NFP (or lack thereof) Overview

October 3rd 2025 - SPX & SPX Options

NFP data likely postponed till next Friday due to government shutdown. ADP report showed further weakness in labor market, with target rate probabilities moving from ~48% in early Sep to ~98% on Oct 2nd for a further 25bps rate cut at the end of Oct meeting.

JPM scenario analysis from earlier in the week (before shutdown and data being postponed.) And yes, that’s +50bps gains across all probabilities… nice sense of humor.

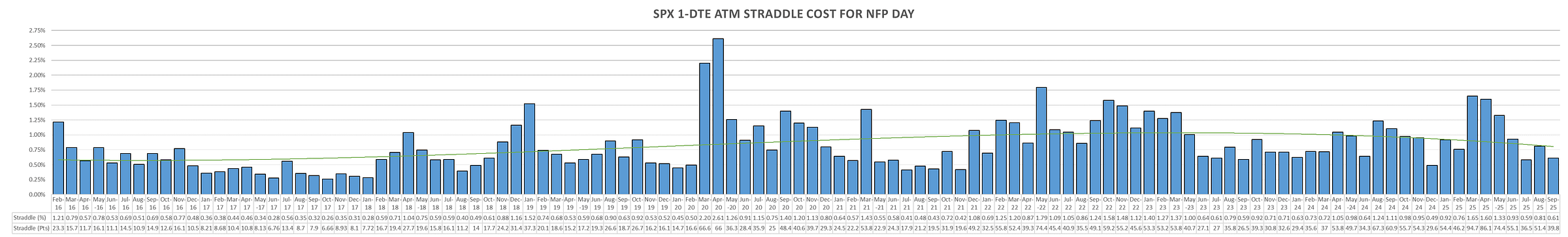

September NFP straddles dropped down to ~60bps, we’ve seen all event/data straddles drift down towards 50-60bps last few months… hard to argue for more expensive straddles when we’ve been running a 4-5+ sharpe SPX for last 5 months.

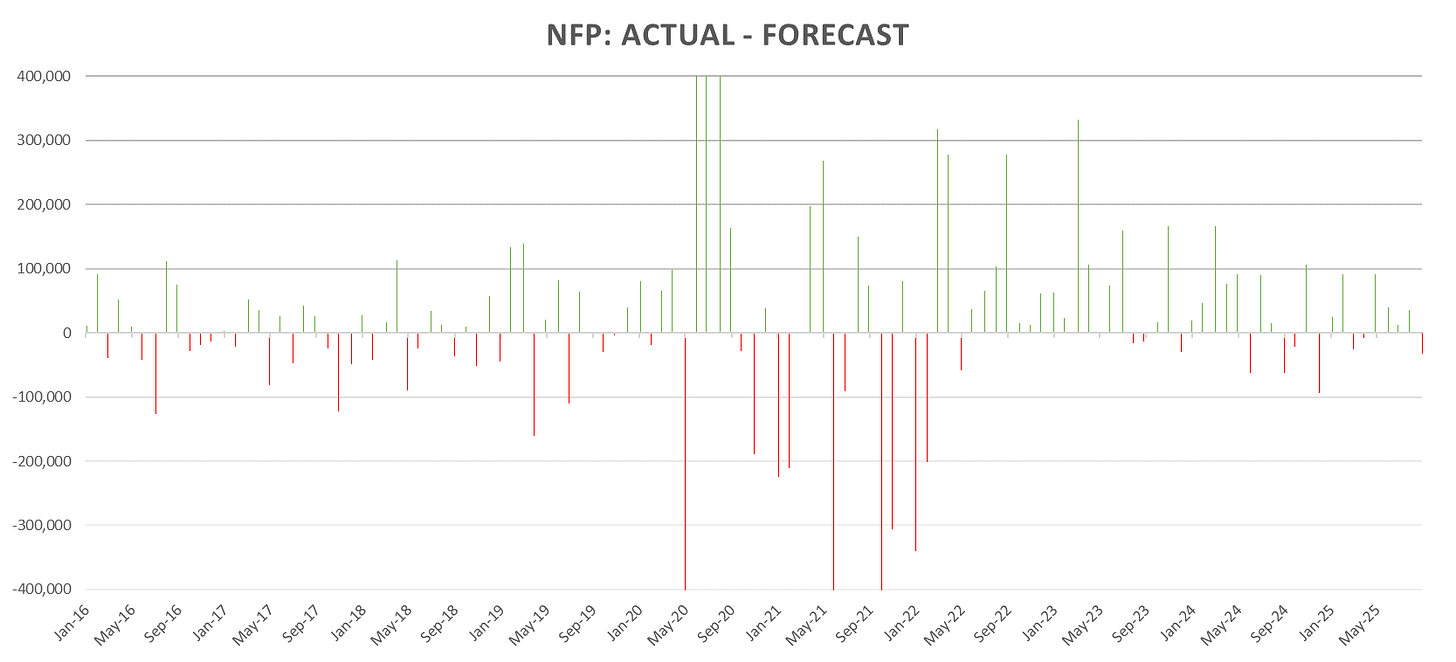

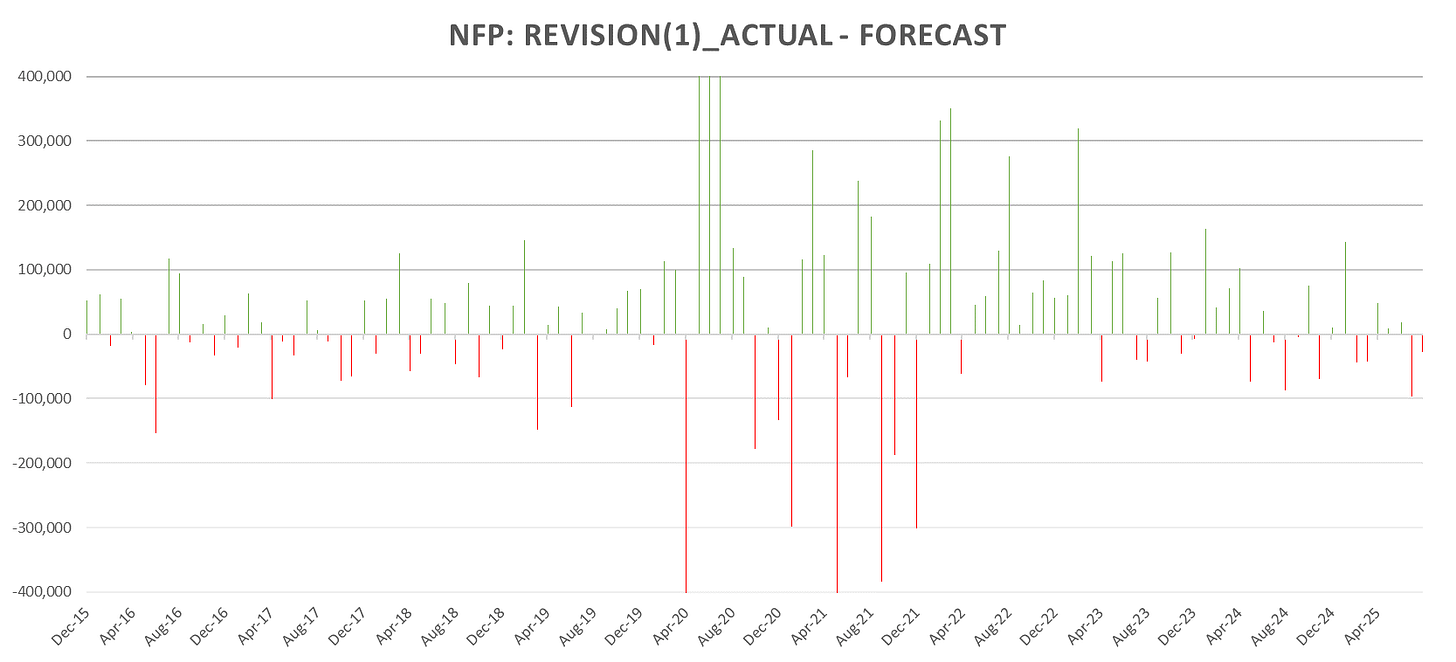

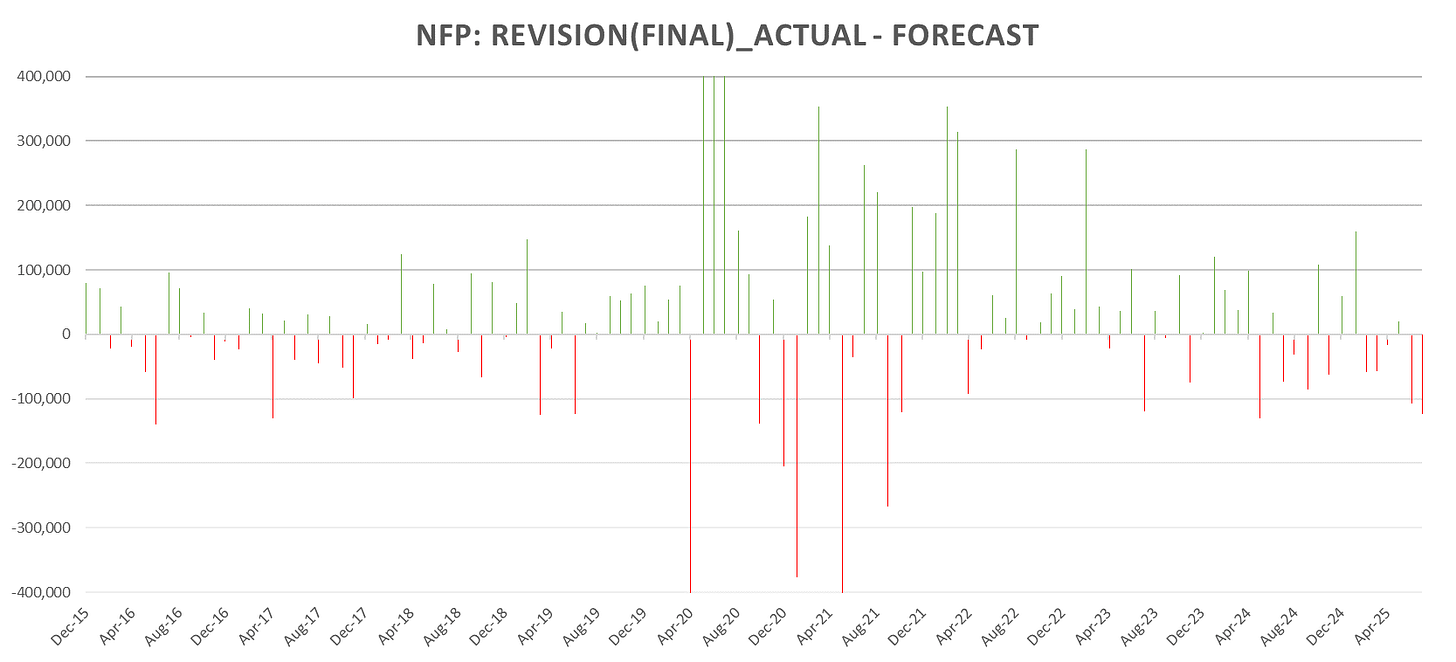

Historic NFP data (from https://www.bls.gov/web/empsit/cesnaicsrev.htm):

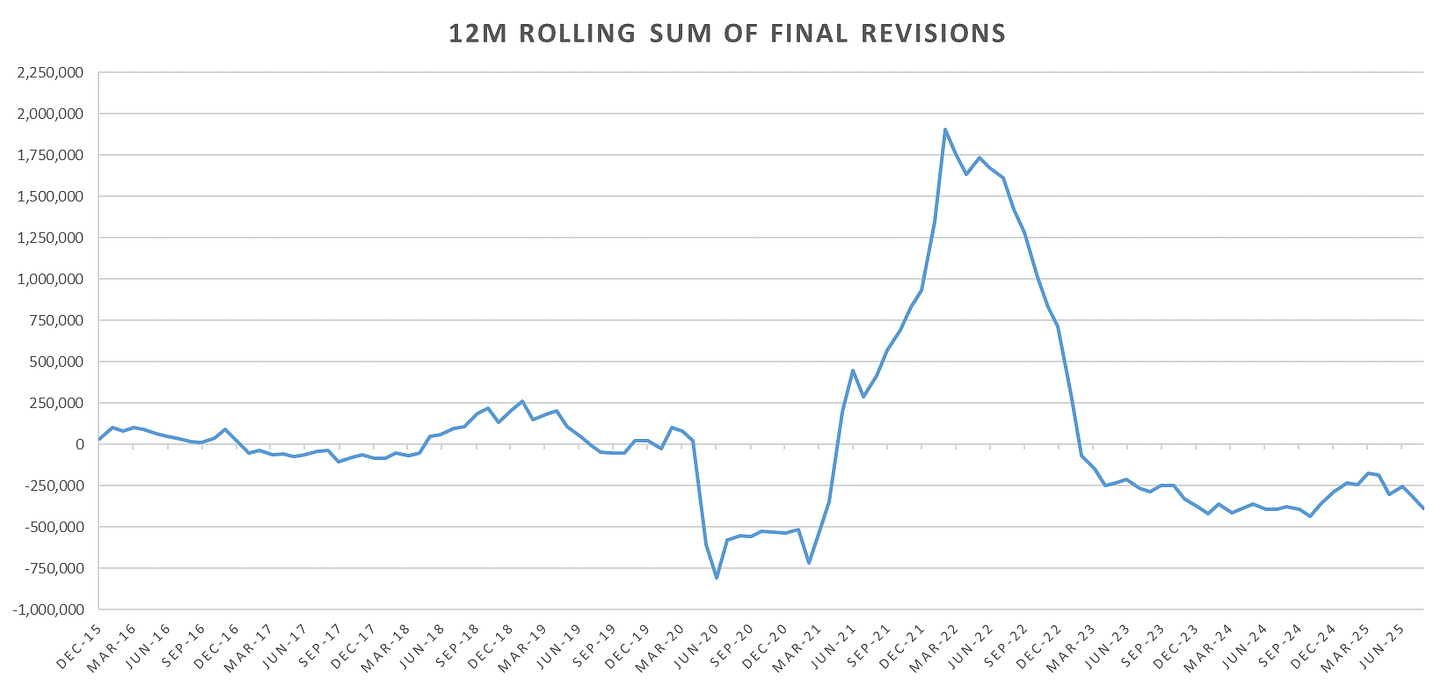

Final revision sum:

12M sum of revisions show the slowdown in full swing, with data from May onwards showing drops in final revisions that push the net jobs growth negative.

Overnight SPX Straddle performance ($200k fixed notional):

Keep reading with a 7-day free trial

Subscribe to Vol Vibes to keep reading this post and get 7 days of free access to the full post archives.