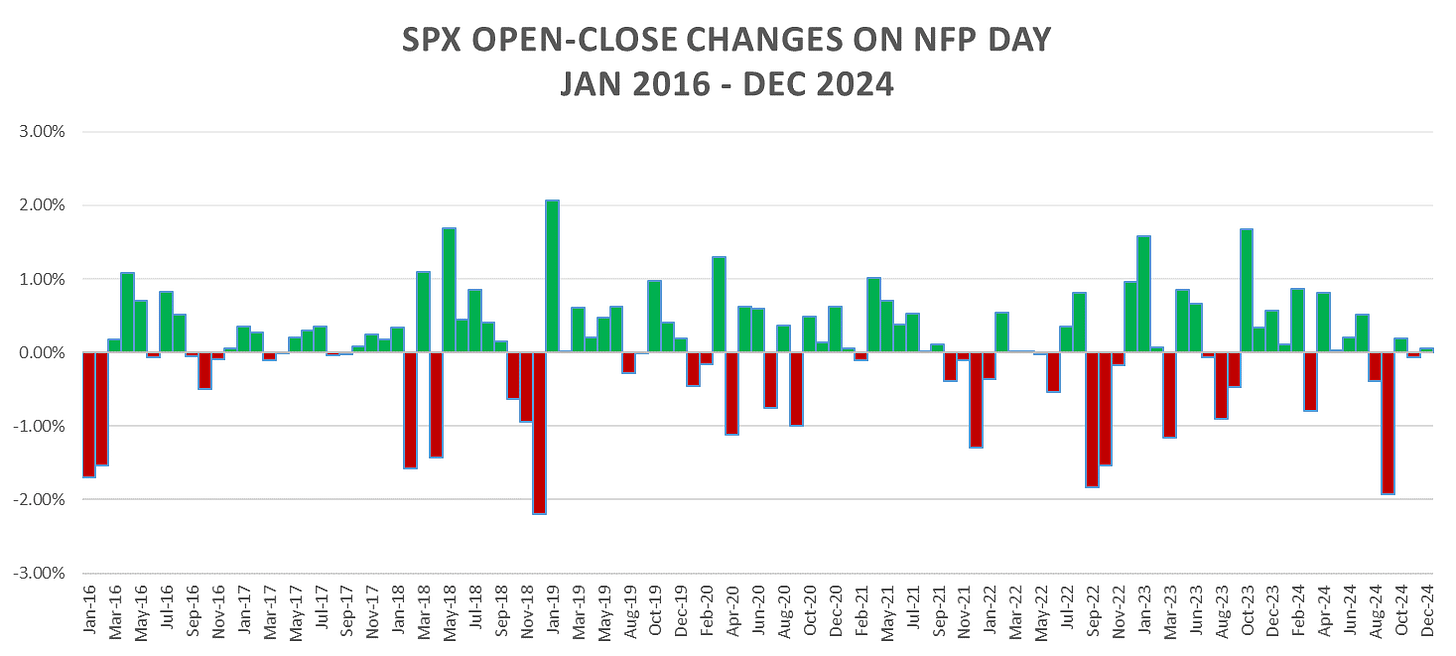

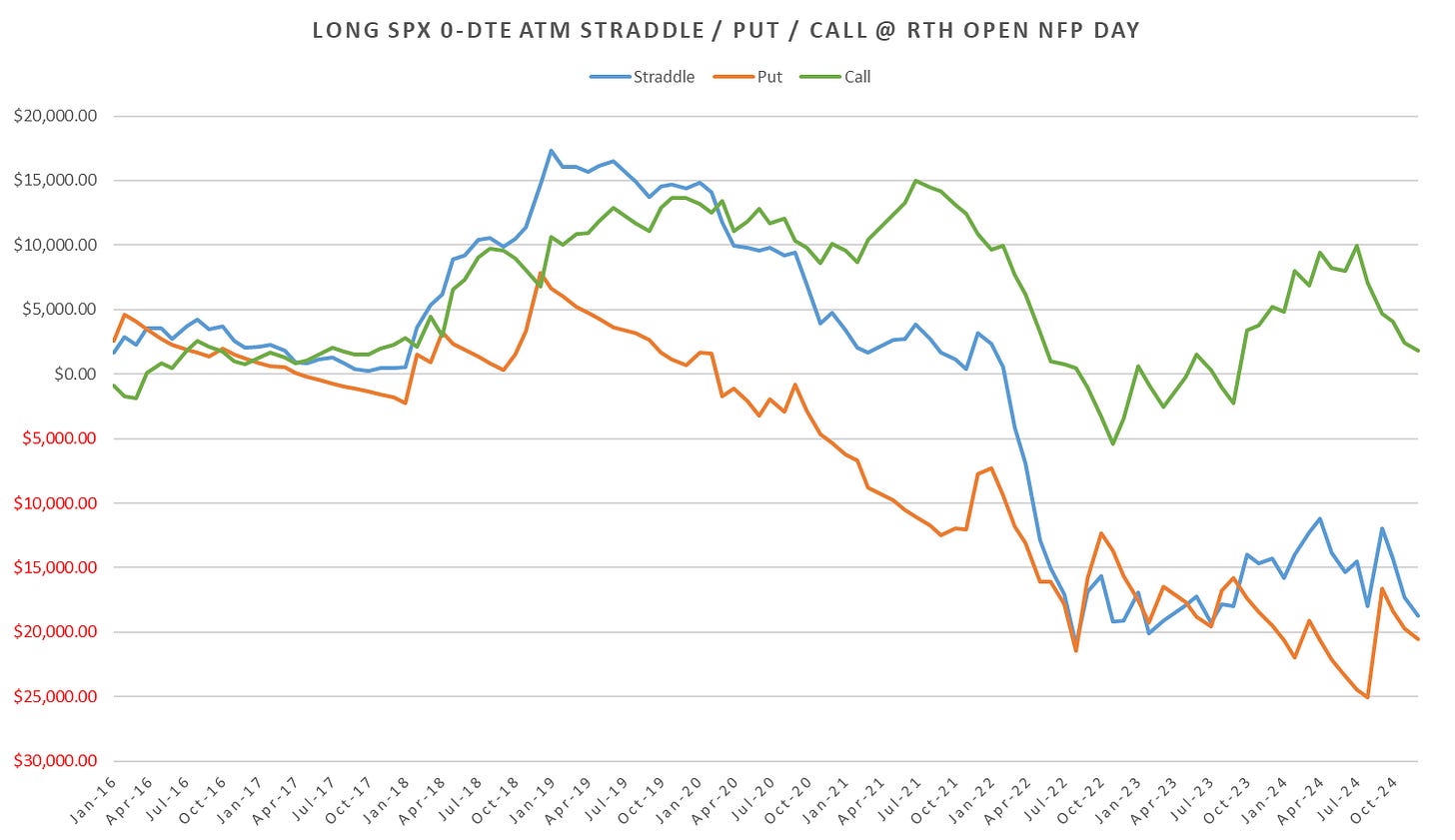

RTH open SPX & Straddles:

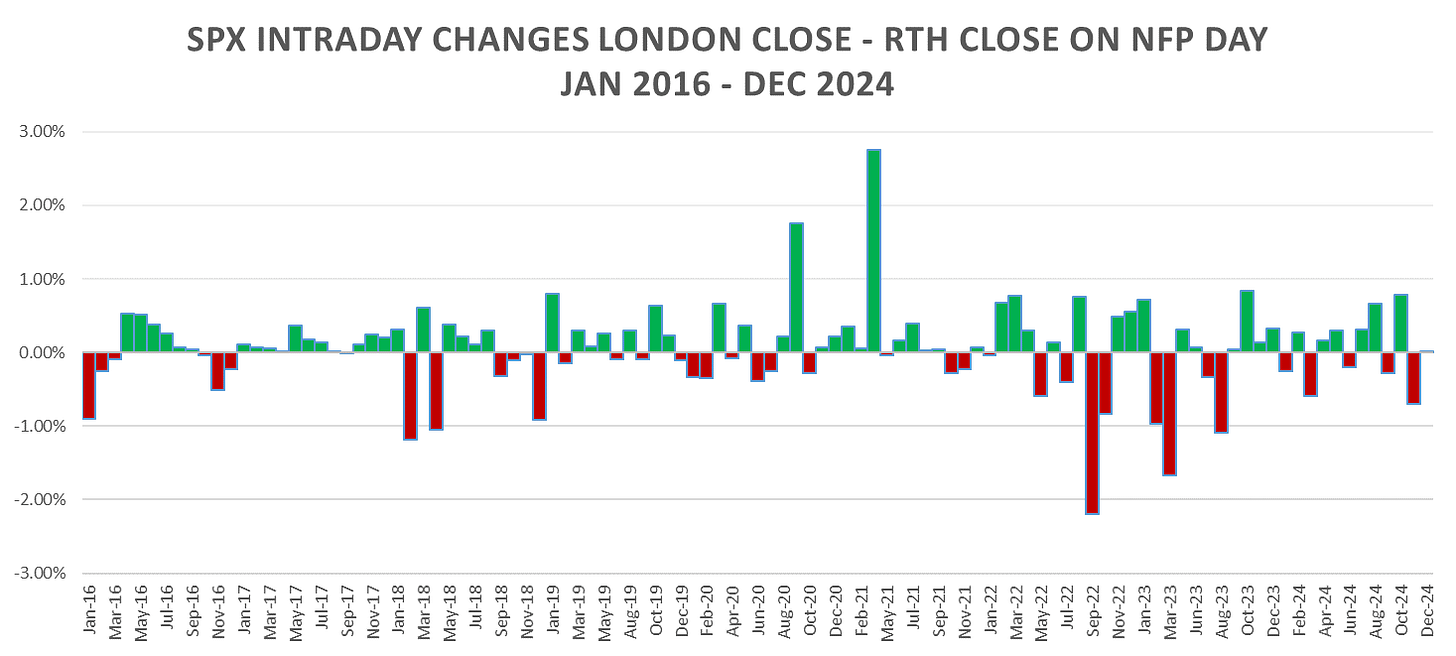

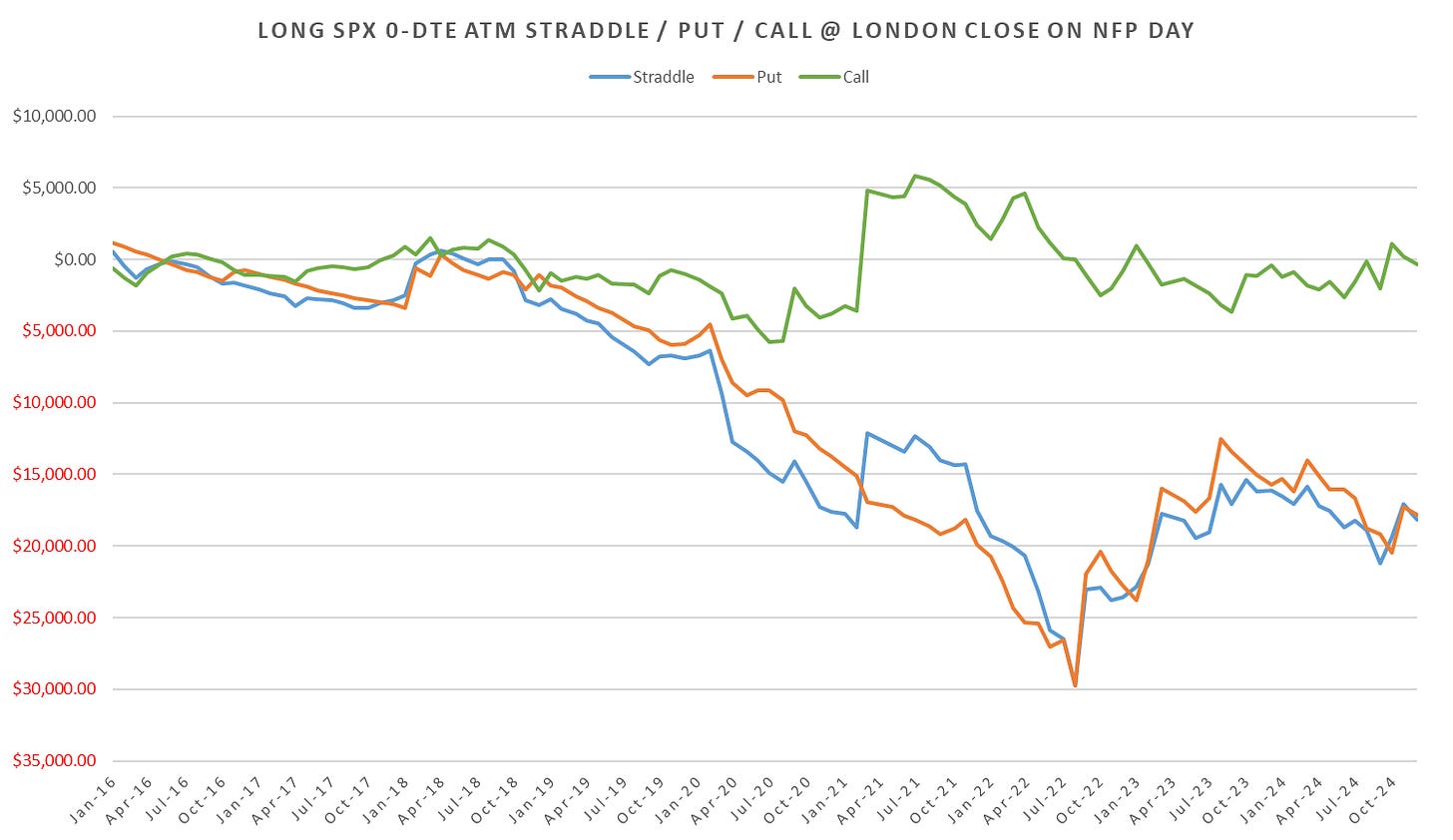

London Close:

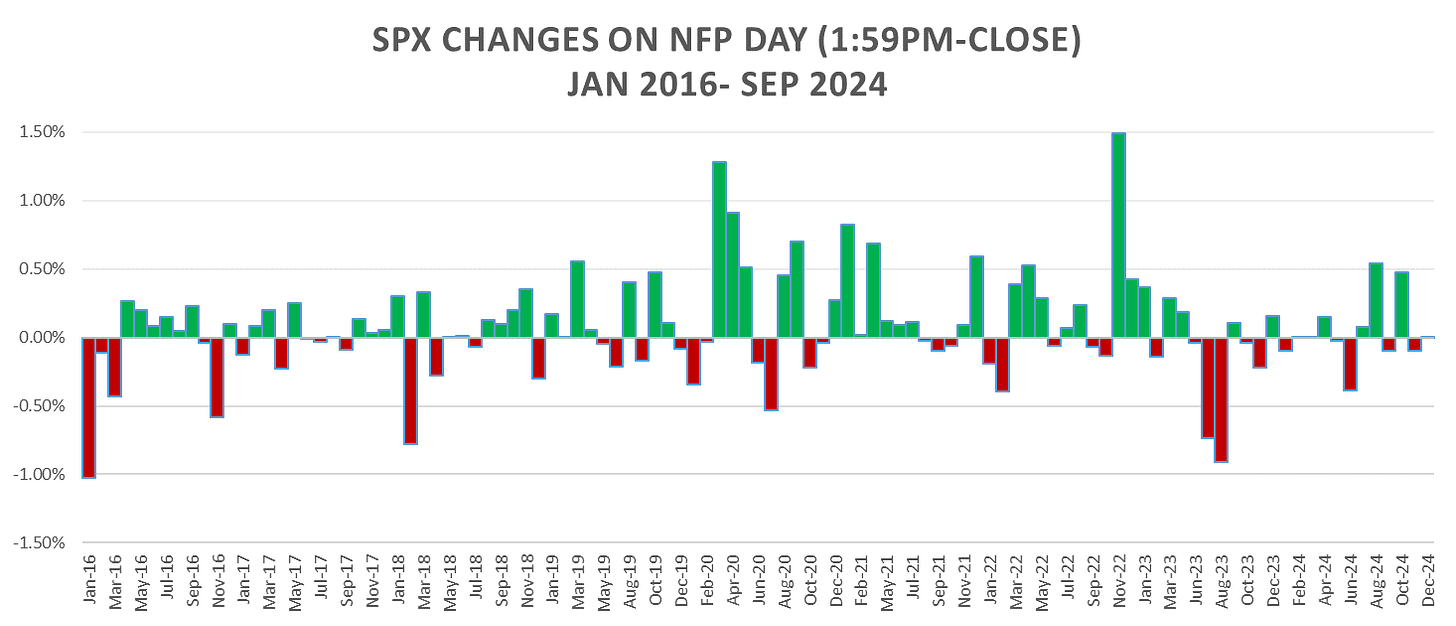

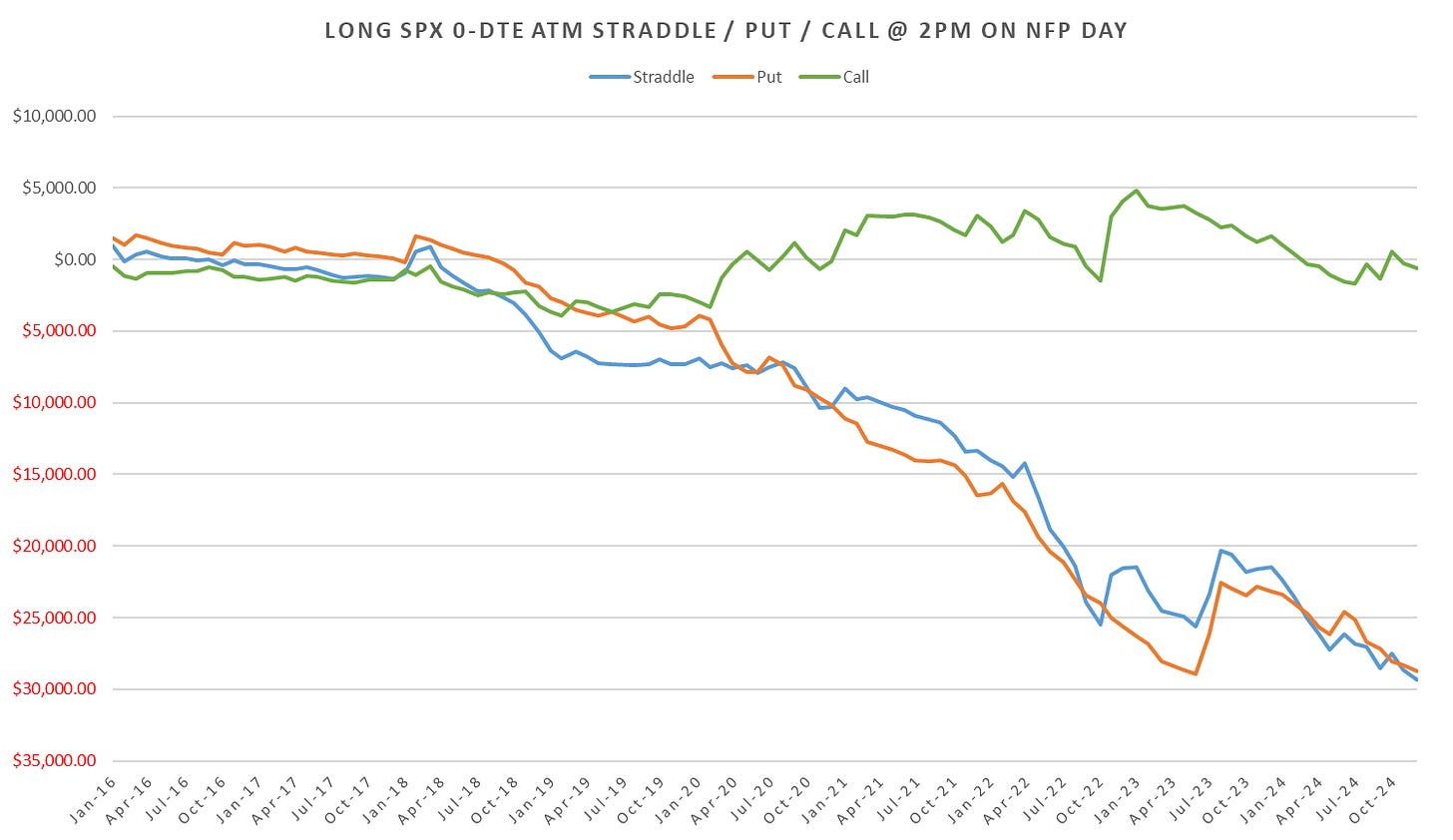

2pm-Close Straddle:

Flat / slow grind higher into eod Friday usually the theme (although last ~2 years just been flat into eod.)