Short update following the vol spike yesterday, to keep things in perspective. While the spike yesterday did shake things up a bit, overall, it did little to move the needle on vols. Weekly rolling straddles have been bleeding for a few months now as the markets slowed the upwards moves (yet still no real downside.) Daily straddles remain on average fairly priced (~ a bit cheap considering the exposure they represent.)

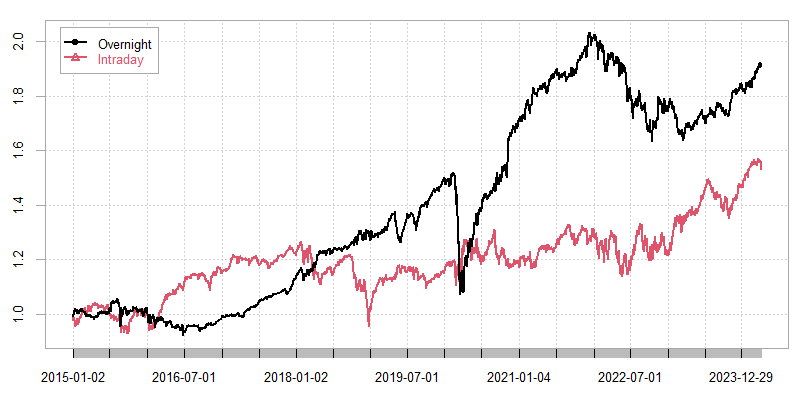

What is a bit new is the even split between overnight/intraday volatility, as some of you might recall, the last 15-20 years have been unusually split between rth/on performance. This has changed for the last few years with a more balanced split in performance.

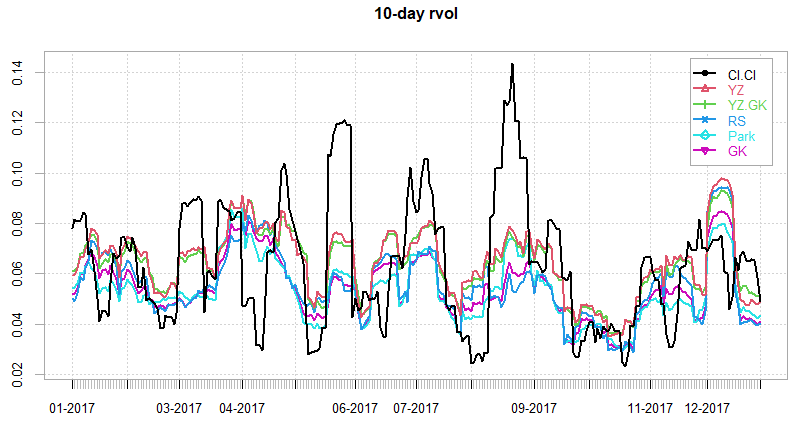

Straddles holding up even with average price slightly above 2017 levels:

SPY ETF Overnight & Intraday performance:

Overnight vol dominated 2020-2022:

From 2022, intraday performance much higher:

Market seems to be going through 2-3 year cycles of intraday/overnight performance…

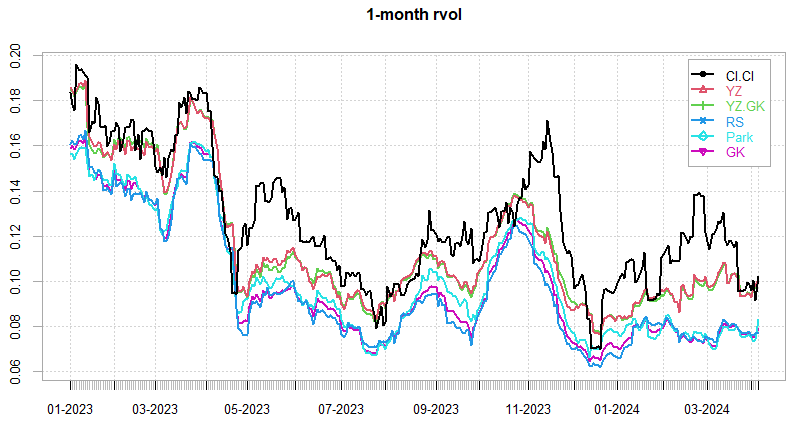

In terms of realized vols, we are still sitting at the lower range of the last 30 years…

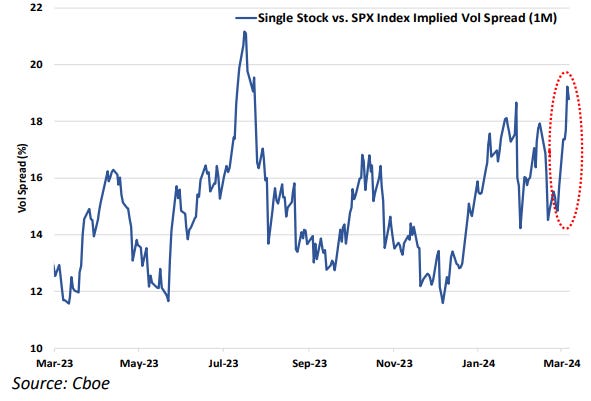

Despite people alluding to 2017 levels of vol (especially considering implied & realized correlations broke 2017 lows) we are still nowhere near the same rvol levels (mainly due to single stock vols still being strong)

Single stock vols nearing summer 2023 blowoff levels:

Of course, the entirety of straddle performance last few years driven entirely by realized upside risk (in contrast to last 10 years.) Markets might be starting to catch on to this, so I have doubts that vols can hang on to decent performance of last few years. Without upside paying out and downside non-existant we might be in for a May-August period of vol destruction. Especially considering the Fed looks hell-bent on keeping markets together till elections…

Stepping aside from vol for a minute, we’ve all read various reasoning behind the chase in MAG7 and semis but is there a more technical reason behind this? Is it not just FOMO?

What if the environment we’re in (low correlations & high dispersion) simply reinforces the chasing of best performing assets? Managers need to chase higher returns to justify their concentrated portfolios and by doing so they forego the (larger than usual due to low corrs) diversification benefits of index portfolios? As they chase, dispersion increases, correlations drop → concentration cost relative to index portfolios rises → have to get more returns to justify existence… etc

https://www.spglobal.com/spdji/en/documents/research/research-the-active-managers-conundrum.pdf

Getting back to index volatility and the comparison with 2017, lets take a look at variance ratios. Idea behind the ratio is to compare low freq vol like close-close to a higher freq vol measure like Yang-Zhang in order to get a sense how price action behaves. Are prices trending intraday/interday or mean reverting? Do we buy the straddle and hold or do we scalp deltas intraday? When do we do that? Set frequency? Or take advantage of intraday/overnight vol patterns? Lets take a look at whats going on:

The higher the ratio, the more movement we get intraday relative to close-close. Evidently, 2017 much higher mean reversion intraday relative to 2023. This is consistent with momentum/mean reversion performance measured using 0-DTE options from our earlier post:

Pre 2020, mean reversion held up relatively well, from mid-2022, intraday price action much ‘trendier’.

Finally, lets go over positioning in VX systems covered in:

and see performance ytd and what the positioning is as of close April 5th 2024.

Currently, triggered out of short vx positions as of ~3pm yesterday. A rough start to short vx in 2024 on the back of sensitive vx/spx beta with the grab of upside vols keeping implieds elevated. Performance ~ flat for core vx system ytd (small loss), the SPX option overlay keeping overall performance slightly positive for the year by adding ~5% since start of the year (call driven.)

Both core vx system & spx overlay currently in dd, ~10% for vx and only ~1.5% for spx overlay, mainly due to the hit this week. Overall the dd within expectations given returns:

Will be posting a couple of 0-DTE options related projects over weekend so follow for more updates!