After the April break, we get another FOMC press conference tomorrow. Powell has made it clear that his main concerns for cutting rates prematurely largely come from uncertainty surrounding tariff impact (and in general uncertainty of what the tariff endgame really is…)

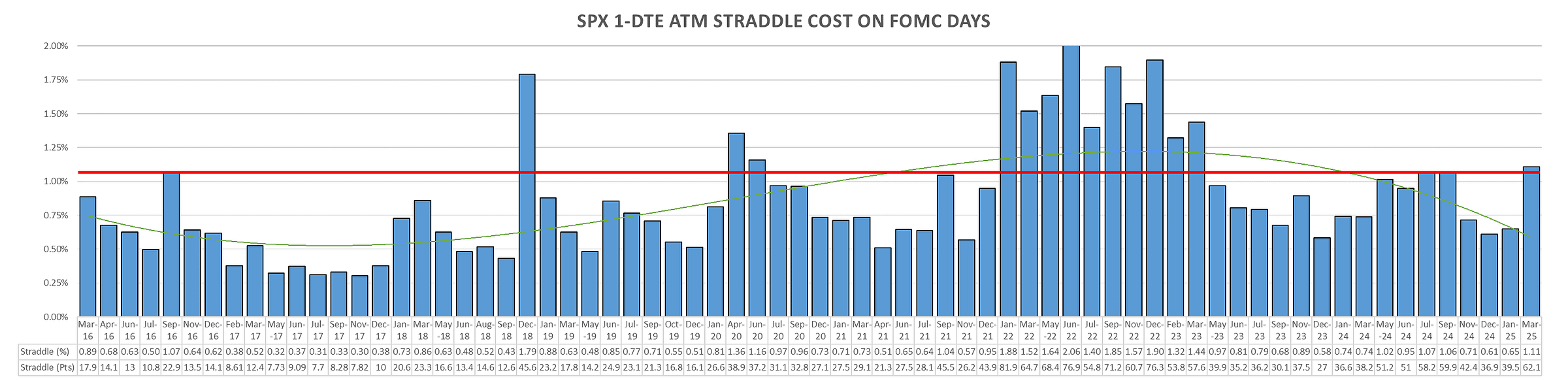

Markets, however, place little premium onto FOMC as of late, barely above 100bps SPX straddle cost for the day (NFP trades 50% more expensive lately…)

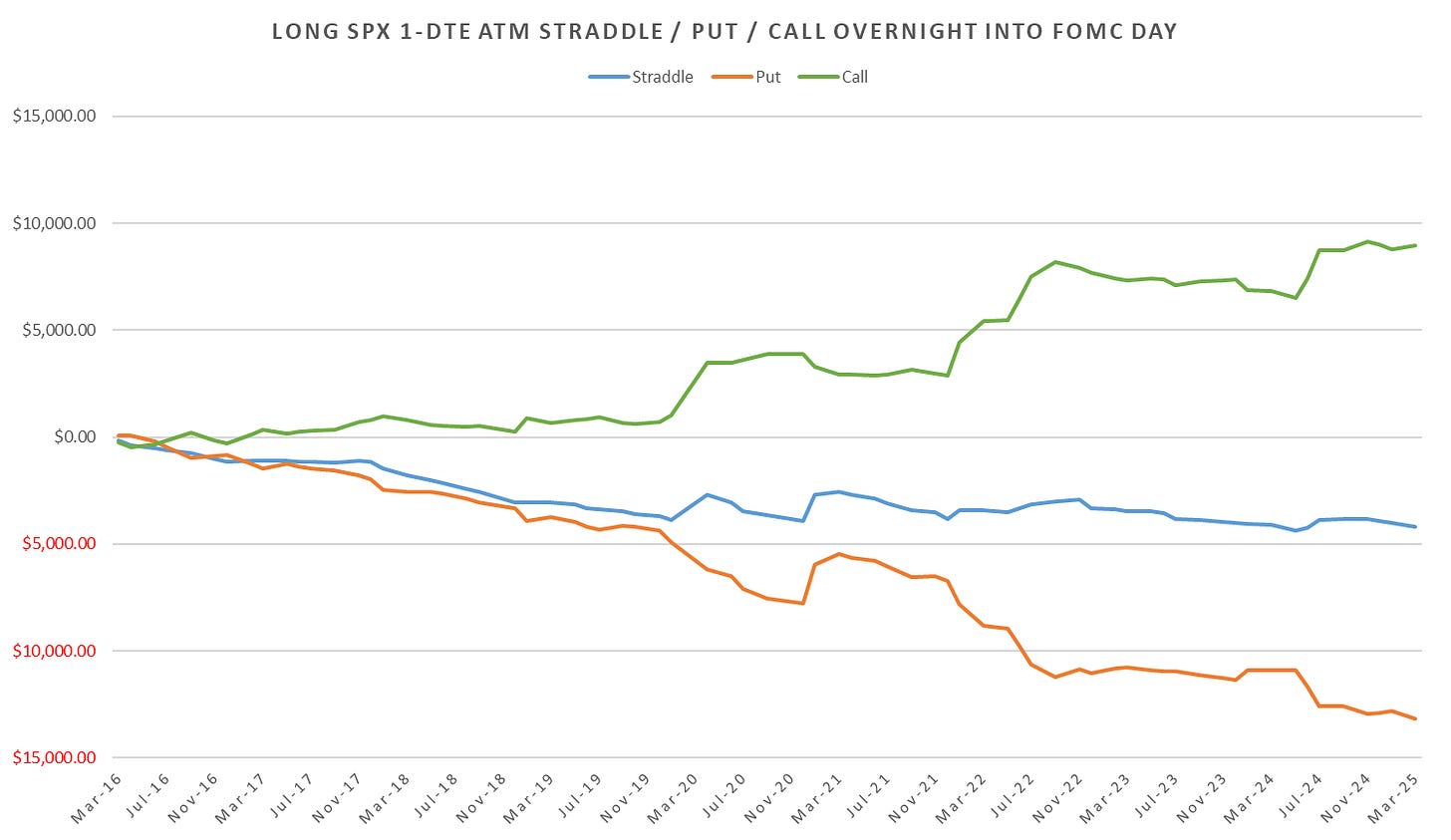

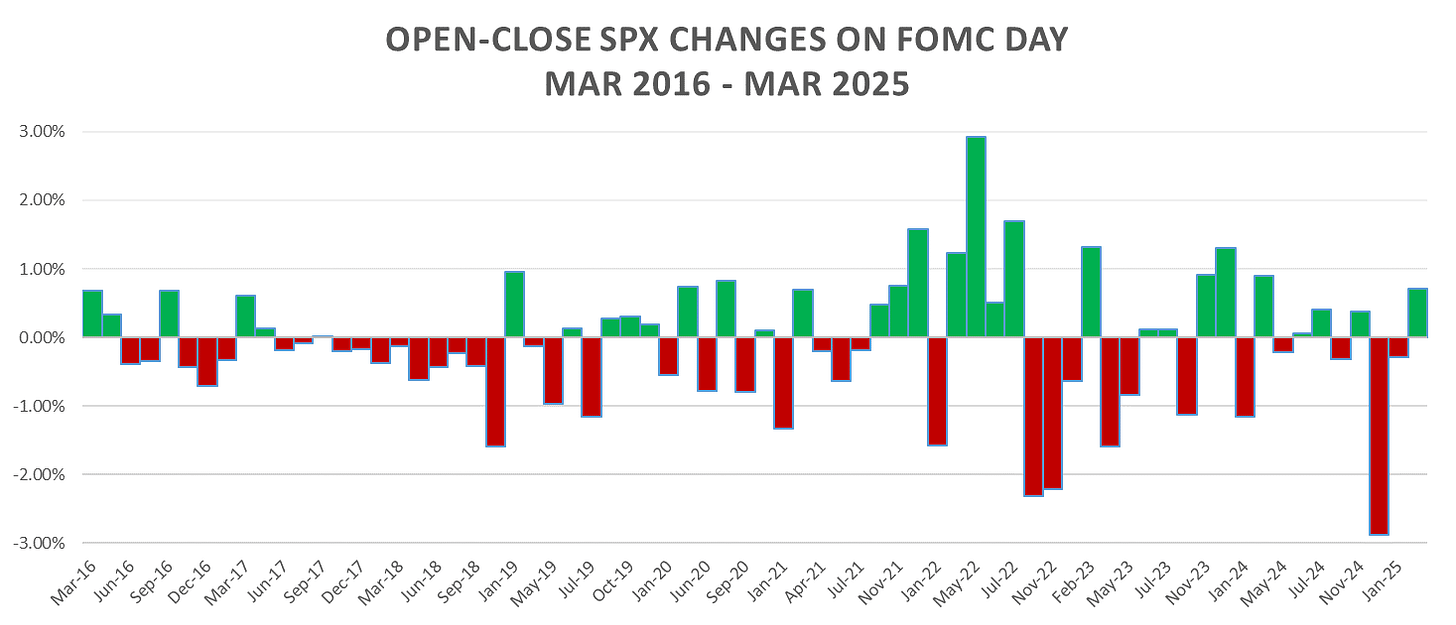

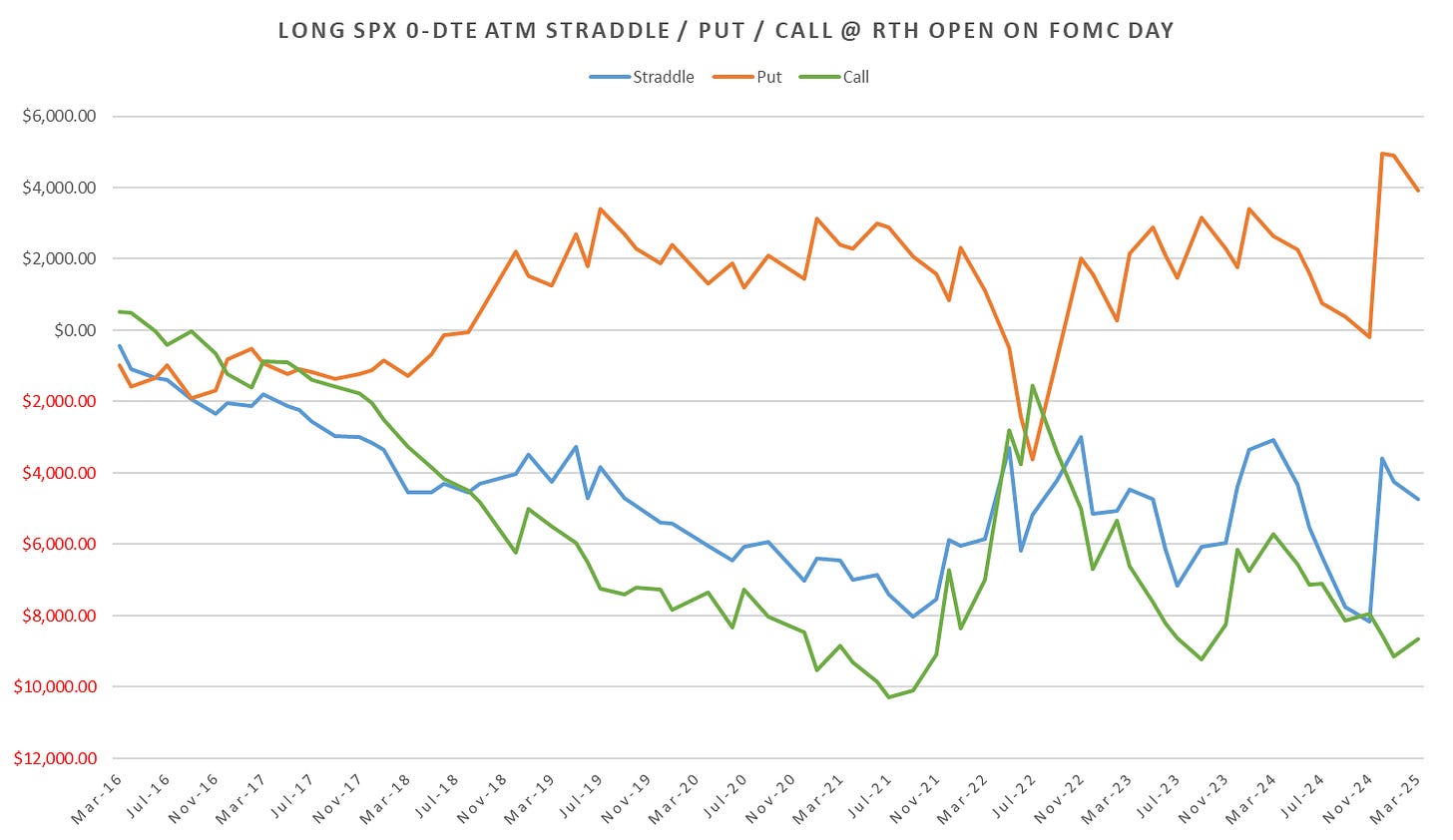

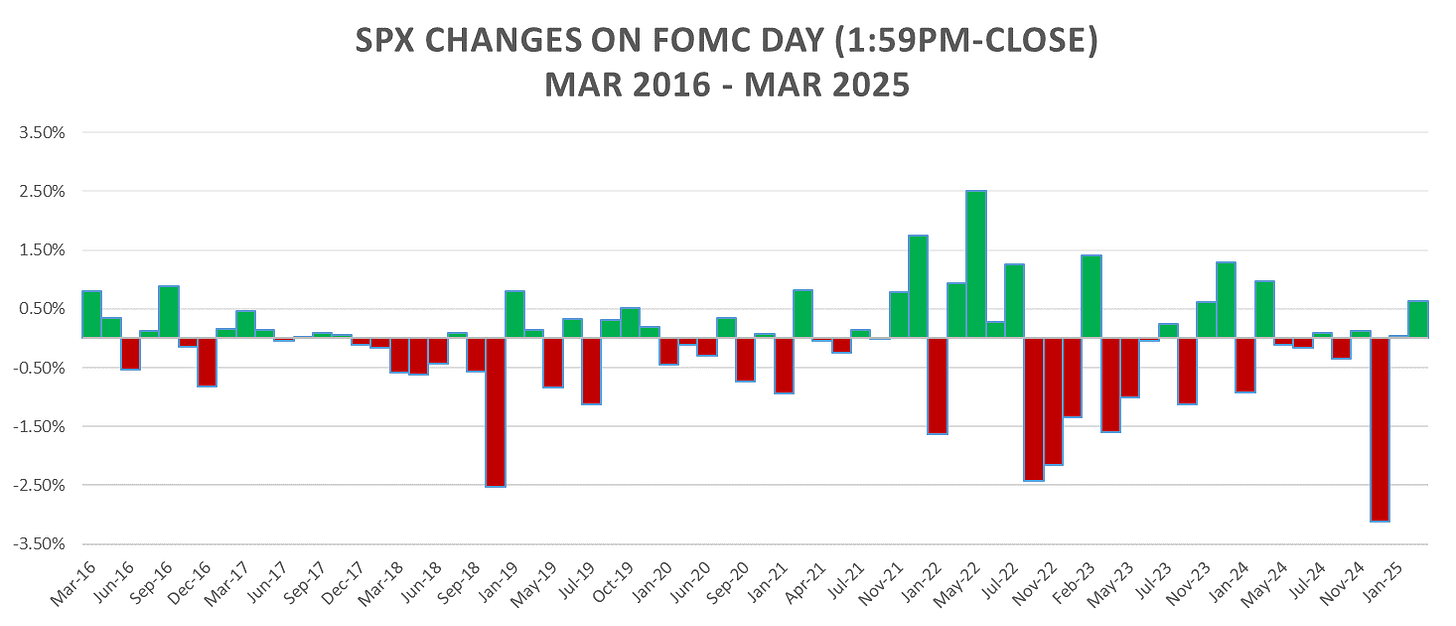

Updated 1-DTE & Intraday SPX Straddle performance:

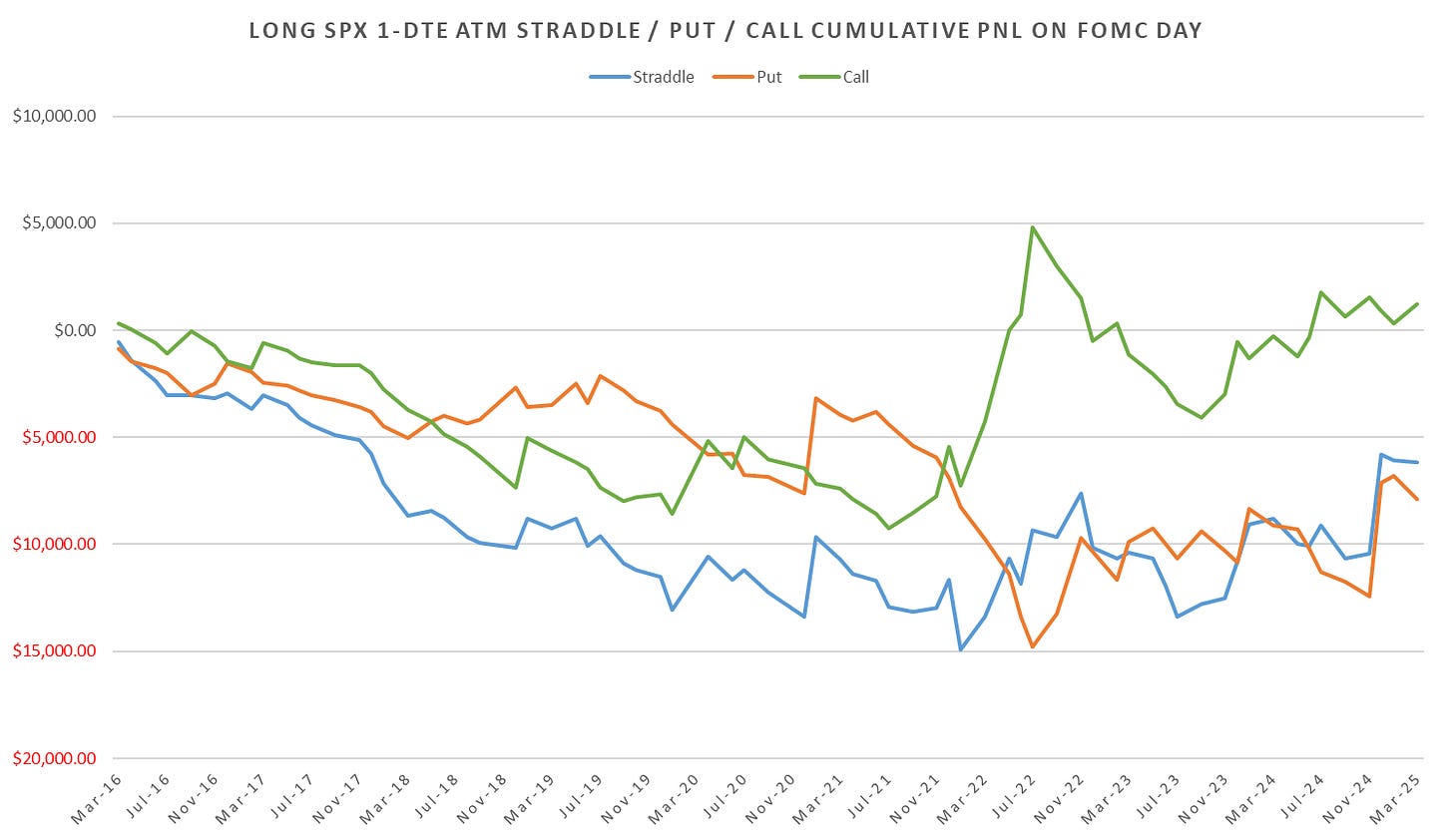

Note: All charts represent $200k notional bet size (ex. ~3 XSP at 6000 SPX)

1-DTE

Overnight Straddles

RTH Straddles

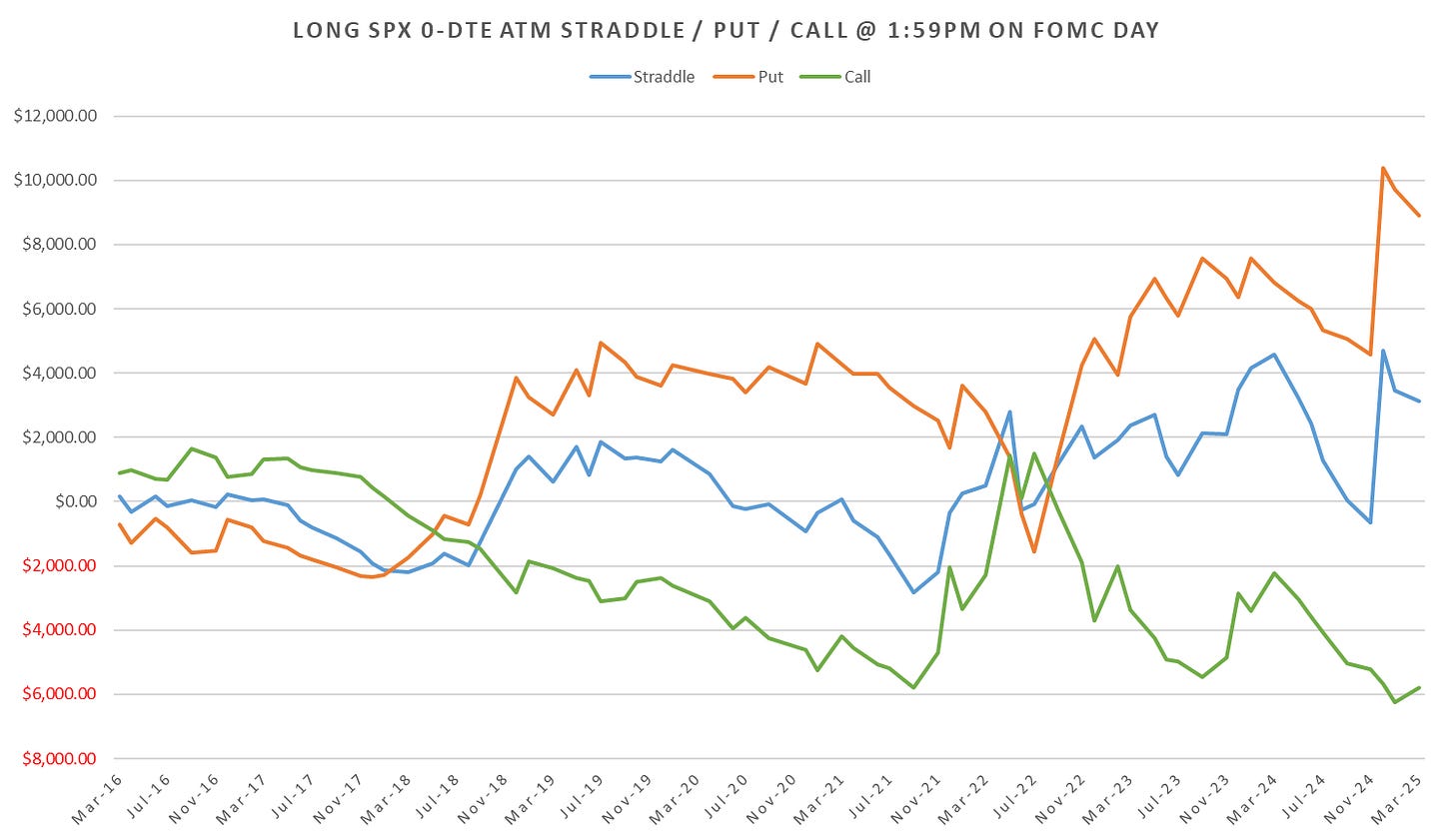

1:59pm

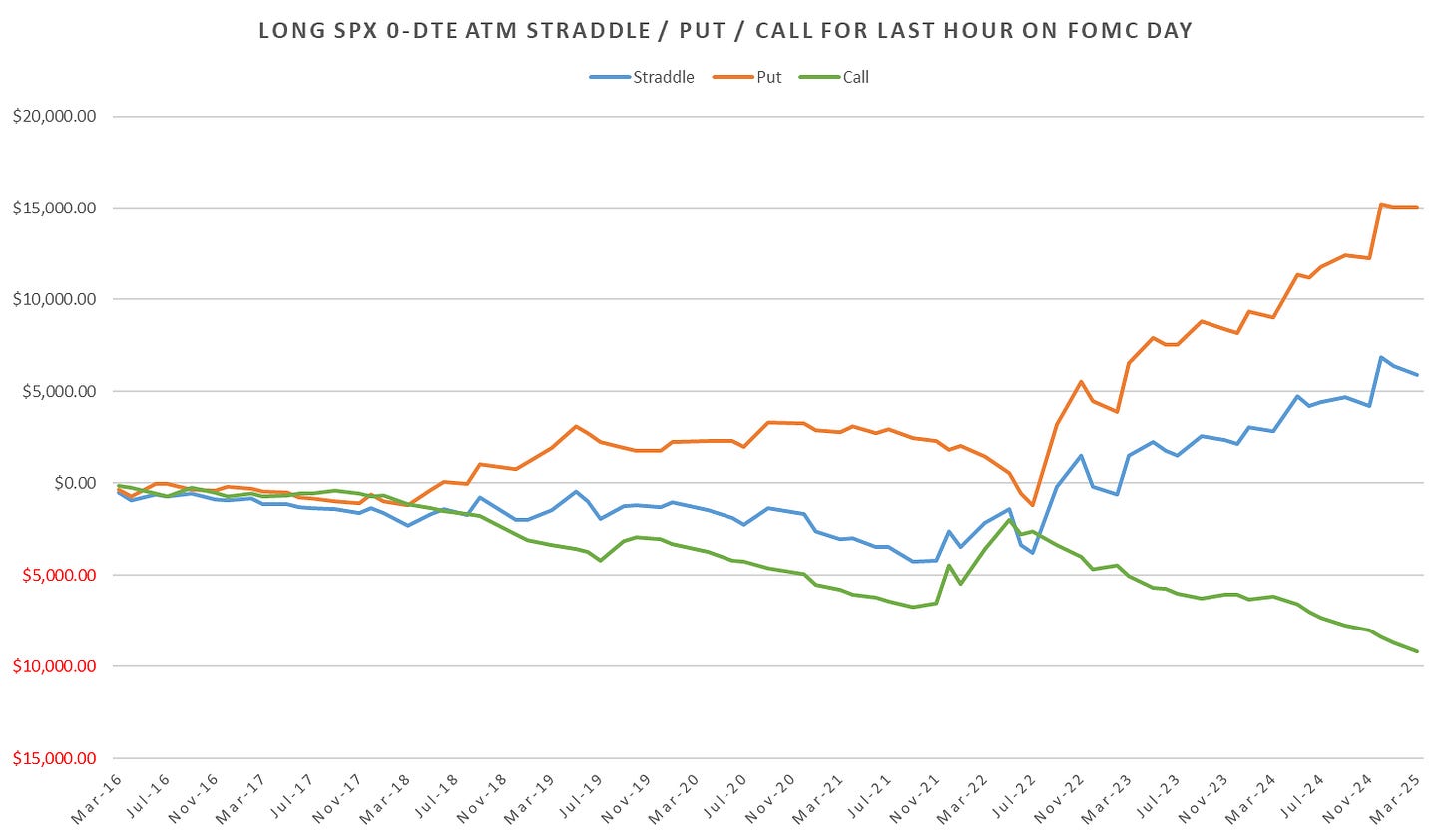

Last Hour

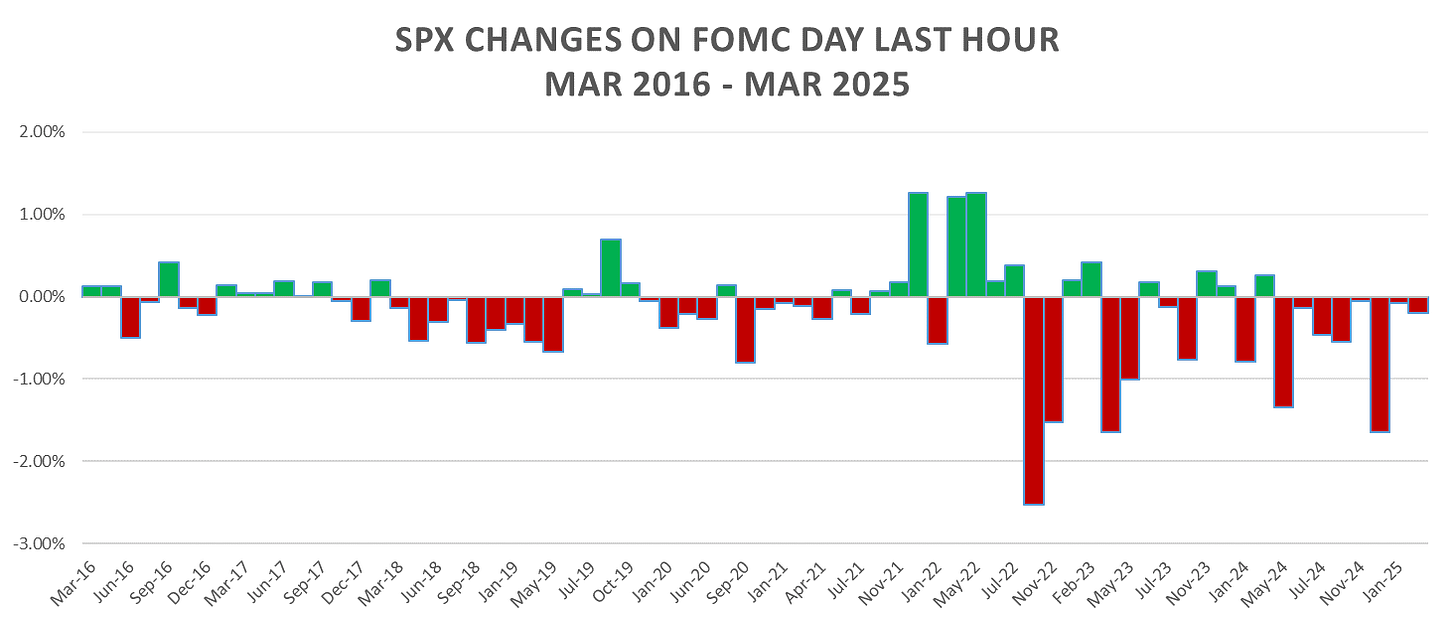

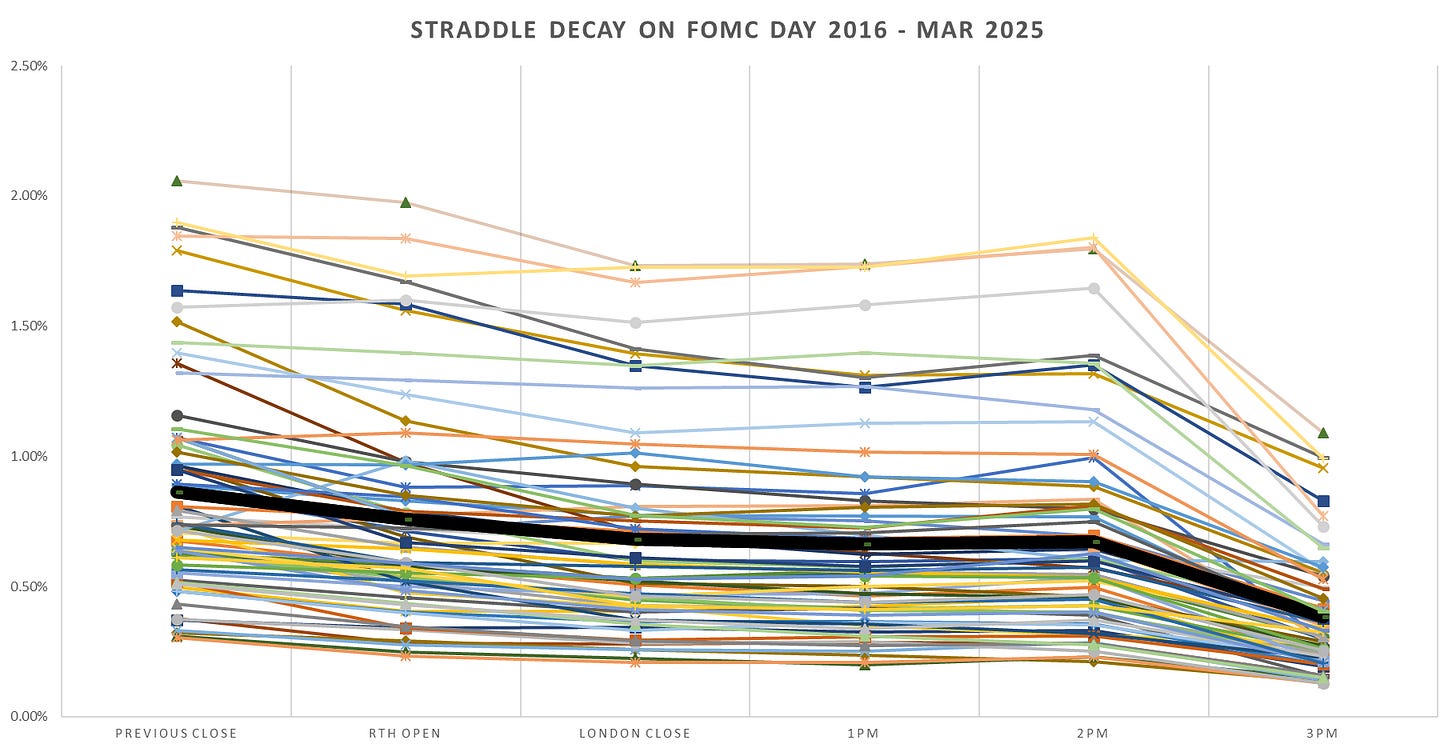

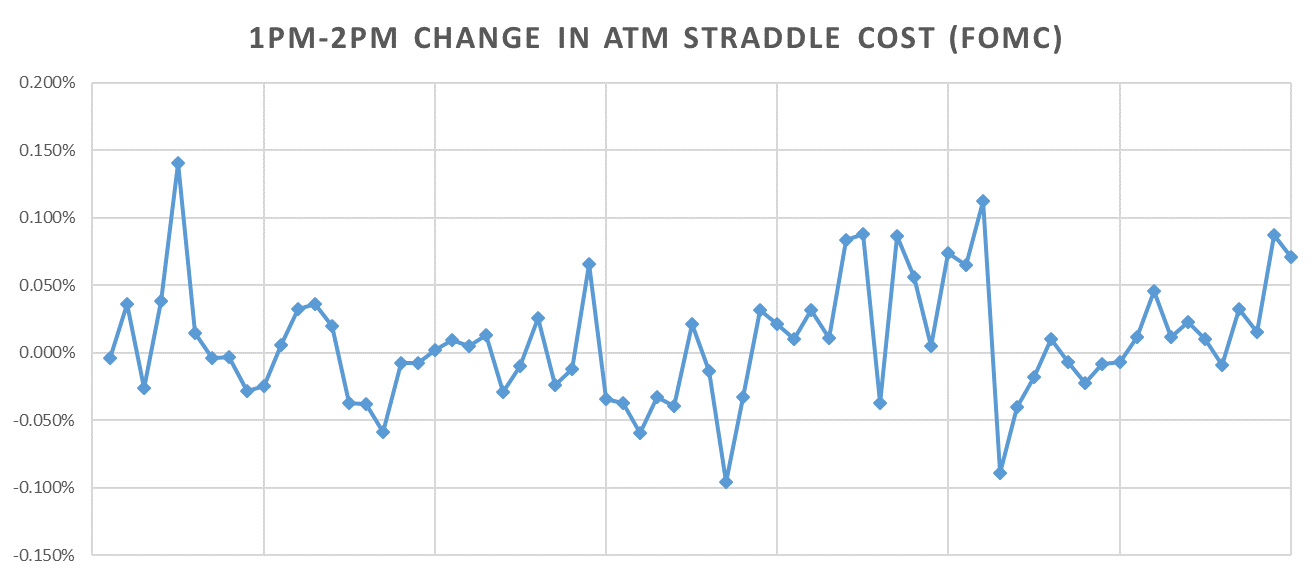

The most consistent FOMC trade apart from the drift higher into the announcement is the persistent weakness following the press conference start:

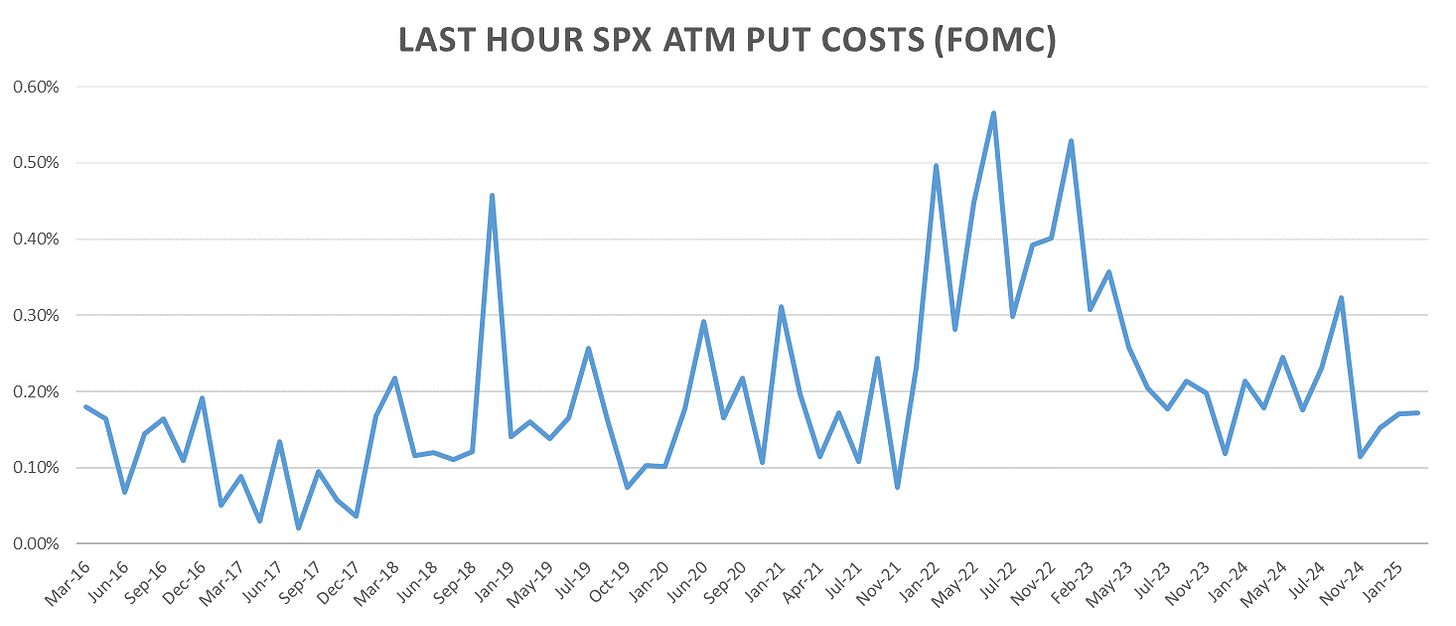

Last hour SPX put cost %:

Intraday Straddle Cost - Hourly

Since 2022 we see bump higher in ivols during the last hour before FOMC:

Feel free to reach out if you’ve got any questions!

Killed it.