FOMC

SPX Index & Options Performance Update - October 2025

SPX up 400pts in 10 days going into end of month, FOMC & Mag7 earnings. Short term upside looks extremely stretched but markets struggle to have a single down day lately.

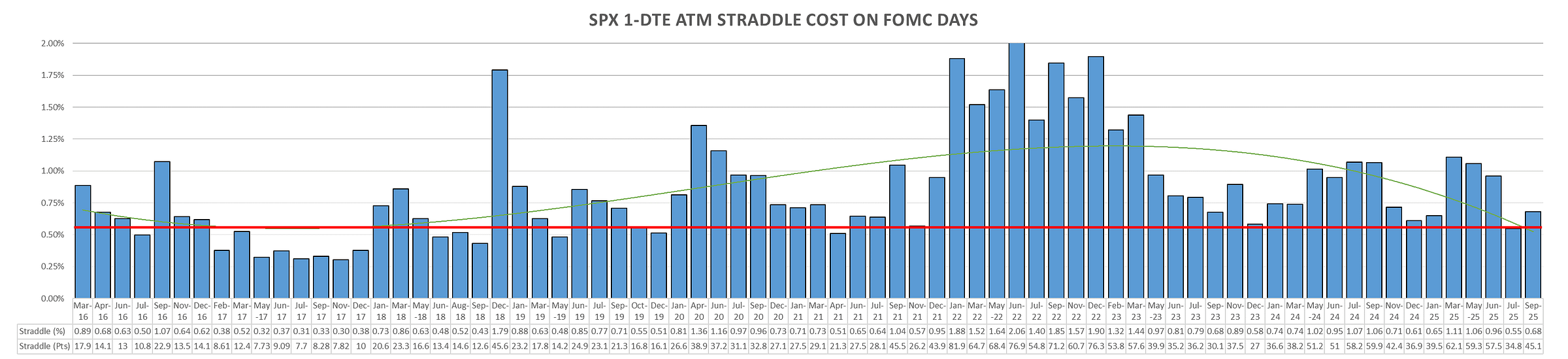

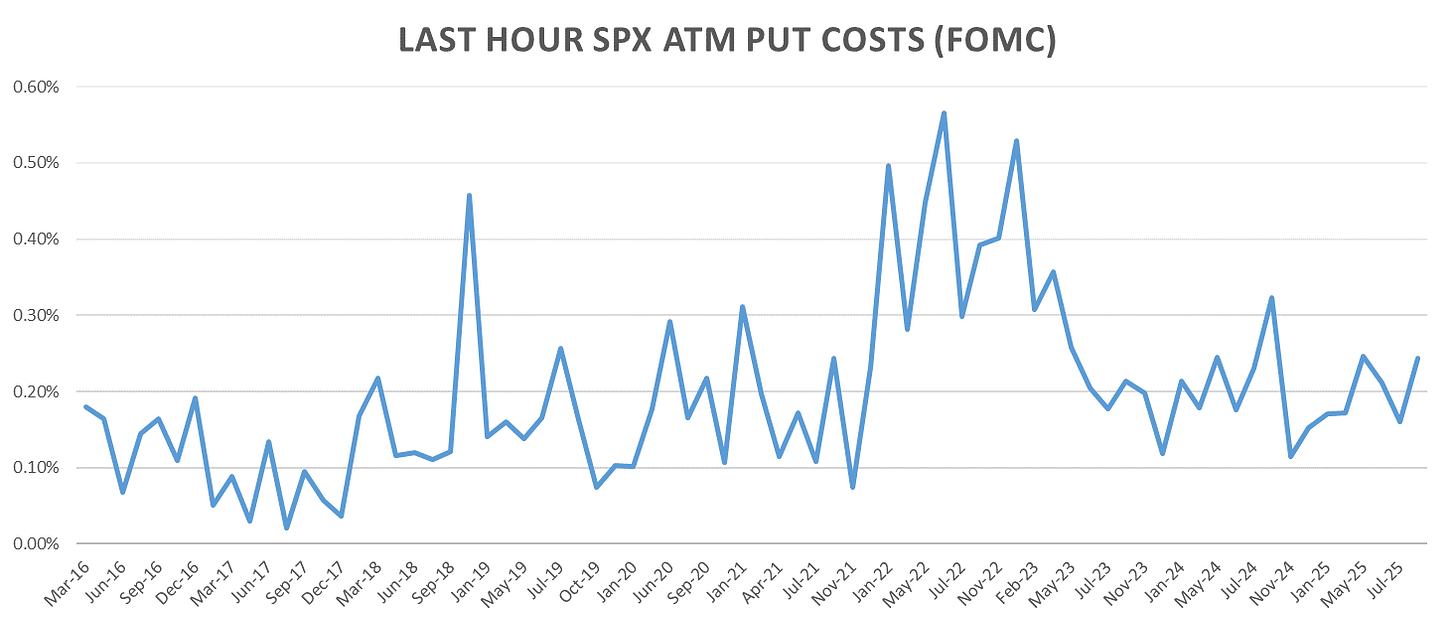

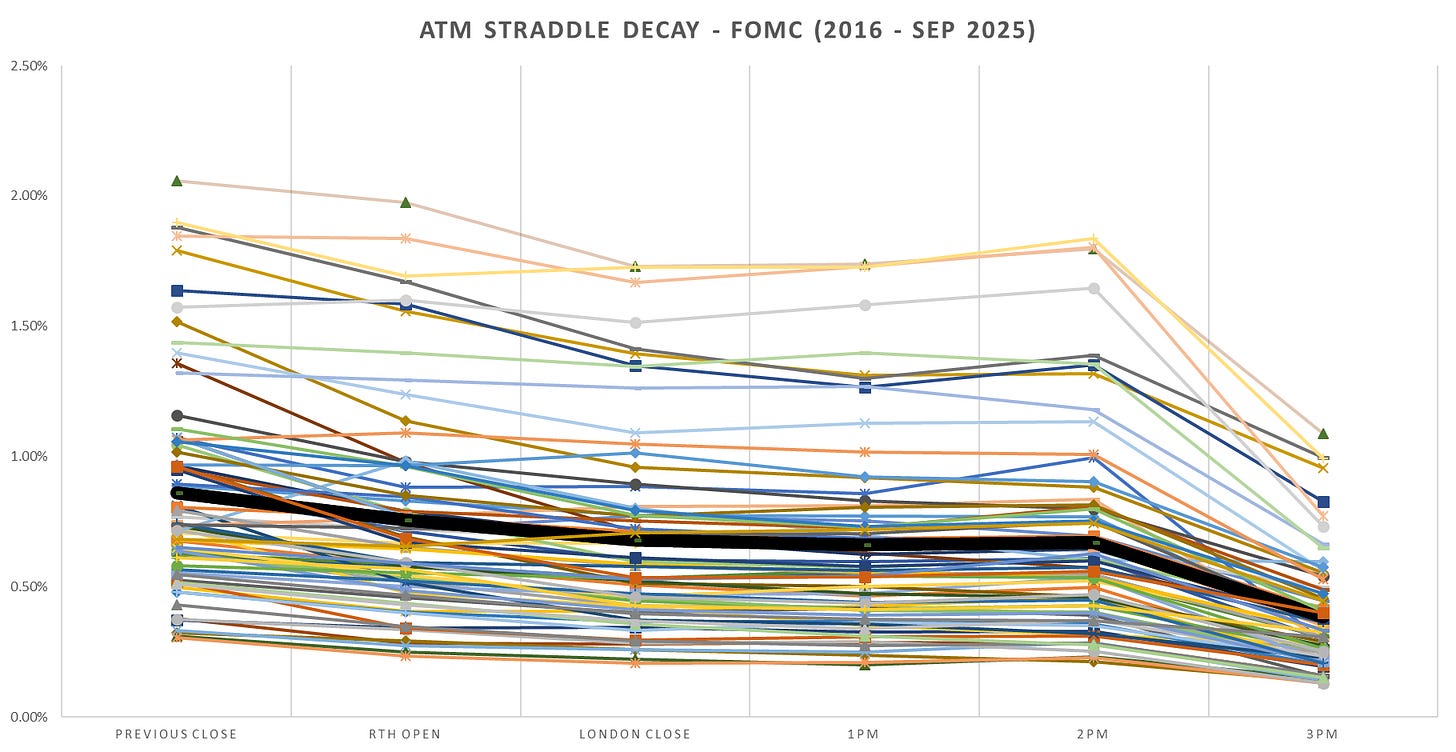

With rate cuts essentially priced in for tomorrow, SPX straddles trading ~55bps into FOMC. This is once again near the lows of 10 year range (outside 2017.)

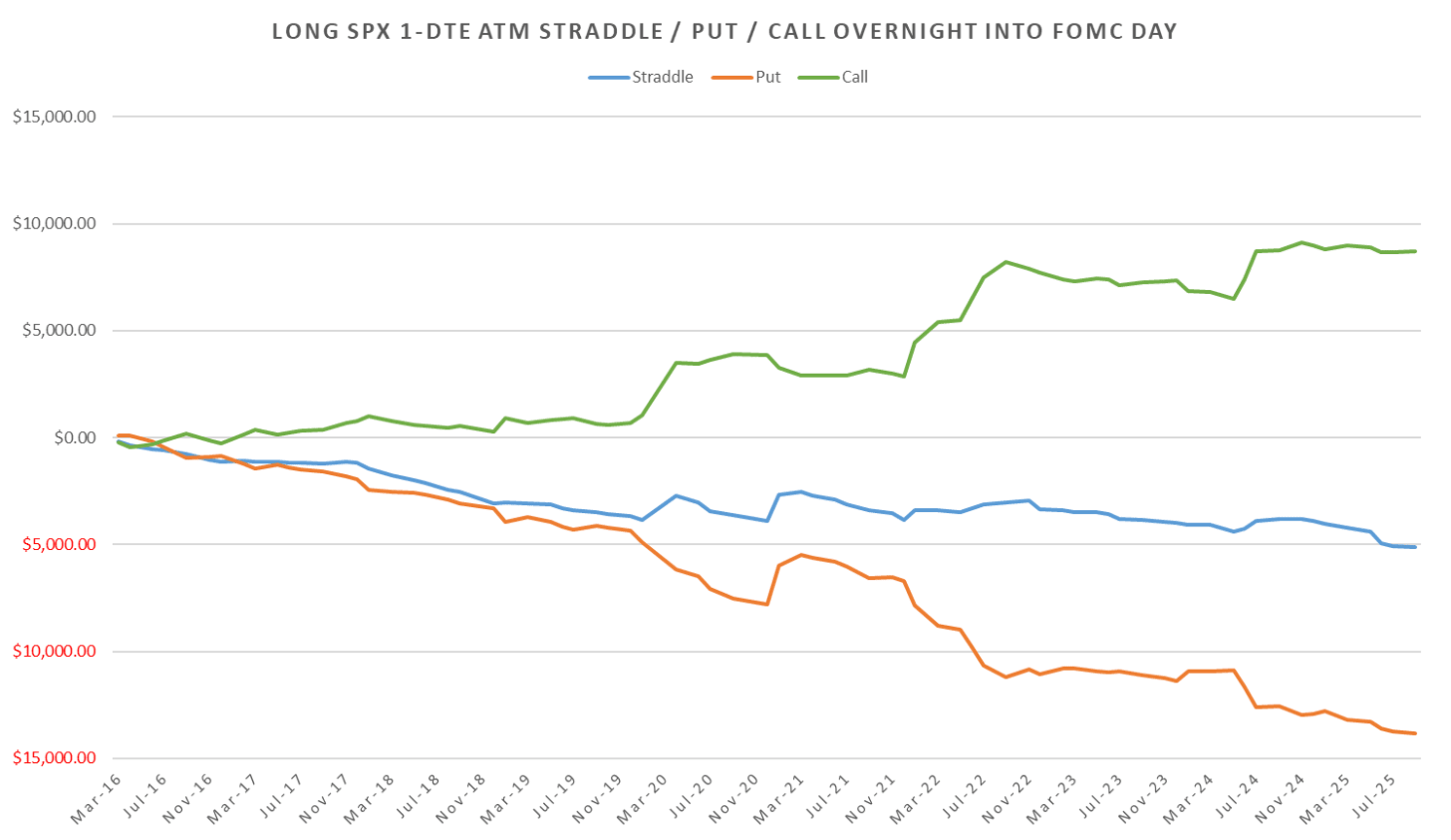

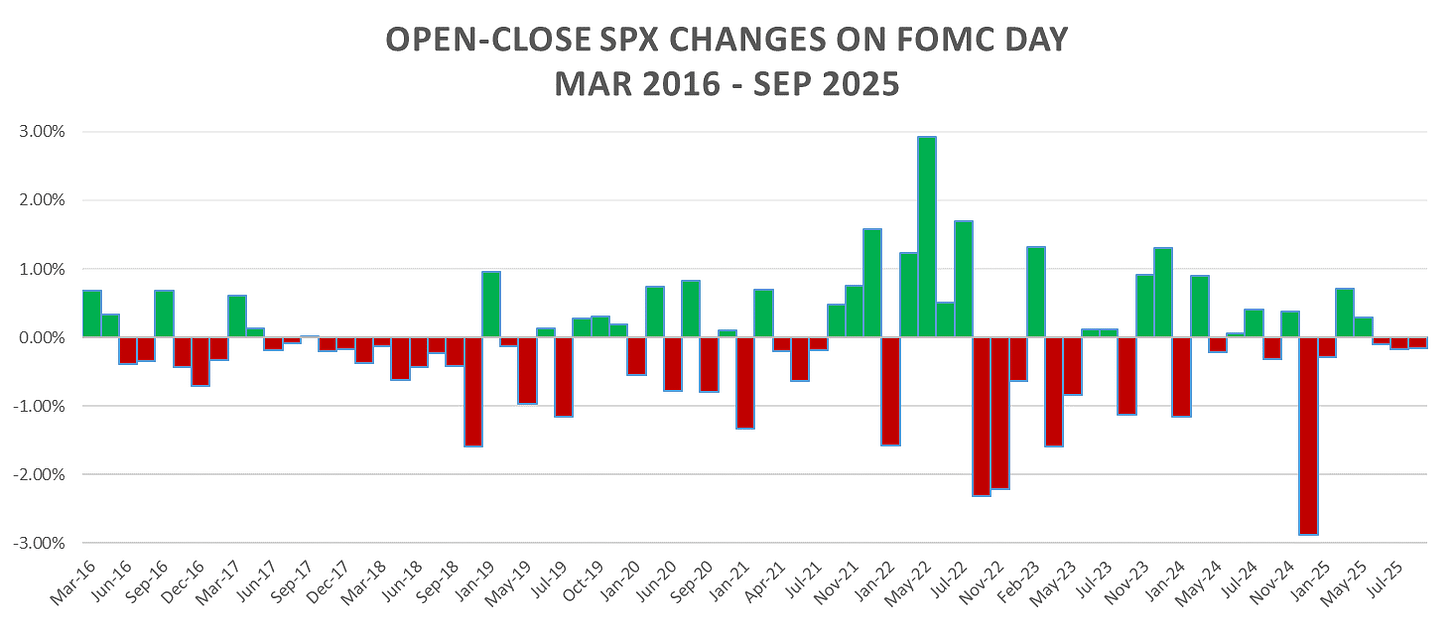

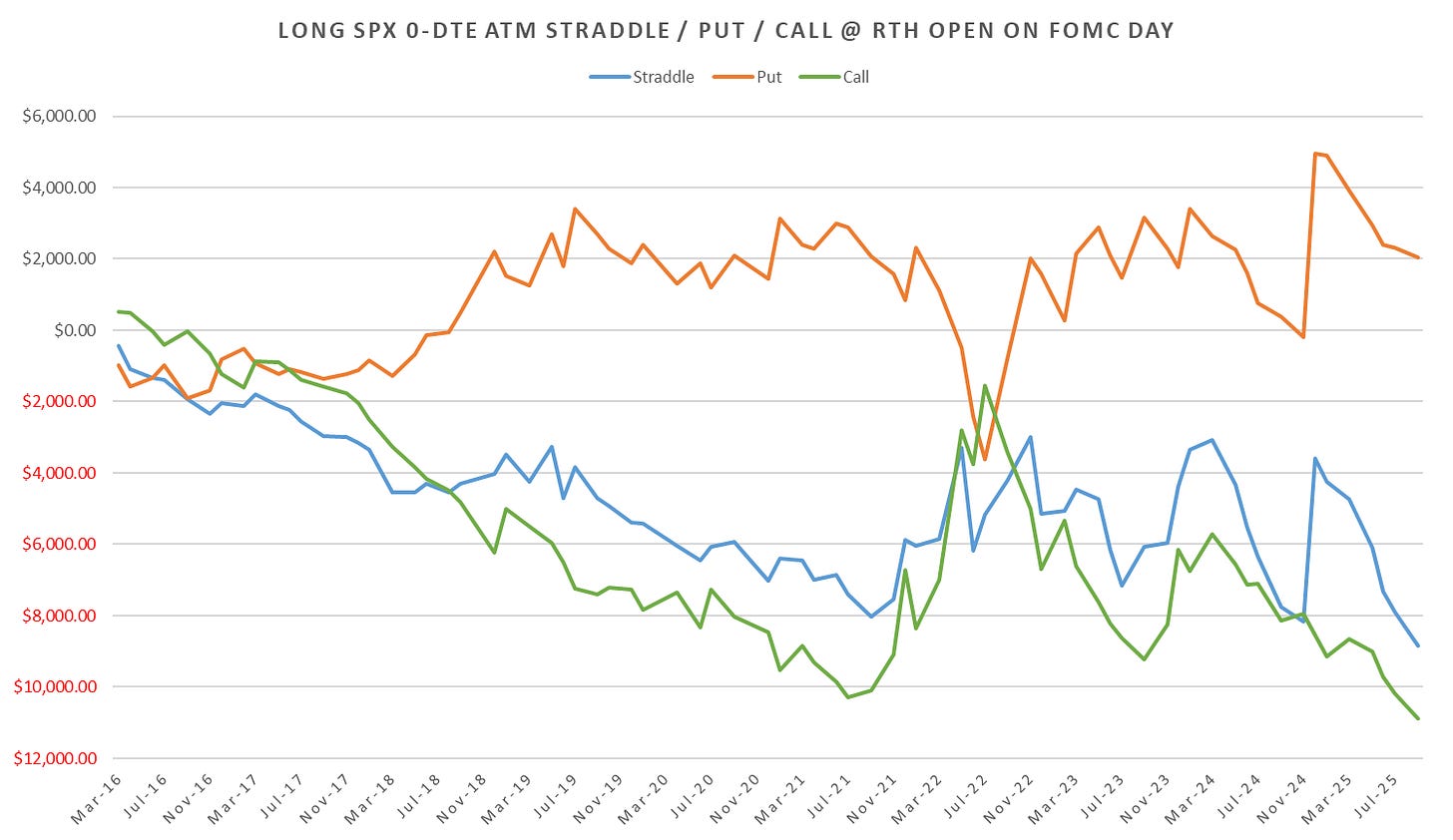

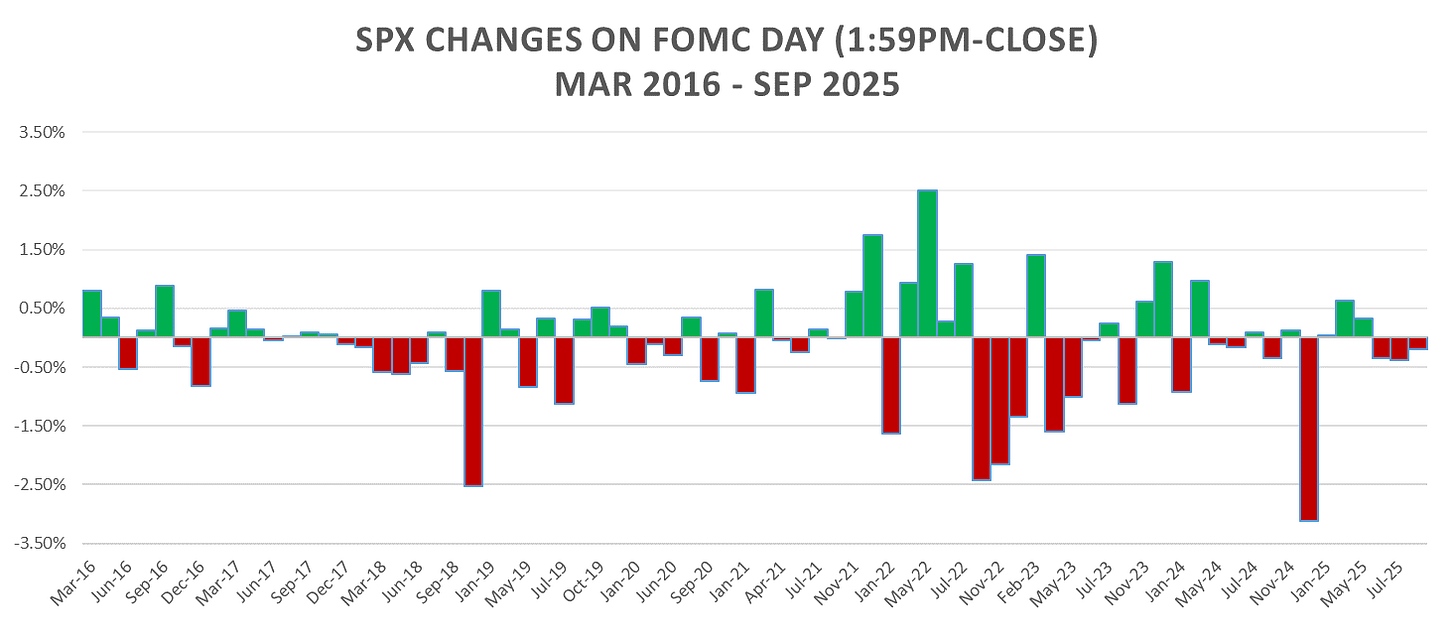

Updated 1-DTE & Intraday SPX Straddle performance:

Note: All charts represent $200k notional bet size (ex. ~3 XSP at 6000 SPX)

1-DTE

Overnight Straddles

RTH Straddles

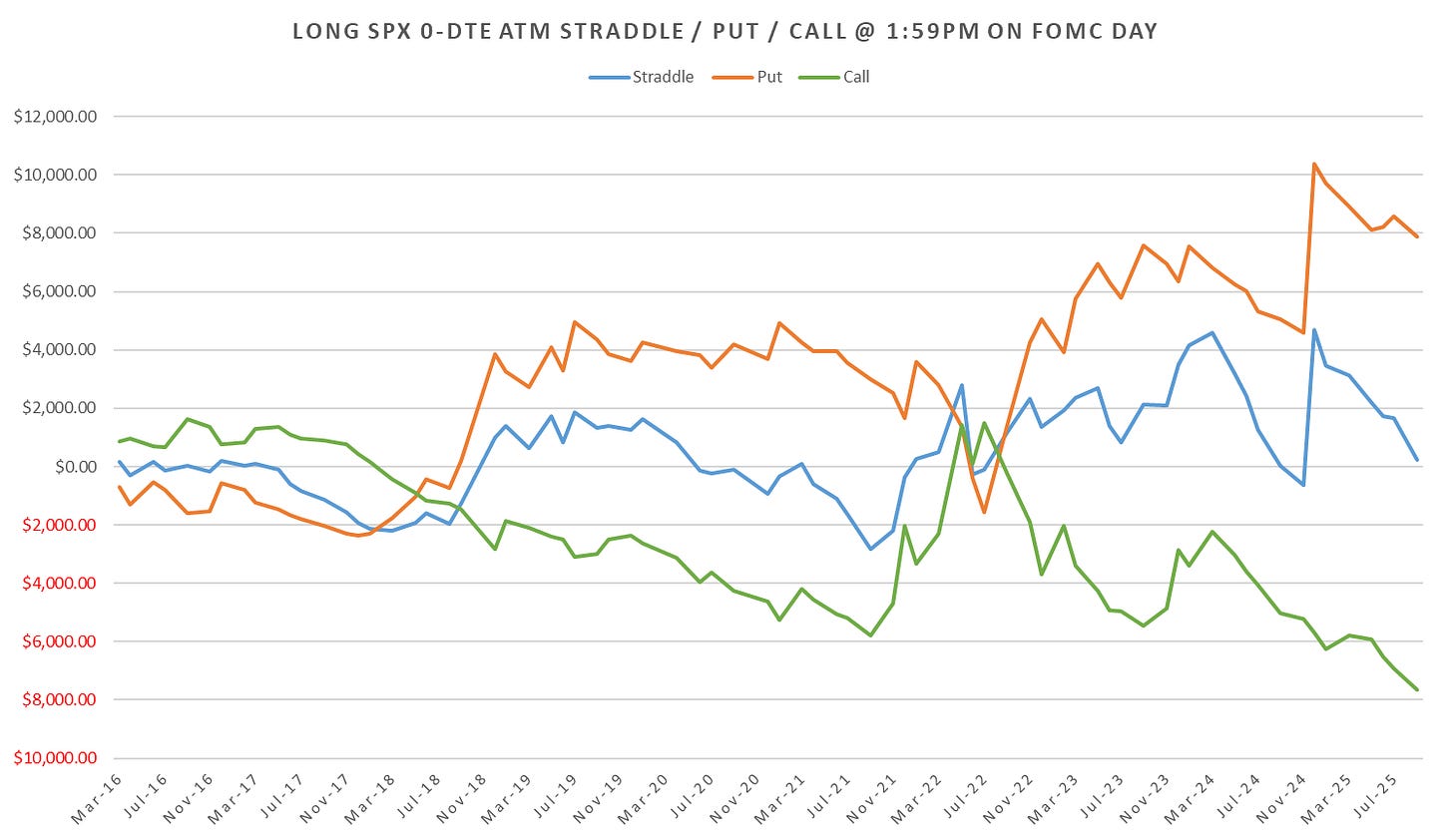

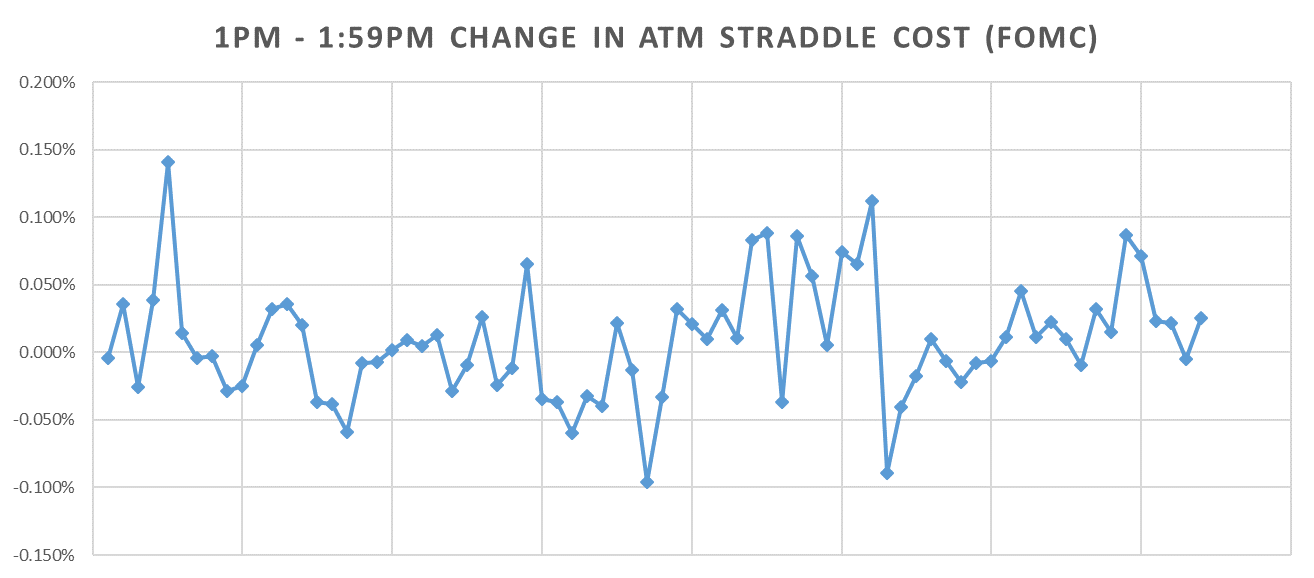

1:59pm

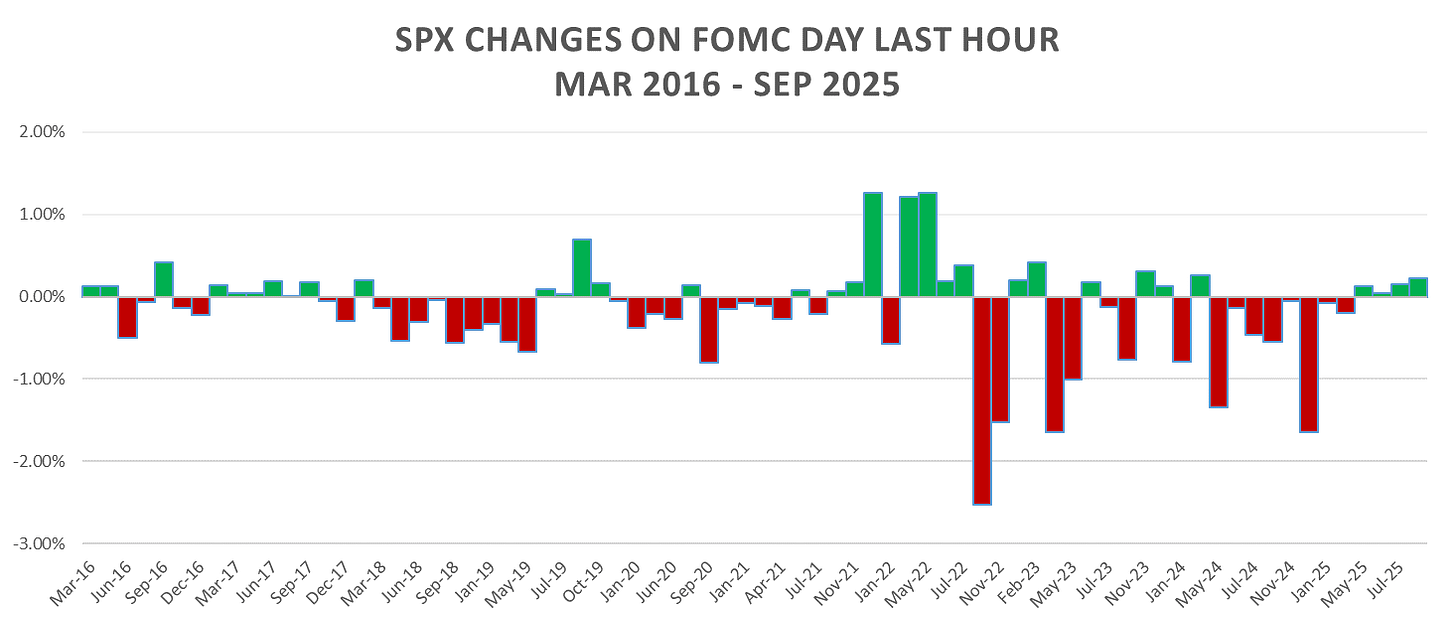

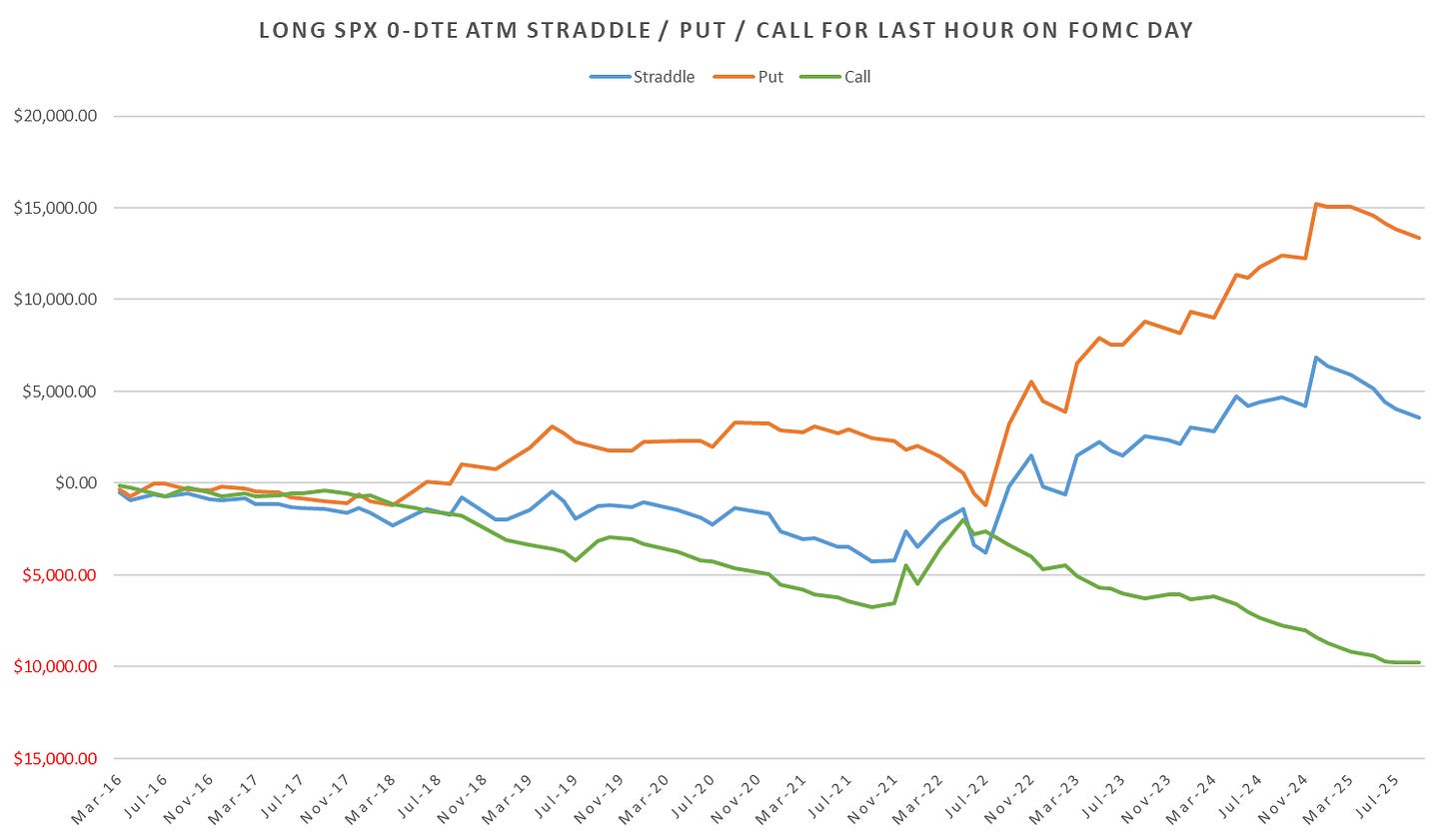

Last Hour

Last hour SPX put cost %:

YTD the last hour performance is increasingly flat / up as Fed is back on the easing cycle with dovish statements.

Intraday Straddle Cost - Hourly

Bump in vols during the hour leading up to FOMC continues.

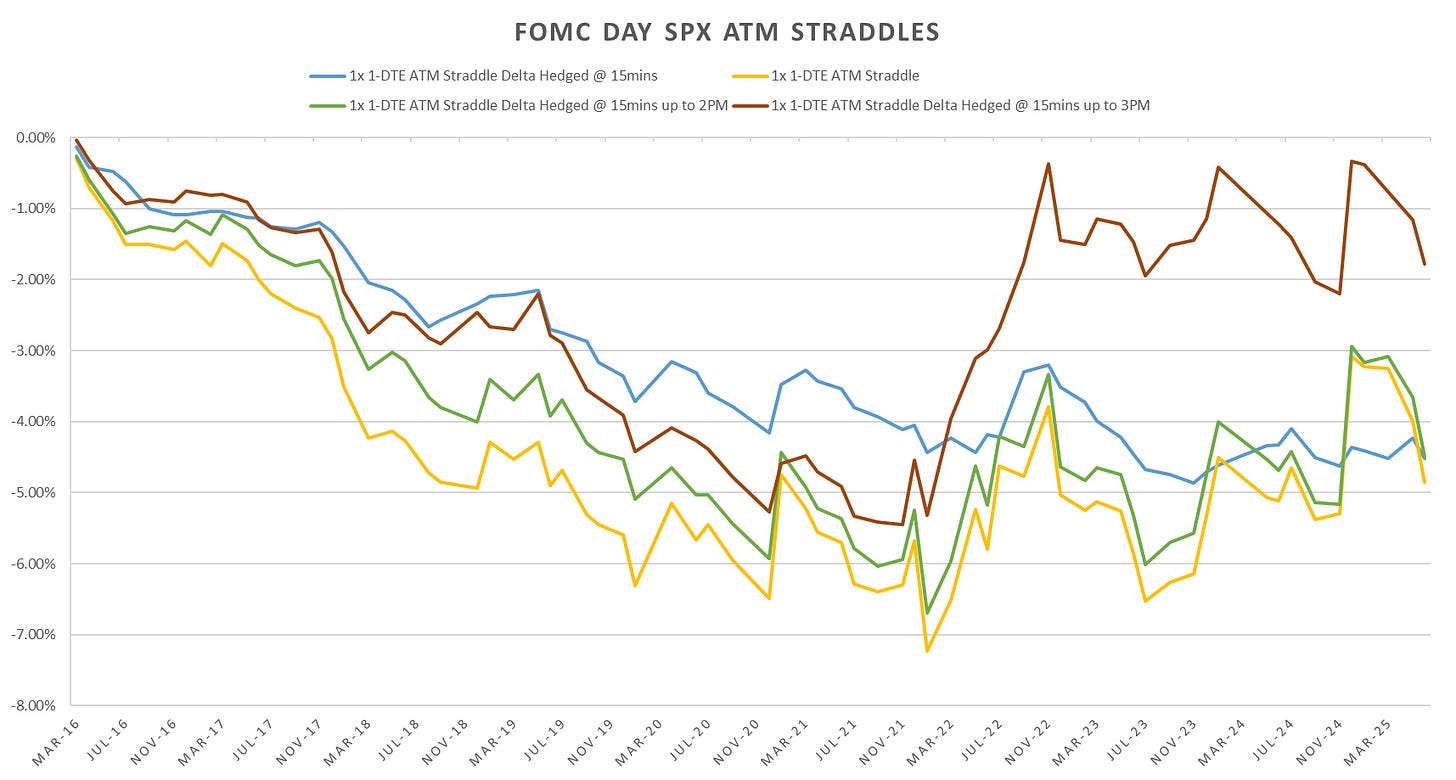

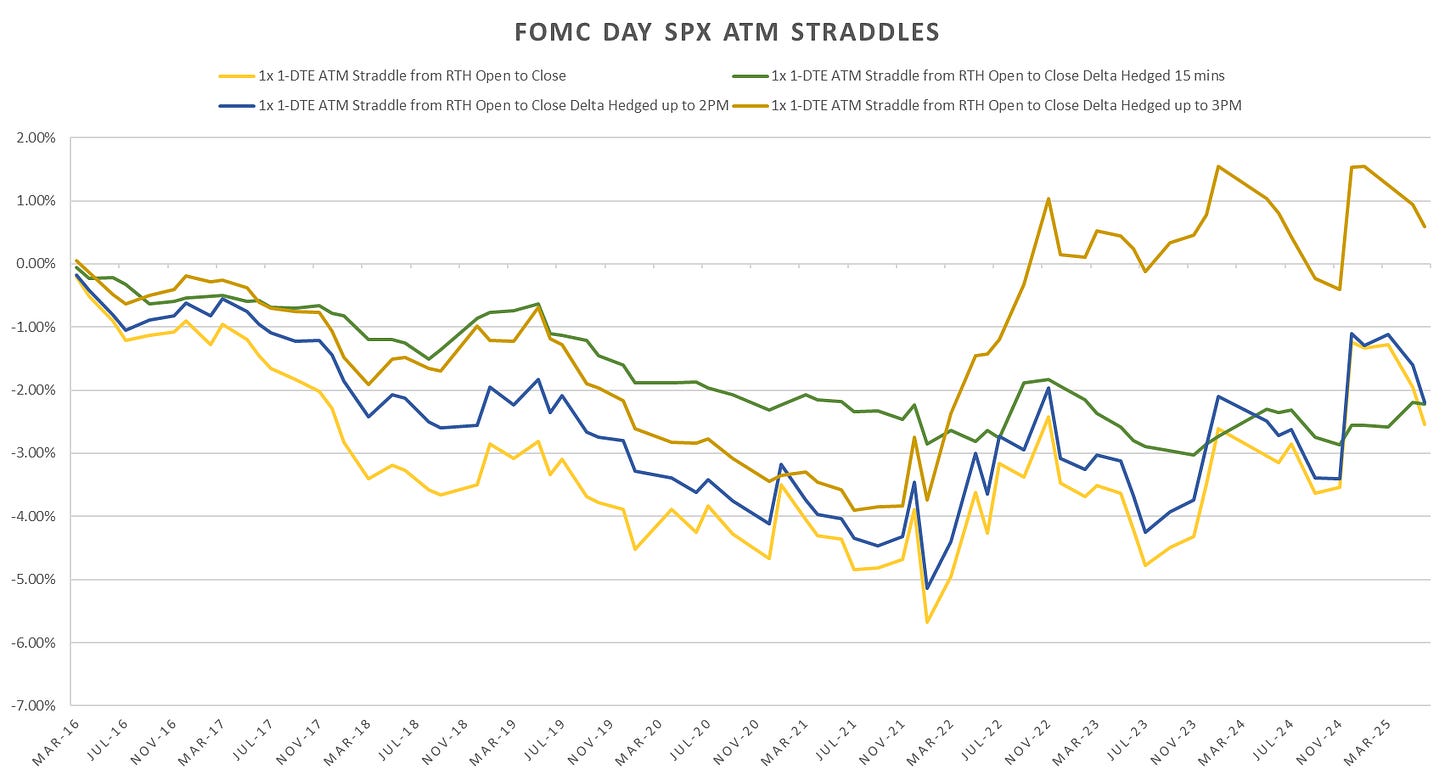

Delta Hedged Straddle Performance

Repost from previous FOMC:

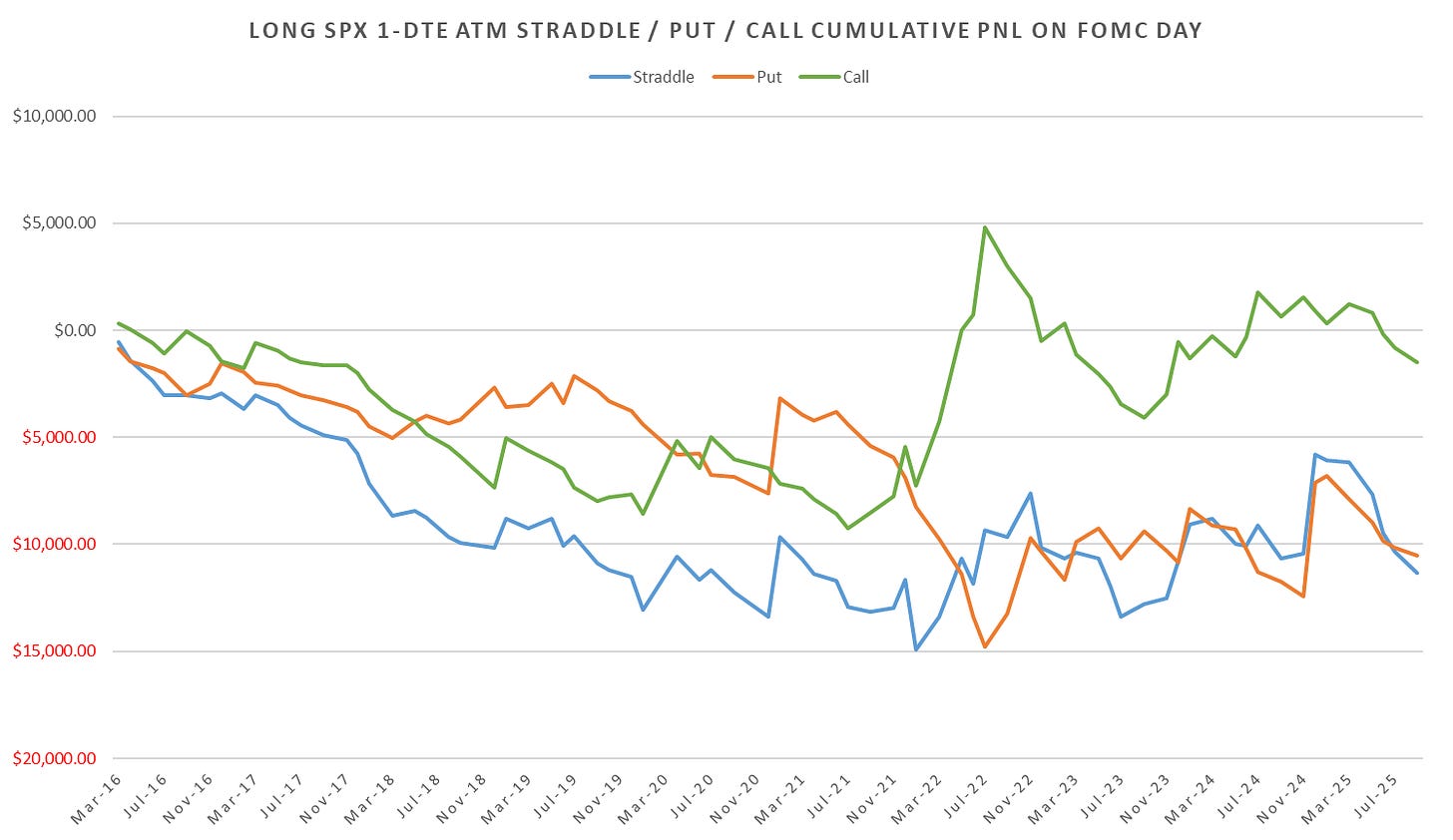

Comparison between between unhedged long 1-DTE SPX straddle & the various delta hedging schemes. Post 2022, as expected given the dominance of last hour vol, hedging long straddles up to 3pm and then not hedging into eod produces ‘best’ relative performance with all the gains mostly happening ~ mid 2022.

Avoiding the overnight decay and instead buying the straddle at US RTH open actually sees positive performance by a smidge over the 10 year period. Delta hedging up to 3pm then not hedging last hour produces highest pnl.

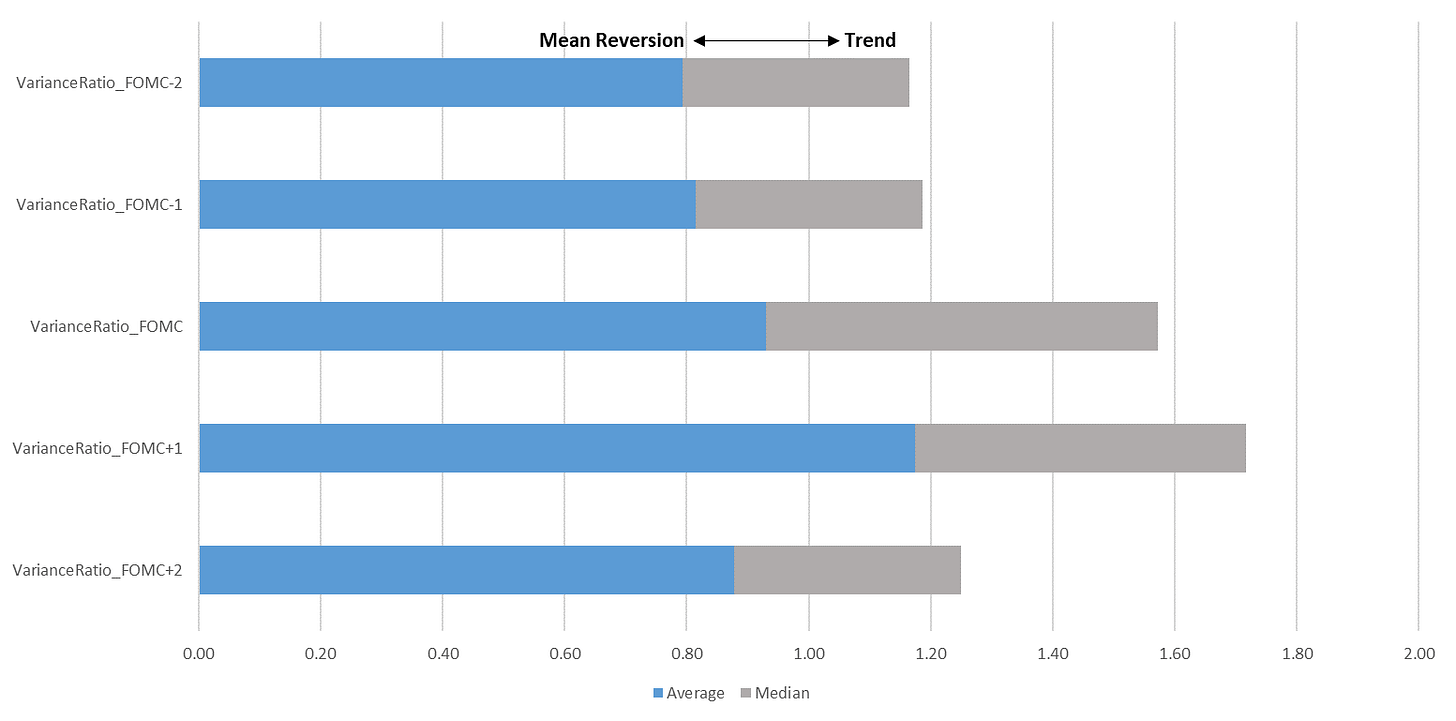

Intraday 5min variance ratio showing pre FOMC intraday mean reversion with trend pickup on FOMC day (post 2pm) that continues into next day. By FOMC+2 back to mean reversion.

Have a great day!