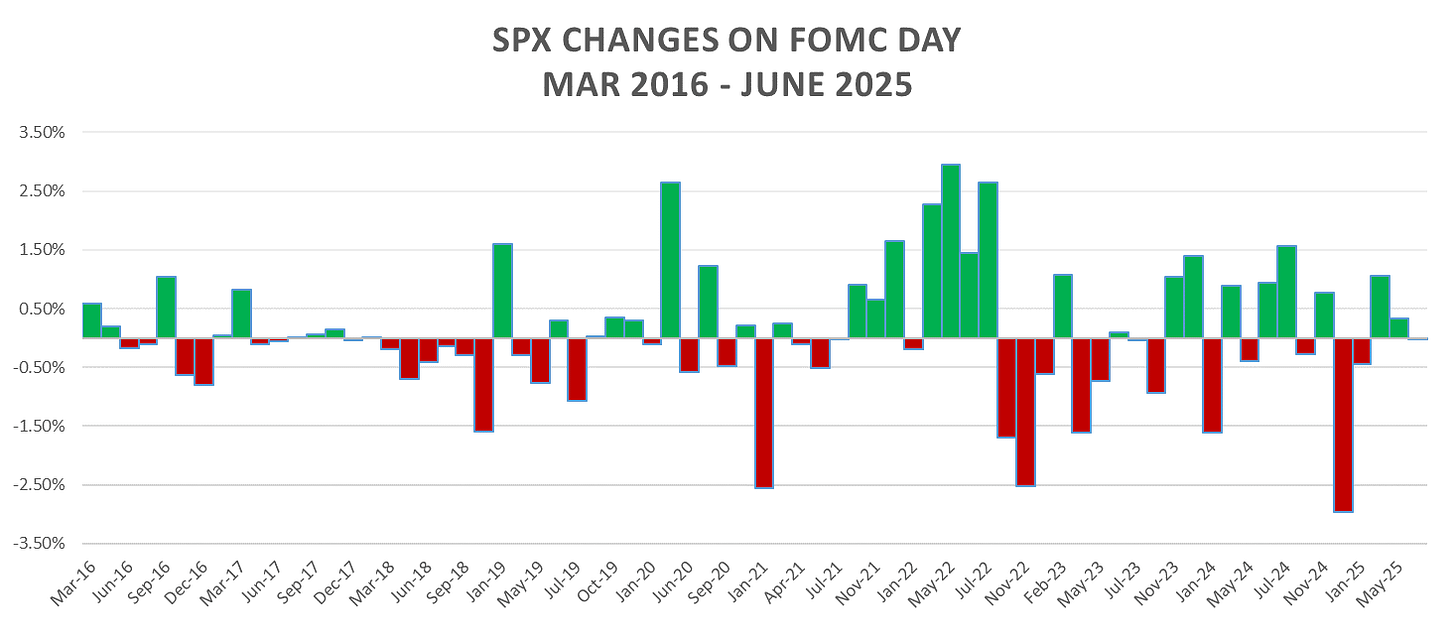

Markets seeing few days of weakness going into FOMC, down ~1% from recent high tick. No rate cut priced in for tomorrow, with ~60% chance of a rate cut in September meeting.

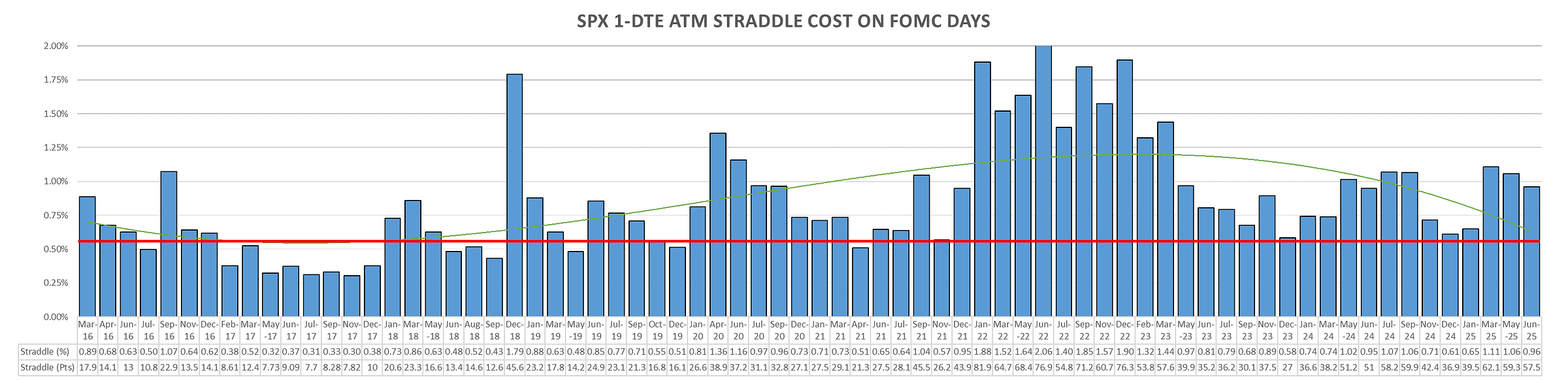

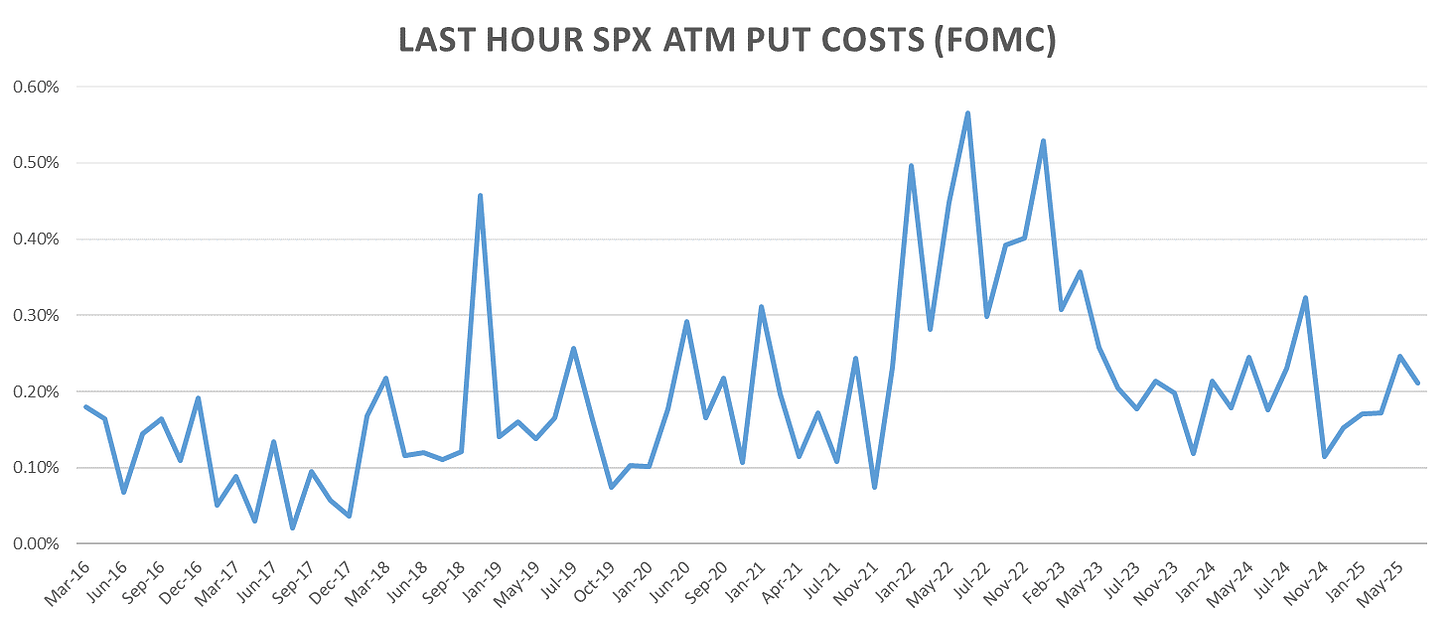

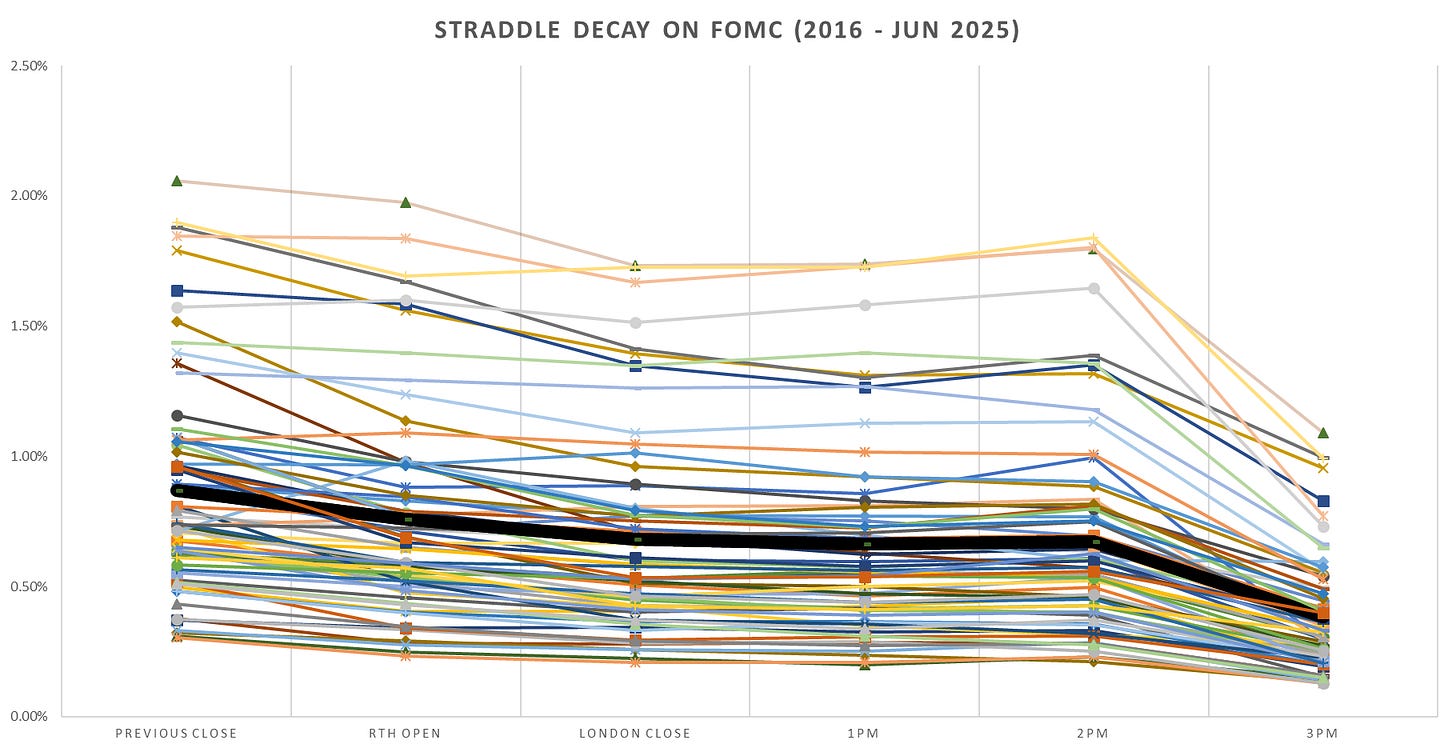

Overall implied vol dropped heavily in July, reflected in one of the cheapest FOMC straddles since 2020 at ~ 55bps.

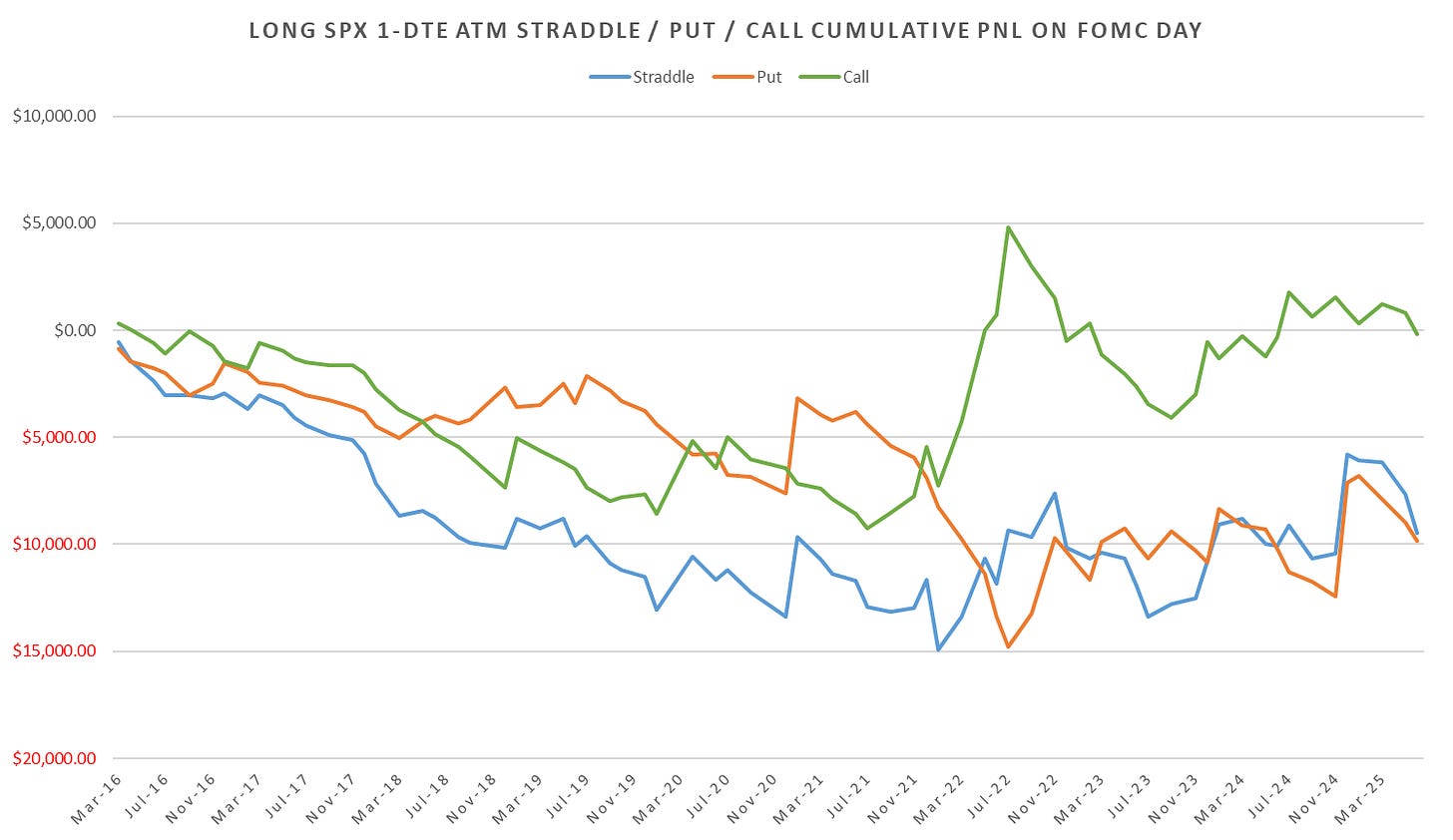

Updated 1-DTE & Intraday SPX Straddle performance:

Note: All charts represent $200k notional bet size (ex. ~3 XSP at 6000 SPX)

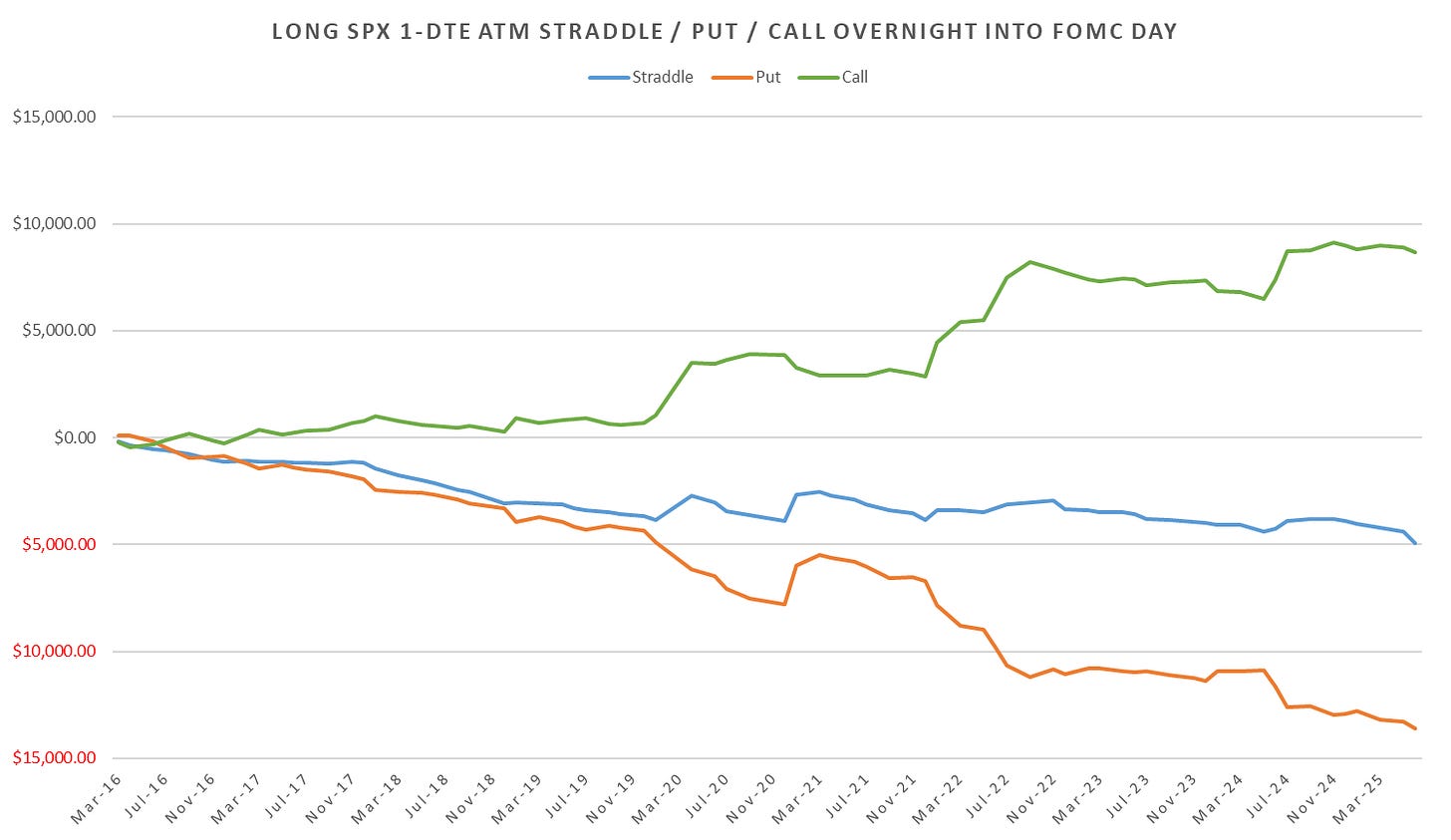

1-DTE

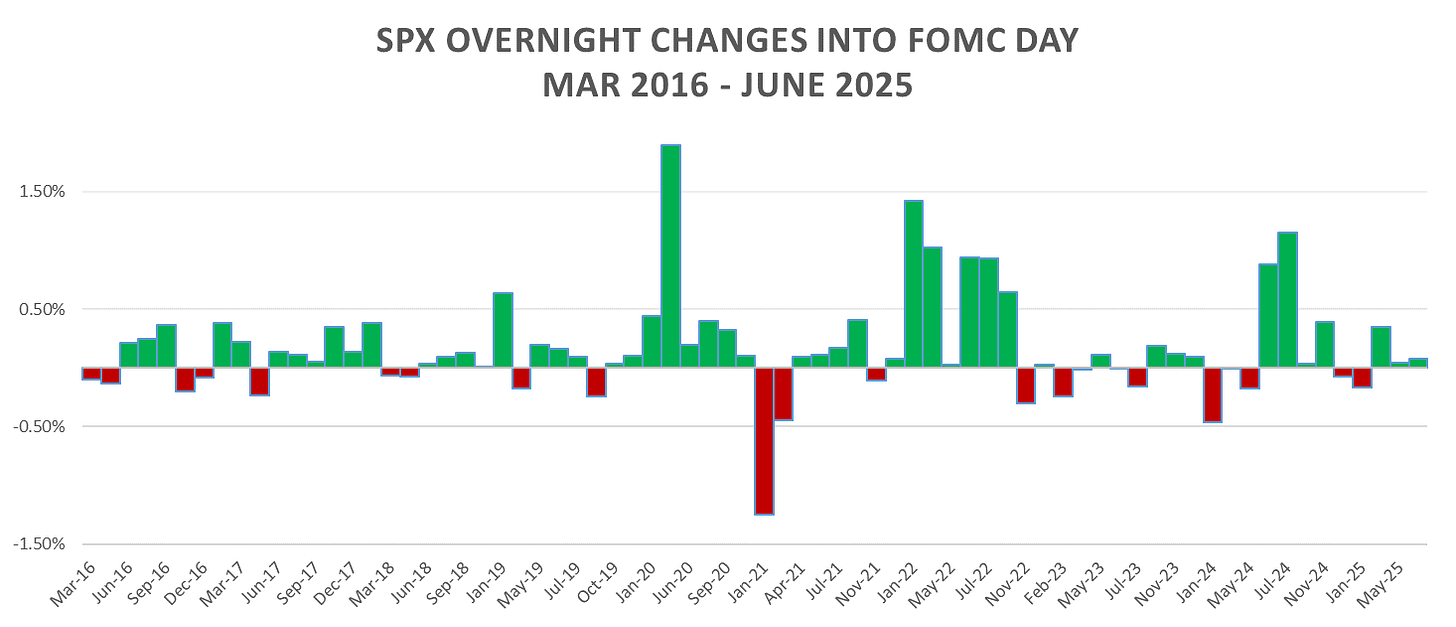

Overnight Straddles

One of the strongest drifts out of all the econ data events, overwhelmingly positive drift higher into the meeting.

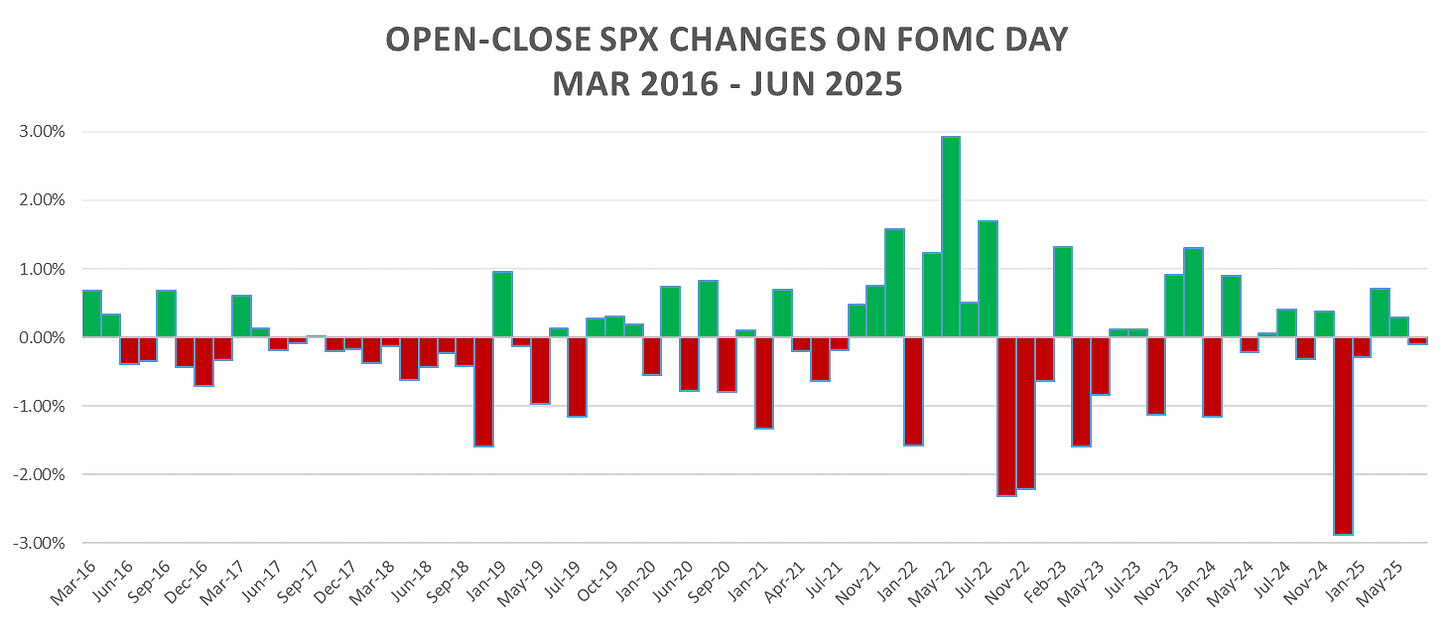

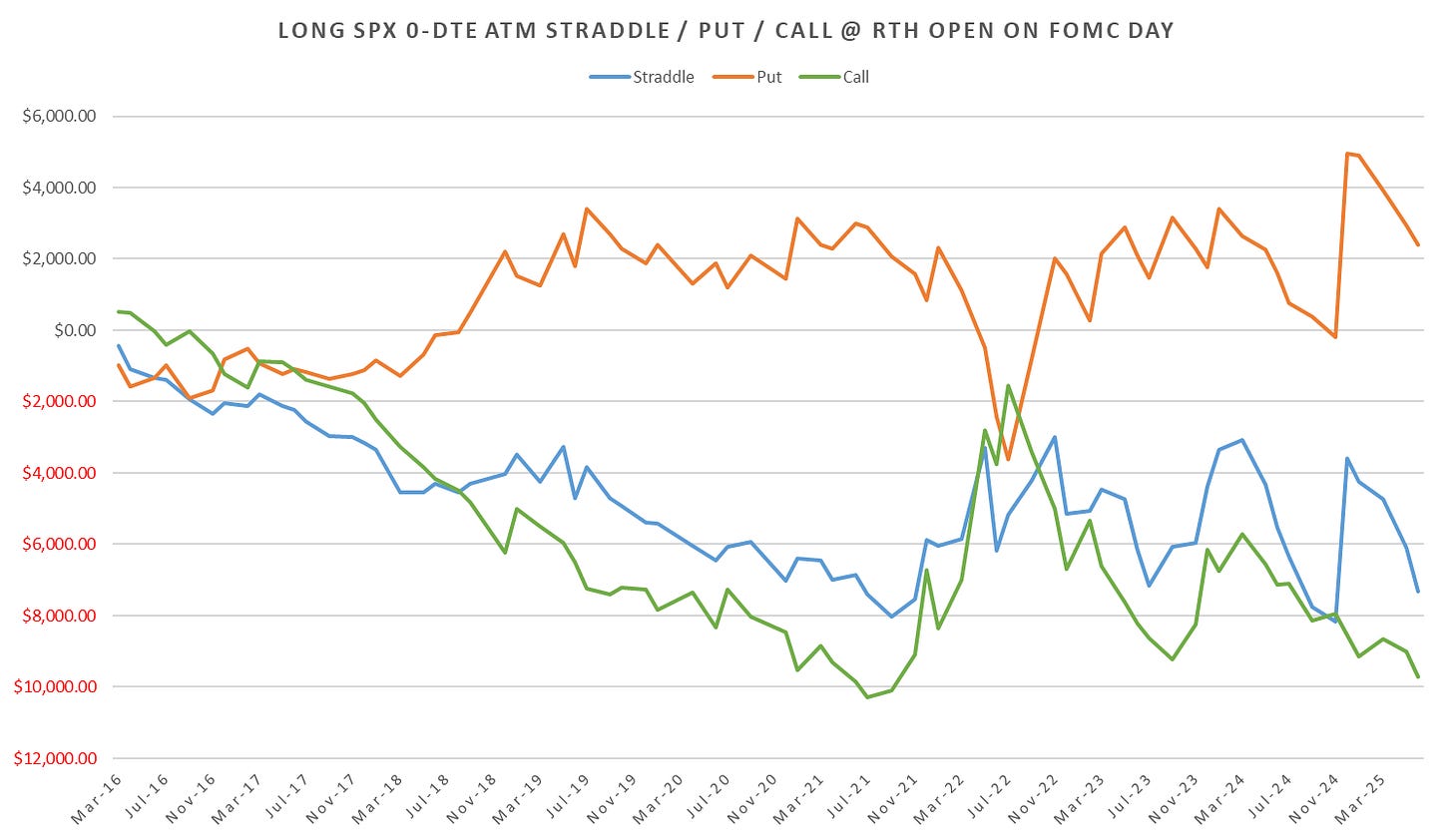

RTH Straddles

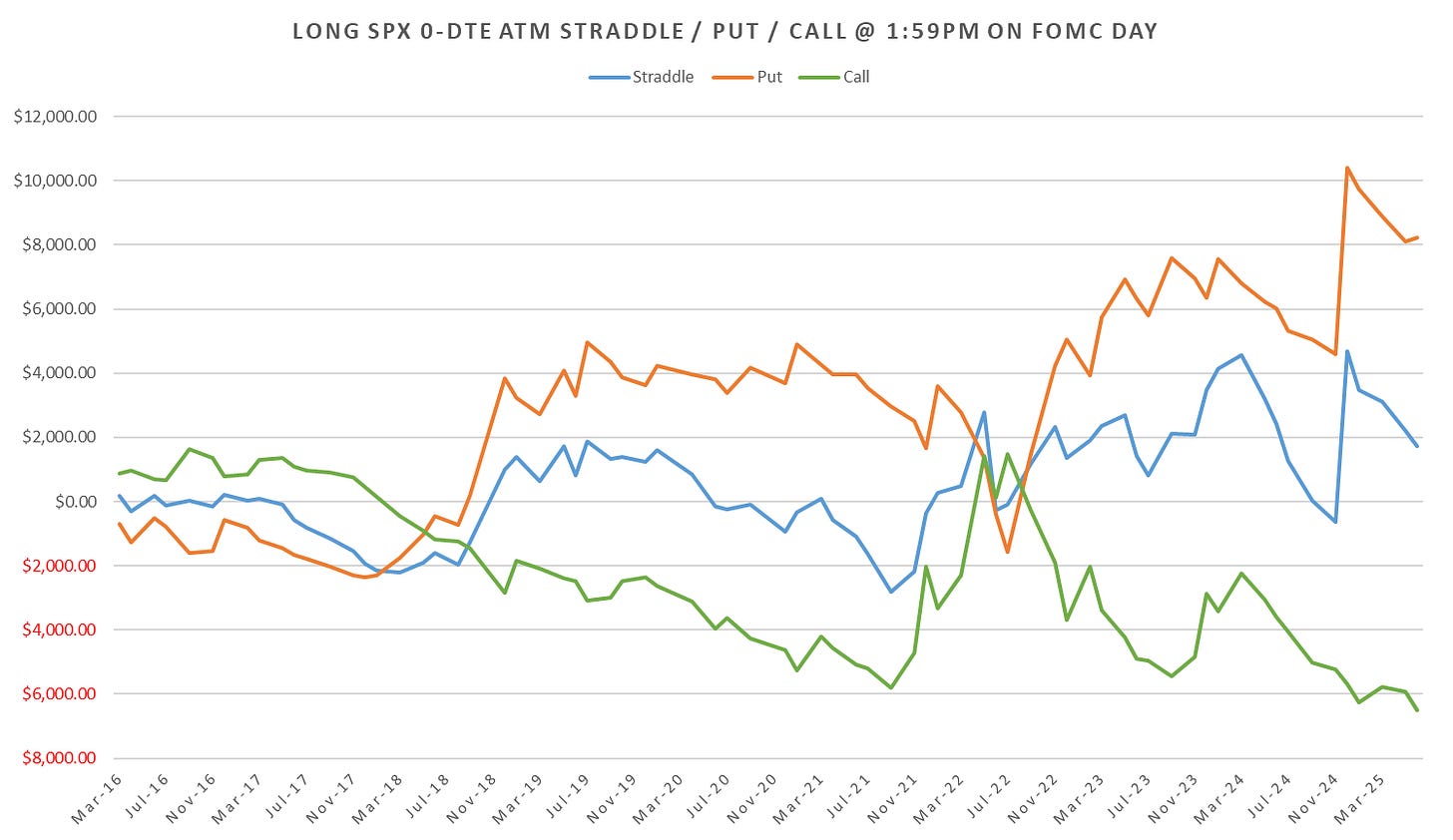

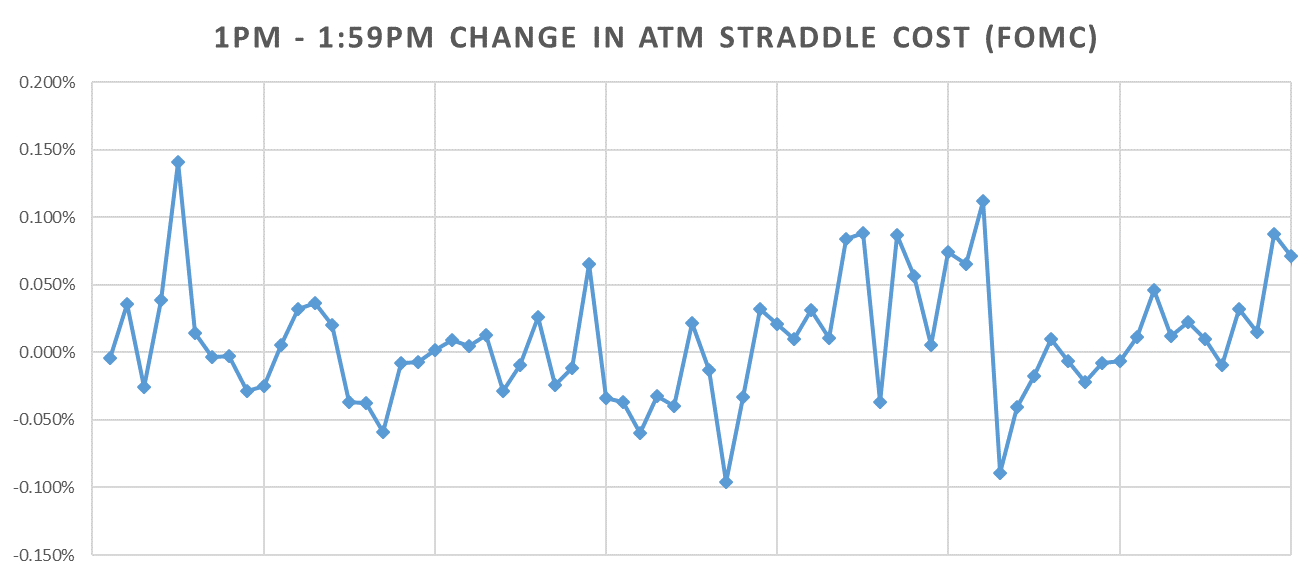

1:59pm

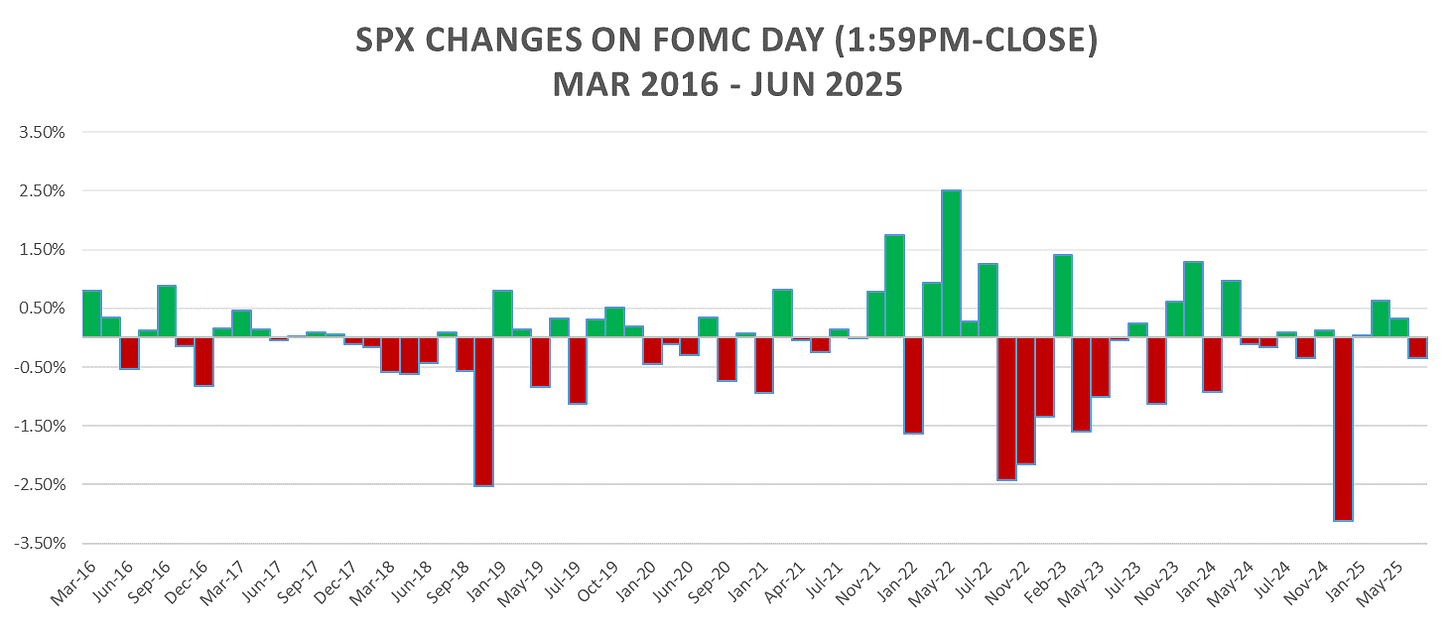

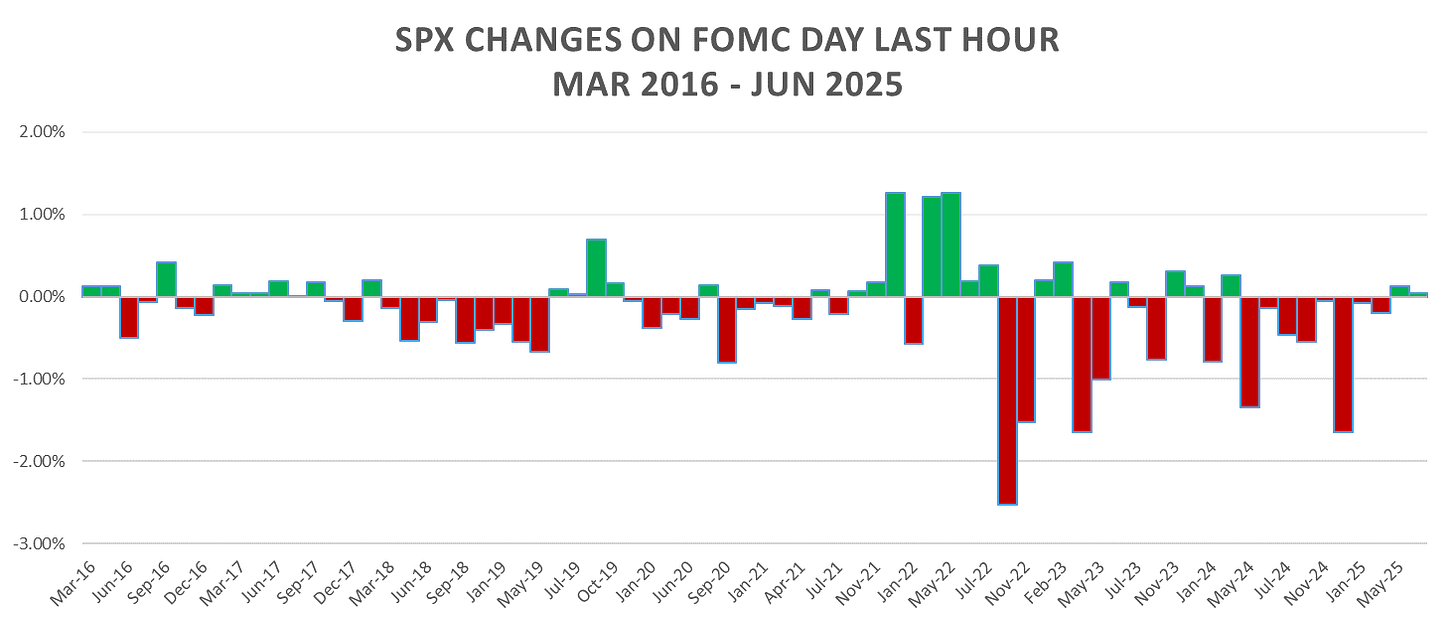

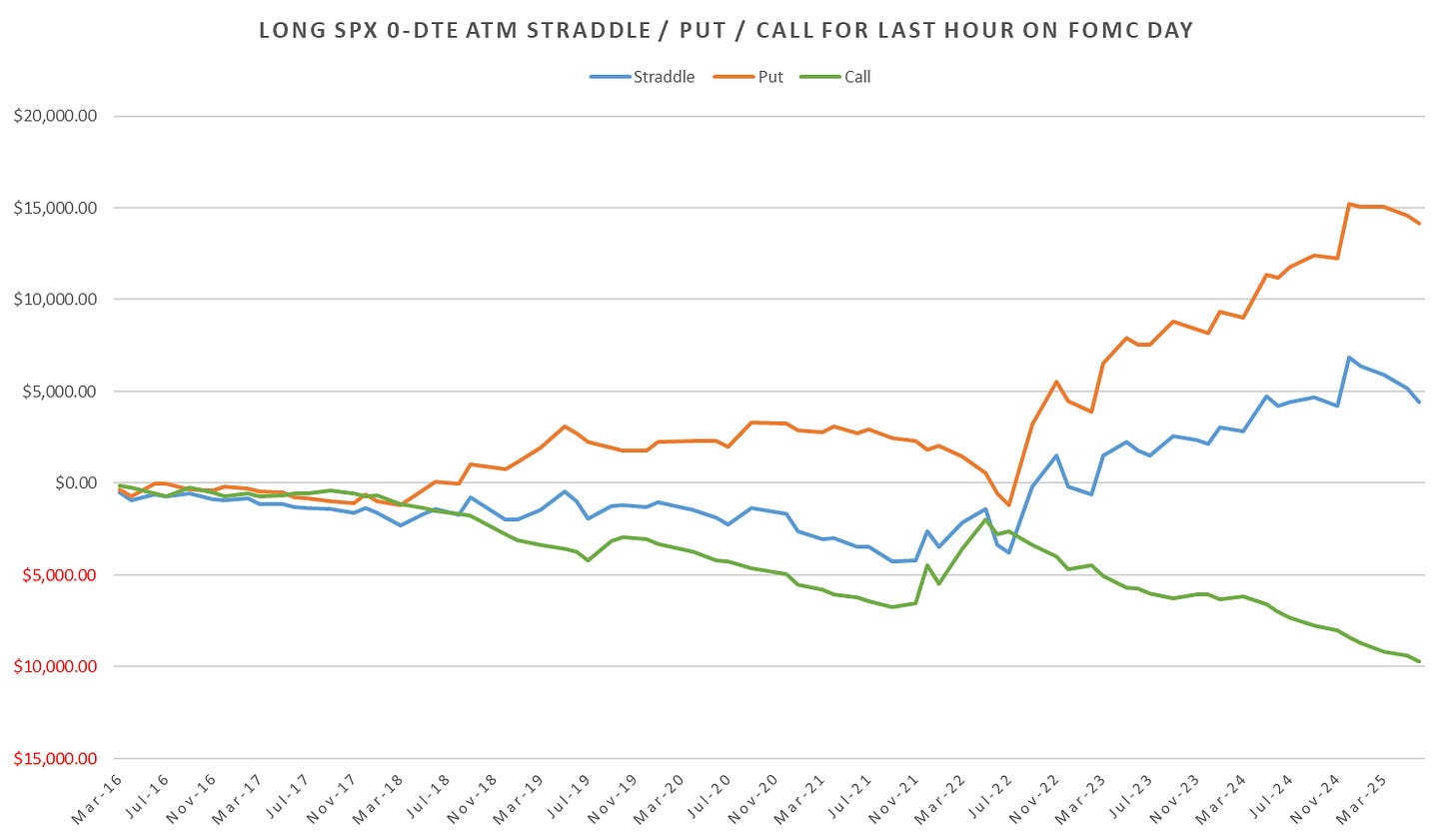

Last Hour

Not as terrible performance during last hour of the conference last few meetings.

Last hour SPX put cost %:

Intraday Straddle Cost - Hourly

Have a great day!