SPX going into CPI at fresh all time highs. Similar to NFP, CPI day straddles have cheapened significantly going into the event. Today’s lower than expected PPI print confirms the narrative that inflation no longer a concern and focus is on weakening labor market.

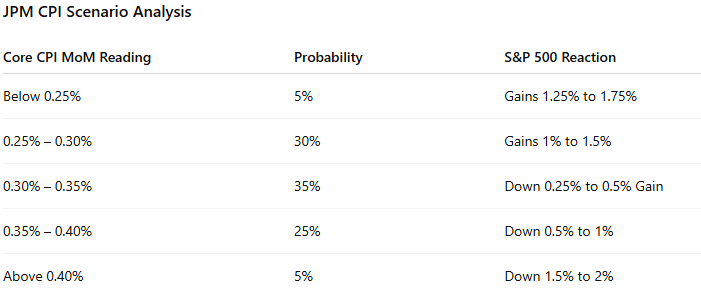

JPM highlights the scenarios for tomorrow, stronger print will challenge the expectations of multiple cuts going forward into Dec.

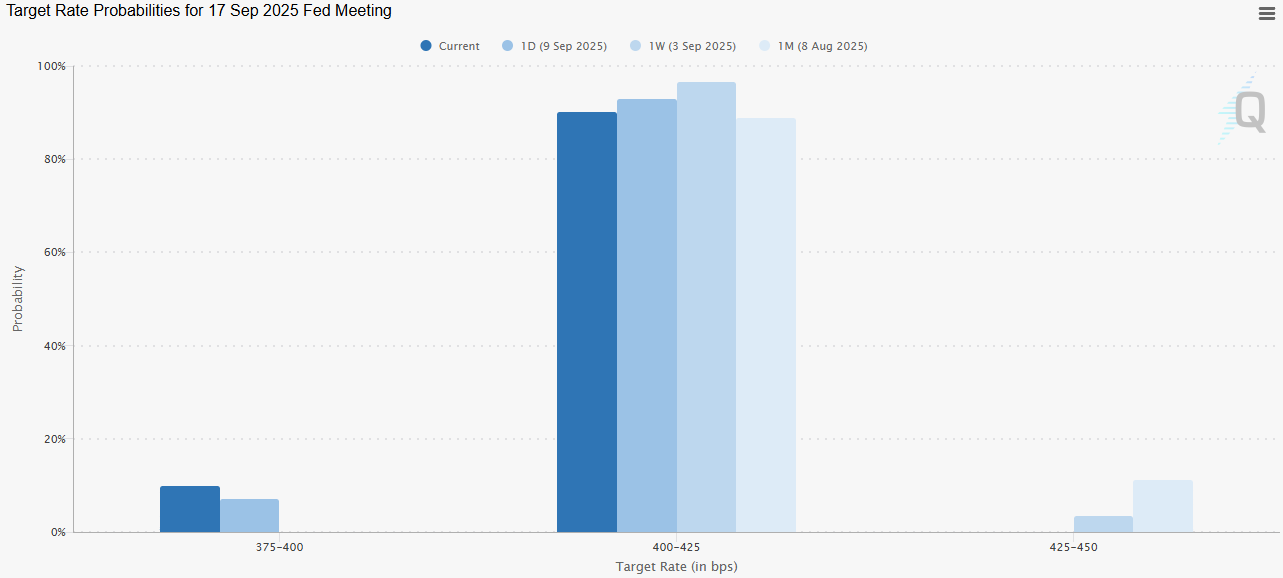

Probabilities for next weeks FOMC now include a small (but growing) chance of a 50bps cut.

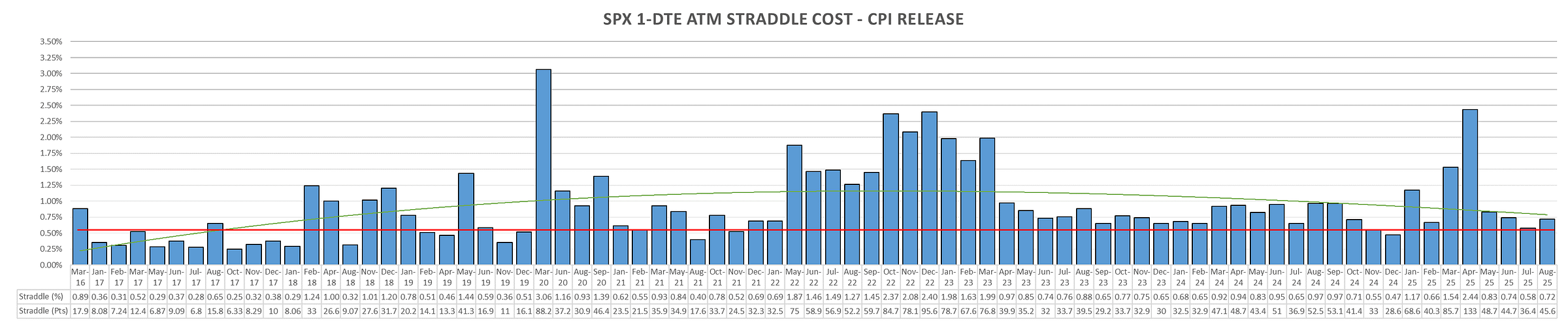

With ~2 hrs till close, tomorrows straddle trading ~55bps. That is the lowest level outside Dec 2024 & Aug/Nov 2021. Despite straddles getting cheaper, buying them has resulted in only net ~2pts positive PnL so far in 2025.

Historical SPX Options Performance:

Keep reading with a 7-day free trial

Subscribe to Vol Vibes to keep reading this post and get 7 days of free access to the full post archives.