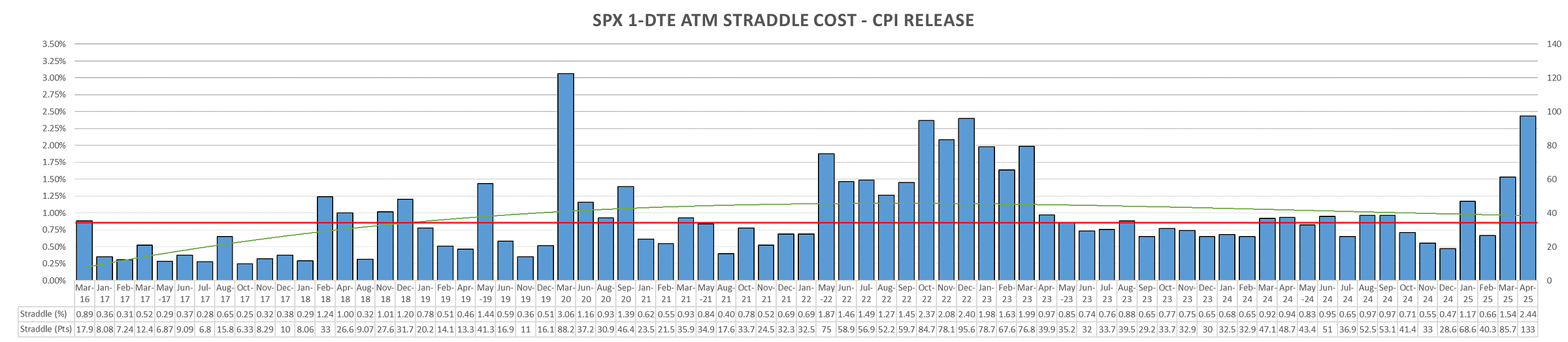

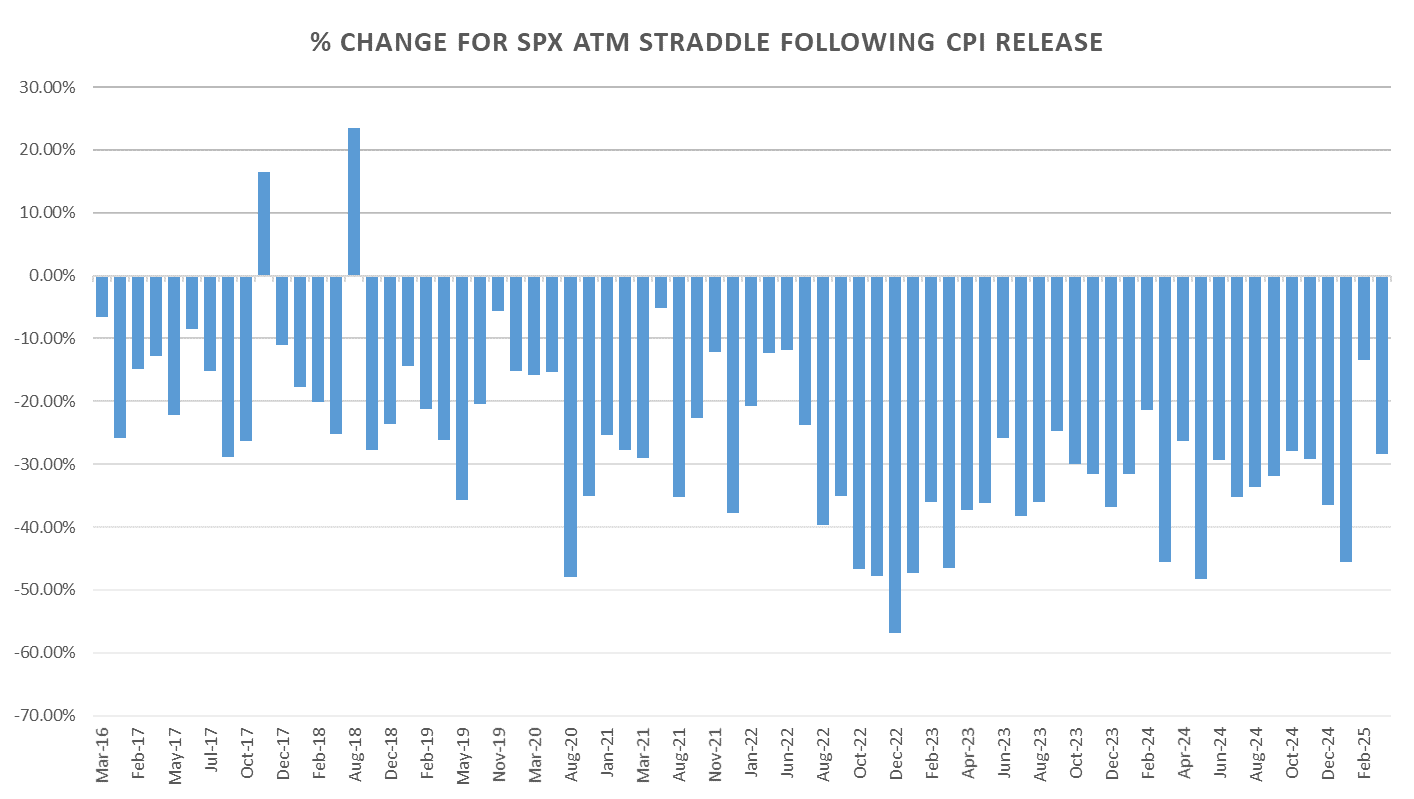

April CPI data is set to come out tomorrow pre market. After March & April data we are back to ~ average 2024 premium for CPI release:

CPI premium has been roughly in line with FOMC, below NFP premium throughout the last few years. Tomorrows premium only ~80bps, well below the March & April data (we saw much higher latent vol for last few data releases.)

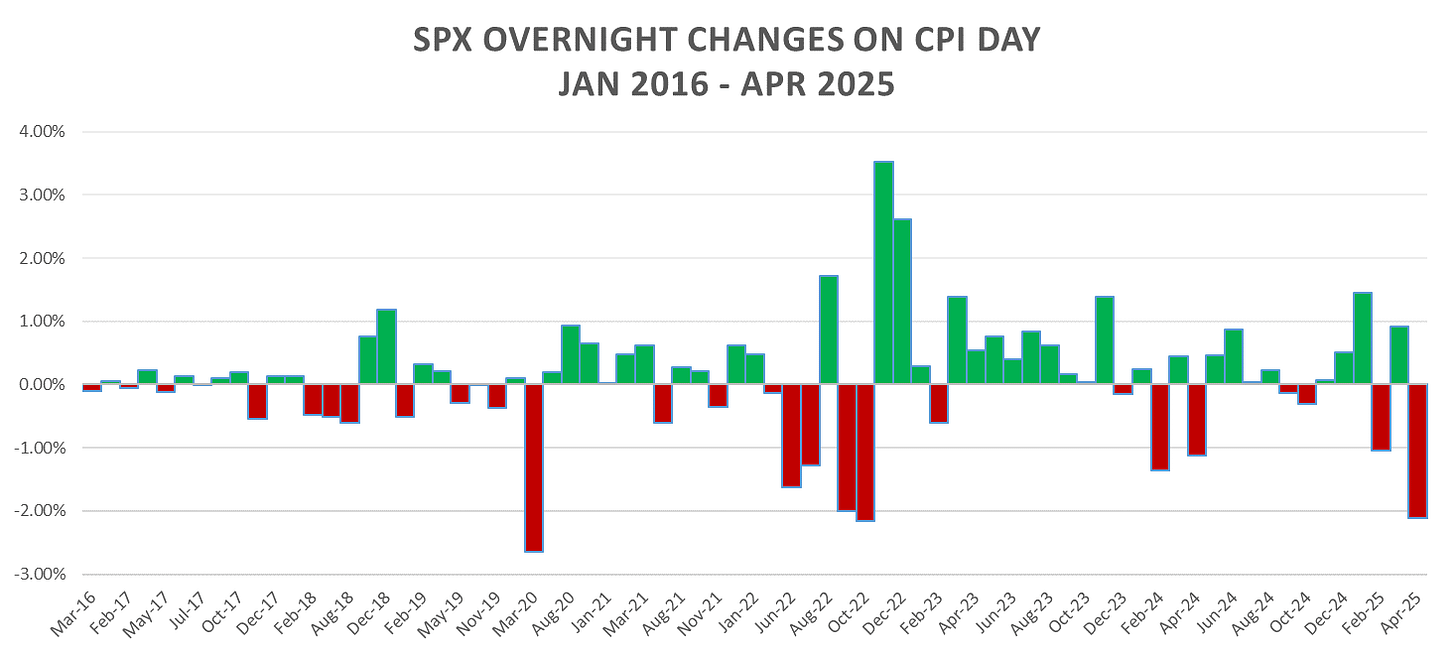

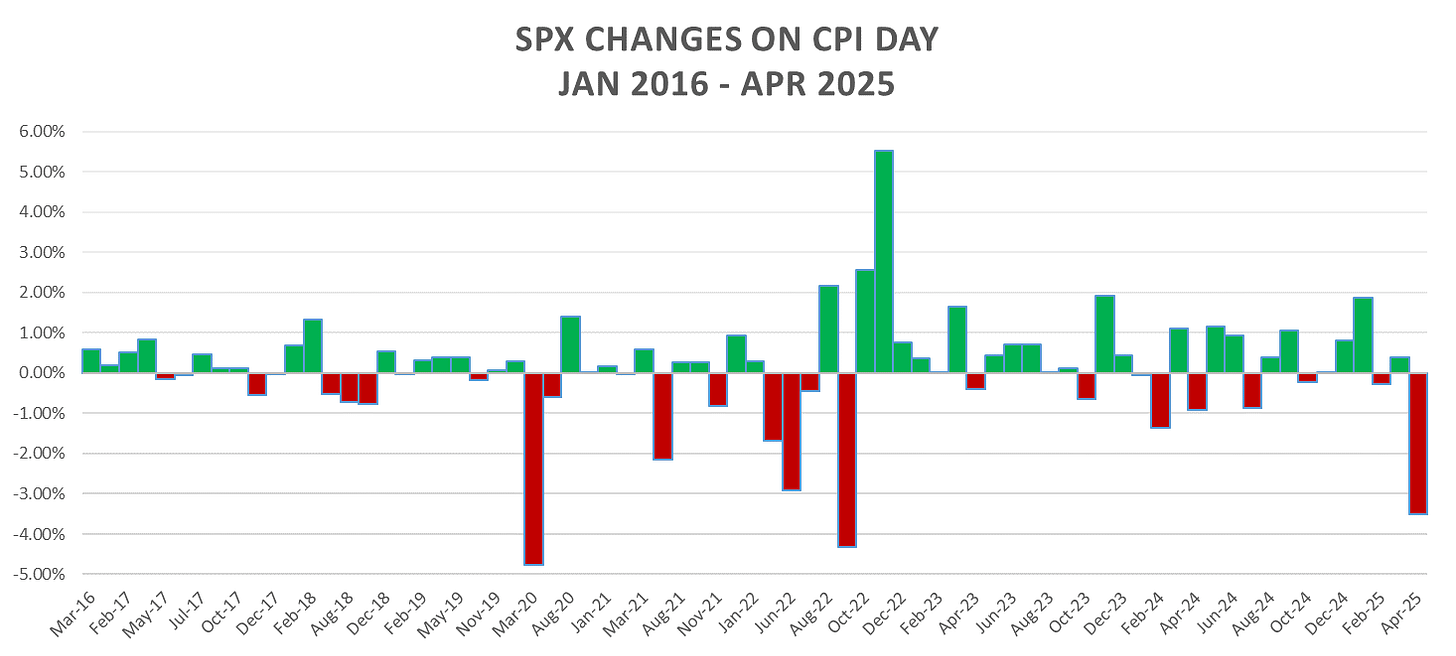

Banks across the board expect CPI to rise in April & expect CPI to spike higher as tariffs take effect. Yields have been pricing this in for the last few months already, so a cooler CPI print likely to push us slightly higher once again.

Markets had a negative initial reaction in Feb & April (although Feb print was a larger beat & April was lower and markets were already falling from tariff reaction.) As with NFP, its more about positioning going into the print rather than the actual number.

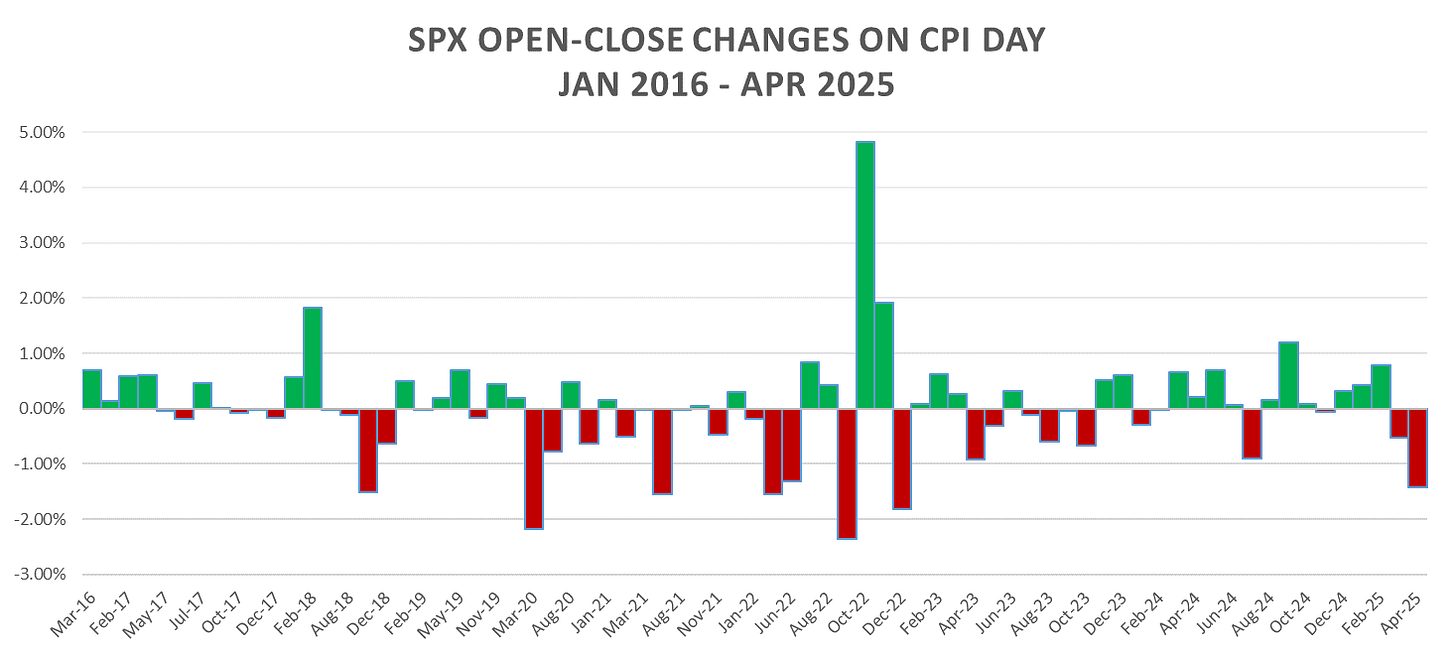

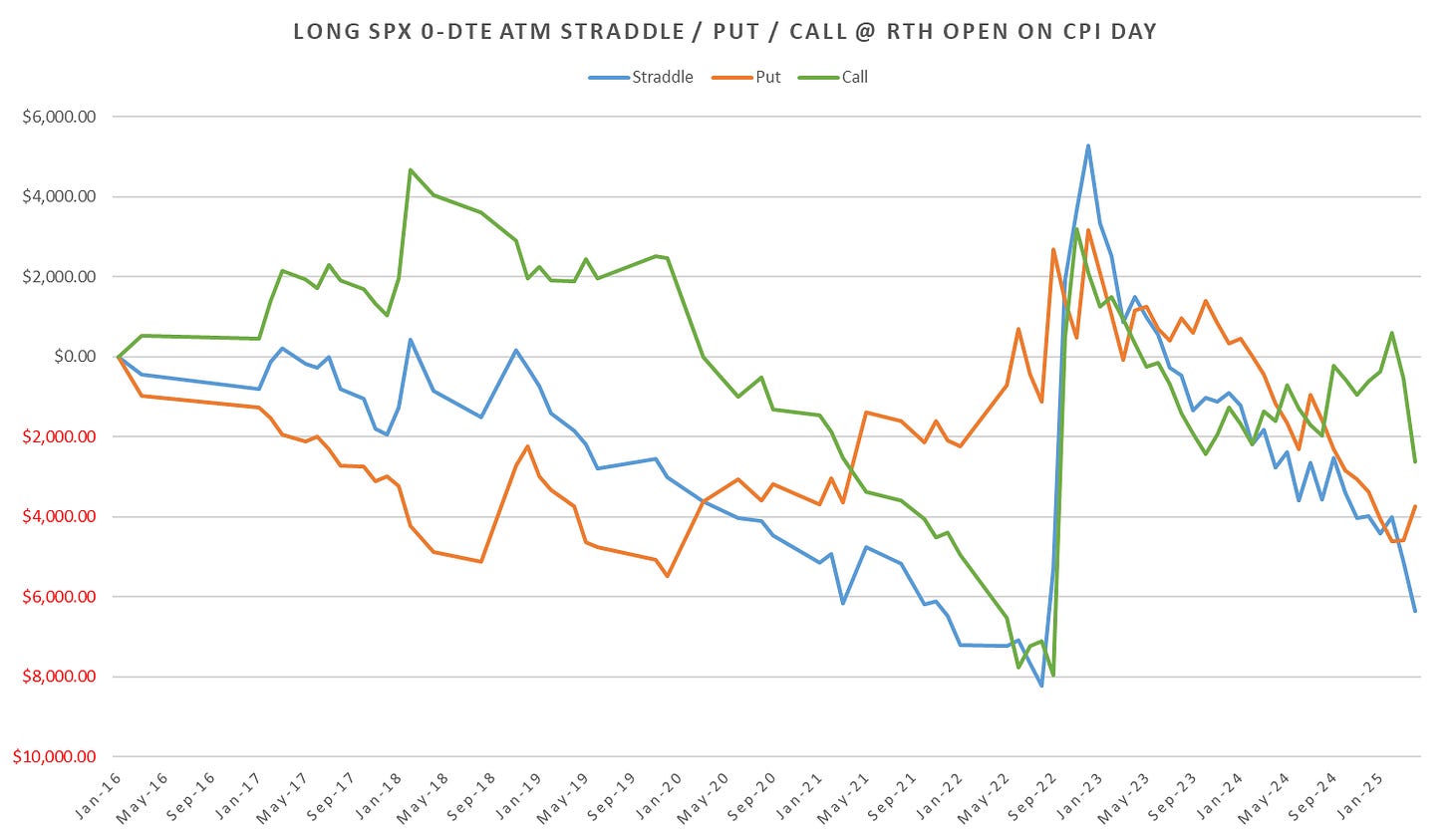

RTH Session:

RTH session mostly churn ever since 2022 scare, even April ended up trading within the breakevens.

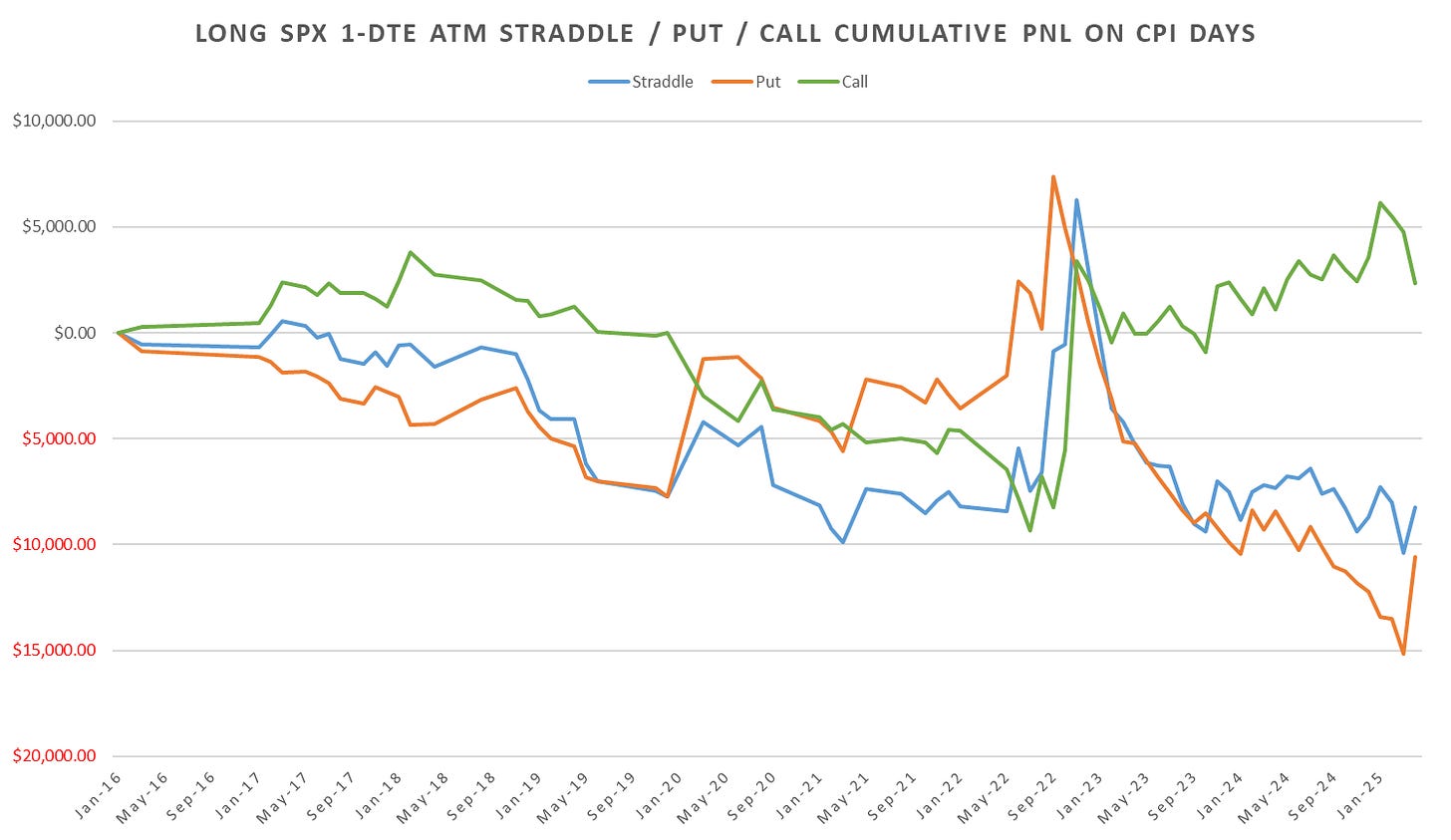

Full day performance:

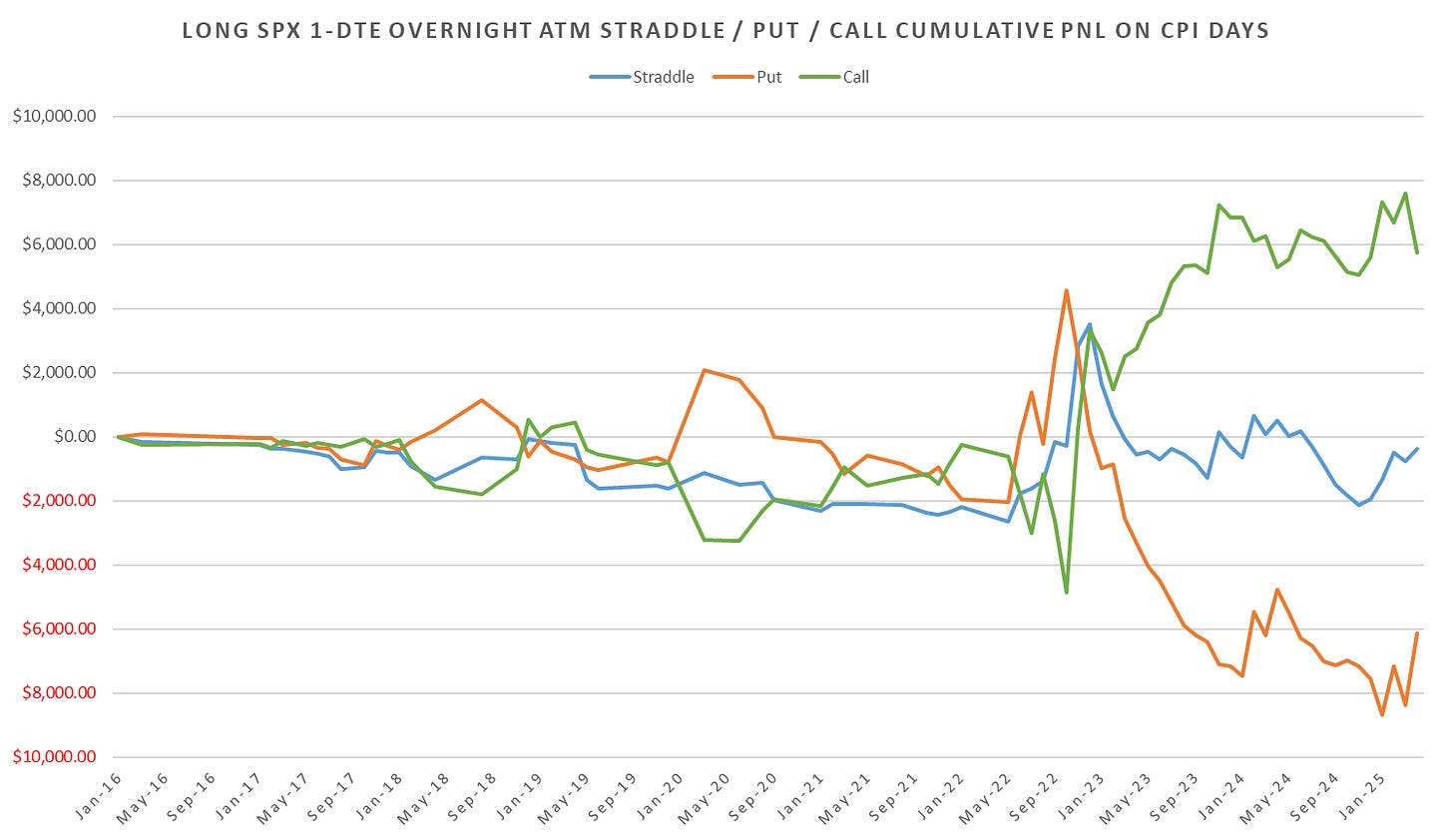

Post announcement premium change:

Have a great day!