Previous:

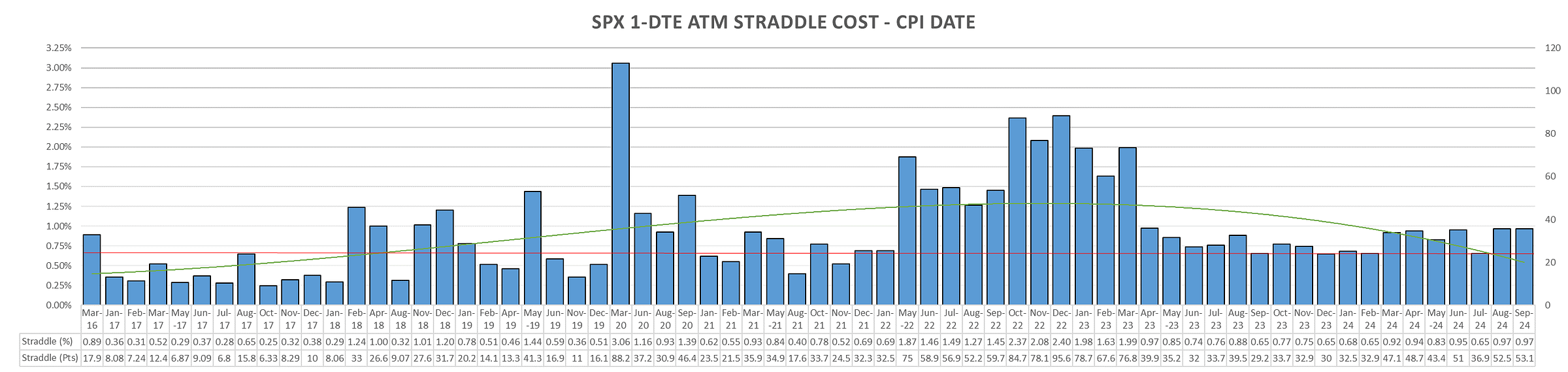

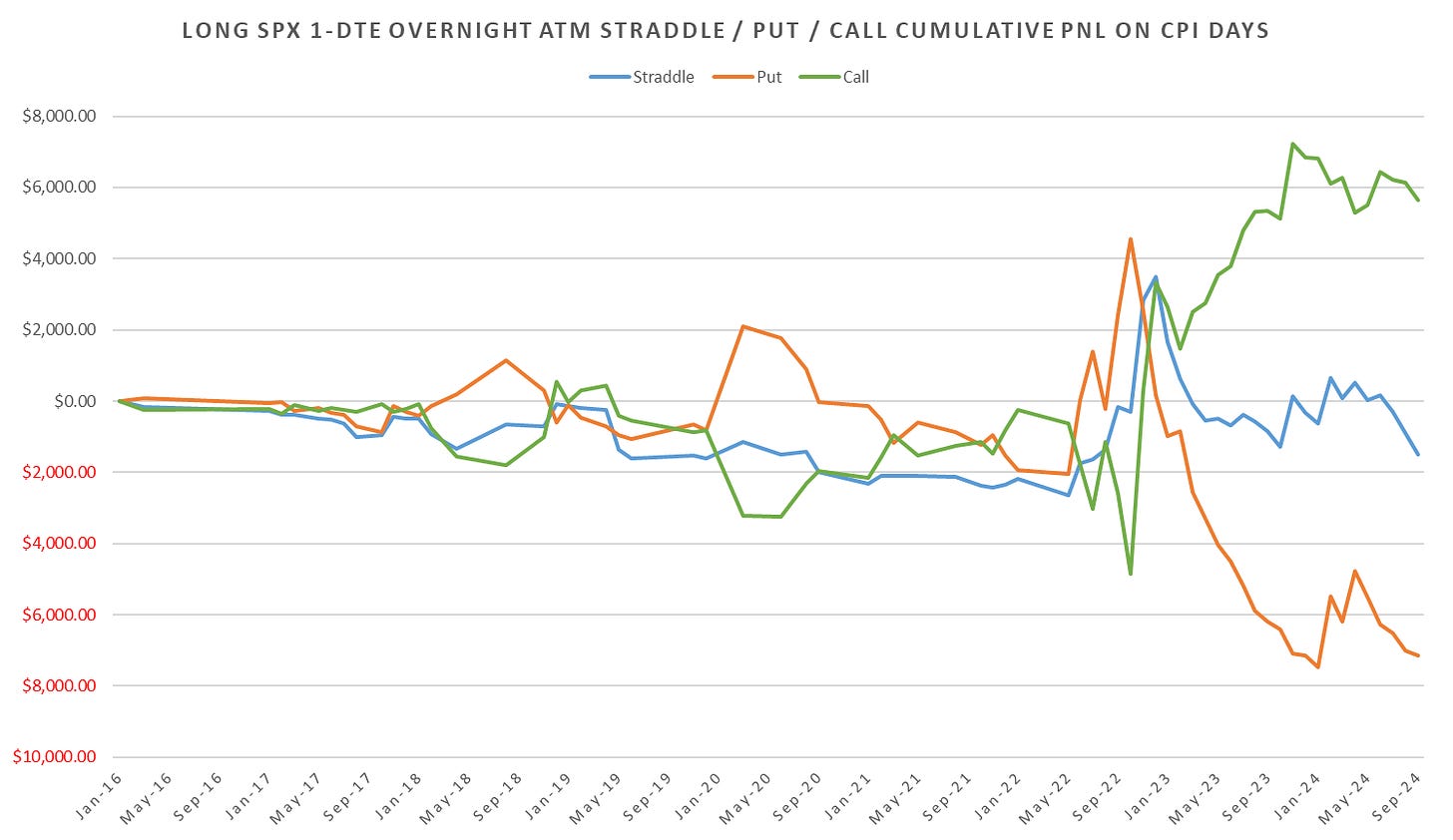

SPX CPI 1-DTE Straddles ~70 bps pre data release, back to post 2021 lows as inflation falls out of ‘key’ data window, replaced by labour market data.

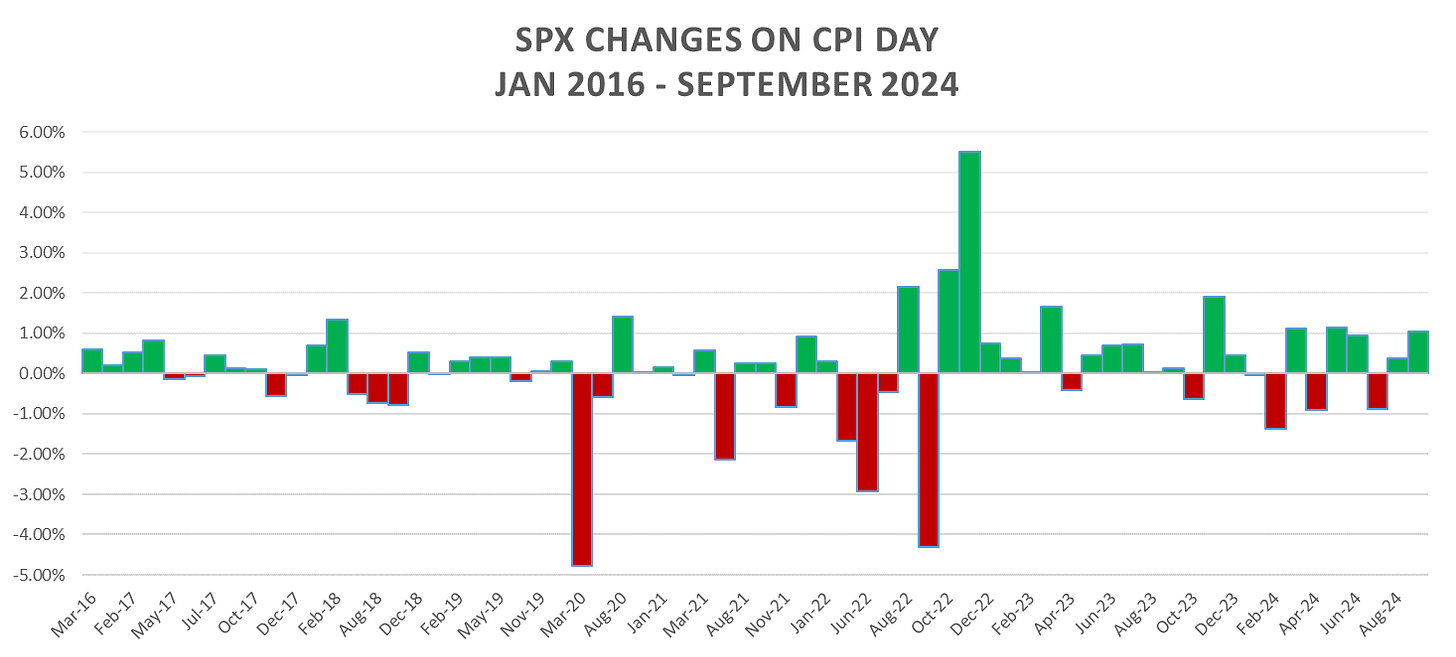

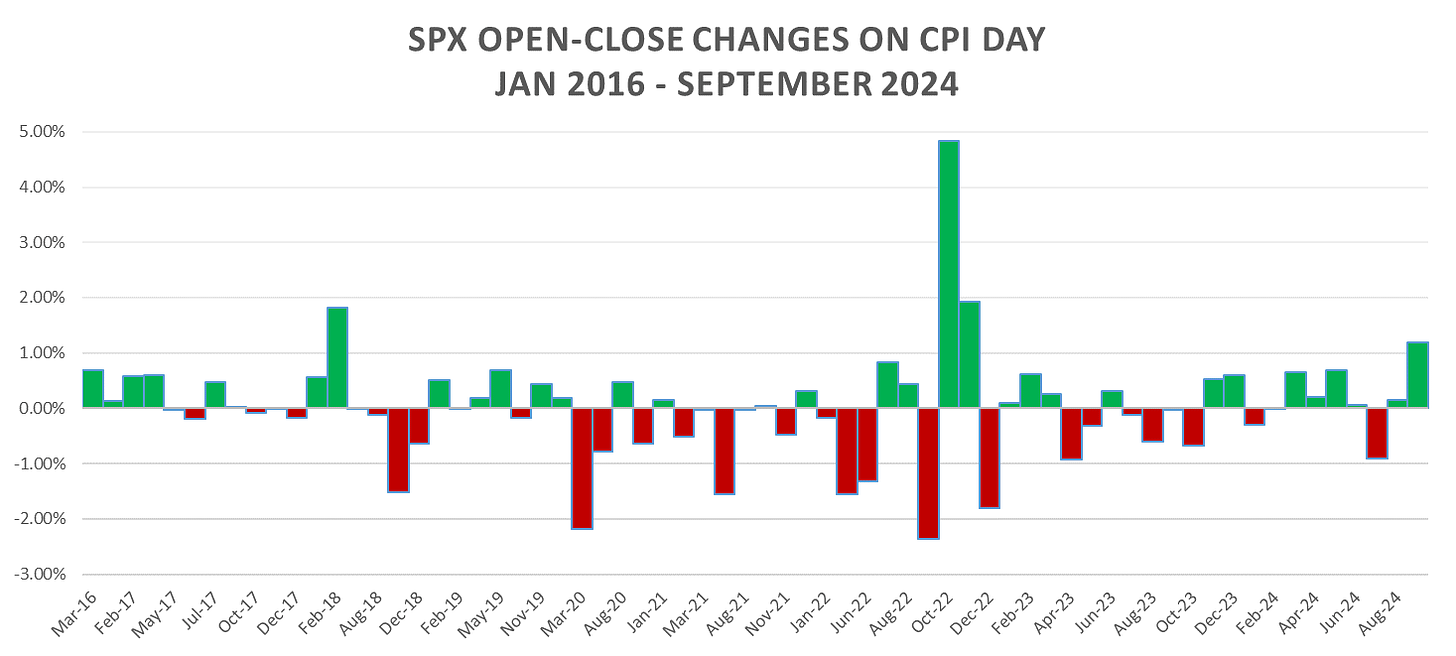

With the current setup, unless we beat hard on the upside, concerns appear to be in the rear view mirror, at least for now. Largely positive reactions, however, given how much we already ran into the print, more likely to be churn into the weekend.

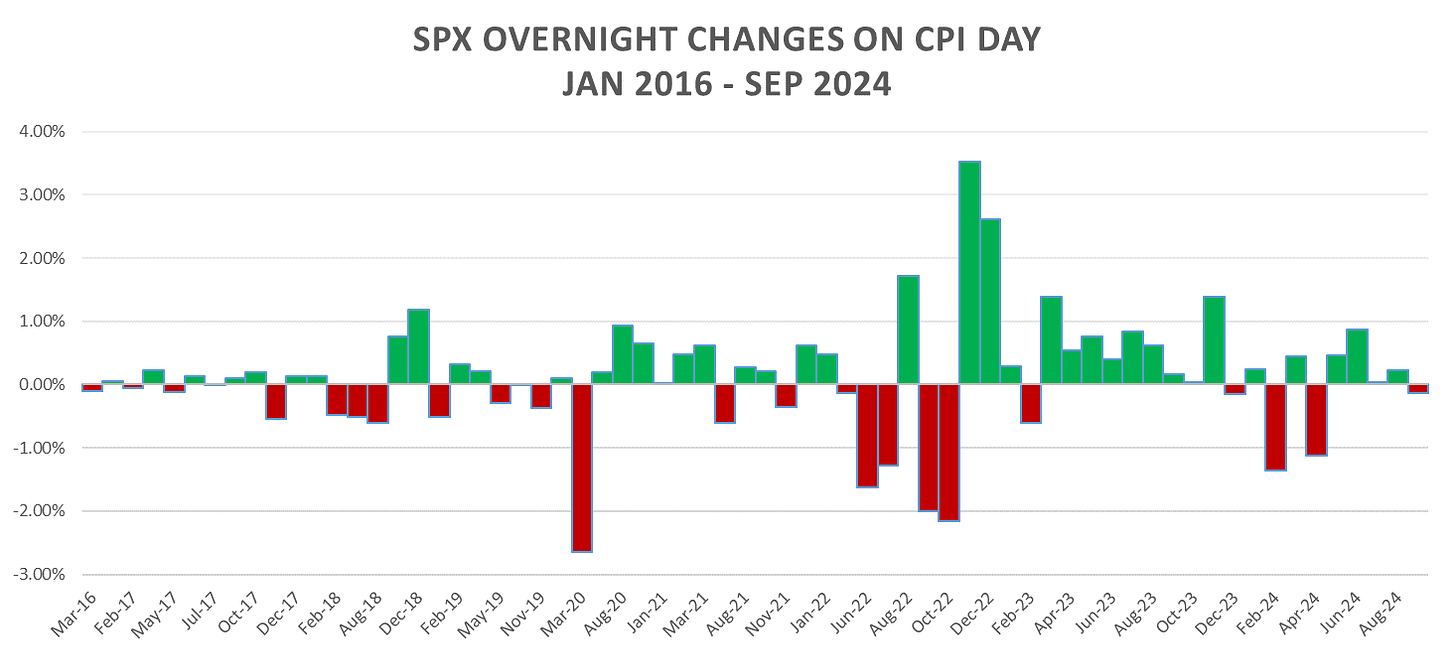

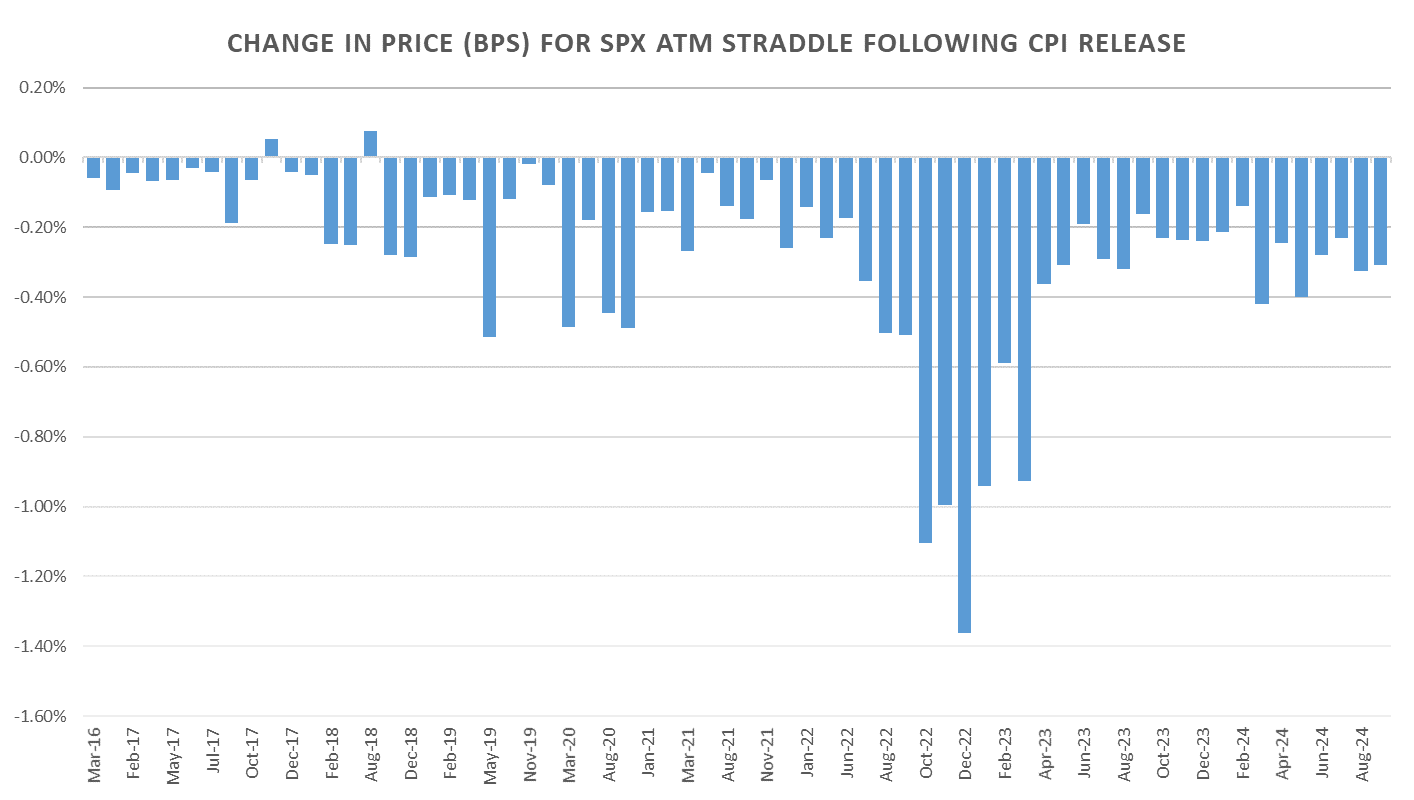

Looking at the reaction to CPI print itself:

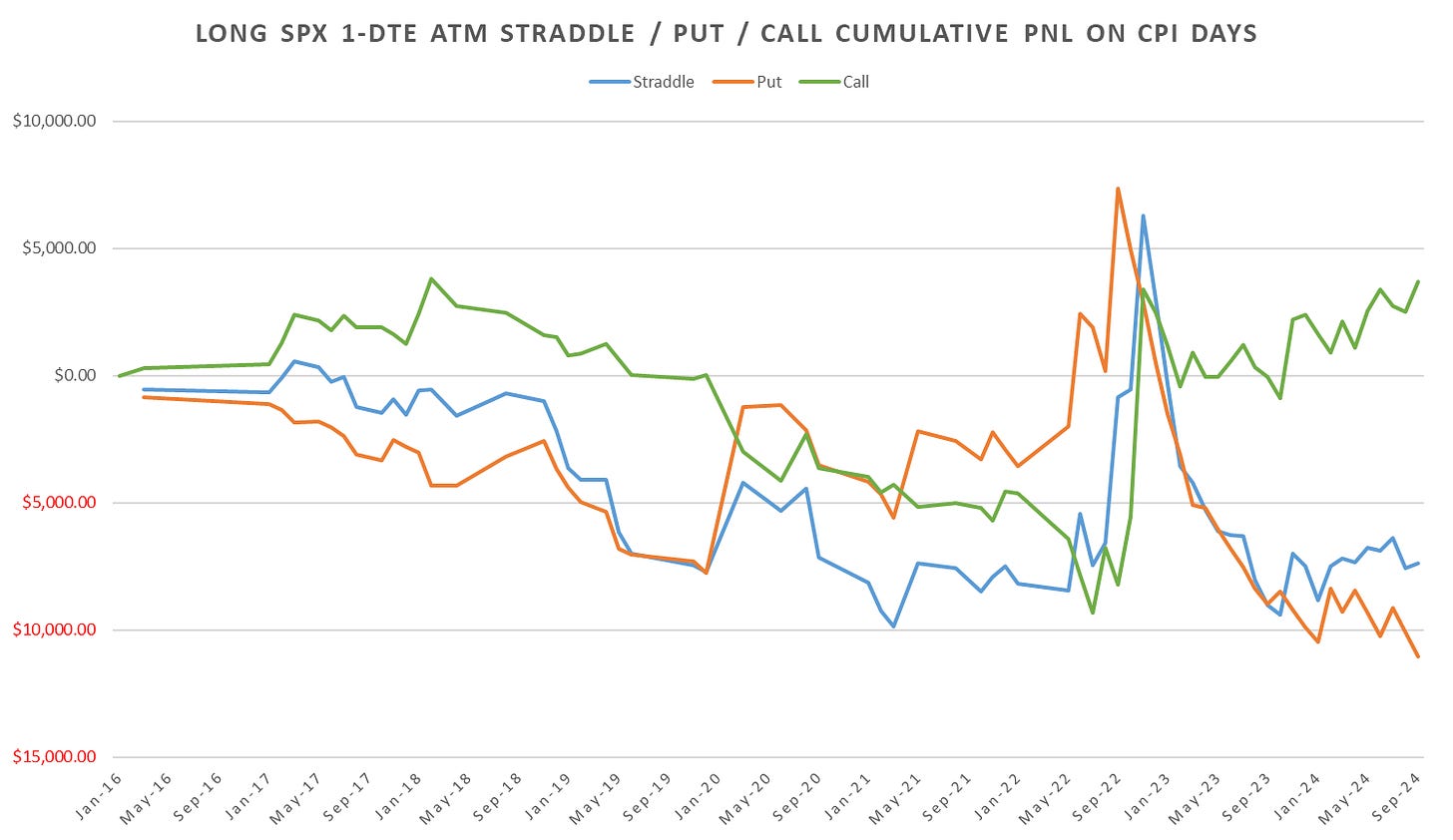

August / September CPI days had slightly elevated premium (~100bps) given the rate cut uncertainty. This led to larger premium burn for both months. Currently, less premium up front (70bps), somewhat flat/slightly positive returns when sub 70 bps straddles.

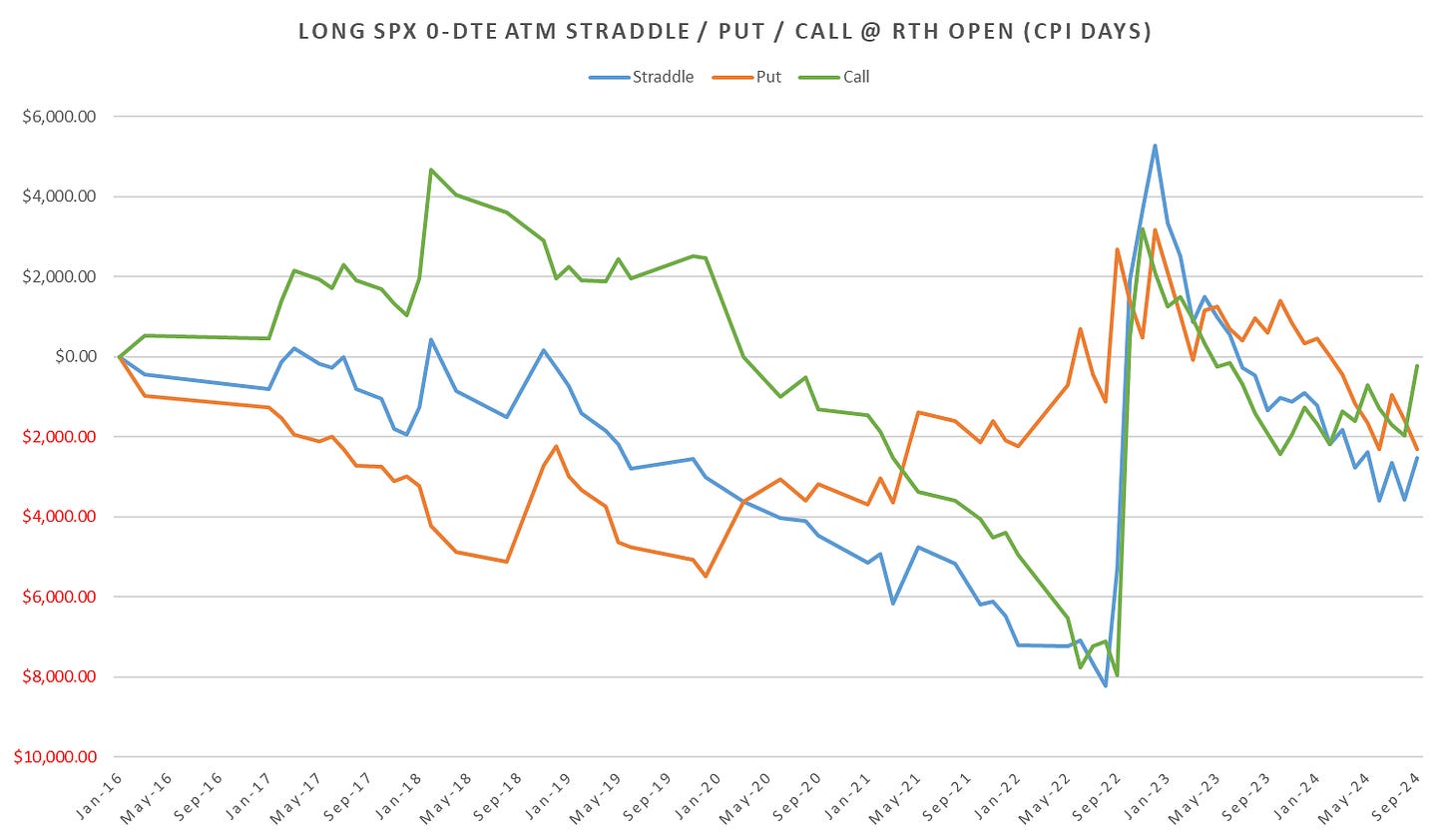

RTH Straddles / SPX:

Note: All $PnL assuming $200k notional positions ~3 XSP contracts.

Here are my Sep CPI estimates with almost-perfect track record:

https://arkominaresearch.substack.com/p/sep-2024-cpi-estimate?r=1r1n6n