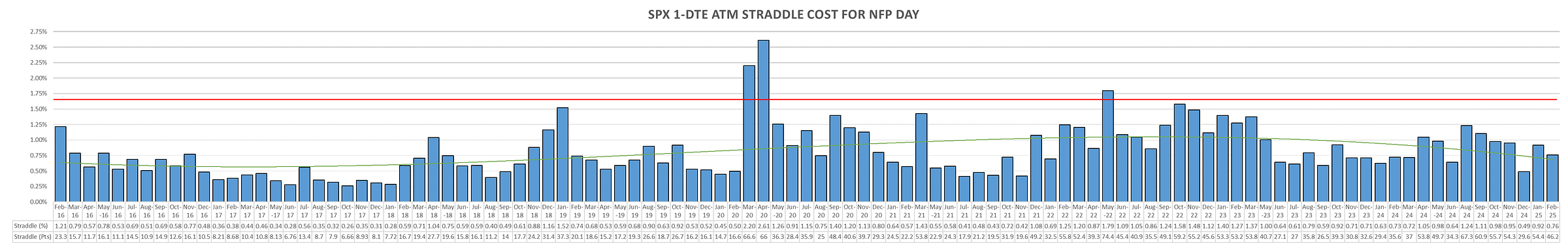

Market expecting a slightly lower number relative to Jan for the Feb NFP, however, the pricing for short term straddles is easily nearing panic levels.

Currently trading at ~160bps (peaked 165), this is the most expensive SPX NFP straddle since 2020 and one data release in 2022… market getting a little ahead of itself.

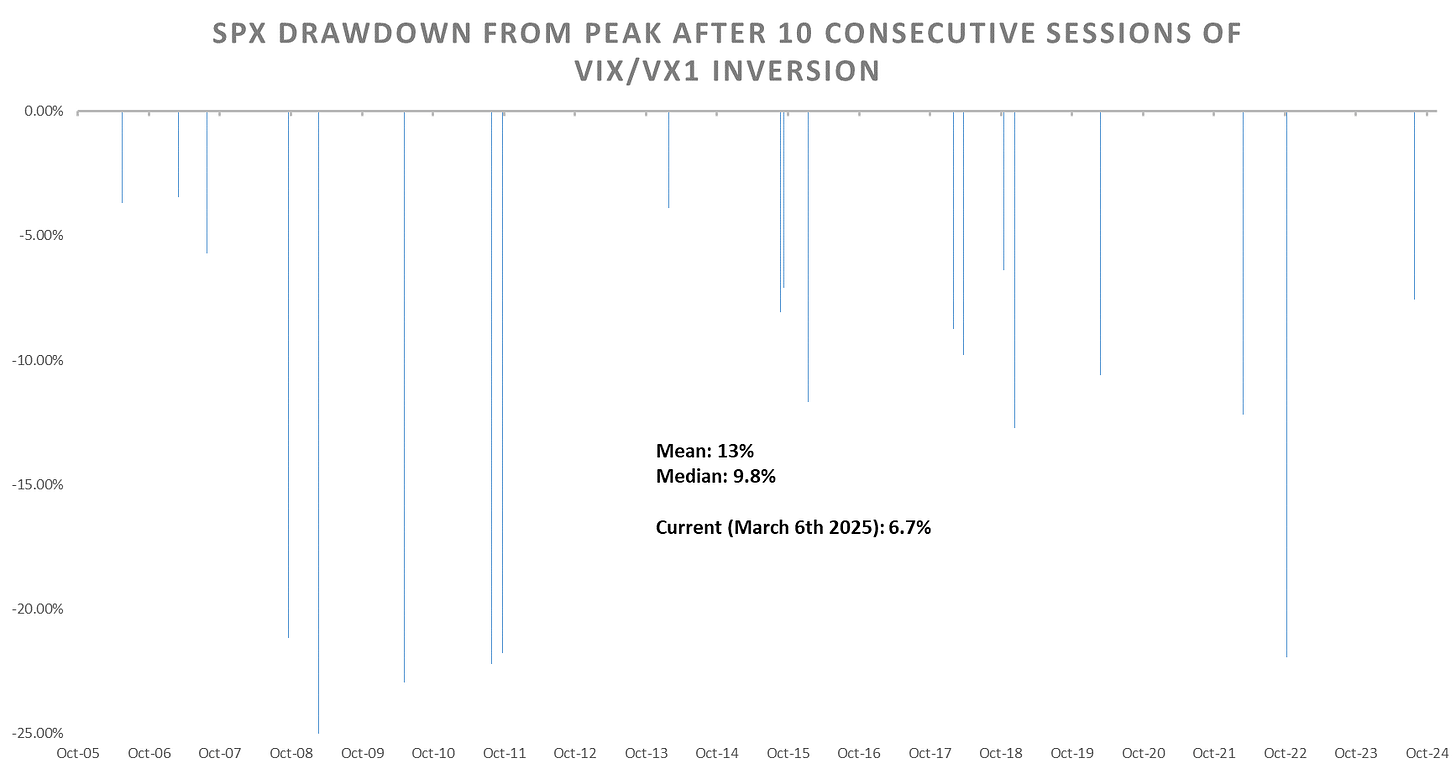

As is largely consensus, an in line print likely to result in a relief rally going into the weekend. Overall we’re not seeing major downside panic, took us 5 days to drop as much as we did in 2 hrs on Dec FOMC, albeit we are now lower.

Given how long we are now seeing VIX/VX1 inversion, one of the more shallow SPX dips historically.

Keep reading with a 7-day free trial

Subscribe to Vol Vibes to keep reading this post and get 7 days of free access to the full post archives.