Indices once again sitting at ATH with the delayed Sep CPI release tomorrow morning. Market feels pretty confident rate cuts are coming despite inflation expected to remain above the 2% target rate.

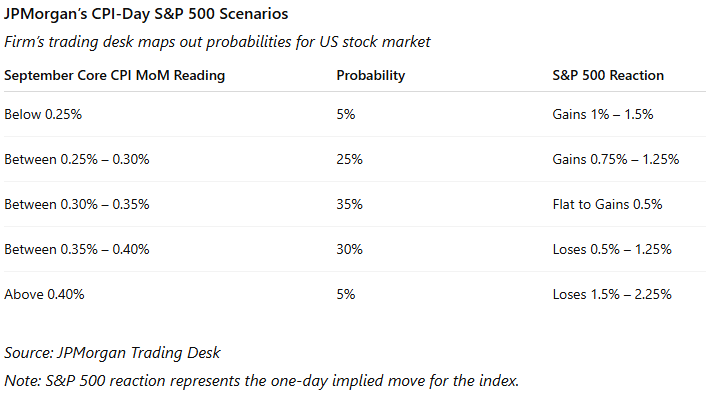

JPM lays out the probabilities for tomorrow. Without a large upside surprise unlikely to see any negative reactions. Quite alarming that we have essentially embraced inflation climbing above 3% a year (and realistically way more if you go to the grocery store…)

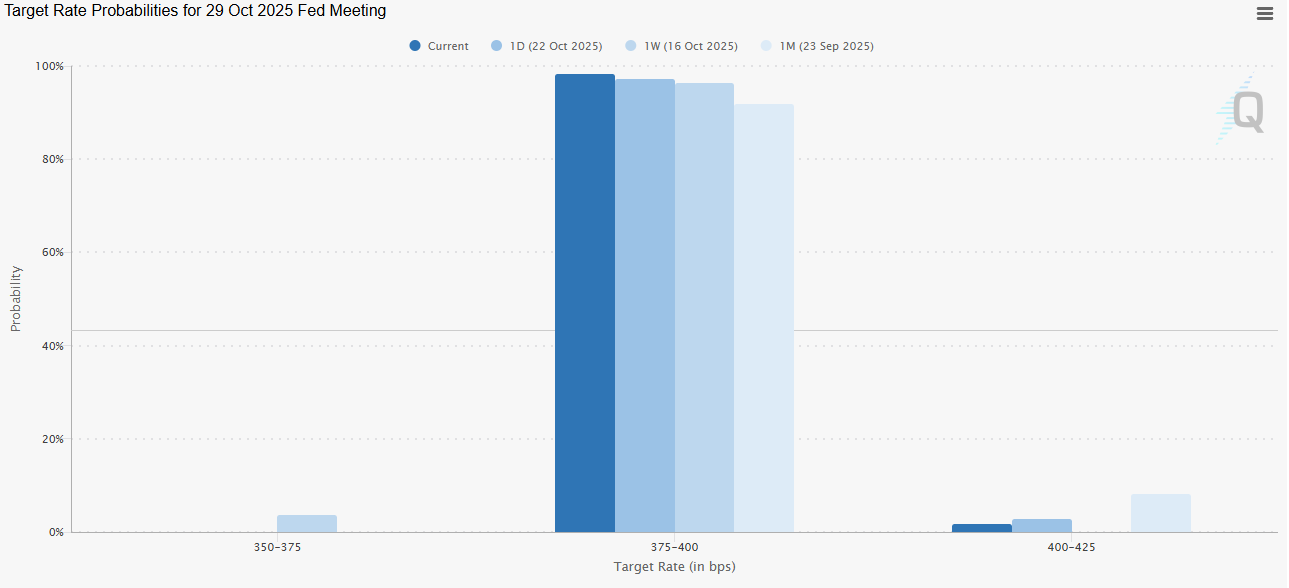

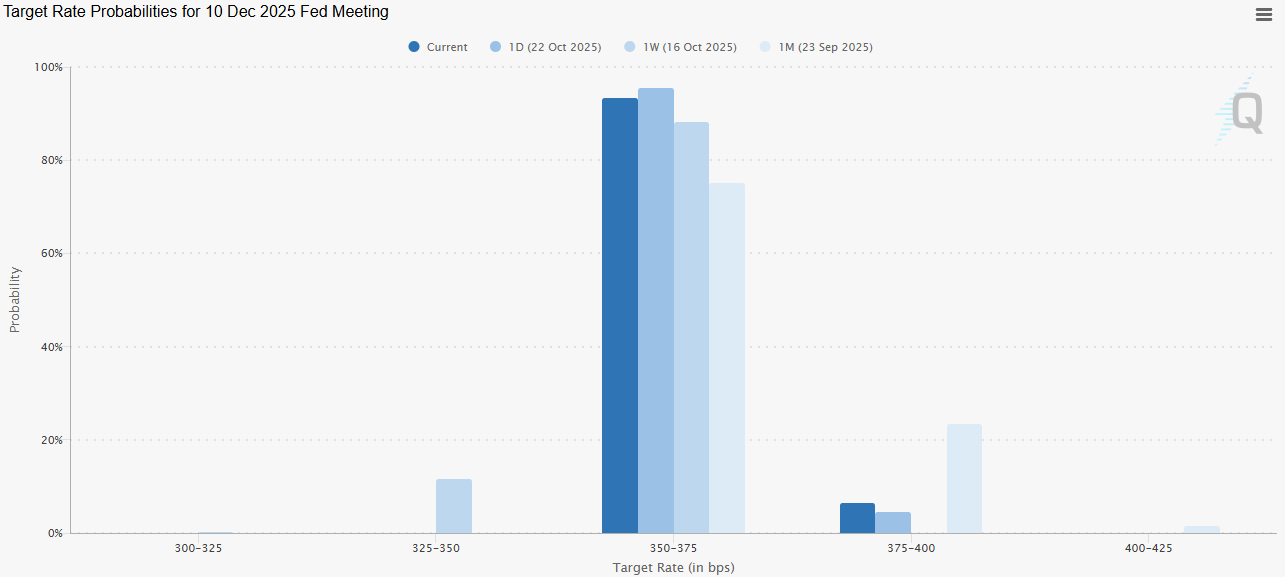

Current probabilities imply 25bps cut in next weeks meeting & further 25bps cut in Dec with somewhat small chance of flat or 50bps cut as well.

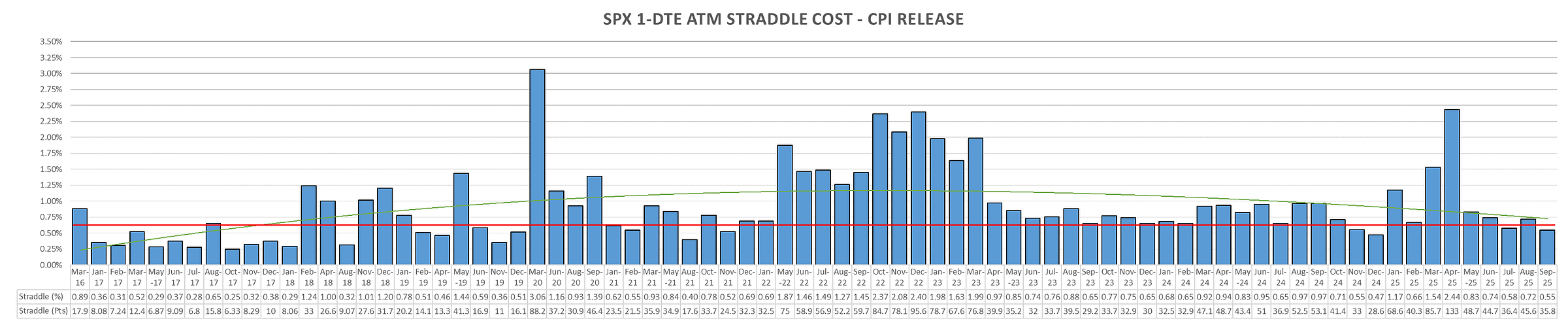

~60bps straddle for tomorrows CPI release, slightly above Sep & July levels but as mentioned in previous posts, market has shifted away from CPI concerns or other econ data and is now putting more emphasis on trade war instead.

Historical SPX Options Performance:

All charts show $ performance based on $200k SPX fixed notional position size

Keep reading with a 7-day free trial

Subscribe to Vol Vibes to keep reading this post and get 7 days of free access to the full post archives.