With markets getting hit by barrage of headlines from the middle east, SPX remains eerily glued to 6000 level. Cross-asset implied vols drifted higher again after a break yesterday, equity indices, however, remain glued to highs on the back of the usual ‘AI’ pilled suspects.

JPM & GS now see only one rate cut by end of year as uncertainty about inflation likely to keep Fed in check despite the weakening econ data.

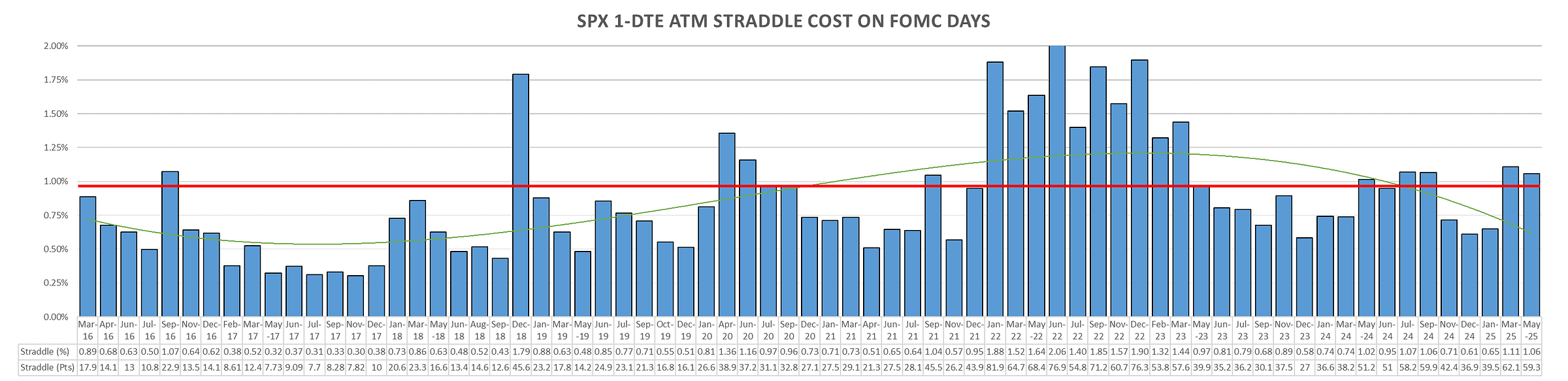

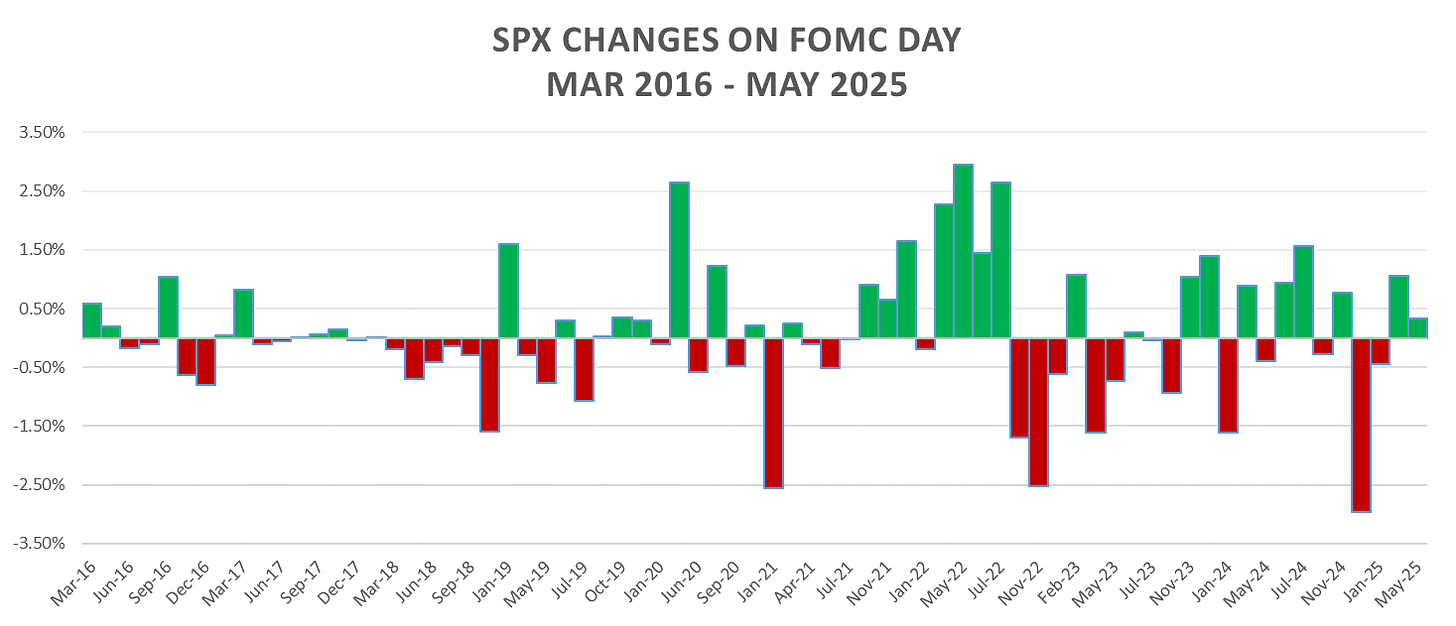

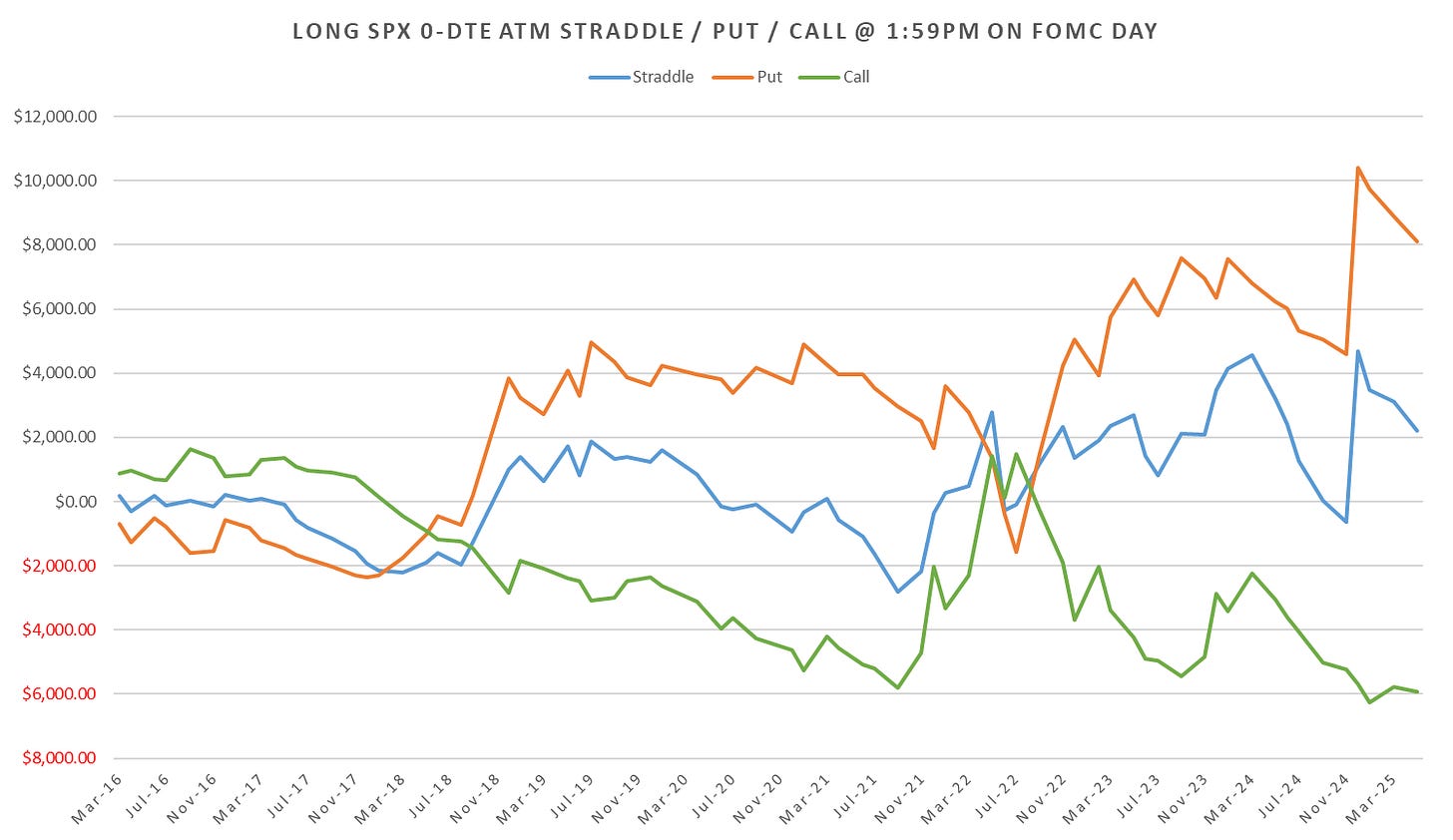

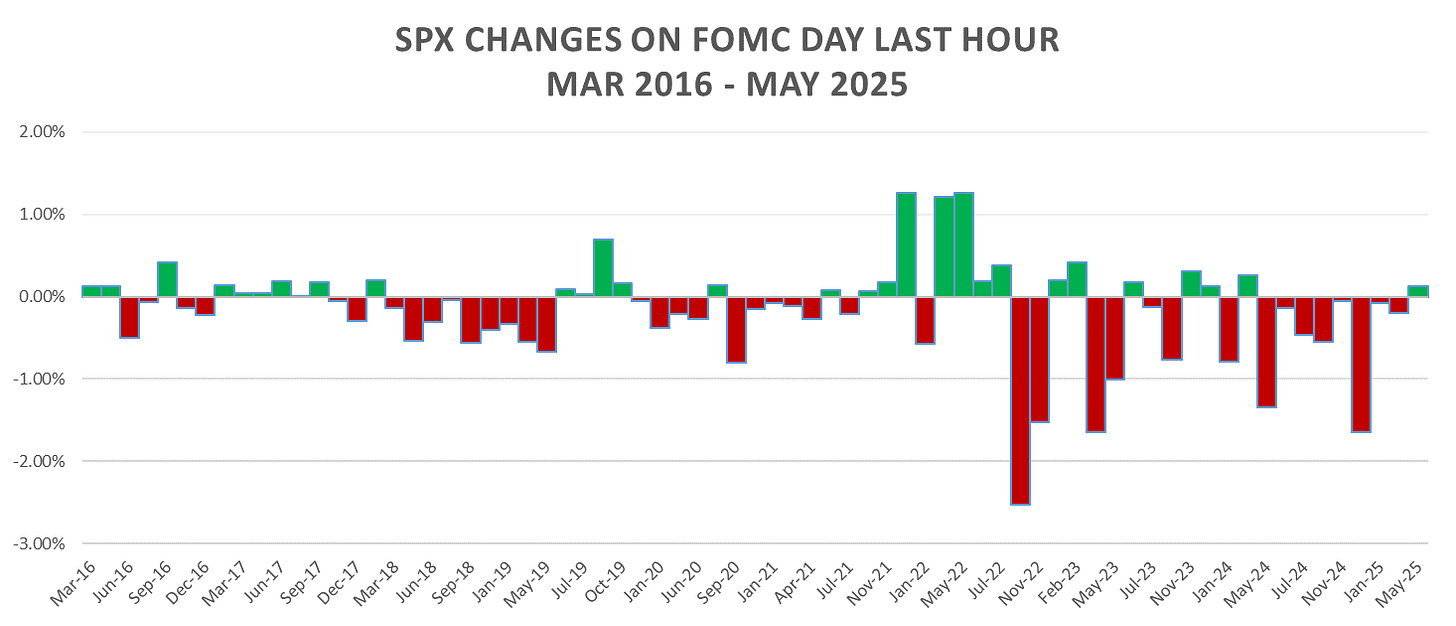

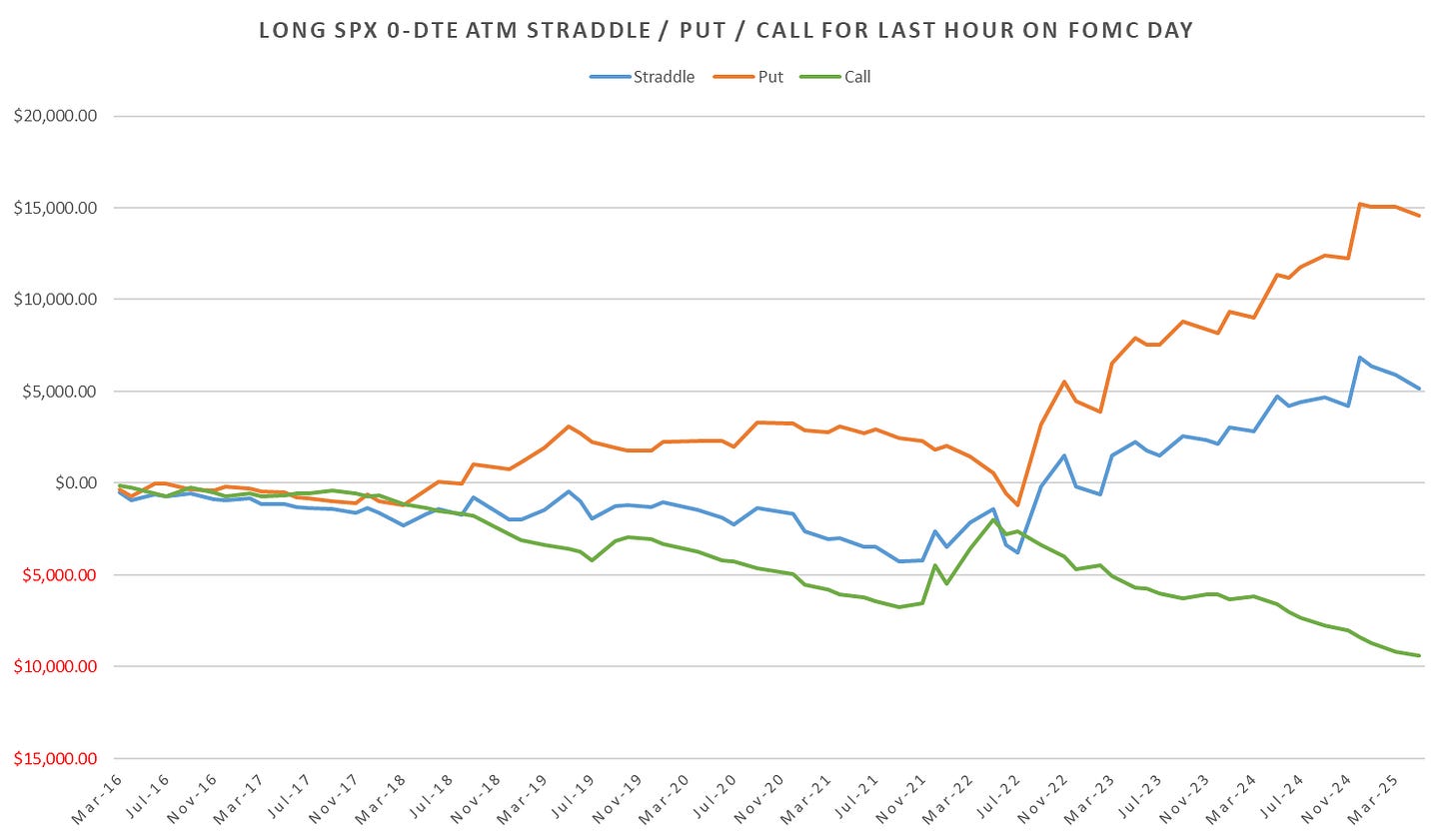

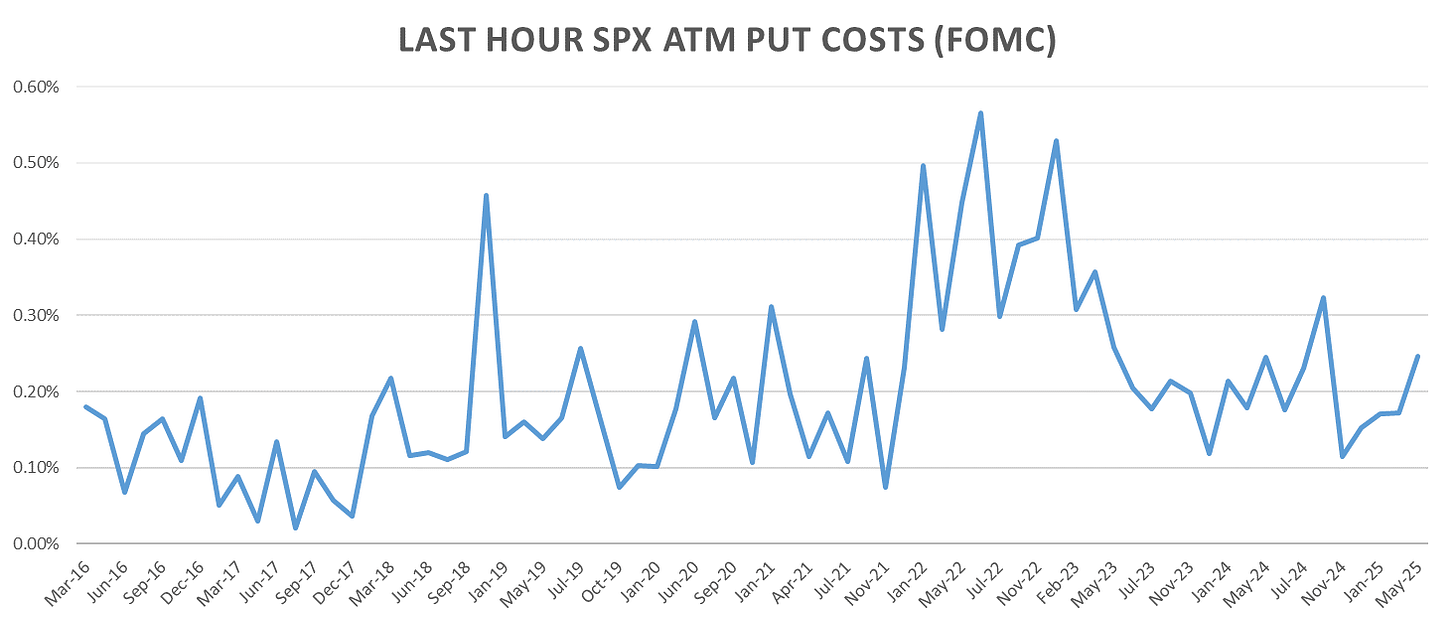

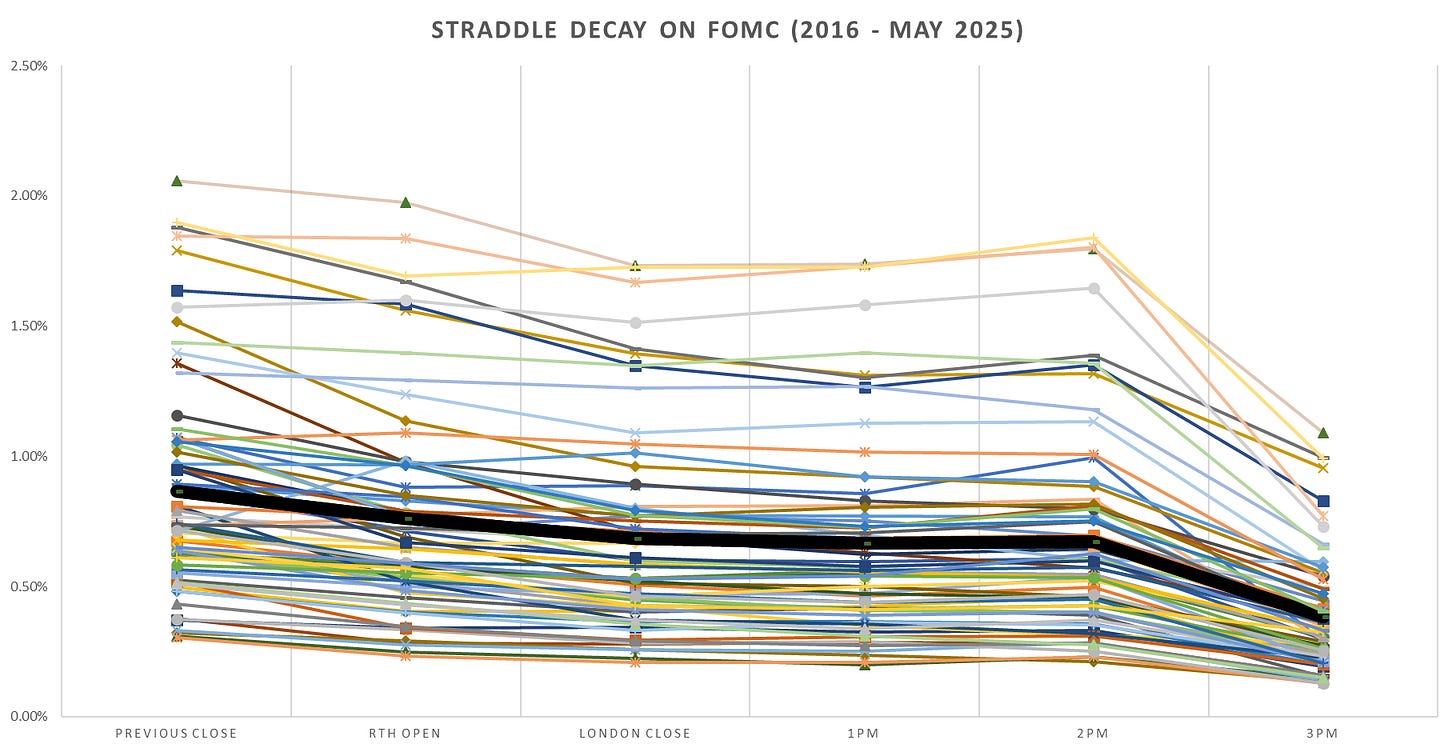

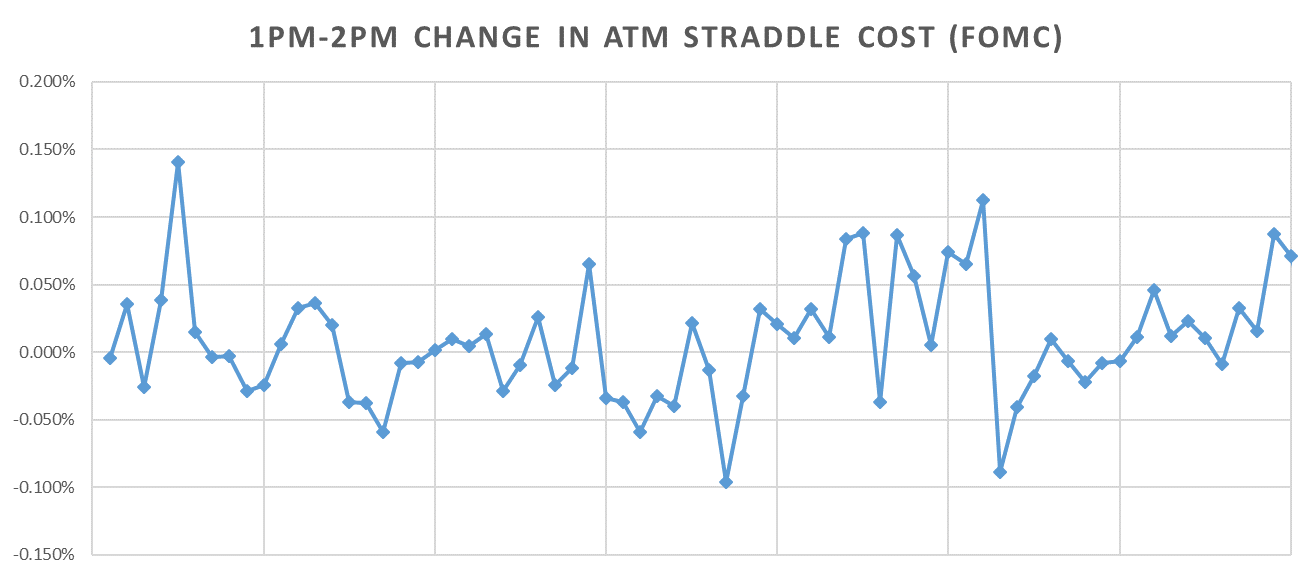

Tomorrows FOMC premium reflects somewhat elevated uncertainty around the rate path and potentially an outsized response from equities:

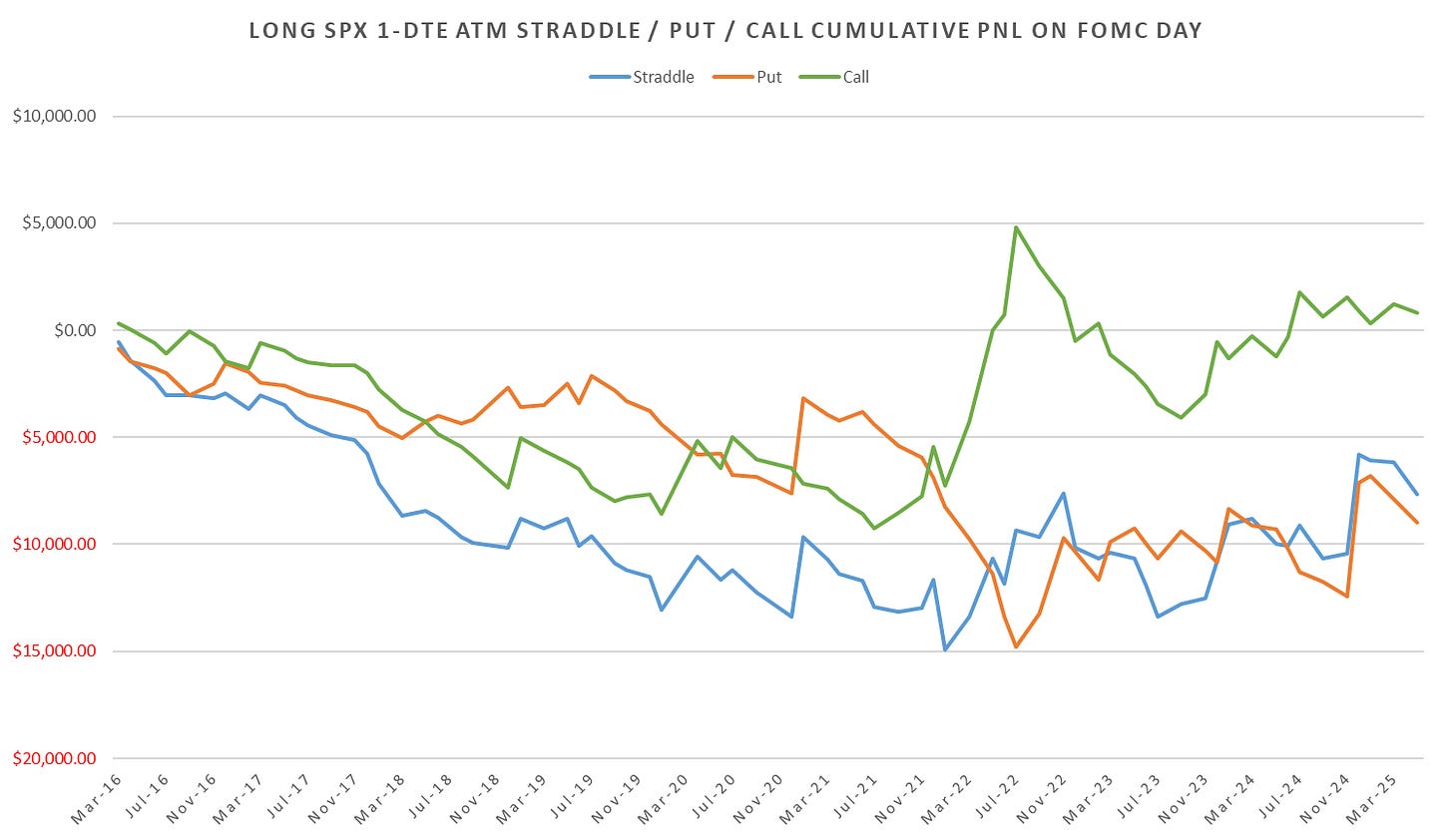

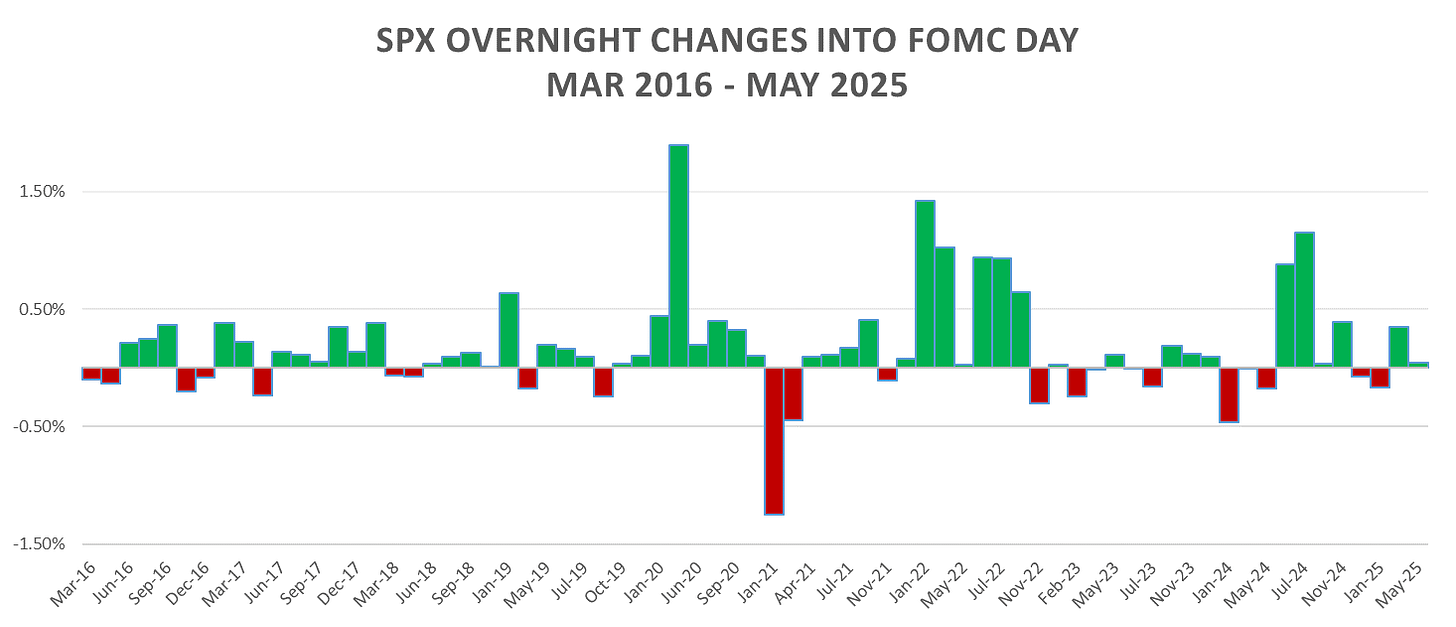

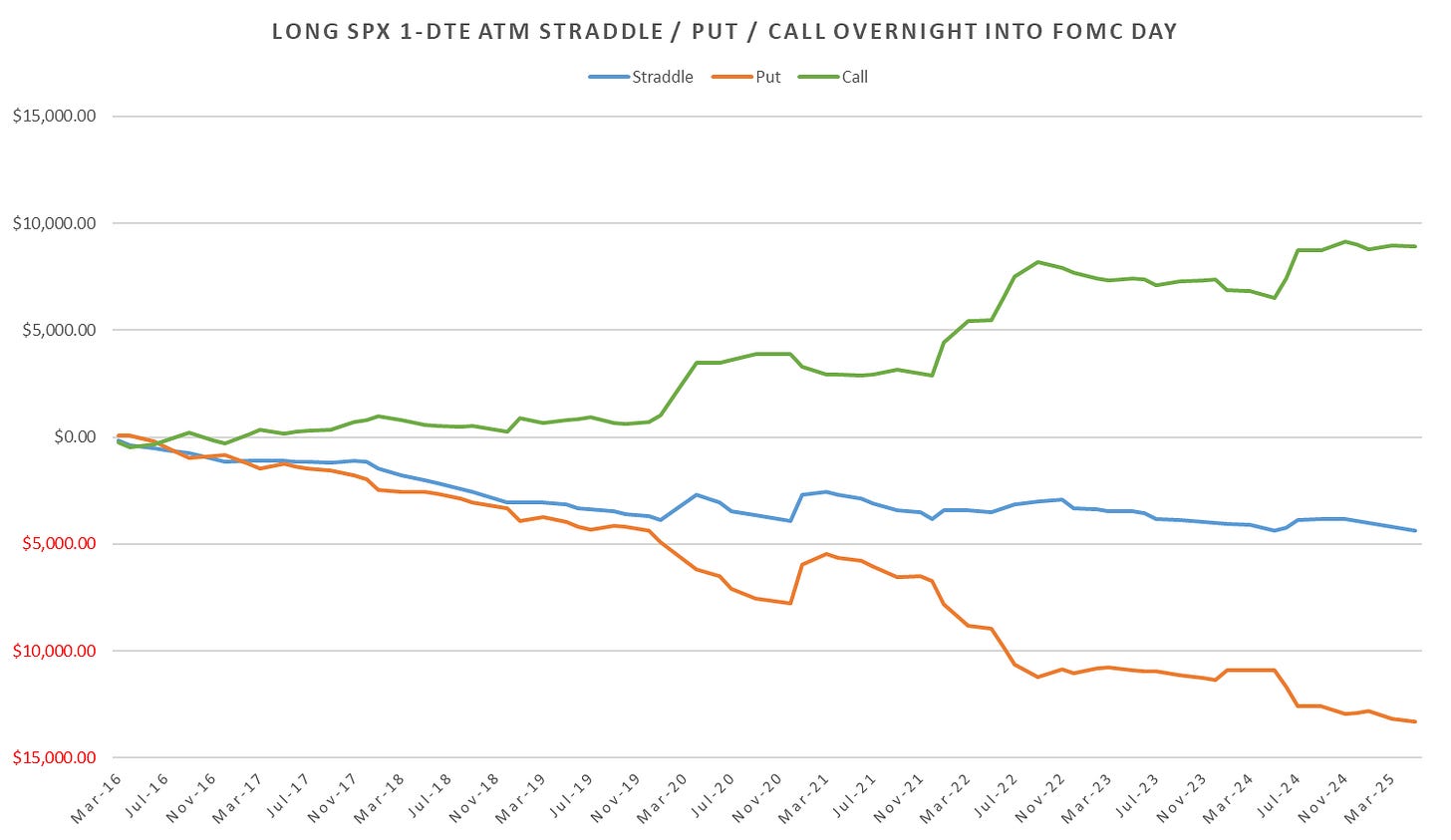

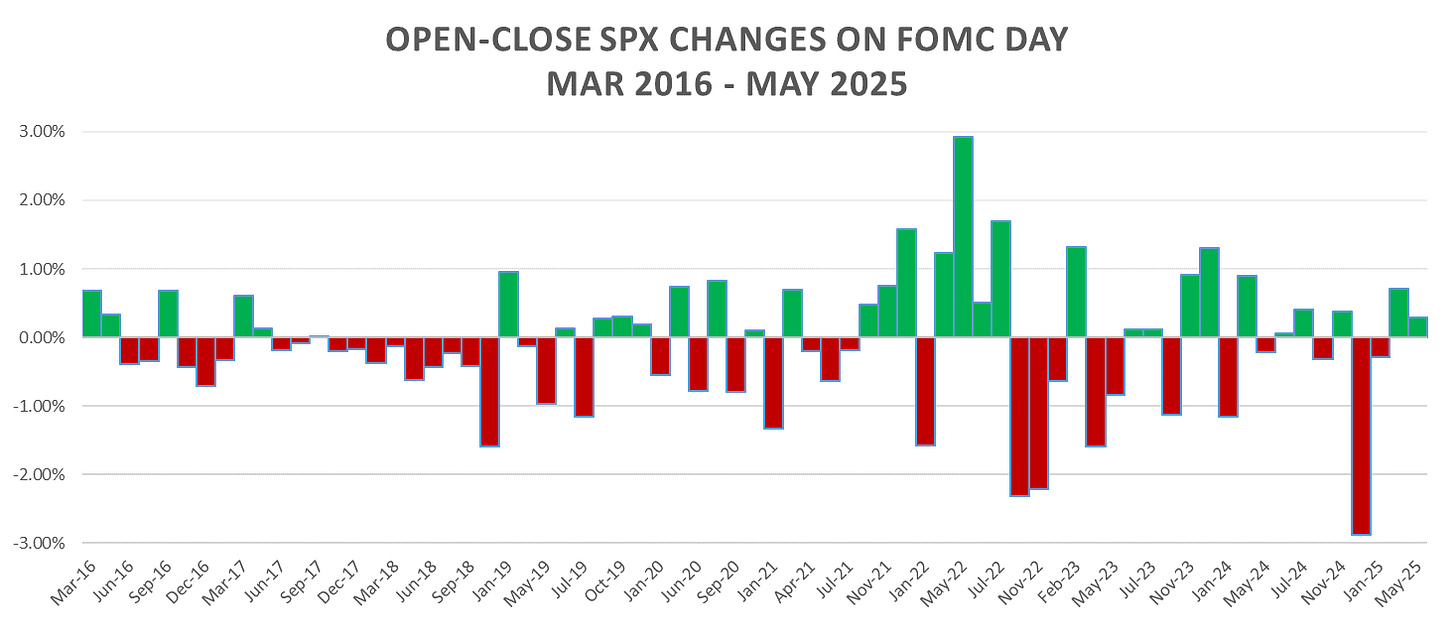

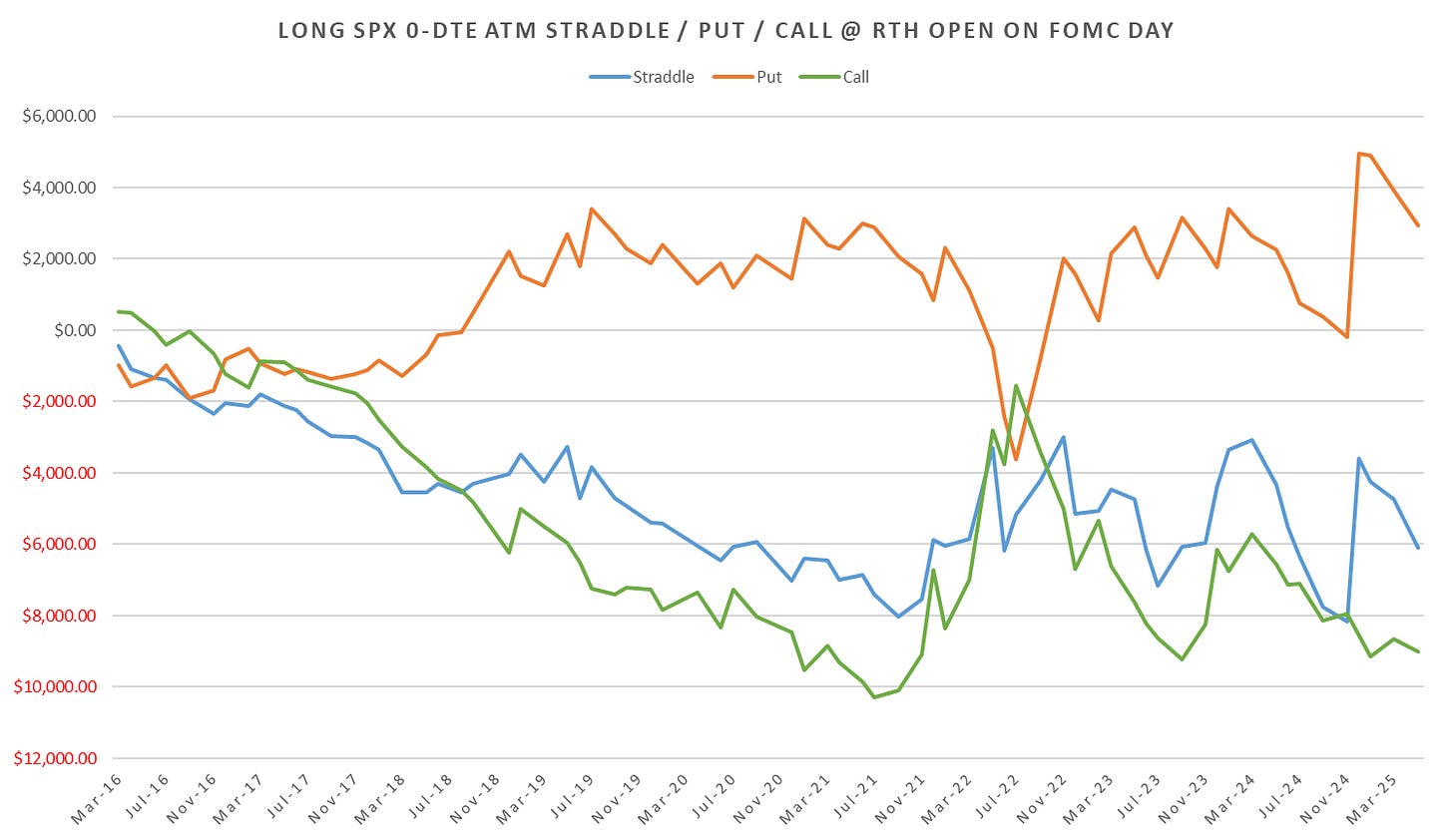

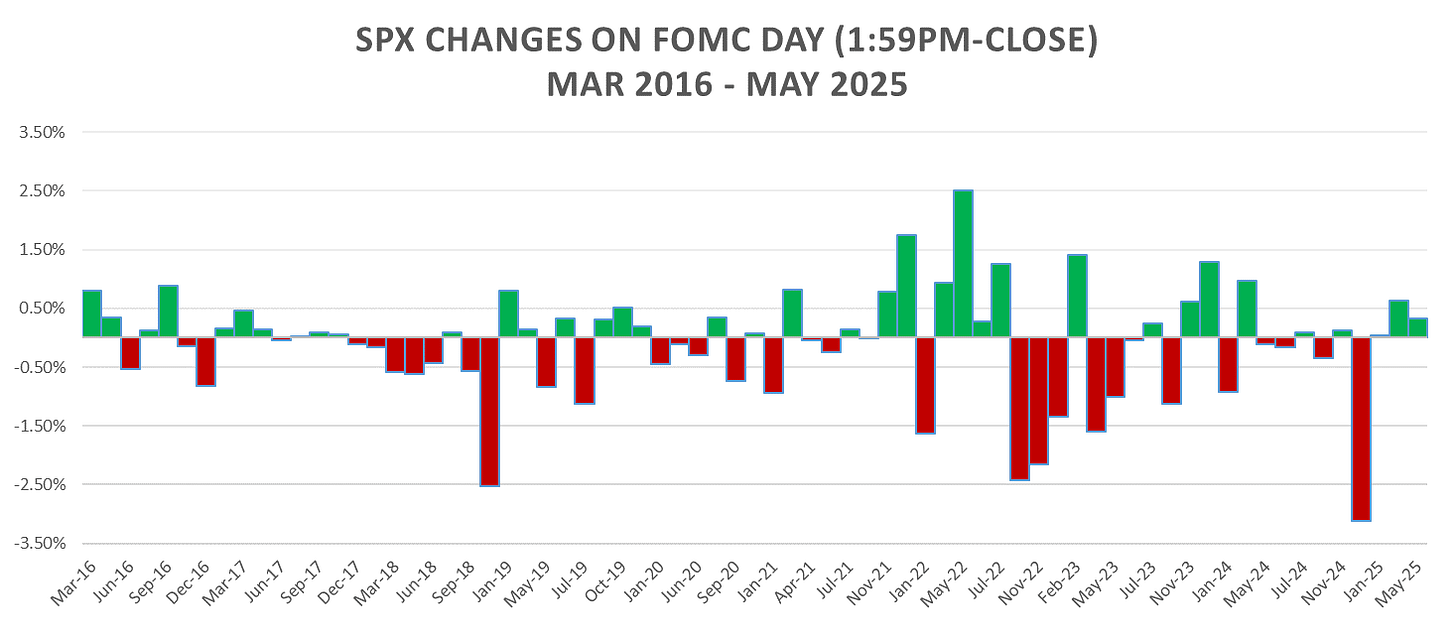

Updated 1-DTE & Intraday SPX Straddle performance:

Note: All charts represent $200k notional bet size (ex. ~3 XSP at 6000 SPX)

1-DTE

Overnight Straddles

RTH Straddles

1:59pm

Last Hour

The press conference continues to sour the mood, SPX reactions have been horrible…

Last hour SPX put cost %:

Intraday Straddle Cost - Hourly

Have a great day!