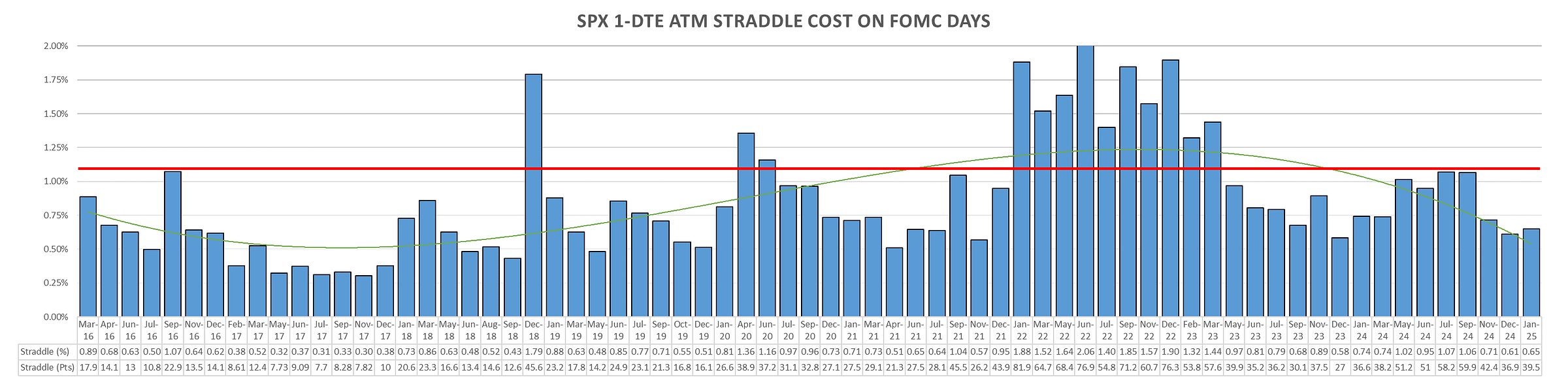

2nd FOMC meeting of 2025 coming up tomorrow. In line with NFP & CPI, short dated vol back to 2022 levels for data releases / FOMC.

Market going into FOMC with ~100bps straddle, lower than NFP or CPI at 150bps. Looks like market is set on Powell delivering dovish comments tomorrow, with 3-4 rate cuts priced in but later in the year (May 90% probability of unchanged funds rate.)

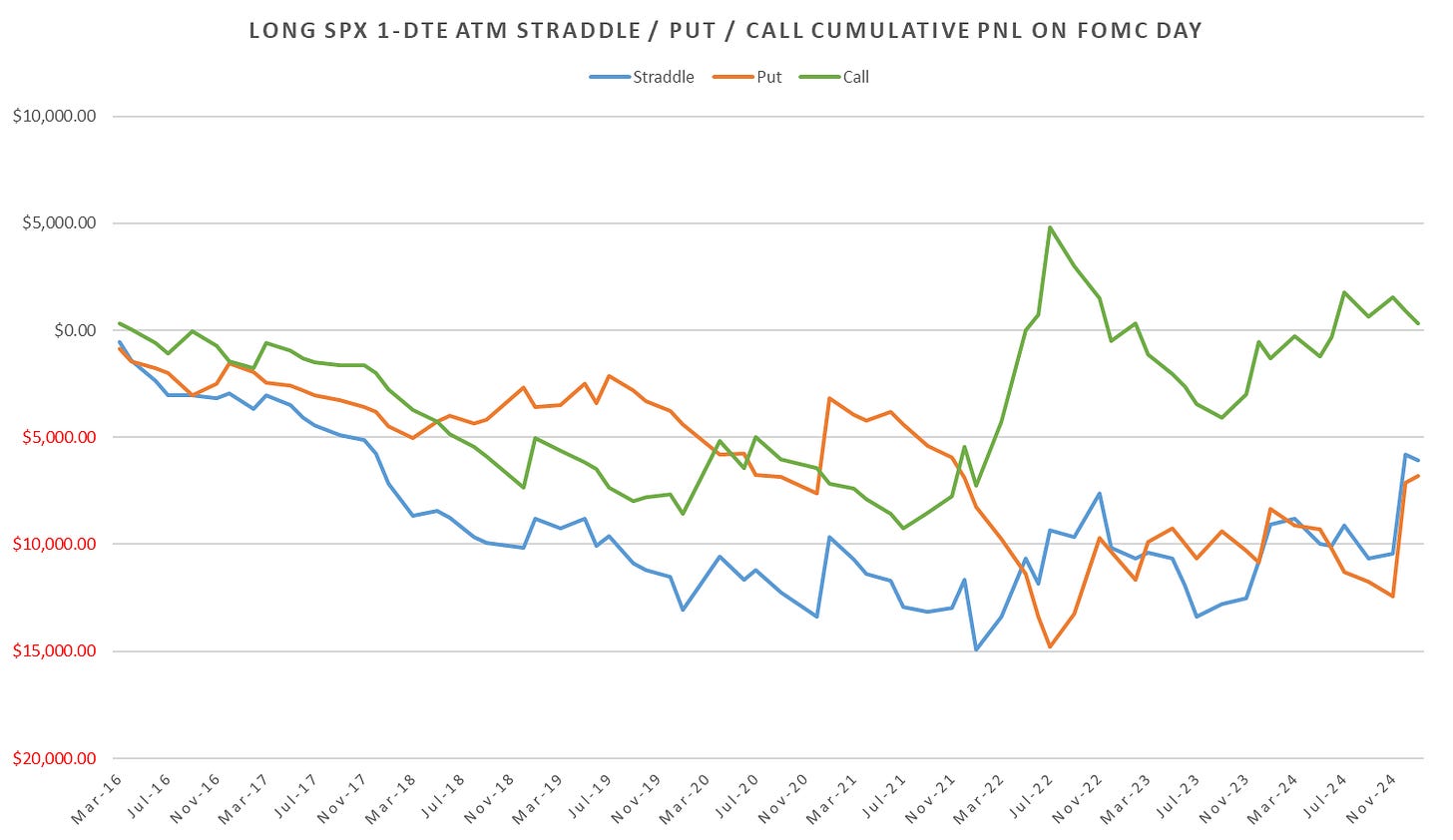

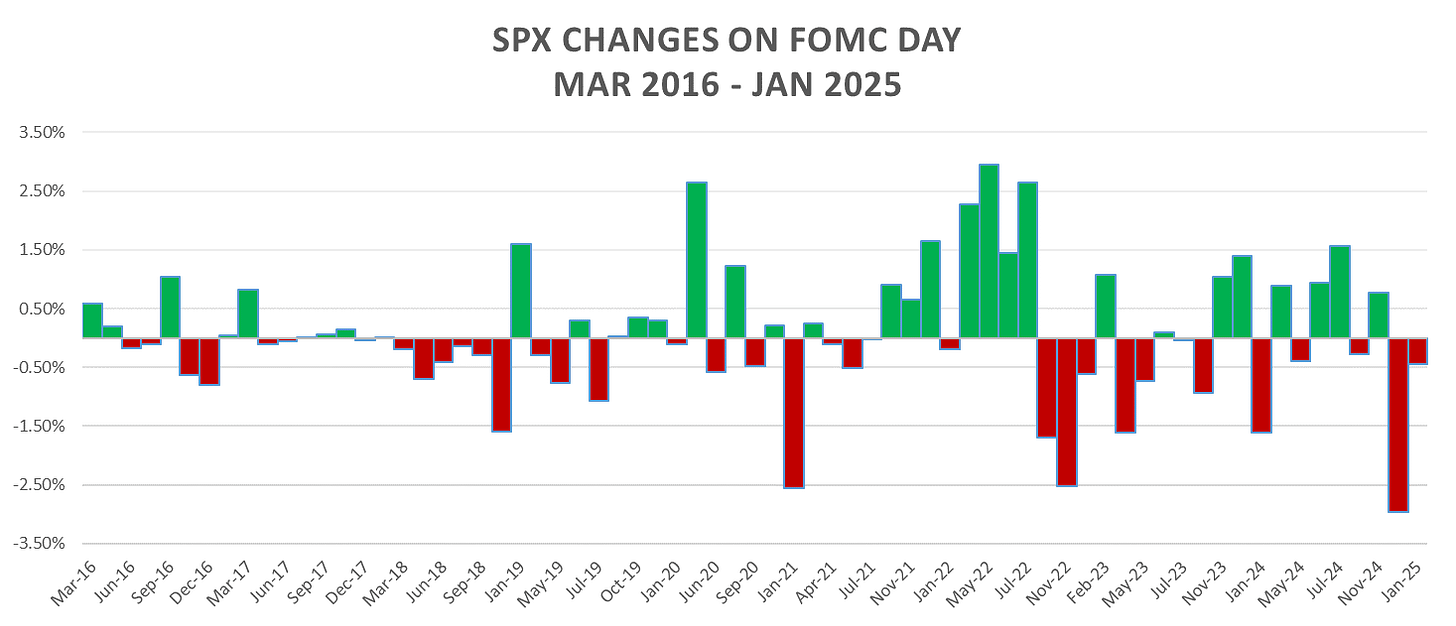

Updated 1-DTE & Intraday SPX Straddle performance:

Note: All charts represent $200k notional bet size (ex. ~3 XSP at 6000 SPX)

1-DTE

Overnight Straddle

Keep reading with a 7-day free trial

Subscribe to Vol Vibes to keep reading this post and get 7 days of free access to the full post archives.