0-DTE popularity is keeping ETF issuers busy! Over the weekend some news dropped on filings for 3 new 0-DTE ‘income’ based ETFs.

(https://x.com/ETFhearsay/status/1890546137259450528)

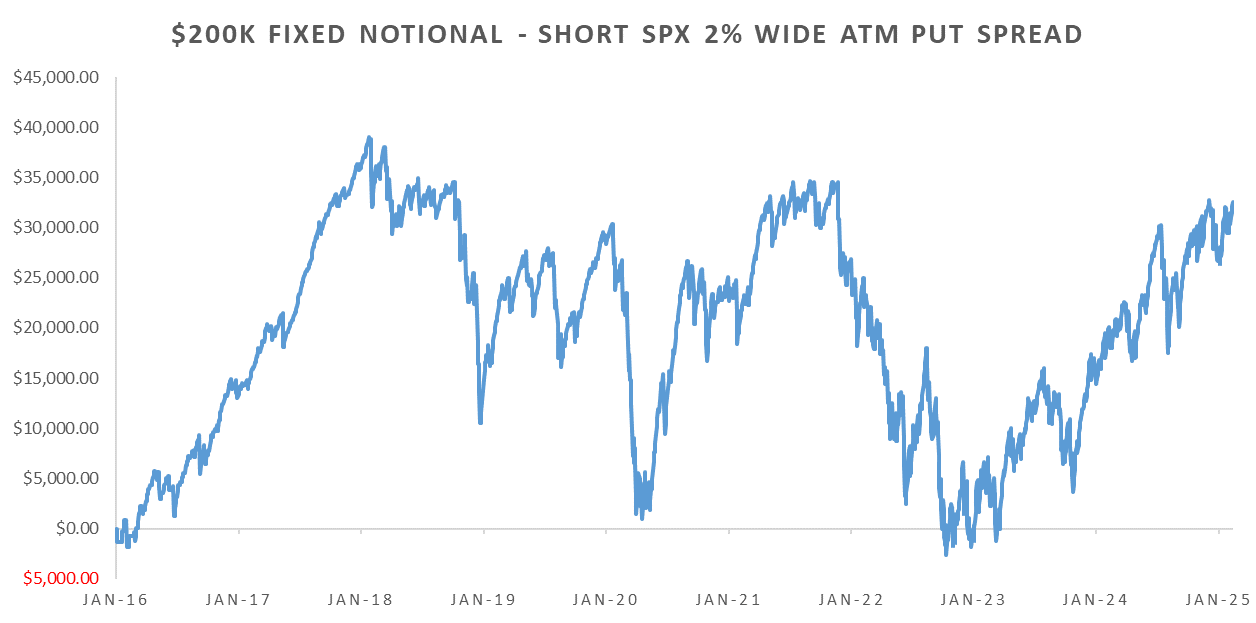

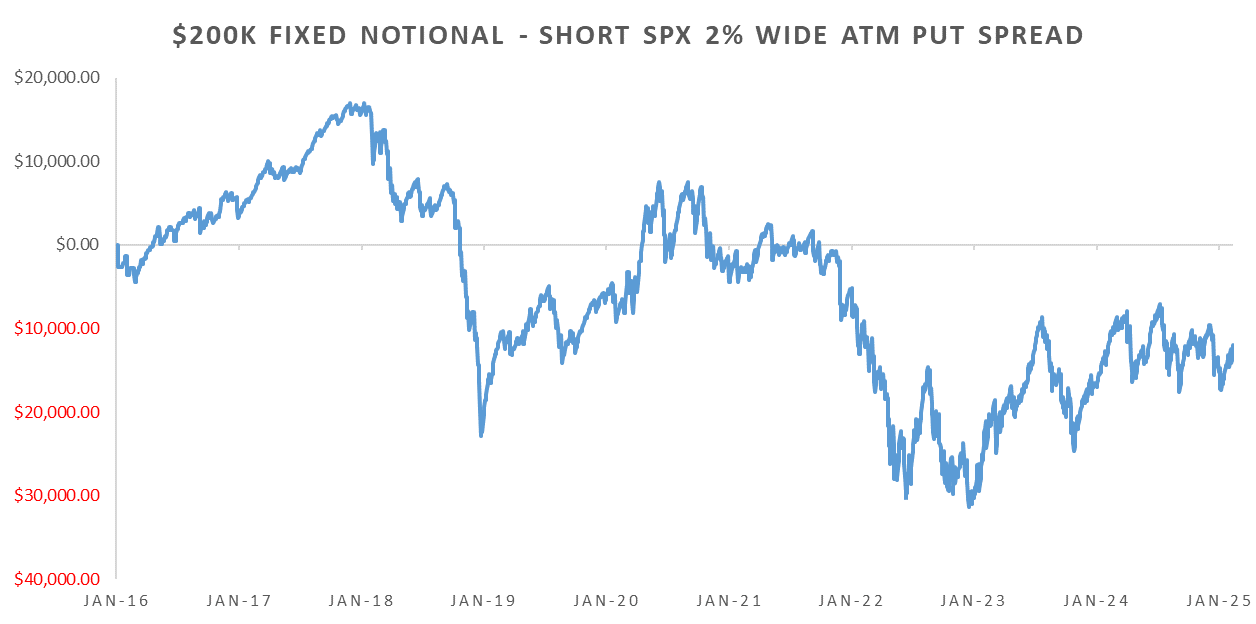

Ignoring the long SPX leg of the trade, lets take a look at the put spread performance. looking at the SEC filings we see the proposed structure is likely a 1-day ATM short put leg + a 1-day 2% OTM long put leg (with a deep ITM call LEAP mimicking a long SPX proxy.)

2016 - Jan 2023 ‘income’ would’ve been -2.5k$ over 7 years total if you had used $200k notional to replicate the same put spread selling strategy…

Edit: As suggested in the comments, perhaps the ETF will sell 0-DTE Put Spreads opened at US regular trading session open.

Foregoing the overnight premium makes it a net drag over the last ~10 years outside of 2017. As outlined many times in posts, the overnight drift remains the largest contributor to returns for global indices.

Why did you use 1dte rather than 0dte (as per the prospectus) for the short put-spreads?