FOMC & post-election index volatility

Index Volatility after elections & FOMC day option performance

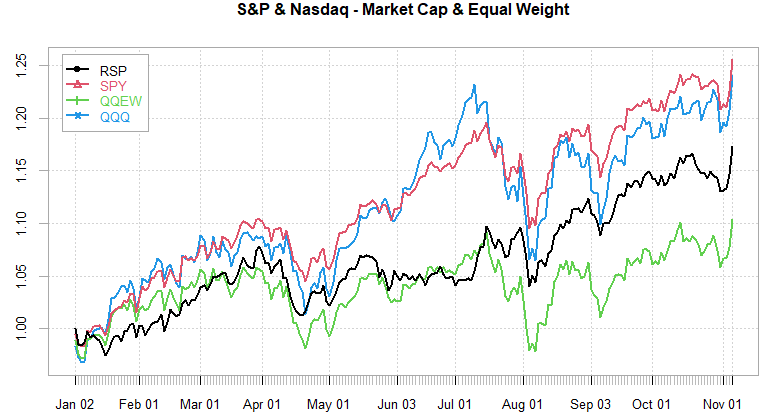

Equities celebrating Trump win with a fairly impressive rally, SPX moved almost double the straddle breakeven from Tuesday close. TSLA stands out as the bigger winner among MAG7, rallying almost 15%.

US bond yields continued to surge, as probably expected given both of the candidates would likely keep spending despite the ‘cut the deficit’ rhetoric… Oil initially sold off, however, recovered entirety of the overnight drop in ~ an hour after market open. USD strengthened relative to JPY and global currencies. Despite the initial bullishness, outside of equities, moves have either started to retrace or largely retraced the election reaction (oil).

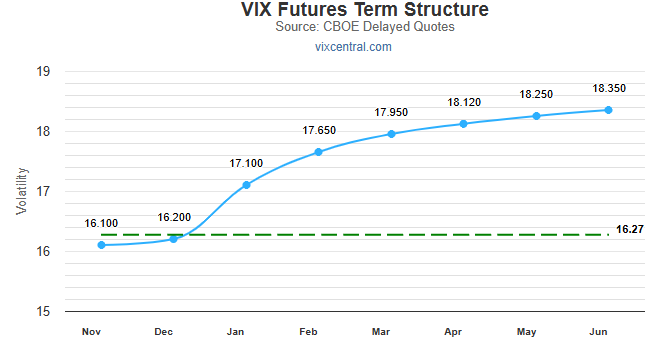

Equity implied volatility as measured by VIX dropped back to 16/17:

As mentioned in the Sunday post, there is still a geopol premium built into the SPX skew, which will likely make VIX sticky around 15/16 levels for the time being. Realized vol modestly higher after a 2%+ move in SPX/NDX & a massive 5%+ rally in small caps (remember upside vol is still vol for money flows.) Vol ETP’s posted a large drop (inverse vol ETPs rallied), although not a lot of carry to collect on the short side going forward until we move up to the Thanksgiving window where we likely see another drop in spot / futures into Dec.

Overall, the entire event premium in SPX got washed out in ~5-6 hrs post market close. 1-DTE straddles are back to avg ytd levels (~67bps SPX straddle for FOMC tomorrow.)

Will post more on the cross-asset moves in the weekend market overview!

FOMC

With elections now in the rear view mirror we can once again focus on what really matters - cutting rates (or not.)

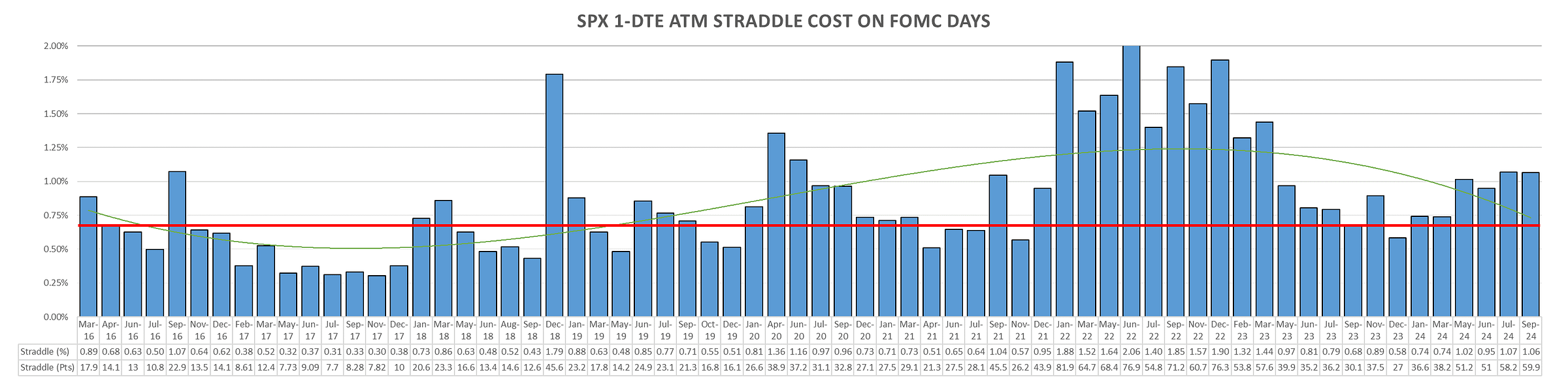

We are going into the Nov FOMC with the cheapest SPX straddle since 2023 (red current cost):

On the cheaper side given Powell promised to deliver a 25bps cut but now has to manage Trumps tariff & tax cuts promises. Also don’t forget, during the first term Trump was unhappy with Powell as he hiked rates & was slow to cut into 2nd half of 2018… Given Powell is not getting reappointed, will be very interesting to watch the rhetoric after the statement.

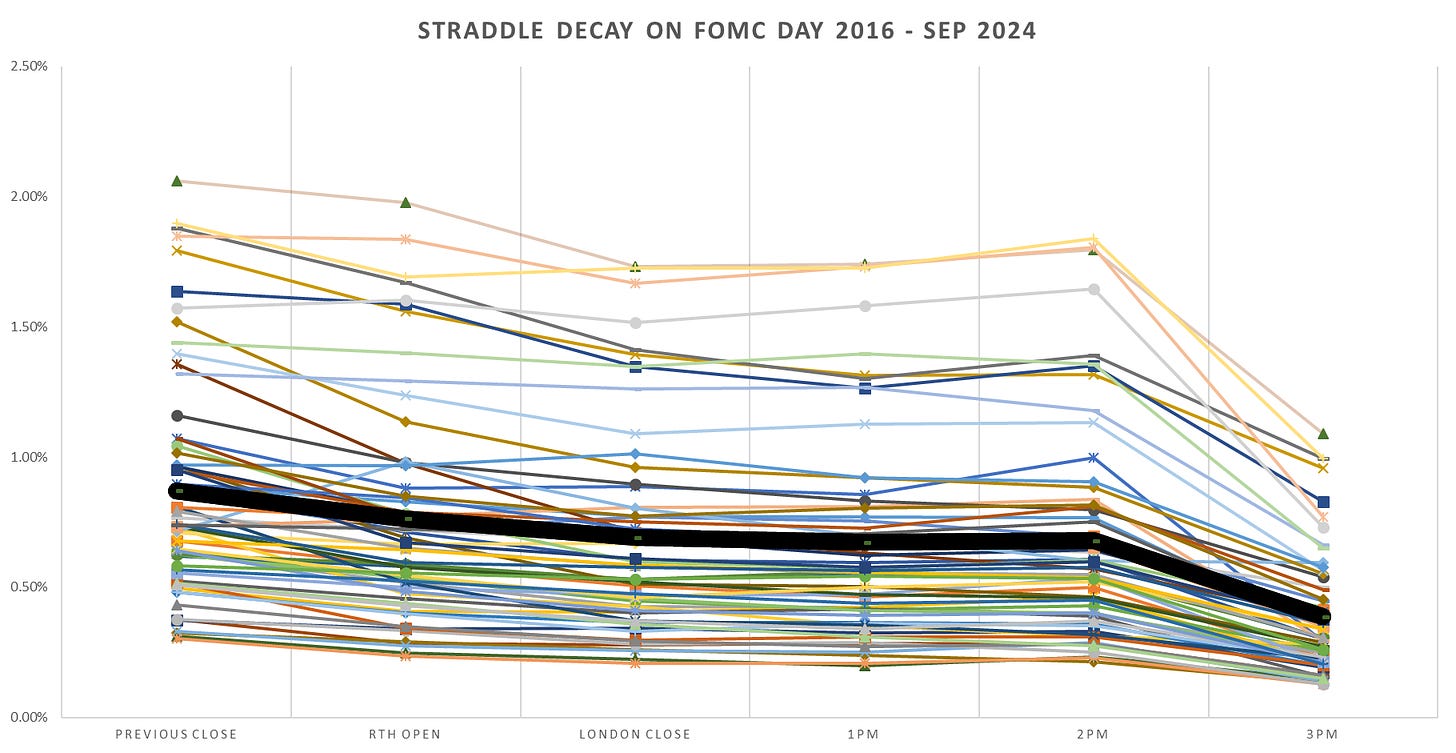

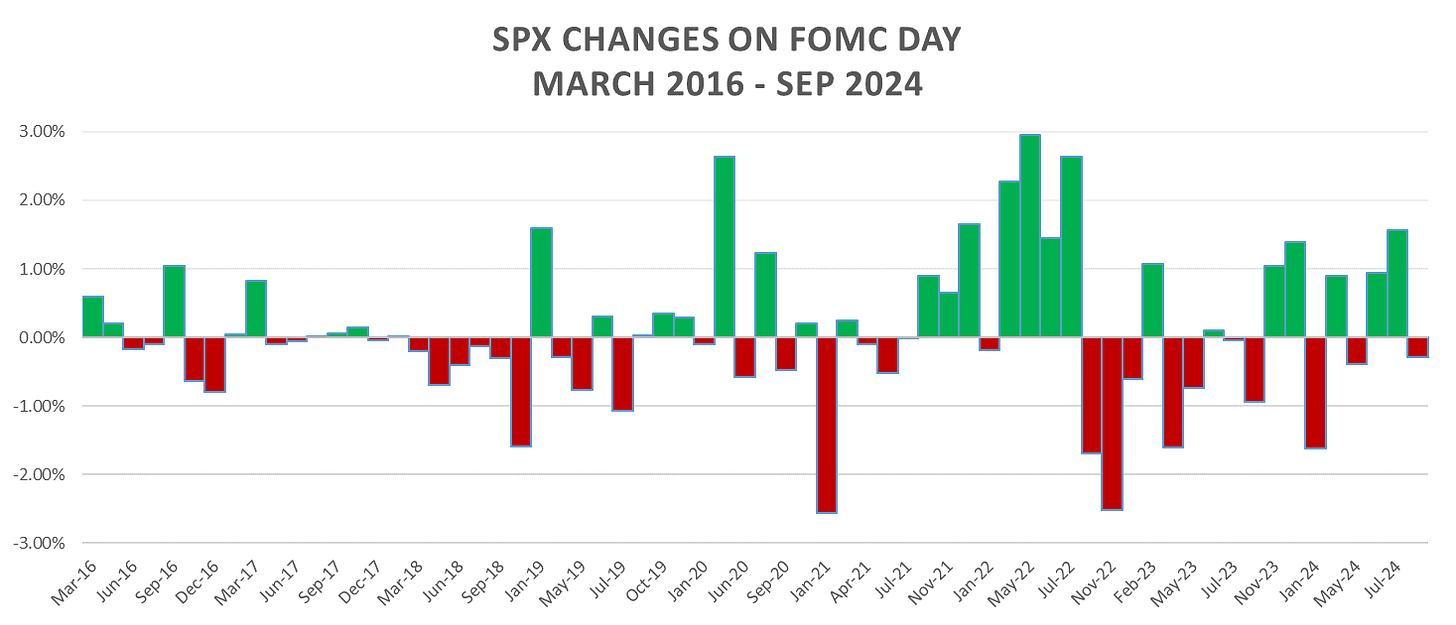

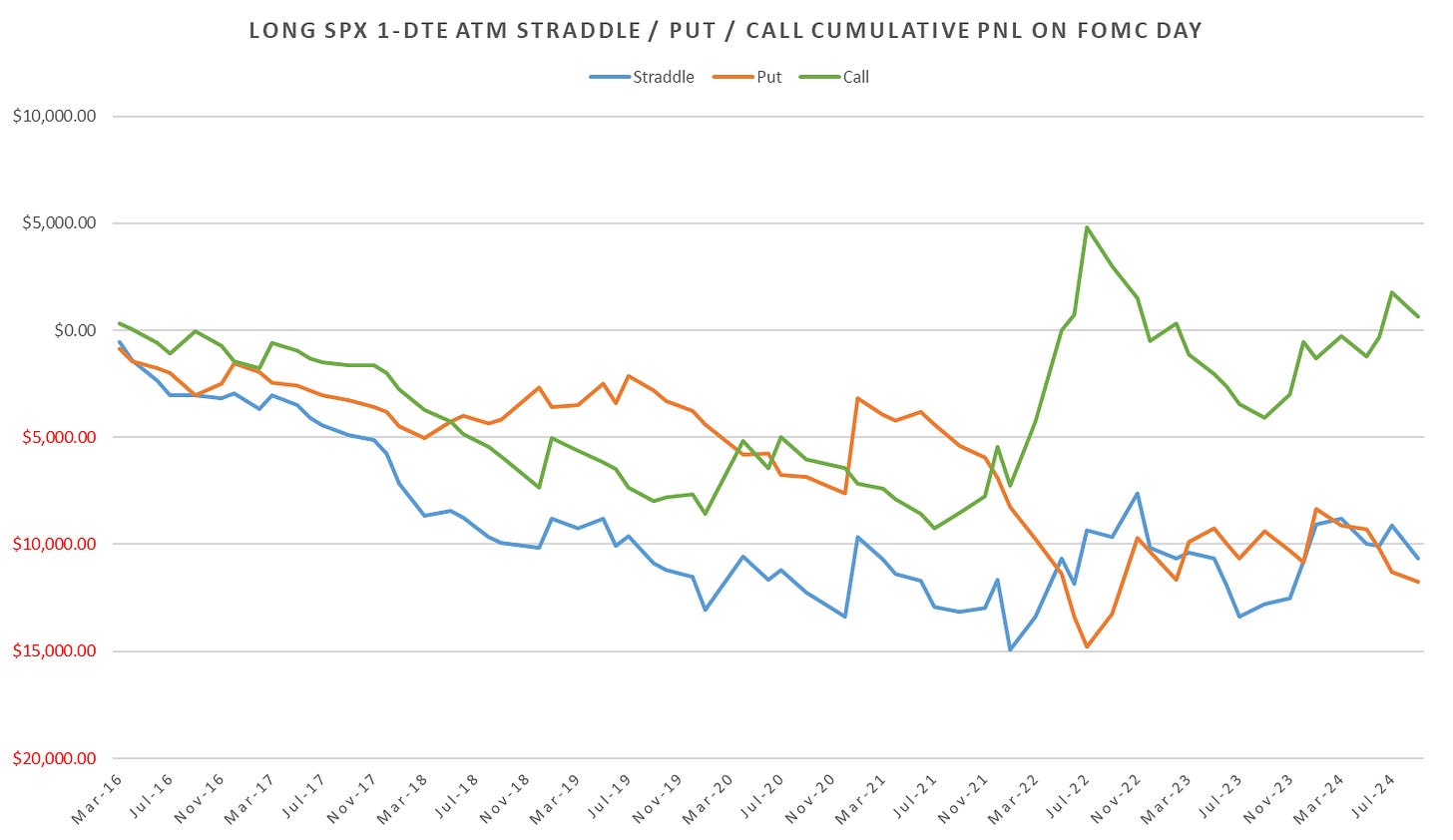

Overall reactions to FOMC statements:

Nothing interesting during the run up to the statement, RTH session relatively weak (but thats just overall how the market is…):

Keep reading with a 7-day free trial

Subscribe to Vol Vibes to keep reading this post and get 7 days of free access to the full post archives.