Monthly OpEx

October 2025 - SPX & SPX Index Options Historical Performance

S&P down 2% from highs into Thursday close and ~80bps down for Oct. Despite the tame index moves, index vol has rapidly expanded last week with VIX trading above 24 & entire curve up to June 2026 sitting above 22. The move in VIX comes largely off implied correlations repricing substantially higher (from 7% to 18% since last Friday), average component vol made new highs at 45 today. Correlations repricing higher on the back of increased trade war risk. Overall the correlation levels are still near historic lows as the ‘AI’ theme perceived bulletproof for now… IF that were to change (somehow) expect VIX to move briefly towards high 30’s on purely higher implied corrs.

Revisiting the OpEx paper:

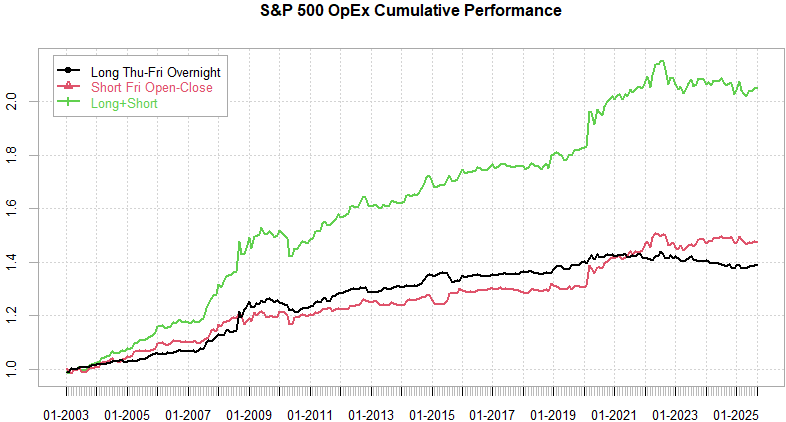

Since 2003 performance:

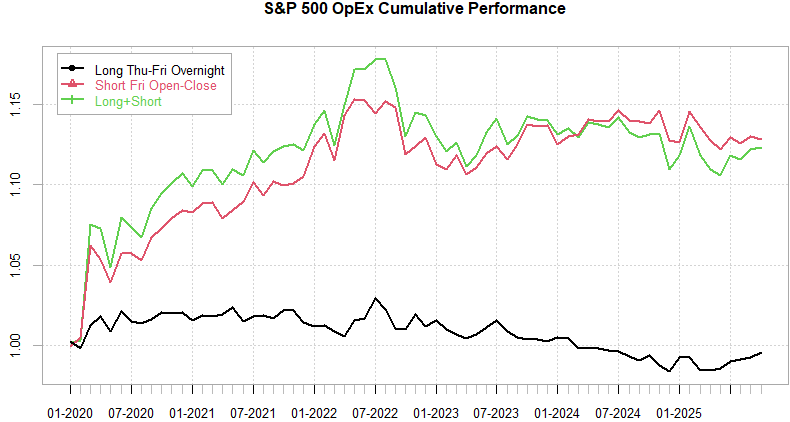

Updated historical performance for OpEx - SPX Options:

(All option $payoffs on $200k notional position size)

Keep reading with a 7-day free trial

Subscribe to Vol Vibes to keep reading this post and get 7 days of free access to the full post archives.