Hedging Efficiency

Revisiting performance of SPX Puts / VIX Calls during Market Corrections

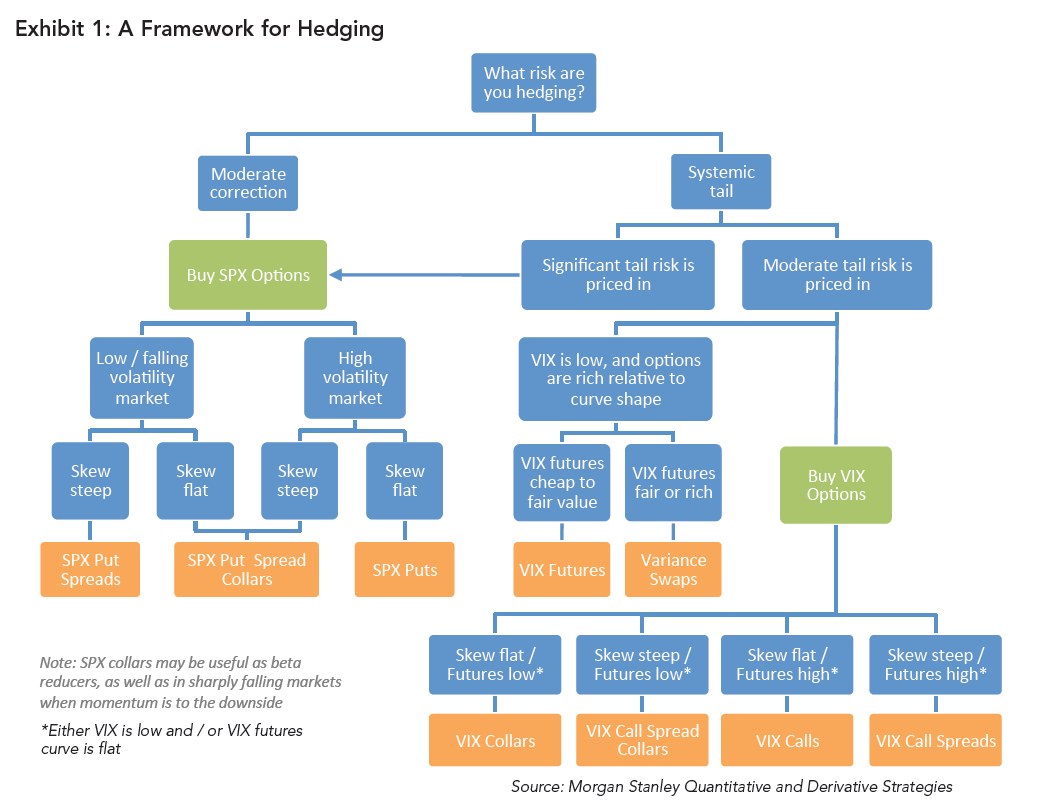

The basis for this post is the following article from 2015. The author covers a hedging framework for efficient selection of hedges for equity index drawdowns.

The main findings of the article suggest that VIX calls / SPX puts choice depends largely on the current pricing between SPX/VIX option implied distributions as well as the type of drawdowns the participants are trying to hedge.

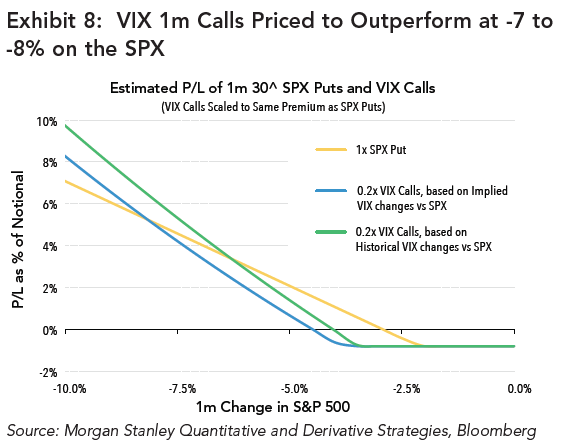

The data covered in the article is from Jan 2008 to ~ June 2015. As shown in examples from the article, VIX calls in the studied sample largely start to outperform SPX hedges when SPX drops below 7/8%.

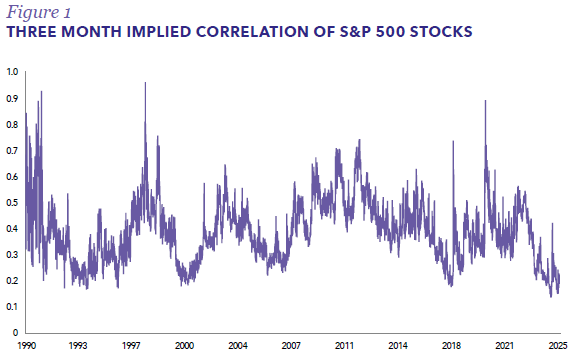

It is obvious, however, that the current market environment is quite different to the market we’ve seen in the post-GFC “QE” years. Index concentration has increased substantially and single stock avg component ivol is now more than double what it was.

Despite this increase in component implied volatility, index volatility as measured by the VIX index is trading (although slightly elevated) but largely at similar low levels, driven by record low implied correlations.

For the remainder of the post, I will look at SPX/VIX options data to see if the ‘breakeven’ point of VIX call outperformance has shifted lower, potentially providing you with a better ‘bang for your buck’ hedge.

2008-2015 market saw index volatility and component volatility move largely in sync. The current high dispersion / low correlation regime, VIX calls potentially represent a cheap correlation normalization play.

We’ve seen a number of excessive VIX spikes lately, (2020, Aug 2024, multiple 2025 episodes.) What we have seen lately is a ‘double engine’ boost to volatility, during recent panics we see component vol increase (albeit slightly as its already elevated) AND we see diversification benefits vanish, pushing correlations higher and in turn creating much sharper VIX spikes than we’ve seen.

In theory this should provide a lower “strike price” of panic. As I will show in examples below, VIX calls now tend to outperform SPX hedges in shallower corrections than previously.