Following up on last weeks overview:

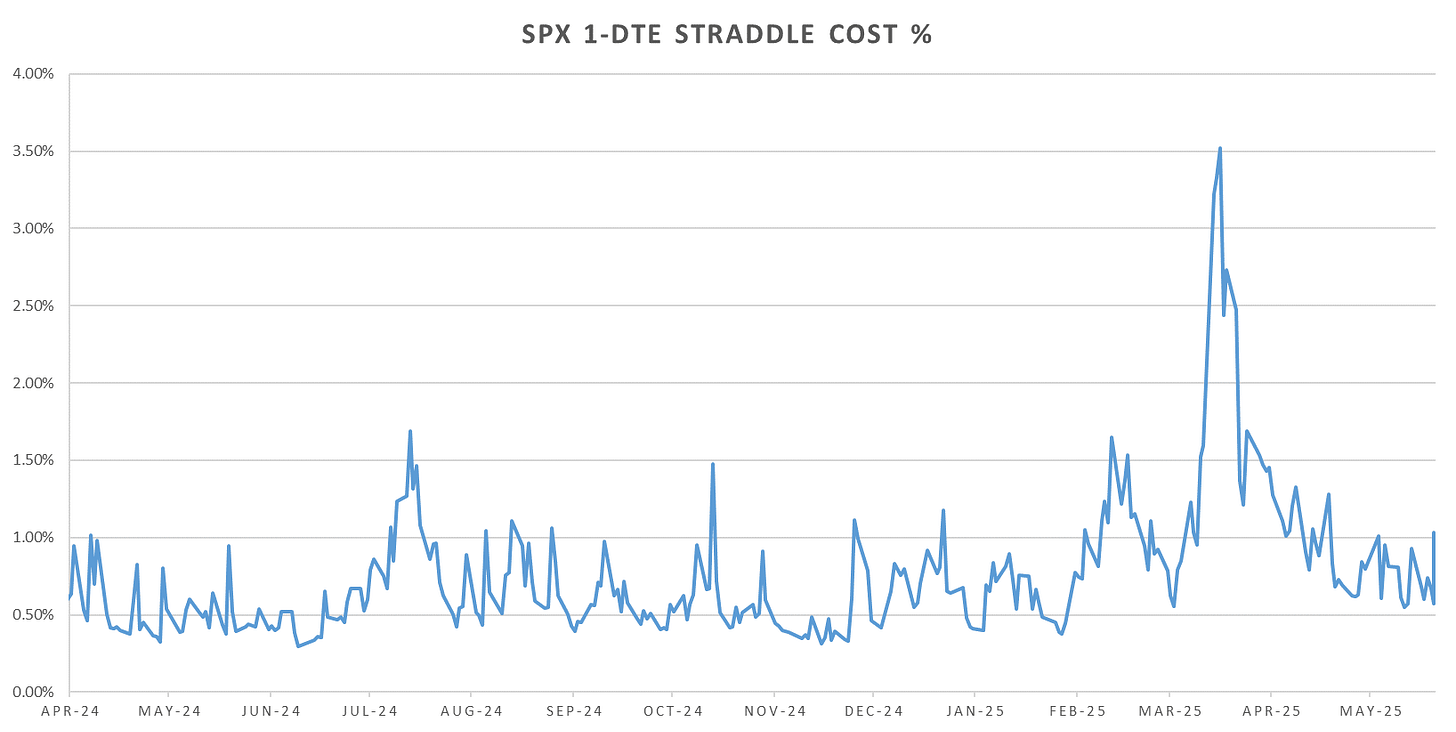

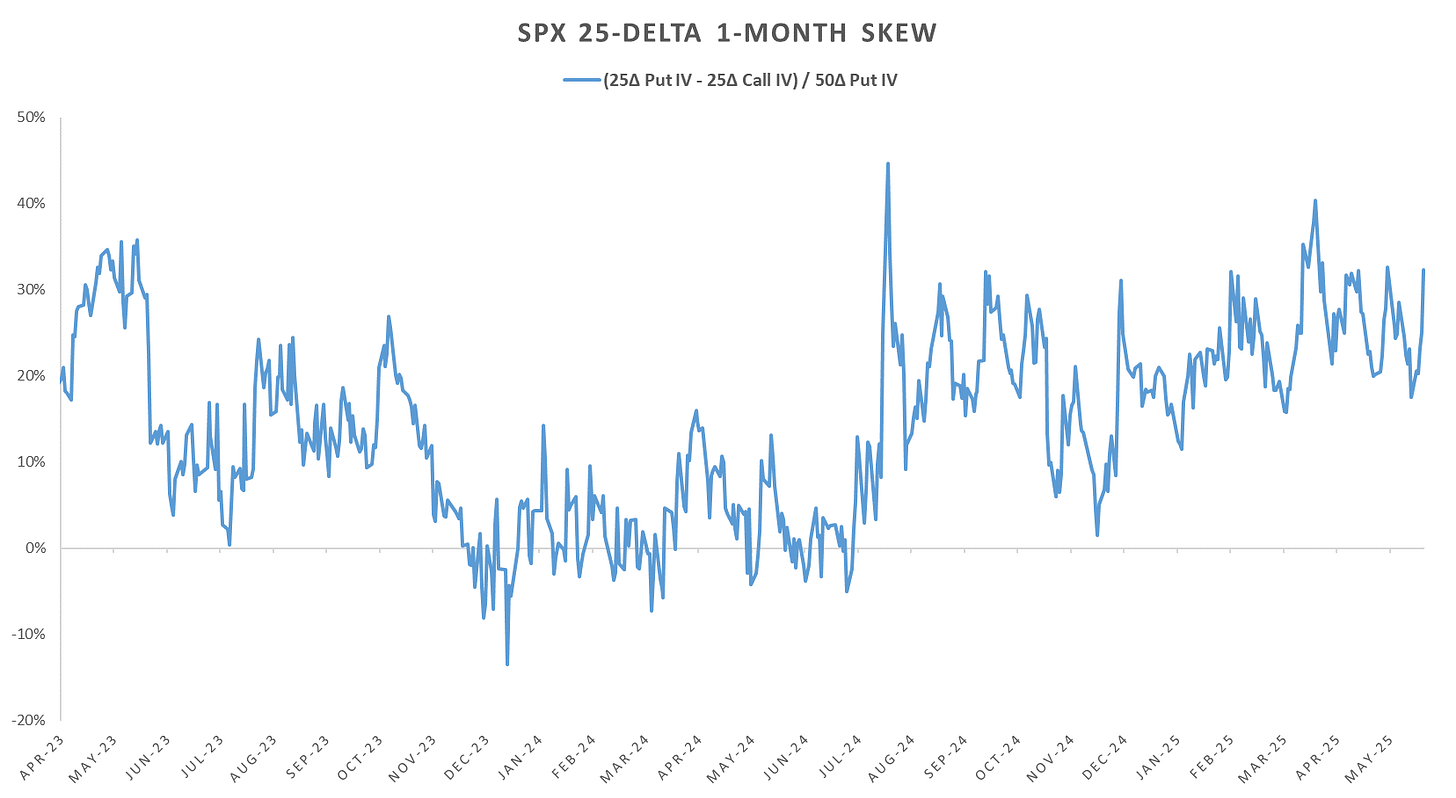

All eyes on oil last week as Israel struck Iran’s nuclear facilities, with Iran retaliating using ballistic missiles. These headlines immediately caused SPX skew to re-steepen back to panic levels, with VIX briefly popping above 20. Despite oil vol & futures still up from the headlines, equities have completely retraced all the losses since Wed highs. Quite a few data points coming out this week but the main event likely to be FOMC (even though FOMC straddles trading ~70-75bps for the last year or so.) Its a short OpEx week with Thursday being a holiday & VIX monthly settlement on Wed morning, which bodes well for some possible downside in SPX into end of week.

SPX weekend straddles traded ~1% going into potential WW3 according to headlines… As many noted, there hasn’t been any downside in US equities due to geopol risks in a long while… which explains the 100pt move higher since Globex open on Sunday.

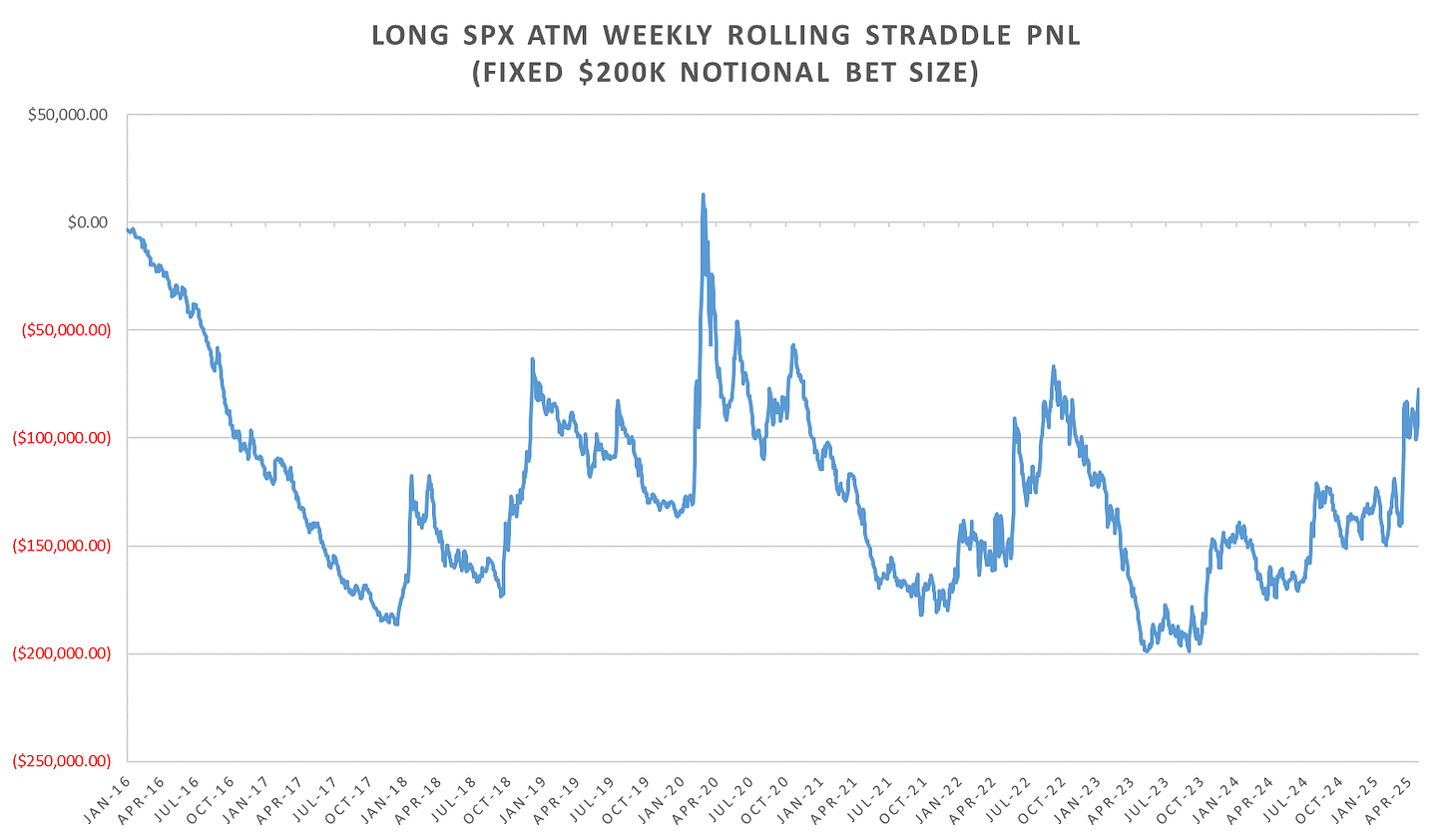

Generally last few years we see a decent move over OpEx week, with long weekly straddles net winners. Weekly straddles have been overall relatively cheap since 2018:

SG has a cumulative return based index, below a fixed notional bet size approach:

Straddle wins overwhelmingly driven by cheap call side.

Looking at cross-asset vols, oil leading as expected, with rest slightly up out of sympathy. As CBOE notes, oil spike largely a short term concern for market as further out the risks from tariffs & overall economic slowdown is expected to keep oil lower.

1m SPX skew immediately steepened back to Mar/Apr levels, already lower on Monday. Skew has been sticky throughout the bounce in equities and the bid ever since Aug 2024 remains in place.

Looking at intraday price action:

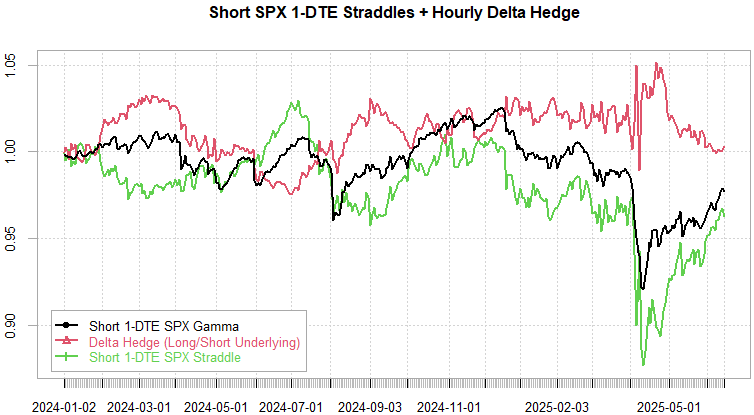

Huge run for short 1-DTE SPX straddles since April lows. The pnl from hourly delta hedges showing how choppy the intraday price action is.

The 10:30am - 11:30am mean reversion sticks out like a sore thumb since April… Any overnight moves end up being faded into london close.

Realized Volatility Overview

RTH outperformance continued last week, with SPY up ~10% ytd during RTH session & down 6% overnight.

10d rvol last week hit single digits across vol estimators. Even the war headlines fail to produce any meaningful downside continuation on indices.

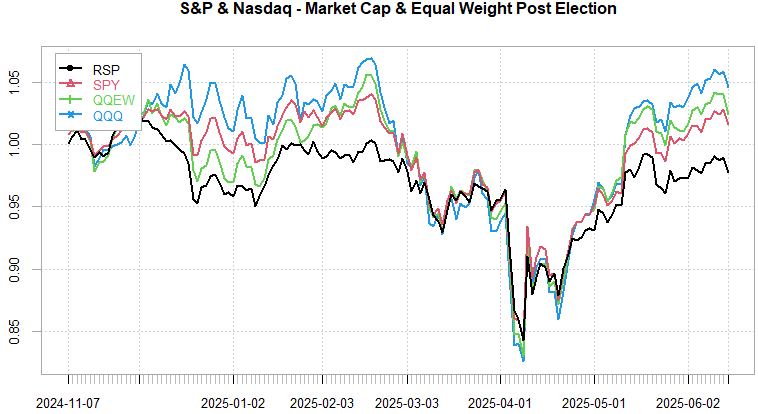

Single stock 1m implied vol (VIXEQ) slightly higher throughout last week along with 1m implied correlations, leading to VIX jump from 16’s to high 19s/20s. Tech relatively best performer since the election now to net positive. Small caps ~10% lower.

Vol ETP’s ~flat for about a month now. Flat term structure in the mid / back end with majority of the ‘carry’ coming from the front month VX closer to expiration, hence the divergence between the performance of the carry trade through VX30 day & VX1.

SPX ATM Straddle Performance

All intraday straddles net red for last 6 trading days. RTH straddles biggest losers, net down ~62pts. Straddles opened at 1pm net up ~10pts. Outside the overnight moves, RTH session has been largely flat up until Friday when the headlines pushed indices lower.

Intraday Variance Ratio

From the following post:

Strong mean reversion intraday last week, bias was long straddles Tue-Thu, with Friday closing with no bias into Monday after a trend lower type of day.

Not much happening in terms of ‘extremes’ so nothing to fade right now. Despite the rally & low realized vol, somehow markets still *feel* unstable. Low cl-cl vol seems almost deceiving as SPX skew is still well bid. Vol reactions on headlines are still very healthy & book depth is still a lot thinner than last year.

VX Carry & SPX Overlay

From the following post:

Last week started out nicely for the system, only to get hit with a whipsaw going into the weekend… Rolled from short June VX 18.3 to short July VX 20.3 on Thursday which dampened the spike a bit. So far still a cash signal but if we don’t get any follow through to the downside today/tmrw will likely retrigger a short on July contract.

As always, don’t hesitate to reach out!

Have a great week!