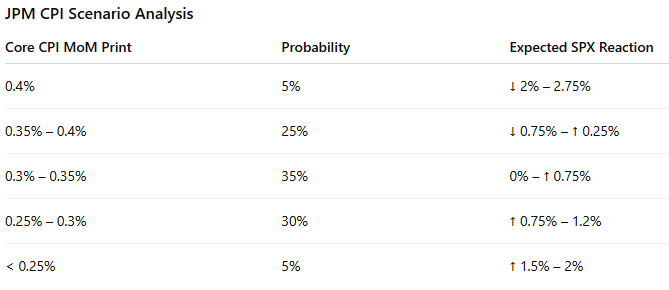

CPI for July releases tomorrow morning. Slightly elevated premium relative to June release. Banks mainly see reduced risk as ‘speed’ of inflation is much less of a risk now than 2022.

JPM sees in line print continue the rally, with a slightly hot print an excuse to sell into choppy seasonality.

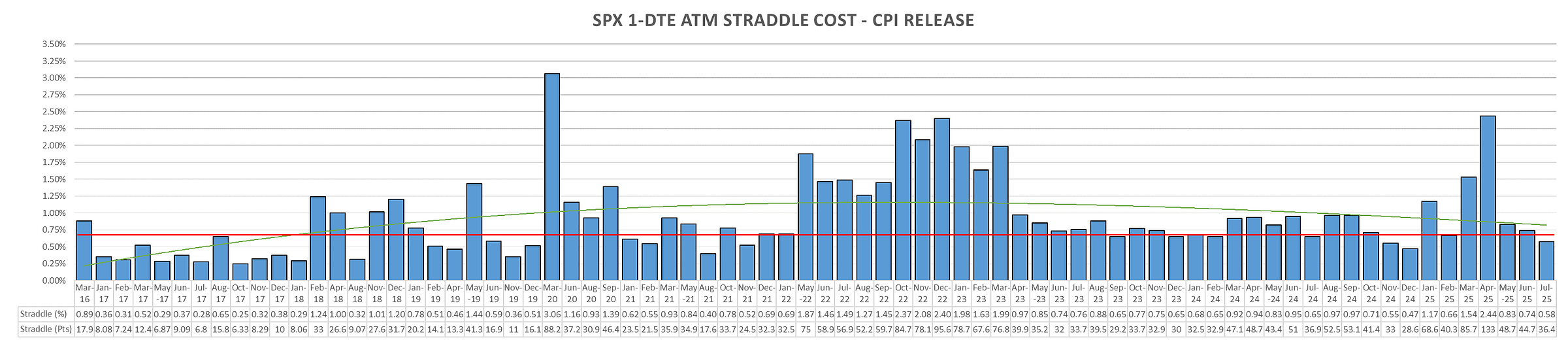

SPX straddles at 70 bps for tomorrow. Fairly in line with average post 2022 CPI release.

Historical SPX Options Performance:

All charts show $ performance based on $200k SPX fixed notional position size

Keep reading with a 7-day free trial

Subscribe to Vol Vibes to keep reading this post and get 7 days of free access to the full post archives.