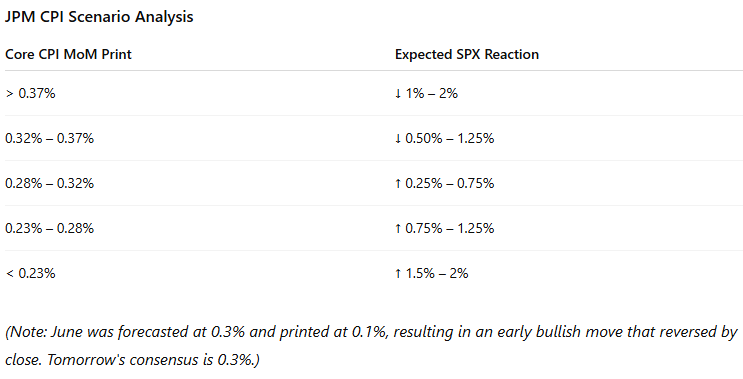

June CPI on deck tomorrow morning. We’ve seen 4 months in a row of weaker than expected prints, however latest NFP report showed larger jobs growth than anticipated launching DXY higher after the steady 6 month selloff.

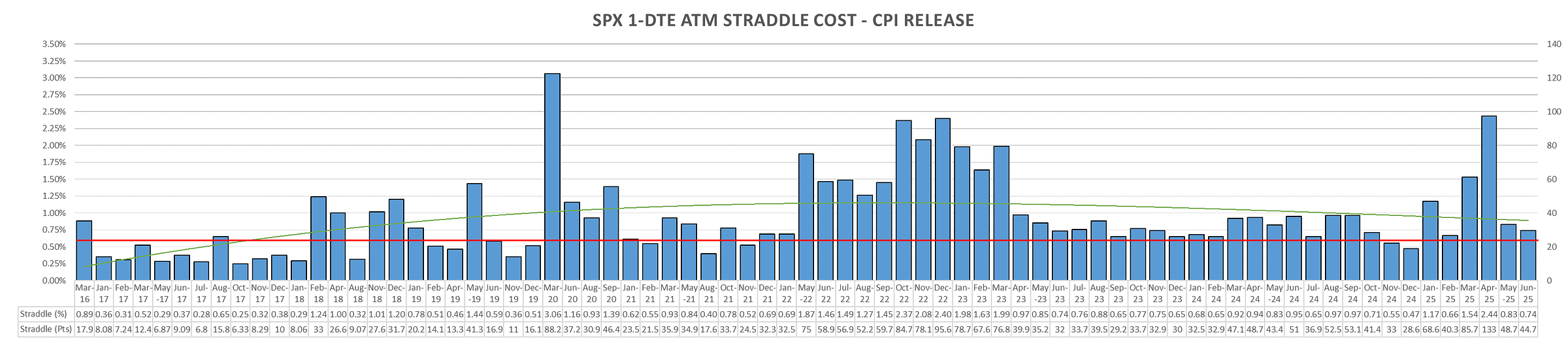

Market likely expecting a very ‘in line’ print given SPX straddles down to pre 2022 lows at ~58bps.

Historical SPX Options Performance:

All charts show $ performance based on $200k SPX fixed notional position size

Keep reading with a 7-day free trial

Subscribe to Vol Vibes to keep reading this post and get 7 days of free access to the full post archives.